Let’s Shed Some Light on LEDs

If LED lights save you so much money – then why don't they pay for themselves?

Let’s Shed Some Light on LEDs

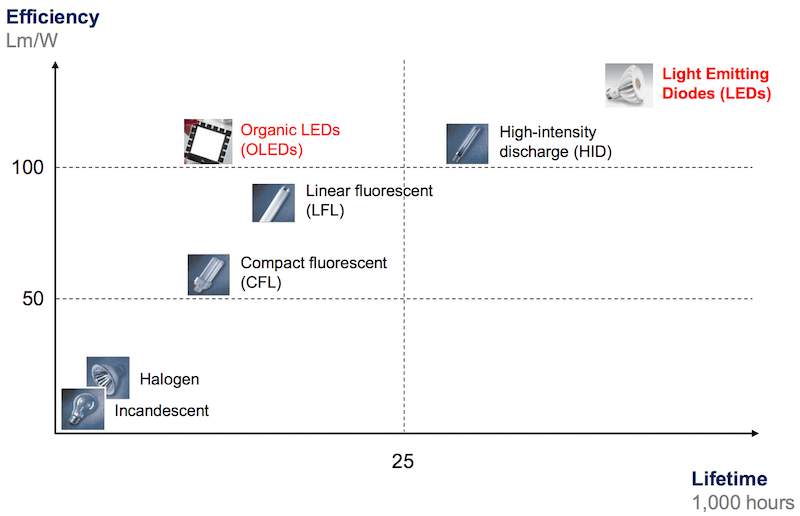

Figure 1: Efficiency and Lifetime of Lighting Technologies1

Source: McKinsey & Company

Lighting solutions have broadly assumed the same format since Edison made his famous discovery in 1879. Today lighting accounts for approximately 17% of electricity consumption in the US (14% residential, 38% commercial / industrial)2. LEDs have long been considered the solution to the inefficient incandescent bulb, primarily due to the significant savings to be garnered through operation. However, the longstanding barrier to LED adoption has been the cost of the bulbs. While these costs are falling to more reasonable levels, certain business models have been developed to increase the rate of adoption.

One company, UrbanVolt, has been at the forefront of driving this change with its “Lighting-as-a-Service” model3. Its business is predicated upon the proliferation of LED bulbs among commercial and industrial businesses as a means to reduce energy consumption in the commercial and industrial sectors. Specifically, UrbanVolt replaces a customer’s legacy incandescent bulbs with LED bulbs at no upfront cost. It then provides maintenance and troubleshooting services to the customer for the contract period. The expected life of LEDs can exceed 20 years, and so the customer stands to benefit from the switch long after the expiry of the contract with UrbanVolt, usually five years in duration.

As public policy and market regulations relating to energy efficiency and greenhouse gas emissions become increasingly stringent, potential customers of UrbanVolt are beginning to seek more ways in which they can reduce their energy costs and carbon footprint. Switching to LED lighting is one obvious way to reduce energy consumption without changing company behavior or practices, allowing resources to be directed to other areas of the strategy. Expected savings can reach 80% from both an energy and economic standpoint. The economics are shared between UrbanVolt and the customer.

Consensus expectations point to an increase in the velocity of LED adoption over the next decade. From 6% penetration today, Goldman Sachs forecasts that LEDs will represent 27% of the installed base of bulbs by 2020 and almost 55% by 2025. It is expected that the LED evolution in the US will present a 4% headwind to power demand growth, driving demand reductions of 6% in coal and 2% in natural gas over the same period.

One issue UrbanVolt faces is that of a shrinking market4. With an expected life of approximately twenty years, LEDs far outlast the service contract and profit sharing agreements put in place with the customer (at the end of which they own the bulbs). Increasing LED penetration will likely drive a boom in the market over the next five years or so, as customers progress from those in the innovator bracket to those in the early adopter and early majority categories. Following this, the market is likely to taper off as the latter portion of adopters come to the market, while the existing customers enjoy the benefits of the lengthy product life-cycle.

UrbanVolt is cognizant of this fact, and has a stated aim to put itself out of the lightbulb business as quickly as possible – such a feat would imply an extremely successful adoption campaign. It is already developing a Lighting-as-a-Service solution for residential customers, who are not served under the current model. It is also investigating other “Product-as-a-Service” energy technologies that could be useful to customers in further reducing their carbon footprints. The launch of one such prospect has been mooted for 2017.

While UrbanVolt is investigating how it might leverage its skill set in the “Product-as-a-Service” space, I believe there are further opportunities to utilize its expertise in the lighting sector to drive both economic and environmental value. Once such opportunity is to leverage the IoT revolution5,6. There are several things that can be done with respect to lighting, including the shift in focus from efficiency, reliability and operation to controllability, connectivity and integration in smart buildings and cities. UrbanVolt’s position as an installer and provider of maintenance to LED lighting systems leaves it well placed to transition to a systems integrator and platform developer, a space that is likely to become more important as smart buildings and smart cities increase in popularity.

While working to put oneself out of business may seem counterintuitive, it speaks to the idea that the consumer is tiring of the high turnover and rapid obsolescence of many products in today’s market. Building a business around true, sustainable value to the consumer and the environment may not be such a bad idea afterall.

Citations:

- McKinsey & Company, “Lighting the Way” 16 April 2012

- Goldman Sachs, “Clean Currents v5: No light matter – LED adoption still in early stages” June 30, 2016

- UrbanVolt Company Website. Retrieved 3 November 2016 from urbanvolt.com

- MacKinnon, New Yorker, “Trying to Solve the LED Quandry” 5 October 2016

- Frost & Sullivan, “Light as a Service” 14 June 2016

- Frost & Sullivan, “The Future of Lighting” 3 June 2016

This is incredibly interesting! I think the idea of expanding on its current business model to that of a systems integrator and platform developer is a great one! Do you think its possible to do this without proprietary technology or IP? I wonder whether for IoT the “Product-as-a-Service” will be the way forward for IP holders? That said, for as long as the IoT market is fragmented (i.e. across technologies as opposed to total smart home or smart building solutions) I think the role of a systems integrator will continue to be appealing!

I think this company will have to adapt quickly or fade away. This model of installing LEDs for free and then charging customers over time made sense when LEDs were very expensive, but costs are coming down so rapidly. Ikea sells LED bulbs for just a few dollars.

If you replace a dead incandescent bulb with an LED, and continue to do so, you will soon convert to LEDs.

The proliferation of LED lighting over the last decade has attracted many investors, particularly private equity. Over the past few years, many LED players have transacted in the M&A markets or recieved institutional capital from outside investors. In addition to the company you mentioned (UrbanVolt received $11 million from CIC Partners on a EURO30 million valuation), leading the way was Philips spinning out its LED business in a deal valued close to $3 billion. Also worth noting, SLV was acquired by Aridan Group in 2016; BMAC was acquired by Grakon in 2016; SloanLED was backed by Baird Capital in 2015; Halco Lighting Technologies was acquired by Lineage Capital in 2013. While there were more LED deals being marketed over the last four years, clearly adoption of LED technology is accelerating (and many stakeholders have a vested interest in its success!). LED lighting is so compelling because it’s an area where companies can start their sustainability initiatives and also materially cut operating costs.

In addition to what was mentioned in the article, LED lighting players are now taking advantage of “Smart LED” technology, a technology that enables large energy consumers to reduce energy consumption during off peak usage or off peak times. For example, many large commercial buildings in metropolitan areas are beginning to implement smart LED technologies, dimming and turning off lights at night that save significant amounts of energy. Lastly, an area where LED players are innovating is in their design strategy. In particular, MaxLite (based in New Jersey) has implemented more modular designs for their LED lighting fixtures, effectively reducing the amount of fixture SKUs they manufacture and sell. As long as these fewer fixtures are compatible with the various forms of LED technology, this can be further expanded upon as a sustainability initiative. Assuming high quality and compatibility, modular lighting product families have the ability to streamline production, reduce cost, optimize inventory and drive efficiency that encourage sustainability for the end consumer because it would force them to use only the most environmentally friendly products at a competitive price.

Thanks for a great article! It’s very interesting to see a business which is looking at opportunities created by the Climate Change crisis through a lens of not only making money, but meaningfully continuing to solving the underlying problem (“working to put yourself out of business” as you eloquently put it). To become more sustainable as a business, I wonder if UrbanVolt can leverage skills in the “Product-as-Service” category to introduce other energy-saving equipment into industry, but which require more regular maintenance. I echo Izkandar’s worry that the IoT space may become dominated by a small number of companies holding the technology or IP, and therefore UrbanVolt would quickly be forced out of the market if they played a “middle-man” role.