International Climate Policy Heats Up the Business of Cooling

New regulations due to climate change present challenges to businesses, but by anticipating market trends and fostering innovation to develop safe, environmentally friendly products, some companies have positioned themselves to succeed in this transitional environment.

On October 15, 2016 ~150 nations signed an agreement to phase out the use of hydrofluorocarbons (HFCs) in air conditioners (A/Cs) and refrigerators.8 This agreement is an amendment to the Montreal Protocol that phased out use of chlorofluorocarbons (CFCs) known to be depleting the ozone layer.3,12 As a consequence, CFCs were replaced with HFCs resulting in a 135-billion-ton reduction in CO2 (carbon dioxide) emissions and the recovery of the ozone layer.3 Similar to the original protocol, the new agreement requires nations to institute regulations that phase out the use of HFCs in appliances with the goal of reducing emissions from 5.0 to 1.2-gigatons by 2050. Scientists believe a reduction of this magnitude will decrease the global average temperature rise by 0.5°F.11,12 HFC emission reductions will be achieved using a three-tiered approach: developed countries (USA) will end HFC production and use by 2019, other developed countries (China and Brazil) by 2024, and developing countries (India, Pakistan) by 2028.4,12

Why are we phasing out HFCs if this chemical replaced CFCs? The answer is that while HFCs do not deplete the ozone layer, HFCs are a highly stable greenhouse gas that contribute to global warming by creating a blanket around the Earth that traps in heat.11 The global A/C market is expected to grow at astonishing rates in developing countries with an estimated 700 million new units to be installed, therefore, it is projected that if HFCs are not replaced with a more environmentally safe technology, then we may expect a 10% increase in greenhouse gases by 2050 and could witness an average global temperature increase of 1°F by 2026.1,3,7 Climate changes of this scale is why nations have rallied together to sign this agreement.

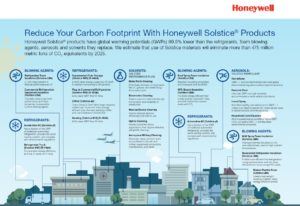

Response to the new regulations by chemical and appliance manufacturers has been mixed. While several alternative coolants exist (e.g. propane) many are not approved for the intended use, are flammable, or have an undetermined safety profile.10 Companies are concerned with the associated costs transitioning to new technologies that could require multimillion dollar investments in manufacturing and design.10 However, Honeywell International anticipated the new regulations and proactively developed new coolant technologies to replace HFCs. Since 2000, Honeywell has invested $500 million in R&D to develop their Solstice product line (Figure 1).5,8 Solstice is composed of hydrofluoroolefin (HFO) that has many benefits when compared to HFCs including a shorter atmospheric lifetime and being less toxic when compared to a single molecule of CO2.5,8

The impact of Solstice on Honeywell’s current and future business is tremendous. While Solstice is not considered a monopoly because other companies have developed alternative coolants, Honeywell has strategically positioned itself to reap the benefits of the new regulation by investing significant resources in R&D early-on, patenting the product (e.g. HFO-1234yf in automobiles)6, creating partnerships with appliance manufacturers worth $3.4 billion, and obtaining approval for use by the EPA.10 Due to the limited number of entrants to market because of the regulatory unknowns, Honeywell’s technology will one of the few products on the market that appliance manufacturers can use in order to comply with the new regulations. Consequently, Honeywell projects Solstice generating $1 billion in annual revenue by 2020.10

One point of concern regarding the new regulations is the impact of price on new technologies and consumer behavior. An estimated 2% price increase may not deter consumers in developed countries, but will likely negatively impact developing countries like India.10 India is currently experiencing an A/C market boom with estimated growth of 15-30% over the next decade (Figure 2).9 Growth is attributed to both an increase in household income, a decrease in A/C prices, and India’s hot climate.2 Only 6-9% of the Indian population owns an A/C, however, it is usually the first appliance purchased by a family.1 There is worry that an aggressive HFC phase out will make A/Cs unaffordable in this market.

The challenge to Honeywell is how they can offset the increased cost of Solstice with decreased manufacturing costs to maintain A/C pricing that is affordable by the growing lower/middle class families in India. Honeywell has designed several Solstice offerings as drop-in technologies in order to have minimal impact on design changes by manufacturers. However, it is likely that Honeywell catered to manufactures in developed countries and that other costs savings can be extracted by Honeywell working directly with manufacturers in developing countries (e.g. Voltas in India) to identify additional efficiencies with product design fit within manufacturing.2 The resources required to foster such partnerships could be supported by the Montreal fund to help finance these activities to support India phasing out HFCs before 2028 while making A/Cs affordable to the Indian consumer. (767 words)

References

- Barry, E. and Davenport C. “Emerging Climate Accord Could Push A/C Out of Sweltering India’s Reach”. Oct. 12, 2016. New York Times.

- “Cooling India with Less Warming: The Business Case for Phasing Down HFCs in Room and Vehicle Air Conditioners”. June 2013. CEEW, IGSD, NRDC, TERI in cooperation with Confederation of Indian Industry (CII).

- Cornwall W. “Nations sign major deal to curb warming chemicals used for air conditioning”. October 15, 2016. Science.

- Harder A. and Gold R. “Companies Readying for New Limits to Emissions From Air Conditioners, Refrigerators”. October 15, 2016, Wall Street Journal.

- “Honeywell Solstice Products are Meeting Demand for Environmentally Preferable Solutions”. Oct. 10, 2016. Honewell.com, http://www.honeywell.com/newsroom/news/2016/10/honeywell-solstice-products-are-meeting-demand-for-environmentally-preferable-solutions.

- https://www.1234facts.com/about-us/patents/. Oct. 2014. Honeywell.

- Mooney C. and Dennis B. “The World is About to Install 700 Million Air Conditioners. Here’s What That Means for the Climate”. May 31, 2016. Washington Post.

- Nayak M. “US Companies Brace for Climate-Friendly Alternatives in Cooling Systems”. October 16, 2016. Reuters.

- Shah, N, Wei M, Letschert V, Phadke A. “Benefits of Leapfrogging to Superefficiency and Low Global Warming Potential Refrigerants in Room Air Conditioning”. October 2015. Ernest Orlando Lawrence Berkeley National Laboratory. (Figure 1)

- Tangel A. and Mann T. “Appliance Makers Try to Keep Their Cool as Rules Change on Refrigerants” October 18, 2016. Wall Street Journal.

- “To Coldly Go”. Sept. 24, 2016. Economist

- Worland J. “Countries Reach Landmark Deal to Limit Global Warming From Air Conditioners”. October 15, 2016. Time.

- http://image.slidesharecdn.com/honeywell-solstice-hfo-refrigerants-presentation-2016-160308195331/95/honeywell-solstice-future-role-of-hfo-refrigerants-1-638.jpg?cb=1457467269 (cover image)

- http://www.honeywell.com/newsroom/news/2016/10/honeywell-solstice-products-are-meeting-demand-for-environmentally-preferable-solutions (Figure 2)

Pricing is always a concern with implementing environmental regulation, but I do wander if we’re going to miss our chance to make a meaningful impact in emerging markets when consumer demand growth and regulation implementation timelines are mismatched. It’s astonishing that only 6-9% of Indian households have an airconditioner! Yet, if the uptick in demand is happening now but regulation still allows HFCs in the current products, it seems like we will miss our chance to have a substantial impact on reducing HFCs in the near term. It makes me wonder if there is a way to have governments subsidize the cost of new air conditioners in emerging markets through tax rebates or a similar mechanism so that we can more quickly scale the market penetration of technologies like Honeywell’s Solstice. Furthermore, I would push Honeywell to use it’s corporate citizenship program to expand the accessibility of it’s technologies in growing emerging markets where we can make the most impact. Right now, they’re philanthropy program focuses on employee volunteerism around Science & math education, Family safety & security, Housing & shelter, Habitat & conservation, Humanitarian Relief; none of these items leverage their expertise in sustainability. I believe it’s absolutely the duty of shareholders to hold Honeywell accountable to having a truly impactful CSR program rather than greenwashing, especially when HFCs are such a large contributor to our carbon-equivalent footprint. The Montreal Protocol brings attention to the important issue of coolants and of course needs to be tiered in order to create polictical buy-in; however, the poltics of climate change stand in the way of the accelerated progress we need to make, and I believe we need to put additional pressures on corporations to value the risk to society appropriately, even if only through using their dedicated philanthropy dollars and employee time more effectively. Would love to hear your thoughts on if you believe the philanthropy angle to engage Honeywell in distributing its technologies would be effective!