McLaren and Brexit: Driving towards an uncertain future

In light of uncertainty around Brexit, McLaren has decided to double down on manufacturing in the United Kingdom.

The 2016 Brexit vote opened the possibility of increased tariffs and restricted immigration between the United Kingdom and European Union. However, as Brexit negotiations won’t be completed until 2019, there is great uncertainty around what Brexit will look like; possibilities range from a “soft Brexit” that results in minimal policy changes, to a “hard Brexit” that results in high tariffs and severe immigration restrictions [1]. In light of this uncertainty, supply chains have to be ready for multiple Brexit scenarios.

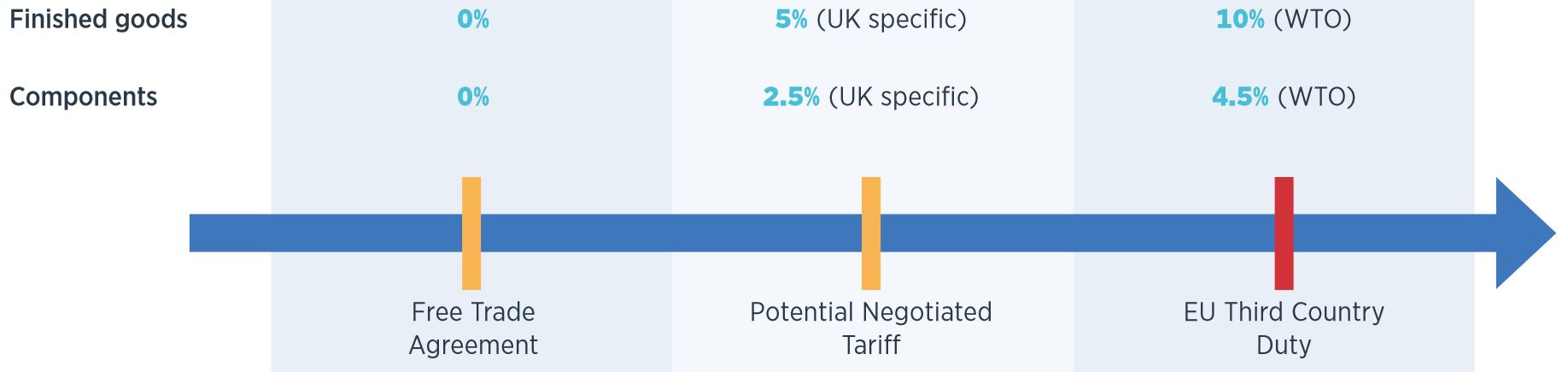

Car manufacturing could be significantly impacted by Brexit. There are several ways a hard Brexit would hurt the profitability of manufacturing cars in the UK. Increased tariffs on car components would increase the cost of buying parts from the EU, while increased tariffs on finished automobiles would force companies to either reduce profitability or increase prices. Potential tariff scenarios are shown in Exhibit 1:

However, there are potential positive impacts of Brexit as well. Brexit resulted in a decrease in the value of the pound; this currency adjustment makes labor and other costs relatively cheaper in the UK than other countries [4]. The British government has also alluded to potential tax cuts and regulatory changes that would make it more attractive to do business in the UK in light of Brexit [5]. Thus, auto manufacturers must consider the positive and negative impacts of Brexit in planning their supply chains.

In analyzing the situation, at least one car company decided to double down on manufacturing in the UK: luxury manufacturer McLaren. In the short term, McLaren is taking advantage of the weak pound by shifting more manufacturing to the UK, including investing £50M in a new chassis facility. McLaren is also focused on increasing the share of components manufactured in the UK, in anticipation of potential tariffs on components from the EU [6]. This mirrors a trend in the UK car industry overall, which has increased its share of locally made parts from 36% to 44% since 2011 [7].

McLaren’s actions are relatively low risk given their business mix. 80% of McLaren’s cars are sold to non-EU countries, meaning that in the event of a hard Brexit, only a small share of their cars would be subject to potential finished goods tariffs [8]. Thus the company would be able to benefit from lower costs without incurring significant tariffs. On the other hand, in the event of a soft Brexit, McLaren would be able to continue their operations much as before. Thus, McLaren has positioned themselves well for any Brexit scenario.

The company is also taking and planning actions to ensure long-term success post-Brexit. While most of their sales wouldn’t be impacted, tariffs would still negatively impact some of their sales; McLaren has thus been lobbying the government for a tariff-free Brexit deal [9]. McLaren is also planning to take advantage of additional government assistance; for example, McLaren is hoping to leverage government assistance on battery development to make half of their cars hybrid by 2022. Finally, McLaren has plans for minimizing any potential tariff burden, including taking advantage of the Inward Processing Relief tariff exemption scheme [6].

Looking ahead, McLaren should take several other actions to prepare themselves for Brexit. The first involves capacity planning. While the economics enable McLaren to continue manufacturing in the UK under a hard Brexit, the same may not be true for other car manufacturers that sell more cars to the EU. McLaren should be prepared to benefit if any of these car companies leave, by hiring their best workers and potentially buying their manufacturing facility at a discount. On a similar note, a hard Brexit could significantly hinder McLaren’s ability to hire foreign engineers and other workers; as a result, they should seek to make any needed foreign hires now, before laws change.

McLaren should also recognize the power they currently have in negotiating with the UK government, which is very afraid of losing car manufacturers. McLaren must take advantage of this by demanding significant tax breaks or other concessions as they increase their UK manufacturing. They should also continue their lobbying to try to secure the best Brexit terms and post-Brexit regulatory environment possible.

While McLaren has worked hard to be prepared for Brexit, their future economics are still very uncertain. Could a particularly harsh Brexit deal make their decision to commit to the UK look like a mistake? Should they consider leaving in this event? Do they even have the option to leave, or is being British too central to their brand? McLaren’s management must be prepared to answer these questions in the years ahead.

(787 words)

Sources

[1] Chris Giles and Alex Barker, “Hard or Soft Brexit? The Six Scenarios for Britain,” Financial Times, https://www.ft.com/content/52fb4998-573f-11e7-9fed-c19e2700005f, Published June 2017.

[2] “Brexit: The Impact on the Automotive Supply Chain,” PA Consulting, http://www2.paconsulting.com/rs/526-HZE-833/images/Brexit%20Impact%20on%20UK%20Auto-Mnf%20report.pdf, Published March 2017.

[3] Thomas Kwasniok et al., “Is Your Supply Chain Ready for Brexit?” Bain & Company, http://www.bain.com/publications/articles/is-your-supply-chain-ready-for-brexit.aspx, Published February 2017.

[4] “Supply Chain: Your Brexit Competitive Advantage,” pwc, https://www.pwc.com/gx/en/issues/assets/brexit-supply-chain-paper.pdf, Published February 2017.

[5] Philip Oltermann, “Hammond threatens EU with aggressive tax changes after Brexit,” The Guardian, https://www.theguardian.com/politics/2017/jan/15/philip-hammond-suggests-uk-outside-single-market-could-become-tax-haven, Published January 2017.

[6] Jonathan Ford, “Profiting from Brexit: McLaren Shifts Supply Chain Back to the UK,” Financial Times, https://www.ft.com/content/b3d67800-9475-11e7-bdfa-eda243196c2c, Published September 2017.

[7] “Automotive Council News Release,” Automotive Council UK, https://www.automotivecouncil.co.uk/wp-content/uploads/sites/13/2017/06/170620-Auto-Council-release_Rise-in-British-parts-used-in-British-car-pr….pdf, Published June 2017.

[8] Costas Pitas, “McLaren Sees Brexit Vote Benefit from Weaker Pound,” Automotive News Europe, http://europe.autonews.com/article/20160722/ANE/160729932/mclaren-sees-brexit-vote-benefit-from-weaker-pound, Published July 2016.

[9] Martin Saarinen, “McLaren and Aston Martin Voice Concern over Brexit Uncertainty,” Auto Express, http://www.autoexpress.co.uk/car-news/consumer-news/101370/specialist-car-brands-like-mclaren-and-aston-martin-voice-concern-over, Published October 2017.

[10] http://cars.mclaren.com/gt/news/factory-driver-stable-increases

A very interesting and seemingly rare positive outcome of Brexit! From your arguments it does seem that Mclaren seems to benefit even in the event of a Hard Brexit , given it sells 80% of its products to Non EU locations. Mclaren being a high end car, even if prices of commodities like steel etc rise , it won’t be affected as it uses carbon fibre for most of its products. Mclaren should focus more on selling international locations to take advantage of the currency arbitrage of a weakening Pound. Being a luxury sports car manufacturer I would assume it cannot suddenly buy manufacturing plants and increase capacity, as the demand-supply for luxury vehicles is self regulated. To answer the question of whether Mclaren can be a British brand out of Britain, jaguar the quintessential British brand has its biggest market as china today. So as long as Mclaren’s engineering is in England,I would assume its brand identity wouldn’t suffer.

Thanks for this well written exposition! It seems like McLaren went all in on the “no-regrets” scenario planning as discussed by the Bain & Co article you cited [1]. It’s ironic that McLaren, a UK-based car company, can be hurt by isolationist policies that are supposed to help domestic manufacturers. From the government’s perspective, even if isolationism hurts McLaren’s cost structure, ideally they would like to see McLaren’s top-line grow by making their cars much cheaper relative to other car manufacturers for people living in the UK. I suppose on the other hand, since it’s a luxury supercar that very few people can afford anyway, another 10% tariff on competition isn’t going to move the needle much. But if these isolationist policies are hurting McLaren sufficiently, Brexit would have been a complete disaster if McLaren decided to leave the UK and manufacture somewhere else (regardless of their branding as a British supercar).

I think the crux of whether McLaren will ultimately benefit or be forced to leave the UK will have to do with how the pound does against the US dollar over the next several years. If the pound continues to decline and exports are propped up by the sudden affordability abroad, then McLaren will do just fine. If for some reason the pound recovers and exports fall, while McLaren still has a more expensive supply chain given the tariffs on imported components, then it’ll start to make less sense for McLaren to be based in the UK. Obviously hard to predict, but it seems like some rates experts expect the pound to have already bottomed out and will be stabilizing at a higher rate in the longer-term [2].

[1] http://www.bain.com/publications/articles/is-your-supply-chain-ready-for-brexit.aspx

[2] https://www.ft.com/content/2a7c2ca8-3850-11e6-a780-b48ed7b6126f

While it’s easy for people to criticize how Brexit has negatively impacted many industries, it’s pretty thought provoking to see how companies are looking at how they can benefit from it. McLaren’s reorientation of its strategy and manufacturing operations shows its forward thinking capabilities as it refuses to wait until 2019 to act. Although McLaren shows that it is possible, it still does not seem easy when faced with serious issues like increased tariffs and limited labor supply, which can negatively affect car manufacturers’ costs and profitability. Even more, I don’t think most companies realize the powerful position they are in to negotiate, like you mentioned, as the government needs them. I think the government will have to implement several initiatives like tax cuts in order to incentivize companies to keep doing business in the UK. If they can make it attractive for car manufacturers to stay, it will have broad-sweeping affects in fueling the economy. I am left wondering why more companies, in and outside of car manufacturing, aren’t following McLaren’s lead and preparing themselves for potential policies and tariffs resulting from Brexit.

This is a very interesting read!

I would like to know and understand how much of production goes to EU countries and how much profit that represents for the company. The importance of Brexit is that the UK will no longer be sheltered by the tariffs of the EU and I would like to see how big of an issue is this really to them?

I would like to understand the real negative implications for McLaren to move production entirely to the UK. As mentioned above, if its a hard Brexit then foreign car manufacturers will have to leave and McLaren will benefit for their remaining talent. In a Financial Times article, it is mentioned how the government is planning to give incentives and funding to companies that use local components for end products. It is also mentioned that the relationship with the government is what will ultimately give McLaren the competitive advantage. So I wonder how the company is going to foster this new relationship and make it into a strong benefit for their business.

Financial Times Article, “Profiting from Brexit: McLaren shifts supply chain back to the UK”

https://www.ft.com/content/b3d67800-9475-11e7-bdfa-eda243196c2c

Great topic and a great read! I think it will be very interesting to see how the UK government decides to uphold tariffs against the rest of the EU and whether these tariffs will be industry specific or not. As you suggested, the UK would love to keep and grow its car manufacturing market and increase production of all automotive parts within the UK as much as possible. However, I think it is also important to consider how the tariffs affect McClaren’s partnership decisions, particularly for its racing division. McClaren had partnered with Mercedes Benz not too long ago to produce Mercedes McClaren, one of its more successful products. With Brexit these collaborations may be less likely to occur in the future.

Interestingly, McCarlen’s racing division had also long partnered with Mercedes Benz before moving to Honda for engine design/construction. Unfortunately, this resulted in poor-track performance forcing McClaren to end its partnership with Honda and instead begin working with UK based Renault this year. It remains to be seen how that partnership affects racing performance. Similarly, moving production to UK may also impact the quality of McClaren’s production cars, for better or worse.

That said, with regard to the discussion about sales and pricing of McClaren production cars, I am not sure we will see much of a difference in sales volume. McClaren is a premium sports car manufacturer; its customers are probably not highly price-sensitive, particularly if purchasing McClaren cars for its brand value and heritage (this includes both the 20% in Europe as well as the 80% abroad).

Finally, I believe that in the long run it is possible the UK economy will recover from Brexit and perhaps the pound will once again emerge as strong. To shift the majority of production and manufacturing into the UK could be risky. Despite Brexit, there seems to be a long-term trend toward globalization. Perhaps ignoring tariffs and regulations, which can change frequently over time, may be the better long-term play, especially if the UK economy recovers. Regardless, at the end of the day, we do not have a crystal ball. Thus, if I were running McClaren I would pick the production location that offers the best chance at high quality and specialized/experienced labor rather than focusing on tariffs and currency exchanges in order to maximize my success as a company.