Machine Learning and Music: What About the Record Labels?

As digital streaming has become the preferred method of consuming music, machine learning has taken its place at the heart of the music world. Where does that leave Sony Music?

Napster was just the beginning. Years of legal battles culminated in the end of free music downloads, but the damage was done: consumers demanded digital music, and the battle to own the next frontier had begun. Spotify owns the current subscription-based streaming model with 36% of global subscribers; Apple and Amazon trail with 19% and 12% share, respectively.[1]

The challenge: digital disruption

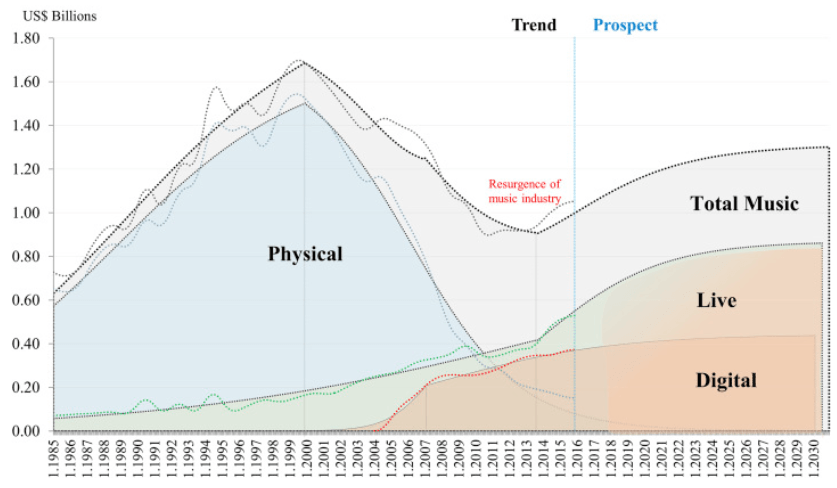

As streaming giants have begun to dominate music, the role of machine learning has increased dramatically. Spotify is well known for its “Discover Weekly” playlists – a curated set of songs that the company puts together based on the subscriber’s listening history. As of 2016, the last time Spotify made a public announcement about its success, the Discover Weekly feature had generated more than 5 billion streams from over 40 million users – at the time, nearly half of all subscribers.[2] The trend is evidenced below:

A measured response:

The music industry has historically been poor at predicting and adapting to change. This time, Sony appears to be aware of the threats in the industry, asserting in its most recent annual report that technological and consumer changes constitute a meaningful risk to its operations.[4]

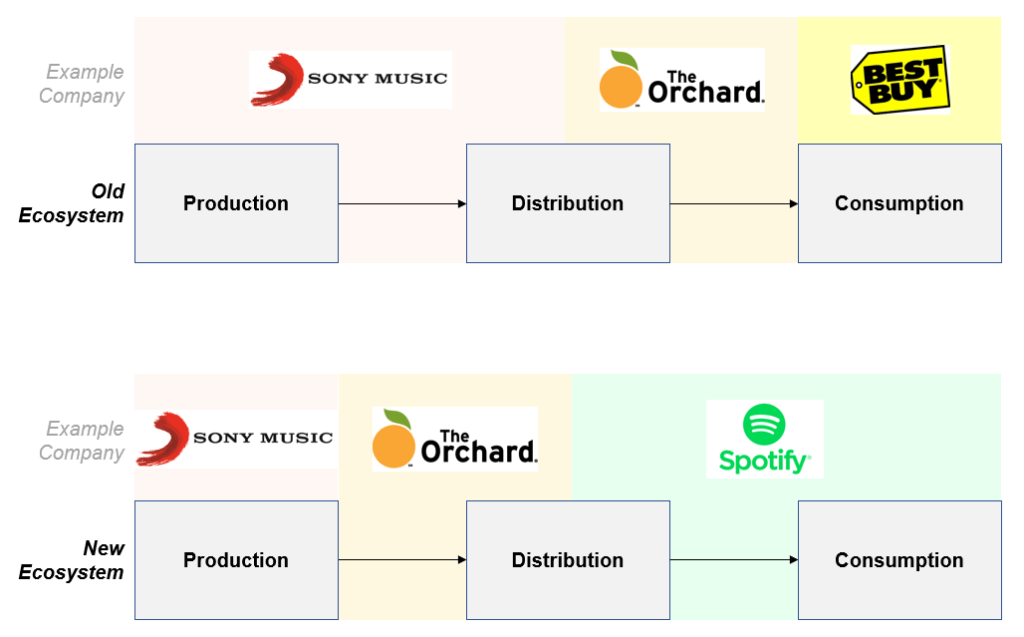

Sony recently increased its stake in The Orchard, a major distribution player, and EMI Music Publishing. With The Orchard, Sony is able to assert influence on a greater part of the value chain; with EMI, Sony has access to more artists. In the short-term, these acquisitions allow Sony to reclaim some of the leverage that Spotify has taken.[5]

Sony appears to be willing to depart from its traditional role in music, as evidenced by two moves that position the company well for the medium-term. Sony created a position for Chief Data Officer, whose role includes building predictive tools to support Sony’s strategic artistic and commercial initiatives.[6] Further, Sony Music is looking to the popular mobile game Fate/Grand Order to provide diversified revenue streams outside of music altogether. Exploring gaming while leveraging core competencies may protect Sony Music from future dramatic changes in the industry.

Path forward:

The proliferation of technology has democratized music in a way that Sony can take advantage of by crowdsourcing artist recommendations from a wide variety of sources and hosting virtual competitions in which artists showcase their talents via uploaded videos. In the short-term, Sony can use technology to better source global talent.

But in an industry increasingly dominated by algorithms, those organization with access to user data will continue to win. Lower product margins and a reduced need for traditional marketing may render Sony irrelevant in the medium-term. Sony needs creative strategies to get user data. Possible ideas include:

- Acquiring an app like Shazam, which is used to identify songs

- Create and promote playlists on Spotify that consist of entirely Sony Music artists. Rudimentary data, such as followers and listens, can be used as a proxy for engagement

- Give away music from their artists for free on Sony’s website for some time. The cost of giving away music may be worth the user data.

Outstanding questions:

- Is there a future for traditional record labels at all? If not: who will take over the traditional functions of a label (finding talent, producing records, marketing artists)?

- Given that machine learning is built on historical behavior, can it predict a drastic change in consumer preferences (e.g., rock in the 1950s)?[7] If genre development is governed by AI, will we see fewer bold creative changes moving forward?

(Word count: 798)

References:

[1] Statistia, “Share of music streaming subscribers worldwide as of the first half of 2018, by company,” access November 12, 2018

[2] Health, Alex “Here’s what’s next for Discover Weekly, Spotify’s most loved feature,” accessed via Business Insider November 12, 2018

[3] Naveed, Kashif; Watanabe, Chihiro; Neittaanmaki, Pekka; “Co-evolution between streaming and live music leads a way to the sustainable growth of the music industry – Lessons from the US experiences,” Science Direct, accessed via Factiva on November 12, 2018

[4] SEC Filings, 2017 10-K, Sony Corporation, access on November 12, 2018

[5] Paine, Andre, “Sony reveals 2021 financial targets and strategy,” accessed via Music Week website November 12, 2018

[6] Sony Music press release, November 5, 2018, “Sol Rashidi named Executive Vice President and Chief Data Officer, Sony Music Entertainment,” access November 12, 2018

[7] Yeomans, Mike “What every manager should know about machine learning,” July 7, 2015, Harvard Business Review; accessed November 12, 2018

One of the interesting trends also is that record labels increasingly derive their revenue from live performances. While digital distribution is less lucrative than selling CDs, it increases the reach of local artists exponentially by connecting them to a global audience and thus increase the demand of Lives. Sony needs to shift away from a heavy reliance on music distribution to a business model that leverage on the IP rights of the record label.

There are also plenty of emerging opportunities in the mobile space. As a player of Grand Order, I can attest to the crazy amount of money people are willing to pay to purchase desirable virtual goods. Perhaps a collaboration of online/offline campaign for Sony’s artists can be the next money spinner for the company?

I’ve thought a lot about the flaws in relying on fundamental (historical) analysis to innovate or predict future consumer behavior. There are some innovations we can look back on (smartphones, the internet, maybe even the printing press!) and find it hard to imagine how any analysis about how things had been done in the past would have been relevant to how that innovation would enable things in the future. If Machine Learning algorithms are only able to make incremental predictions based on observed historical data, they will never be able to “go from zero to one” in creation of a new concept (or in this case, piece/genre of art, like rock music). Can we design machine learning algorithms with the creative capacity of humans?