Major League Baseball: A Leader in Live Content Distribution

This is a story of how Major League Baseball (“the MLB”) out-innovated other professional sports leagues (NFL, NBA, NHL) and Silicon Valley (Facebook, Google, Amazon) in response to an increasingly digitalized supply chain for live entertainment content. If you’ve watched NCAA March Madness games on your computer or Game of Thrones on your iPad, you’re well-acquainted with the MLB’s self-incubated streaming technology. More below.

Later Innings for Cable

News, movies, and music are migrating to our mobile devices and computers – a trend that is both a concern and opportunity for sports and entertainment providers like the MLB.

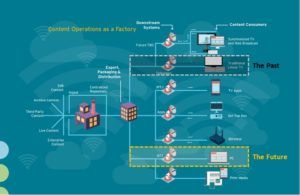

The concern stems from that fact that most MLB content was governed by cable companies and consumed through TV. After a de facto monopoly on live content, cable is losing juice as the consumption of live sports undergoes “digital 2.0” via online streaming. As depicted in Exhibit 1 below, which illustrates the process of generating and delivering live content, it is a necessity for the MLB to restructure its supply chain to meet end-users (fans) where they’re most engaged.

The opportunity for the MLB lies in the various shortcomings of cable. First, since cable is a bundled service, it comes at an unnecessarily high cost. Second, cable is tethered to a defined geographic area, leaving out-of-market fans struggling to keep up. Third, contractual disputes between networks and cable providers have led to temporary blackouts in major markets, including New York and Los Angeles. In all three instances, the supply of content becomes starved or completely shut off, which in a cable-dominated world was the price of doing business.

BAM! A Grand Slam

In recent history and for the near-term, the MLB has stepped up to the plate in response to the challenges of evolving digitalization. In 2000, the MLB’s team owners founded a start-up: MLB Advanced Media (“BAM”), a separate entity within MLB that would go on to develop the preeminent over-the-top (“OTT”) / direct to consumer live streaming application [1]. BAM’s pinnacle product – MLB.TV – allows fans to watch any out of market game on their computer, smartphone or tablet for ~$100 per season [2]. The games are streamed in HD quality where fans view the same production that is broadcasted on cable TV (Exhibit 2). By mitigating cable’s reign over the supply of content, the MLB now disseminates its product to a wider breath of end-users.

The MLB’s decision to solve its supply chain problem in-house will continue to pay dividends in the medium and long-term. As it turns out, BAM’s streaming tech is world class and other sports, media and entertainment platforms want a piece of the action. The World Cup, NHL, PGA, NCAA March Madness, WWE and PPV boxing are all paying clients of BAM [1]. In 2015, HBO called on BAM to run its “HBO Now” platform after their first, in-house attempt at streaming (“HBO GO”) led to outages during Game of Thrones and True Detective [3]. iPhone, Roku, Apple TV, Playstation 3 and other streaming-focused hardware now beta test with BAM to make sure their designs are explicitly compatible before broad market launch [3]. The entire supply chain of live content consumption revolves around BAM.

In August 2017, Disney purchased a controlling stake in BAM (now called “BAMTech”) for ~$3.75 billion. The MLB’s 30 teams still retain a 15% stake [4] [5].

What’s on Deck

The significant monetary opportunity within live streaming has drawn the attention of Facebook, Google, Amazon, and Twitter. While MLB beat Silicon Valley to the party, these media giants have deep pockets, a large captive audience, and are prepping their arsenals to make a serious play at hosting streaming. To further ride the opportunistic wave of increased digitalization, the MLB should forge meaningful partnerships with these companies. In fact, they’re getting a head start. In 2017, select regular season MLB games were streamed live on Twitter and Facebook and the 2017 World Series was available on YouTube TV [6].

Additionally, the MLB should think about future vehicles of content consumption. Virtual reality (VR), for example, was omitted from the right side of Exhibit 1 but will play a meaningful role going forward. The NBA has already streamed live games in VR through its partnership with NextVR [7].

Calling Balls and Strikes

A few open questions for discussion:

- How will cable companies respond to their lost share of content?

- Is the MLB shooting itself in the foot by selling its streaming platform to other (often competing) sources of entertainment?

- Does online consumption cannibalize non-digital consumption? If I can watch the game in HD on my iPhone, will my average “in-person” game attendance decline?

Word Count: 770

—

Exhibit 1: Supply Chain of Digital Content

Source: Adapted from Cognizant 20-20 Insights, February 2016

Exhibit 2: MLB.TV Interface

Source: Major League Baseball

Sources

[1] Brown, Maury. “The Biggest Media Company You’ve Never Heard Of,” Forbes, July 7, 2014, https://www.forbes.com/sites/maurybrown/2014/07/07/the-biggest-media-company-youve-never-heard-of/#620cc6271cef

[2] Brown, Maury. “From Lower Costs To Single-Teams, MLB.TV Ready To Stream 2016 Season,” Forbes, February 15, 2016, https://www.forbes.com/sites/maurybrown/2016/02/15/from-lower-costs-to-single-teams-mlb-tv-ready-to-stream-2016-season/#55f77cd72b0b

[3] Popper, Ben. “The Changeup: How baseball’s tech team built the future of television,” The Verge, August 2016, https://www.theverge.com/2015/8/4/9090897/mlb-bam-live-streaming-internet-tv-nhl-hbo-now-espn

[4] Perez, Sarah. “BAMTech valued at $3.75 billion following Disney deal,” TechCrunch, August 8, 2017, https://techcrunch.com/2017/08/08/bamtech-valued-at-3-75-billion-following-disney-deal/

[5] Brown, Maury. “Disney Accelerates Purchase Of BAMTech And Announces Streaming Service With ESPN,” Forbes, August 8, 2017, https://www.forbes.com/sites/maurybrown/2017/08/08/disney-accelerates-purchase-of-bamtech-espn-disney-will-see-new-digital-streaming-media-apps/#6df9800e4a5d

[6] Brown, Maury. “Live MLB Games Begin Streaming To Twitter On Tuesdays, Comes On Heels Of Facebook Deal,” Forbes, May 25, 2017, https://www.forbes.com/sites/maurybrown/2017/05/25/live-mlb-games-begin-streaming-to-twitter-on-tuesdays-comes-on-heels-of-facebook-deal/#3905d3805f0d

[7] Moynihan, Tim. “GET READY TO WATCH LIVE NBA GAMES IN GLORIOUS VR,” Wired, October 20, 2016, https://www.wired.com/2016/10/get-ready-watch-live-nba-games-glorious-vr/

The questions facing the MLB when it comes to digitalization are vexing and complex ones, especially as regards cannibalization of their non-digital offerings. However, history would seem to indicate that sports leagues need to move to where their consumers are, and especially as baseball has a reputation for attracting an older crowd it could get an outsized benefit from moving its operations online quickly and offering diverse digital products that can attract a young audience. One additional question is how individual teams with their own networks (e.g. the Yankees and YES) or teams with strong relationships with regional networks (e.g. the Red Sox and NESN) will respond to the league’s move to one singular online platform? Will they cede greater control to the MLB who through BAM has shown competence and leadership in digitization? Or will they attempt to build some of their own platforms that compete independently?

Interesting write-up. I read this post amidst the recently announced FCC plan to end net neutrality, and I wonder how that would affect BAM and related products. Given the overlap between ISPs and cable TV providers, one of the ways the Comcasts of the world might try to recoup

some of the dollars lost to streaming may be to charge users a large surcharge to access BAM content.

I think the in-person vs in-the-comfort-of-your-own-couch dynamic is interesting. It’s almost always a better game-viewing experience at home (or at a bar) given replays, variety of camera views, etc. However, it’s much less Instagram-able and I think the opportunity to tell all your friends on social media about how you went to the game will continue to be large factor driving in-person attendance.

Great summary of the threats and opportunities facing sports leagues, such as MLB, as we sit at a crucial crossroads for live sports content distribution. As Josh astutely pointed out, it is only a matter of time for the traditional way of delivering content through cable to be disrupted. The big questions in my mind are 1) who will be the winners coming through the other side, 2) what will be the format, pricing, and structure (e.g. local vs. national deals) for the next generation of products, and 3) how will government regulation affect the new ecosystem, including the impact of net neutrality. Regardless of the answers to these questions, the way we consume live sports content is likely to change significantly over the next 5-10 years, and BAM is well-positioned to continue to grow and prosper under Disney’s ownership.

BAM has been a great technological development that has allowed me to keep on top of my Blue Jays down here in the US. A benefit that wasn’t mentioned in the intitial article is the significant additional selection offered to consumers. Canadian viewers were typically restricted to Jays and Mariners games (with the exception of special events, like Sunday Night Baseball for example) depending on their region, but now have access to all of the Rockies, Marlins or Rays games they want. Increased exposure is great for the growth of these teams in non-traditional markets, and begs the question of if MLB will have to revisit its revenue sharing model given teams like the Red Sox and Yankees will no longer monopolize screen time outside their markets.

There is also the question of what impact there will elsewhere in the broadcast value chain. MLBTV still relies on local broadcasters for the physical production – filming, commentary, graphics, etc. In a world where viewers substitute for MLBTV, will there still be economic incentives for local broadcasters to incur these costs? Will MLBTV need to develop 30 broadcast teams to cover all of the different markets? How will that impact the product – will it lose its local flavor?

Lastly, I can’t help but think that it might be time for BAM to cash out. With the R&D might and significant financial resources of Facebook, Twitter (who has shown to have great broadcasting / video streaming capabilities following its Periscope acquisition) and Snapchat bearing down on them (not to mention the interesting advertising / social media synergies that could come with these players) does it make sense for BAM to sell to one of them before losing out?

I had no idea that the MLB was so tech forward! Thank you very much for expanding my knowledge!

I agree that the MLB has a number of decisions regarding their content distribution that will have a great affect on the league’s revenue. Cable networks are already pushing “build your own” packages that will allow consumers to choose whether or not to purchase channels that show the baseball which could greatly affect how many incidental viewers particular games might have. Distribution rights will have to be negotiated with the upcoming digital players, especially since the $100 price premium seems unsustainable when compared to competitors.

Part of the value proposition of MLB.TV is that you can in a way bring your home team with you when you live away from the team that you cheer for. While this can help MLB maximize profits, the MLB also answers to each individual team as a stakeholder as well. I wonder what impact distributing “home team” content will have on consolidating fan bases into major market teams. In the past, when people moved, exposure to a new home team may have eventually led to changing their team preferences. However, distributing content allows people to maintain their attachment and could contribute to a trend of “bandwagoning” on big market or successful teams. Does the MLB have a plan to reinforce local team loyalty in order to satisfy each team’s interest?

I enjoyed the author’s article on how OTT streaming services challenge the traditional TV supply chain, and was amazed to learn about how successful BAM has been. The “response from cable networks” is an important question worth further consideration:

The contrarian view, that cable companies are actually well-positioned to overcome what seems like a threat from OTT, is worth exploring further. While new entrants like BAM have beaten cable networks to market with superior OTT streaming technology, there is a strong economic value-driven case to be made that cable networks will win out in the long run. Their control of last-mile distribution to the consumer, massive scale, and expertise in bundling are extremely powerful competitive levers and position them to satisfy the needs of the vast majority of the market. Today, “single-channel” OTT products provide a clear value proposition to consumers who want to selectively buy only a small slice of media content, but the market for bundled media products is proven to be enormous and offers more compelling economics to the average consumer, who actually saves money vs. un-bundled equivalent services on a per-service basis. Generally, un-bundling only benefits consumers from a price standpoint to the extent that they only purchase a few un-bundled products. But as long as consumers value purchasing a few different kinds of media, cable companies will be able to offer more attractive bundled economics for their own competing service (whether delivered via linear TV or their own digital streaming product) than will single-channel OTT players. See HBS alumnus and VC Chris Dixon’s writing on bundling economics for more: http://cdixon.org/2012/07/08/how-bundling-benefits-sellers-and-buyers/

Regarding your second question, I think BAMTech has a much bigger opportunity by serving as a streaming platform provider than it does from trying to protect viewership of live baseball games. Given that content providers are increasingly moving direct to consumer, there is a huge market opportunity for BAMTech to gain new clients. For instance, BAMTech recently signed a $300 mil commercial partnership with Riot Games to stream League of Legends (http://www.espn.com/esports/story/_/id/18292308/mlb-bamtech-streaming-platform-inks-300-million-exclusivity-deal-riot-games-league-legends). Additionally, part of Disney’s strategic rationale for acquiring BAMTech is because BAMTech will power Disney’s upcoming ESPN and Disney-branded streaming services. In a world where the traditional cable bundle moves fully a-la-carte, these 100+ cable networks will all be looking for a provider to power their direct to consumer streaming services. My opinion is that people who want to watch baseball will always watch baseball, regardless of the other general entertainment options available.

Is the MLB shooting itself in the foot by selling its streaming platform to other (often competing) sources of entertainment?