Is Fast Beauty the Next Fast Fashion?

Fast fashion players like H&M and Zara massively disrupted the world of apparel retailing via compressed supply chains. Will beauty be the next category to experience this type of shock?

Fast Fashion All Over Again?

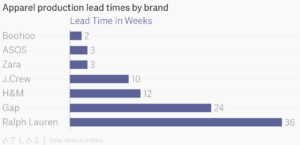

The profound impact of the “fast fashion” effect in retail has been well documented [1]. Amidst a stagnant retail economy, brands including Zara, H&M and ASOS have fueled massive growth via a first-to-market strategy. Underlying these brands’ success is extreme compression of their supply chains [2]. Massively shortened manufacturing lead times allow consumers to purchase trending runway looks off-the-rack – often, before even the couture designer has commercialized the original design. As seen in Figure 1 below, the supply chain lead times of these fast fashion players significantly outstrip traditional retailers such as Gap and Ralph Lauren, both of which have struggled as of late [3],[4].

Figure 1

The beauty industry has not (yet) been disrupted as significantly by such “fast” players, owing to several historic differences in beauty vs. fashion/apparel retailing:

- Beauty products tended to be replenishment purchases, meaning consumers were more likely to repurchase a favorite product repeatedly than to constantly seek out new trends

- In the absence of regular runway shows, as seen in the fashion world, trends in beauty had historically been less observable and thus more difficult to copy-cat by fast players

- Finally, the majority of beauty brands distributed via unowned retail channels, meaning most brands lacked a direct-to-consumer connection, reducing opportunities to respond directly to new buying patterns

How Should a Beauty Incumbent React?

Digitization across the beauty value chain has massively disrupted the industry, and allowed a host of nimble “fast beauty” players to challenge incumbent organizations [5]. The trends laid out above have begun to reverse, necessitating swift organizational change. The remainder of this post will focus on how one such incumbent, Estee Lauder Companies (ELC), should react to these new forces.

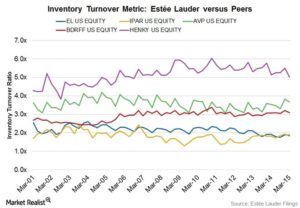

As seen in Figure 2 below, companies within the Estee Lauder Companies portfolio (including brands such as MAC, Clinique, Estee Lauder and Bobbi Brown) have historically seen lower inventory turnover metrics vs. beauty peers. Although ELC’s selective distribution has historically been cited to explain their slower inventory turn, supply chain also plays a role.

Figure 2

No brand within the ELC portfolio is positioned as a “fast beauty” player, and thus specifically optimized to quickly capitalize on emerging trends in the industry from a manufacturing perspective. As a result, the organization has had little need to re-engineer supply chains to optimize for quicker inventory turns, and more urgent speed-to-market demands. ELC has taken several steps to begin to develop these capabilities. For instance, the portfolio acquired two new brands in 2016, Becca Cosmetics and Too Faced, both of which distribute primarily through Sephora [6]. Sephora tends to be a more trend-driven selling environment than the department store channel. To make these new brand acquisitions successful, ELC will need to focus on optimizing supply chain from a speed-to-market perspective.

Another way that ELC has responded to the “fast beauty” threat in the industry is to reposition legacy brands as being more trend-driven. For example, MAC Cosmetics has begun to explicitly draft off the success of other brands in the industry with a copy-cat strategy – for instance, the brand recent released a “Lip Duo” product to rival the massively successful “Lip Kit” popularized by Kylie Cosmetics. However, MAC’s product release occurred months after the Lip Kit phenomena had already taken the beauty industry by storm. Earlier signal detection, coupled with a more responsive supply chain, would have allowed MAC to capitalize even more effectively on the rising tide of the Lip Kit trend.

How to Get Even Faster

Estee Lauder Companies should consider additional steps in order to remain competitive in the face of a rapidly digitizing beauty supply chain:

- Social Media as Signal Detection: Platforms like Instagram have provided unparalleled insight into consumer demand, and provided a new way for brands to engage in micro trendcasting. Social web should be thought of as a external “pull driver” in the context of a digitalized supply chain, and ELC must design its analytics function appropriately to take advantage of these new beacons. [7]

- Diversification Away from Legacy Channels of Distribution: ELC should diversify distribution away from the struggling department store channel, and focus on high-growth specialty beauty retail (e.g. Sephora, ULTA) and direct-to-consumer selling. While the former will inspire urgency to innovate in order to remain competitive in a trend-driven selling environment, the latter will facilitate an even closer customer relationship.

- Acquisition of a Fast Beauty Brand: Finally, ELC should consider building or buying a true fast beauty brand, to compete with new market share stealers on their own turf. However, the organization will need to grapple with new questions: What new skills will be required to make such a brand successful? Is it possible to reverse-engineer learnings from this type of brand across the broader ELC portfolio?

(Word count: 793)

[1] Paula Rosemblum, “Fast Fashion Has Completely Disrupted Apparel Retail,” Forbes, May 21, 2015, https://www.forbes.com/sites/paularosenblum/2015/05/21/fast-fashion-has-completely-disrupted-apparel-retail/#581fb4a7e3eb, accessed November 12, 2017.

[2] Oliver Wyman, “Fast Fashion: Staying On-Trend with a New Style of Supply Chain,” Oliver Wyman, 2015, http://www.oliverwyman.com/content/dam/oliver-wyman/global/en/2015/aug/2015_OliverWyman_Fast_Fashion_screen.pdf, accessed November 12, 2017.

[3] Stephanie Hoi-Nga Wong, “Ralph Lauren’s ‘80s Empire Struggles to Adapt to Modern Fashion,” Bloomberg, February 2, 2017, https://www.bloomberg.com/news/articles/2017-02-02/ralph-lauren-s-80s-empire-struggles-to-adapt-to-modern-fashion, accessed November 12, 2017.

[4] Nicholas Rossolillo, “Why Gap Will Keep Struggling in 2017,” The Motley Fool, December 16, 2016, https://www.fool.com/investing/2016/12/16/why-gap-will-keep-struggling-in-2017.aspx, accessed November 12, 2017.

[5] Janna Zittrer, “Cosmetics companies take cues from fast fashion to find success,” The Globe and Mail, March 21, 2017, https://beta.theglobeandmail.com/life/fashion-and-beauty/beauty/cosmetics-companies-take-cues-from-fast-fashion-to-findsuccess/article34360651/?ref=http://www.theglobeandmail.com&, accessed November 12, 2017.

[6] Chantal Fernandez, “Estee Lauder vs. L’Oreal: Who’s Winning Beauty’s Arms Race?,” Business of Fashion, January 31, 2017, https://www.businessoffashion.com/articles/intelligence/estee-lauder-vs-loreal-whos-winning-beautys-arms-race, accessed November 12, 2017.

[7] Stefan Schrauf and Philipp Berttram, “Industry 4.0: How digitization makes the supply chain more efficient, agile, and customer-focused,” Strategy&, 2016, https://www.strategyand.pwc.com/media/file/Industry4.0.pdf, accessed November 12, 2017.

Really great article. I think you make great points on how speed to market, and therefore supply chain digitization, is becoming critical to the beauty industry.

I appreciate your great ideas on how to apply digitization to trend detection. What if you pushed digitization even further upstream to the manufacturing plants? This could definitely improve lead times and process efficiency, improving your speed to market. Currently, many cosmetics companies use contract manufacturers with low visibility into their logistics[1]. Perhaps cosmetics companies could develop a proprietary technology to improve visibility into their manufacturers’ processes so that they can increase efficiency. One concern would be that if those contract manufacturers produce cosmetics for multiple different companies, that technology might be replicated by competitors as well.

In response to your questions about bringing a new “fast-fashion” brand into the ELC portfolio, I believe the brand would need to maintain an innovation-driven and first-to-market mentality. In my opinion, much of the appeal of new beauty products comes from being “first” and being “different,” and so, while using social media detection technology to spot trends is definitely crucial, it would be important to not become an entirely copy-cat driven brand. To your second question about applying these learnings to other brands in the ELC portfolio, it should be assessed on a brand-by-brand basis, as certain brands might have a more traditional consumer that prefers to stay away from beauty fads, and you would not want to dilute that traditional brand image.

[1] Justine Brown, “Cosmetics Logistics: The Beauty of an Optimized Supply Chain,” Inbound Logistics, February 28, 2014, http://www.inboundlogistics.com/cms/article/cosmetics-logistics-the-beauty-of-an-optimized-supply-chain/, accessed November 2017.

Great article! I think when trying to become digital and fast fashion as an organization, you need to first pivot the mindset of your company, regardless of how much adoption takes place in all your portfolio companies. Many companies like AirBnB and Pepsi have innovation labs that not only become think tanks for the company, but are responsible for changing the culture and mindset to design and user centric thinking, and becoming digital from the “ground up”.

I think all brands will need to start reducing the cycle time of their supply chain and use digital platforms as a way to access more data and understand their customer segment better. It doesn’t matter if you follow or set trends, understanding your changing customer base is essential. Even Ralph Lauren and GAP are focusing on going direct to consumer and retail and fashion companies look to vertically integrate more. The question is, once you have access to more information about your consumer, how do you understand it to translate that into a coherent strategy and action plan for your brand? The question is whether to build this analytics talent base in house or to utilize more and more companies in the area specializing in this. For example, the company “Wise Analytics Group” focuses on analytics of consumer bases for beauty products: http://wiseanalyticsgroup.com

My vote is to build this in house to keep a defensible edge, but this requires building out a new core competency.