Is insurance against natural catastrophes sustainable?

How to cope with unpredictability caused by climate change?

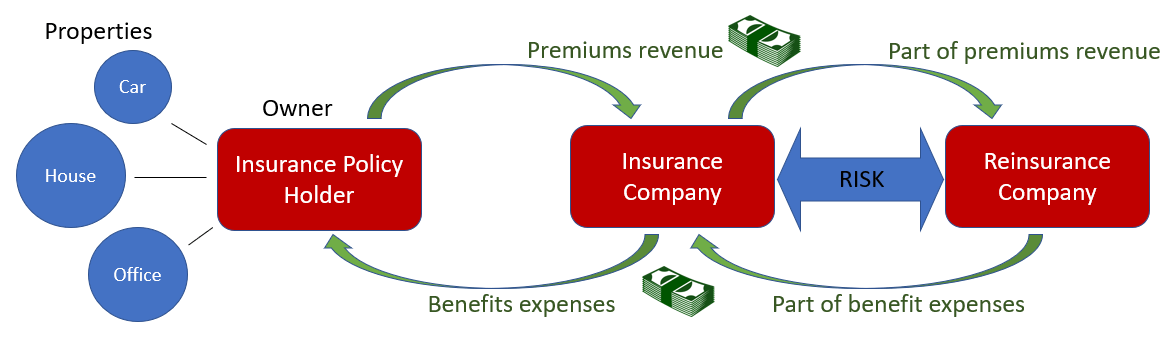

Reinsurance companies are often described as the insurer of insurance companies, a simple but accurate definition for what they do. Some risks are just too large and undiversified for an insurance company to bear, so the insurer will look for reinsurer to share this risk. In practice, the insurer and the reinsurer share the revenues from the premiums of the insurance policies sold, and will share the expenses of eventual benefits or reimbursements that will need to be paid to policy holders.

Munich Re is one of the top 2 global reinsurance companies in the world, with revenues of €27.8 billion in 2016[i]. The profits of reinsurance companies arise from the difference between the premiums they earn and the claims they must pay. One of the reasons why insurers look for the services of Munich Re is to share the risk associated to the protection of property and lives against the damage caused by natural catastrophes. In fact, nowadays global reinsurance companies pay the larger share for catastrophic claims[ii], which makes them a critical step in the supply chain of insurance against natural catastrophes. Without reinsurers, insurance against natural catastrophes is not possible. Munich Re has helped to pay for the damages of the 1906 San Francisco earthquake and fire[iii] and of Hurricane Hugo in 1989[iv].

The ability to accurately price risk is a core capability for every reinsurance company. In fact, the ability of estimating and pricing risk of natural catastrophes is what enables Munich RE to offer its services at a price at which they can profit but is still make the investment worth for their customer – the primary insurer.

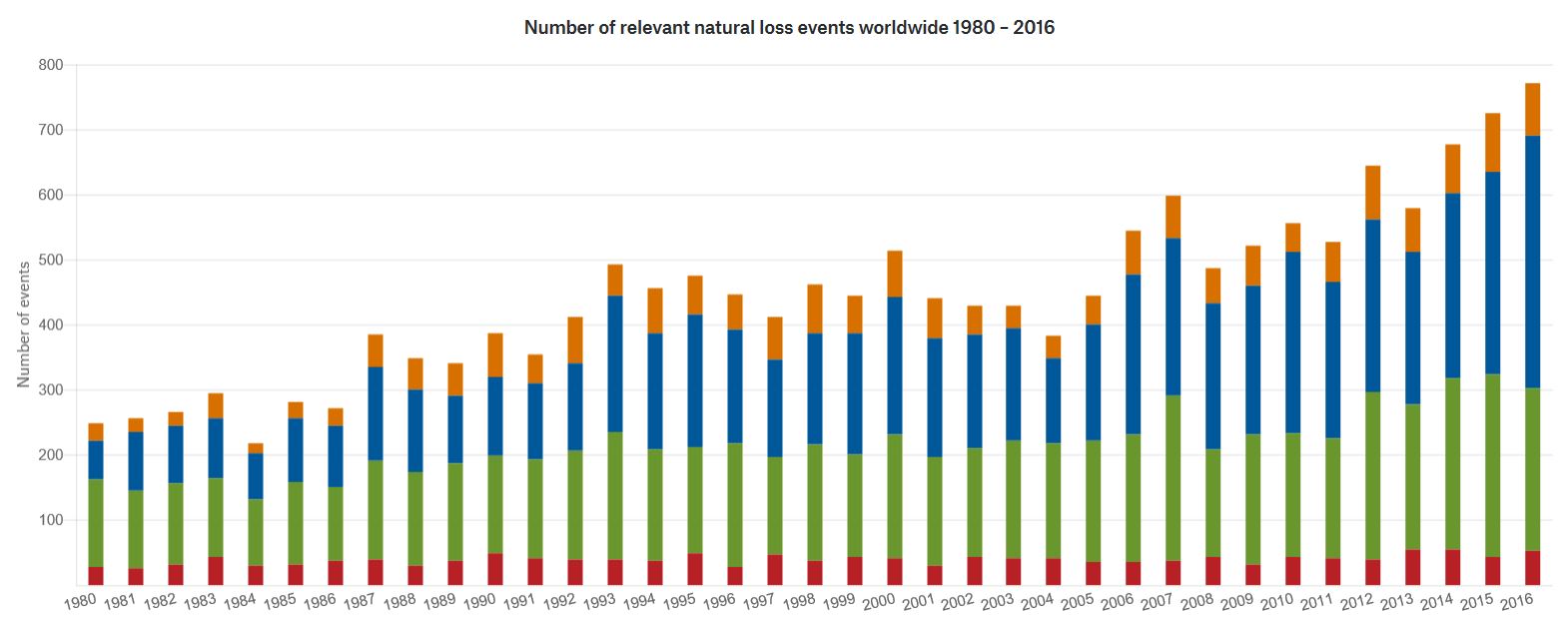

Since 1980, the frequency of weather-related catastrophes has increased three-fold.[v] [vi] .

If the frequency of natural disasters keeps increasing at a predictable pace, Munich Re will increase its price in order to compensate for the higher risks.

If that happens, presumably there will come a point when prices will be so high that revenues of Munich Re will start to decrease because less costumers will be able to afford coverage or will have interest to do so, but reinsurance, and hence insurance, would still be supplied.

However, the situation could be much worse if natural catastrophes start to increase in an unpredictable pattern. The consequence of inaccurately pricing the risk of natural disasters is that the company could have unexpected losses as the revenue received from the premiums in exchange for coverage are not enough to off-set the expenses with claims from end customers. One might argue that this unpredictable trend has already began: in the period between 2012 and 2015, Munich Re (reinsurance division) spent €686 million a year to help recover properties damages by natural catastrophes[vii], but in the third quarter of 2016, RE Munich announced to shareholders that it would decrease its results outlook for the year by due to higher than expected losses caused by hurricanes Harvey, Irma and Maria.[viii] Comparable expenses in 2016 were €929 million.

To cope with the additional risk brought by climate change, Munich Re has established a research institution called Corporate Climate Center (CCI) that has been studying climate change and its consequences since 1974. Researchers of CCI have reported that Munich Re will be capable of confidently estimating the likelihood of natural catastrophes until 2050, but if measures are not taken to reduce the emission of CO2, the risk of natural disasters will become impossible to predict and assets will become uninsurable.[ix] In fact, the difference between the costs of natural disasters and the amount insured – the so-called “protection gap” – has gone from 63% in 2012 to 72% in 2016.[x]

Munich Re is arguably the best positioned institutions in the world to predict natural disasters. They have the best data and the right incentives and resources to do so. As such, they should take a more active role in influencing governments and regulations to incentivize more drastic measure to reduce the carbon emissions.

What other actions should Munich Re take to reduce the protection gap and ensure the supply and profitability of natural catastrophes insurance in future decades.

(792 words)

[i] Munich RE, 2016 Preliminary Financial Statements, [https://www.munichre.com/site/corporate/get/params_E1386298429_Dattachment/1373399/MunichRe-IR-Preliminary-financial-statements-2016.pdf], accessed November 2017

[ii] McKinsey & Company, “Global reinsurance: Fit for the future”, September 2017 [https://www.mckinsey.com/industries/financial-services/our-insights/global-reinsurance-fit-for-the-future]

[iii] Munich RE, “Group History” https://www.munichre.com/en/group/company/history/early-years/index.html, accessed November 2017

[iv] Munich RE, “Group History” https://www.munichre.com/en/group/company/history/new-era/index.html, accessed November 2017

[v] University of Cambridge, “Cambridge Institute for Sustainability Leadership – ClimateWise launches two reports that warn of growing protection gap due to rising impact of climate risks” https://www.cisl.cam.ac.uk/business-action/sustainable-finance/climatewise/news/insurance-leaders-warn-protection-gap-due-to-impact-climate-risks, accessed November 2017

[vi] Munich Re, “Nat Cat Database” http://natcatservice.munichre.com/events/1?filter=eyJ5ZWFyRnJvbSI6MTk4MCwieWVhclRvIjoyMDE2fQ%3D%3D&type=1 accessed November 2017

[vii] Munich RE, “Key Figures” https://www.munichre.com/en/ir/annual-report-2016/key-figures/index.html

accessed November 2017

[viii] Munich RE, “Press Release” https://www.munichre.com/en/media-relations/publications/press-releases/2017/2017-10-26-press-release/index.html accessed November 2017

[ix] New Republic https://newrepublic.com/article/123212/who-will-pay-climate-change accessed November 2017

[x] Munich Re, “Nat Cat Database” http://natcatservice.munichre.com/events/1?filter=eyJ5ZWFyRnJvbSI6MTk4MCwieWVhclRvIjoyMDE2fQ%3D%3D&type=1 accessed November 2017

Intriguing piece about Munich Re’s attempts to provide insurance for natural disasters in response to climate change. I was unfamiliar with the concept of reinsurance and the associated organizations, but it makes sense that the enormous risks of natural catastrophes would simply be too great for even large conventional insurers to absorb by themselves.

The article mentions improving prediction methods as one way for Munich Re to continue to provide reinsurance as the frequency and magnitude of claims increase. However, another perhaps more impactful investment for Munich Re to consider would be funding the development of energy-efficient technologies and more generally fighting climate change itself. Just as medical insurers subsidize gym memberships and annual physicals to improve the health of their customers and reduce their claims exposure, so could Munich Re invest in cleantech to slow the pace of climate change and hedge against disaster claims. It is difficult for small organizations to substantially reduce global carbon emissions, but there is tremendous potential for one of the largest reinsurance companies in the world to affect positive change in this area.

I imagine one of the difficulties with pursuing this strategy is that is it nearly impossible to quantify the risk mitigation that could be achieved through such efforts. Perhaps as a starting point, Munich Re could look into supporting organizations that are attempting to develop metrics and tools to enable this kind of quantitative analysis.

Insurance is a complex business and Henrique has done a great job explaining the relevance of re-insurance in distributing the risk down the supply chain. Given that Munich- Re is so exposed to the risks of climate change but are not a major contributor the best they can do is try and predict risk and price premiums. Better predicting mother nature seems like a challenge though improving analytics and satellites should definitely help. Should they though consider getting more involved in climate change management and sustainability overall to try and improve their own outcomes? I believe they should play a role at least in education and the implications for the insurance industry. Perhaps they can consider tying their premiums to better climate change practices or providing discounts to businesses or individuals who are more sustainable.

This is a super interesting topic and the first I have read about reinsurance companies (though it of course makes sense they exist). I would push back on one point you make, which is that as prices increase fewer companies will purchase the insurance or have the ability to do so. I would argue that, given the increasing rate of natural disasters, prices and the instances of people purchasing natural disaster insurance will increase and insurance companies will have greater purchasing power. Additionally, I imagine that demand from the insurance companies is fairly inelastic. The cost of taking on the risk themselves is too high and thus the insurance companies will always be willing to pay for reinsurance. I think Munich Re has positioned itself very well to be the leader in what will be an increasingly important industry.

whoops meant to leave the below as a new comment 🙂

This is a super interesting topic and the first I have read about reinsurance companies (though it of course makes sense they exist). I would push back on one point you make, which is that as prices increase fewer companies will purchase the insurance or have the ability to do so. I would argue that, given the increasing rate of natural disasters, prices and the instances of people purchasing natural disaster insurance will increase and insurance companies will have greater purchasing power. Additionally, I imagine that demand from the insurance companies is fairly inelastic. The cost of taking on the risk themselves is too high and thus the insurance companies will always be willing to pay for reinsurance. I think Munich Re has positioned itself very well to be the leader in what will be an increasingly important industry.

This is a very interesting topic that I am sure will continue to grow in prominence as time passes. Some insurance companies have adopted an interesting tactic in an effort to restrict the drivers of global climate change. For instance, according to Reuters, Zurich Insurance recently announced plans to devote $5 billion to impact investments that are aimed at reducing carbon dioxide emissions (among other social causes). Zurich expects to invest largely in “green bonds” and lend to companies that aim to have a positive impact on climate change. Zurich’s head of responsible investment stated that “…we can obtain OK market returns, on top of that we are doing something good.” She failed to also mention that if impact investing ultimately dampens the effects of climate change, resulting in fewer/more predictable natural disasters, it could save insurers a lot of money in reduced claim payouts.

This is such a fascinating dilemma. Thought it seems that Reinsurance companies like this will be forced to bear the brunt of climate change related weather events, there is hope for mitigation:

I agree with ELH that predicting mother nature is a quite a challenge indeed. I’m not sure that weather satellites will help much as the risk exposure is over the next few decades, not so much the near future that satellites can help us predict and understand.

To this end, I really like Ryu’s point about mitigating the risk and attempting to quantify it as best as possible. Surely there are other collaborators in large organizations who have a shared interest in (1) understanding the pace of a changing global climate and (2) mitigating the effects of a changing global climate as much as possible.

I didn’t know about the role of the re-insurer and I must confess that I never thought about the changes in the insurance world due to climate change. However, it seems to be crucial for the future.

Having a data center with which the company can better predict the patterns of climate change seems to be a way to control risk, costs and “protection gap”. However, my first question is why these companies don’t rely on the info of other institutes/organizations more specialized in the topic. Besides, the money invested in the center could be used to support organizations that are more academic and are developing ways to reduce the pace of climate change. A partnership will be a better way to allocate resources.

I think that the insurance companies have enough leverage to work with governments to set work standards. For a country or a city, the fact that they will be not covered in the case of a climate disaster could foster the collaboration between countries/industries to arrive to a final solution and generate the commitment to reduce the impact on the planet.

This is an issue that insurers and reinsurers in the United States have recently had to grapple with given the uptick in natural disasters in 2017, including the fires in Norcal and flooding in Puerto Rico and Texas. From a more macro perspective, I wonder what the role of government ultimately plays in this equation. Generally, one would imagine that insurers and reinsurers will adjust to a new equilibrium relatively quickly, as those who do not will become insolvent fairly quickly. There is the risk that a major event wipes out too many insurers all at once, but one would then imagine that the government would step in as necessary. Take for example the many governments which provided massive capital injections into insurers and reinsurers during the 2008 financial crisis. It seems unlikely that any given catastrophe would ultimately lead to an inability for insurers to pay out en masse. As for a specific company and its role in this, i would imagine that so long as one stays one of the the largest insurers in a market, one would fall under the protection of the government in any sort of black swan scenario. Meanwhile, as pointed out by the essay, working diligently to improve predictive analytics and influence government and social policies would seem to be the best plan of action.

Thank you for the interesting essay! Previously in my life I have been working with reinsurance companies for shipping but never have heard about “natural disasters” products.

I see here 2 key steps for Munich RE:

1. Continuous improvement of data quality while increasing data quantity. Insurance is pretty low marginal business and increasing the number of observations can increase forecast accuracy while eliminating type I and type II mistakes in the situation of not completely independent random events.

2. Adding additional products to their portfolio. Industry of insurance (in terms of data and mathematics, e.g. credibility models) is very close to options calculations at exchanges. Weather derivatives usual cover “low-risk, high-probability events” (https://www.investopedia.com/articles/optioninvestor/05/052505.asp) and are simple version of this instruments but allow to get additional revenue not only at the critical situation (e.g. CME Group Weather products: http://www.cmegroup.com/trading/weather/). More exotic variants of weather options can become new product as well for Munich RE as they have a lot of data what is their competitive advantage at critical situations. The same time with market weather options Munich RE can even reinsure itself.

Excellent analysis of yet another problem caused by a climate change. I see a number of additional implications:

1. Underlying premiums will rise to compensate for the additional risk, which will flow through to Munich Re. Soon, insurance will become too expensive for end users who will either 1) be unprotected against national disasters 2) be forced to uproot from geographies that are prone to disasters.

2. Munich Re should lobby governments to support laws & international agreements that curb emissions. While this is not an overnight solution, the best result for Munich Re is less disasters.

3. Munich Re will shift its portfolio away from disaster to a different form of reinsurance. Again, loser here is the end user who faces a dearth of insurance options.

I disagree that Munich Re is very exposed to this risk. Fundamentally, the reinsurance business works because it diversifies risks that are otherwise too large for local carriers to diversify. As the frequency of natural disasters (e.g. Hurricane Sandy, Katrina, etc.) increases, yes the cost of reinsurance will increase, but so too will the benefits of diversifying that now more likely and costly risk. Yes, the pricing model will need to be re-calibrated, but assuming its still done correctly, there is a net benefit to everyone, and Munich Re’s customers will be more and more eager to protect themselves from more frequent and more costly risks.

Fundamentally, what this really comes down to is the responsiveness of insurers to the new “true-distribution” of risks. Those who respond too quickly and aggressively (i.e. raise prices too high), will lose business. Those who don’t respond sufficiently will be forced out of business by high claim costs. This flows down the chain and ultimately impacts the costs of insurance to the end consumer, who will then be incentivized to avoid exposure to the risks. The downside here is that these costs either increase the cost of living, or displace large populations who can no longer afford them, and can’t live with uncovered risks. The human costs here are massive, but as with other effects of climate change, the benefits are clear and immediate (cheap energy), while the costs are hidden and spread (higher insurance premiums for Manhattan).

The one additional thing to remember is that catastrophe insurance is highly uncorrelated to other financial assets, and with increased costs and therefore increased premiums, you would actually expect the overall industry to grow (attracting capital with low cost), creating an almost perverse value for companies and capital providers in this area who can benefit and provide this business profitably.

Very interesting essay. As reinsurance company’s customers are insurance companies, we rarely have a chance to deal with this issue. However, many insurance companies have been using reinsurance companies to mitigate their risks for more than 1300 years. Without reinsurance companies, insurance companies couldn’t expand their business models, which offer chances to their customers(companies and people) to perform their tasks with much less risks and thus our industrial landscape would be totally different from now. One of the cases that we can think of reinsurance business is 9.11 in 2010. For 2 years after the tragic, hundreds of reinsurance companies had shared the risks($22B claims) and compensated it, which prevented serial bankruptcy of insurance companies.

As political, religious, and climate uncertainty increases, reinsurance companies raise insurance premium gradually. However, insurance companies don’t have many options to choose because they should hedge their risks anyway. And, of course, it will have impact on our premium too.

This is a very interesting topic, Henrique. I hadn’t spent too much time thinking about the impacts on reinsurers, and do question (to Steve’s point) whether they will feel this impact deeply given they are diversified. We struggled with this too at my prior company in looking at life insurance claims. There were some spikes in claims that seemed to take place across the industry, not just our company, and seemed to be highly correlated with changes in weather (increase in deaths from pneumonia and other pulmonary/respiratory diseases, death from weather related accidents, etc.). Big data seems to be the best investment right now.

Fascinating essay, Henrique. One idea that struck me as I read this is that Munich Re could consider broadening its service offering to include consulting for businesses that are subject to natural catastrophes or other negative effects of climate change. Given Munich Re’s information advantage on climate change trends, they could sell this information to companies who can then better assess and make decisions regarding potential climate change risks to their businesses. They could also help companies plan their operations around these risks – for example, they could study a company’s existing supply chain and help them to develop emergency plans or alternative plans for if/when disaster strikes. This could mitigate the impact of the adverse events, leading to lower payouts.

One point to consider from a regulatory standpoint as well – should governments require some minimal level of catastrophe insurance for all companies or companies in certain industries? The idea behind this would be to ensure that the risk pool is as broad as possible, much like the logic of mandatory insurance in the US healthcare system. One could argue that since all parts of the economy are so interdependent, all should share in bearing the risk. Even if certain companies on the surface do not appear to face climate change risks, they may depend on others who do, or their customers may, and so on.

Interesting post, Henrique. The insurance business economics to an insurer work similarly to roulette economics to a casino. If a specific policy was priced at exactly the expected value of a claim, insurers would not make any money, just like casinos wouldn’t make money if all bets paid based on their expected probabilities. Insurance overall is not a perfectly rational decision for the policy holder, but due to the catastrophic nature of these events, people take out policies and insurers make money. Therefore, I would argue that no matter how much premia rise to respond to increase in frequency & costs of catastrophes, there will always be a market for these services. You bring up an interesting point around the possibility of having un-insurable claims. I think that, if we do get to that point, we’ll have much bigger problems to deal with…

The author poignantly articulated the ways in which climate change could drastically increase the frequency and severity of claims to reinsurance vendors, but it seems to me that the company’s response to these sorts of trends is not nearly enough given their criticality to the business model. The company should do three things from my perspective. First, they should start to sell policies with more adjustable premiums that allow them to change pricing quickly as they get more information on weather events. This dynamic pricing would help the firm via a profit pool buffer with which to offset losses in the event that adverse weather events do materialize. Second, they will likely need to set caps on their coverage and strive for greater portfolio diversity across regions to minimize the impact of individual storms. Finally, they should be on the front lines exchanging data with governmentally and non-governmental agencies to show the severity of climate change and advocating for tougher control policies in all regions.