MAERSK – Feeling Slow-Steamed by Regulators

The backbone of global trade, the shipping industry, is responsible for 3% of GHG emissions. Leading shipping companies like Maersk set an example by reducing their carbon footprint, but can they sustain these practices when marine pollution regulators fail to ensure an even playing field with competitors?

Few can dispute the fact that the development of global trade over the last few decades has led to tremendous economic growth for emerging and developed countries alike. But the enabler of global trade, the shipping industry, is responsible for around 3% of global greenhouse gas (GHG) emissions, which raises important questions about the future of shipping and its effect on trade. If the shipping industry lowers its carbon footprint but incurs higher transportation costs, will it curtail global trade and commerce?

A study by the International Maritime Organization (IMO), a UN agency focused on regulating international shipping and prevention of marine pollution, estimates that ships’ CO2 emissions will continue to grow between 50% and 250% by 2050. Global shipping is estimated to generate slightly more CO2 emissions than aviation[1], so the challenges are striking in scale and in importance, particularly in a world of increasing trade.

In 2015, most of the world reached a commitment to curb GHG emissions and keep temperature increases below 2º C through the Paris Agreement.[2] Touted as a critical step in the right direction, the Paris Agreement fell short largely by ignoring the effect of ships and airplanes.[3] Less than a week ago, however, the IMO released a long-awaited climate plan to address marine pollution, calling it “another good news story for the #environment” on Twitter.[4]

Under the plan, an interim strategy to address GHG pollution will be set in 2018, and five years after that it will outlining more specific climate-protection measures.[5] The notable omission of actual reduction targets and the lack of a promise to reach a binding agreement on such targets over the next 8 years was a highly disappointing example of kicking the can down the road.

Somewhat surprisingly, 51 organizations including some of the largest shipping names in the world such as Maersk, Unifeeder, and Cargill, submitted a letter to the IMO calling for stringent and ambitious emissions reduction objectives.[6]

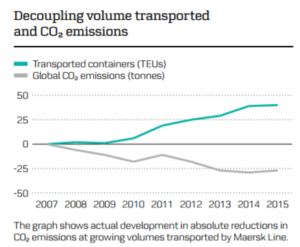

Maersk Line is the world’s largest container shipping company, operating 611 container vessels and generating over $23bn in revenue. Maersk has been at the forefront of carbon footprint reduction, achieving a 42% decrease in CO2 emissions per container from 2007 to 2015, and committed to taking this number to 60% by 2020. Maersk generated emissions of 44.6g of CO2 per container per km, 20% lower than the industry average of 53.4g.[7] Maersk was able to reduce its total emissions while increasing its total transported containers:

Maersk claims it achieved this through a combination of investing in new, more energy efficient vessels, in network and data improvements, and in retrofitting older vessels to increase container capacity. Vessels with higher capacity carry more goods on every trip while keeping the overall energy bill the same. More importantly, Maersk engaged in slow-steaming, or the practice of running ships at well below maximum speed. Reducing speed by 20% allows for a 40% decrease in the amount of fuel consumed, cutting CO2 emissions as well as fuel expenses. It also improves schedule reliability: slow and steady wins the race. Slow-steaming’s emission reductions were significant even after accounting for the fact that Maersk had to add 1-2 vessels to compensate for the lower service frequency.[8]

But not everything has been rosy for Maersk. The benefits of slow-steaming have eroded as the low fuel price environment makes the trade-off between speed and needing additional vessels less attractive.[9] Combined with its substantial investments in new, efficient vessels, Maersk was not low-cost enough to handle the decline in freight rates this year, posting a net profit loss of $116mm in Q3 2016, a decrease of $380mm over the prior year.[10] It now seems obvious why they want other shipping companies to be held to the same environmental standards.

The IMO must urgently ramp up its marine pollution reduction goals to level the playing field so that good companies like Maersk do not feel forced to revert to lower cost practices that are harmful for the environment just to compete. It should institutionalize slow-steaming by monitoring boat speed, set clear targets on emissions per container reductions, and encourage ships to switch from diesel to liquefied natural gas as fuel, which studies show would produce far less emissions of harmful gases such as SOx and NOx.[11]

(742 words)

~*~*~*~*~*~

Sources Used

[1] Third IMO Greenhouse Gas Study, 2014. Accessible here.

[2] “Climate Change in 2016: Implications for Business”, Harvard Business School.

[3] “Shipping Industry: Climate Change? What’s the Big Rush!”, by John Upton for Grist.org. Accessible here.

[4] IMO’s Twitter Account (10/28/2016). Accessible here.

[5] “Shipping Industry: Climate Change? What’s the Big Rush!”, by John Upton for Grist.org. Accessible here.

[6] “Maersk and co call on IMO to set ambitious emissions target.” By Rebecca Moore on 10/20/2016 for Tanker Shipping and Trade. Accessible here.

[7] Maersk Group Sustainability Report, 2015. Accessible here.

[8] Maersk Press Release: Slow Steaming to Stay, 09/01/2010. Accessible here.

[9] “Smarter Steaming Ahead: Policy Options, Costs and Benefits of Regulated Slow Steaming”, by Seas at Risk, 2012. Accessible here.

[10] Maersk Quarterly Earnings Release. Accessible here.

[11] IMO: Studies on the Feasibility and Use of LNG as a Fuel for Shipping, 2016. Accessible here.

It is disappointing to see that the International Maritime Organization is failing to push for a level playing field regulation of CO2 and other harmful gasses emissions. However, companies like Maersk simply can’t rely on regulation. As we talked about in class during the IKEA case, companies and organizations cannot dependent on government and regulation due to the lack of framework in sustainability, instead, should take on sustainability in its own hands. Maersk should continue investing in the long-term and use its commitment in sustainability as a competitive advantage. For example, in 2014, Maersk was able to enter into a multi-annual agreement with a customer committing to a tailored CO2 target in alliance with the customer (http://www.maersk.com/~/media/the%20maersk%20group/sustainability/files/publications/2016/files/maersk_group_sustainability_report_2015_a3_final.pdf). Maersk should continue to leverage its commitment in sustainability to build coalitions and partnerships.

That being said, Maersk should still try to influence and engage with regulators to create policies that support sustainability. A few recommendations for IMO include: 1) industry specific carbon tax/cap and trade, 2) stricter regulations on Sox and NOx beyond those adopted, as you mentioned, 3) new regulations on black carbon, particle matter and waste (https://www.bsr.org/reports/BSR_Sustainability_Trends__Container_Shipping_Industry.pdf).

Great article! I hadn’t realized that Maersk engaged in slow-steaming with such regularity. I am curious as to how costs associated with slow-steaming are passed on in freight rates. You mention that benefits from reduced fuel costs were offset by increased need for vessels. Given the extremely thin margins with which vessel companies are currently operating (with time charters near, or in some cases even below, operating costs), how do you see the trade-off between profitability and eco-conscious initiatives? Similarly, while low vessel values have led to increased scrapping of older, less fuel efficient vessels, how will companies such as Maersk be able to continue to invest in ECO product tankers and other more environmentally-friendly vessels? It seems a major re-calibration will be needed in the industry to bring supply and demand in-line enough to generate attractive returns for investors before any real investment can be made in the pursuit of green goals.

Very interesting, Ilan. I am pleasantly surprised that Maersk has been so steadily increasing their share of slow steaming. That they were able to find a way to incur cost savings and increase overall efficiency of the operations while trying to become more sustainable and fuel efficient by electing for slow steaming makes me optimistic about other verticals. I like the healthy dose of reality when you identified that Maersk’s incentives for pushing other shipping companies to comply with stricter emission standards are probably selfish. It’s very unfortunate that low fuel costs have been making slow steaming less and less attractive for Maersk, even to the point of substantial net losses. I hope IMO does shape up and push the stricter standards on all companies that voluntary efforts to become more sustainable are not financially penalized.

Great piece Ilan! Do you think Maersk & others could switch to liquefied natural gas at a reasonable cost? LNG prices are already going up and it is very expensive to store & transport LNG in a boat, as the temperature needs to be maintained at very low level for the gas to remain liquefied. Do you think states should subsidize the use of LNG to reduce the environmental impact of the shipping industry?