How Technology is Reinventing the Supermarket: Whole Foods in the Digital Age

Whole Foods is incorporating technology into its model to bring customers the grocery store of the future.

Imagine a grocery store where you can receive personal recommendations and offers the moment you step in the store, where checkout takes seconds and you can pay for groceries without ever taking out your wallet. Sound far-fetched? It’s closer than you think. -Nielsen “The Future of Grocery”

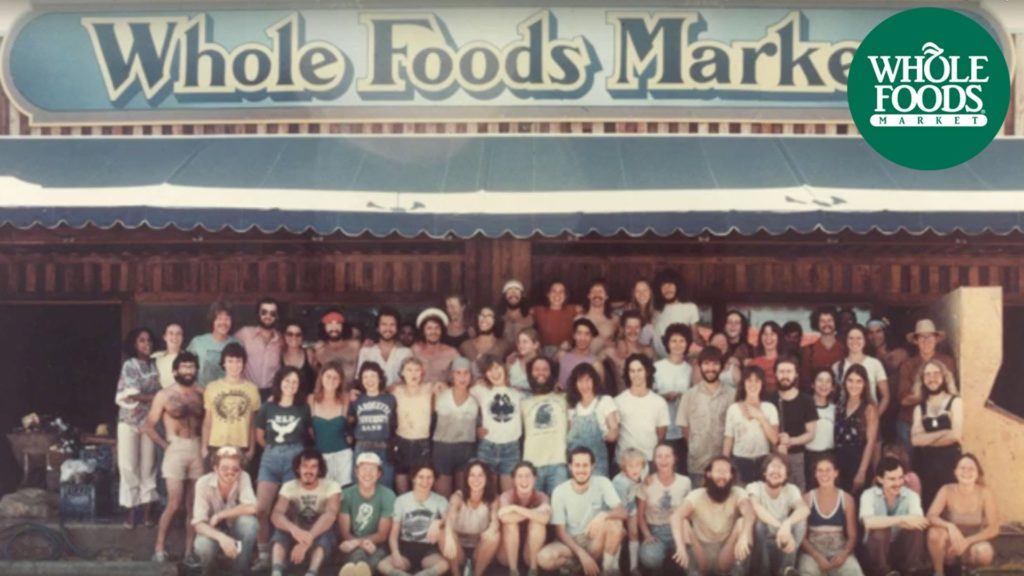

An Old Natural Market Looking to Innovate

Whole Foods was started in 1978 by two college drop-outs who wanted to sell natural foods to their classmates. Set up in their dorm room, the original Whole Foods utilized very little technology. Eventually, the duo bought a real store, expanded, and marched their way across the nation. As a wave of demand for organic and natural food products swept over the United States, Whole Foods captured a large percentage of those customers.

The original store. Source: Whole Foods Website

The original store. Source: Whole Foods Website

Now in the 21st century with over 400 stores, Whole Foods has become not only a natural foods market, but an innovative grocer and food delivery service. In the company’s core values, they state that Whole Foods, “continually experiments and innovates.”[1] True to that mission, the company has taken several steps in recent years to take advantage of emerging technology. Operating within an evolving landscape of startup competitors, the company must continue to incorporate new digital solutions in the years to come.

Digitizing the Operating Model – Cost Reduction through Tech-Enabled Information Systems

In 2013, Whole Foods announced a partnership with Infor, a technology vendor more known for industrial automation software at the time[2]. With the partnership, Whole Foods took a smart approach to solving a long-term problem: organic food remained much more expensive than non-organic options. To expand their market, Whole Foods needed to reduce their costs and maintain competitive prices. To do so, Whole Foods partnered with Infor to automate its merchandising, supply chain, and inventory systems. While implementation continues, in 2016 the Wall Street Journal reported that the Infor partnership was enabling Whole Foods to reduce its inventory management systems from twelve to one. All of its cost savings measures combined, Whole Foods was well on its way to reducing costs by $300M by 2017.[3]

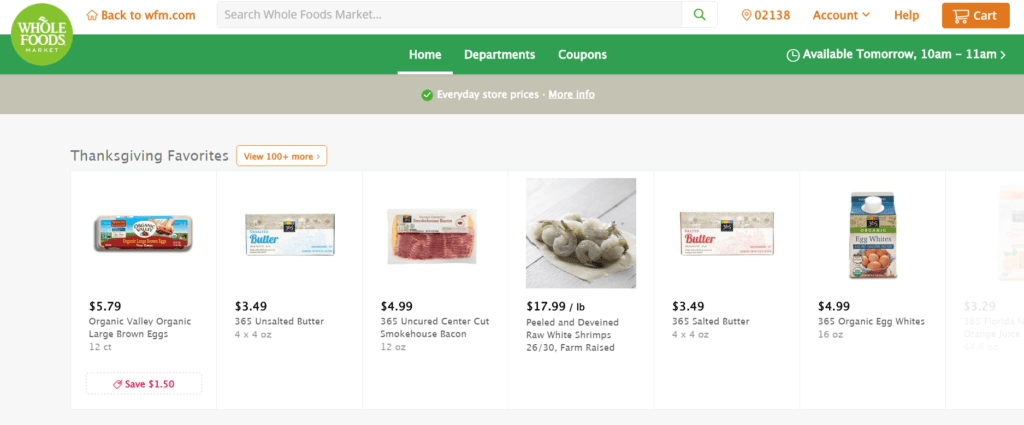

Digitizing the Business Model – Bringing Food Shopping Online

Beyond enhancements to its operations, Whole Foods also used technology to respond to adapting consumer preferences. As these customers began to shop more online, the company started to offer online purchasing and delivery. In 2014, Whole Foods announced a partnership with delivery startup, Instacart.[4] The partnership would allow customers to have Whole Foods products delivered within 1 hour. This digital platform and physical delivery system enhanced convenience for customers, addressing the 2nd most important concern (only second to price) amongst grocery shoppers in North America.[5] This move was also defensive, in part thwarting off the arrival of online-online grocery threats, like Amazon Fresh. After their first Instacart pilot in 2014, Whole Foods scaled online delivery to 60 stores in 16 cities in 2015.[6]

Whole Foods’ Instacart online storefront. Source: Whole Foods Instacart Site

Whole Foods’ Instacart online storefront. Source: Whole Foods Instacart Site

Capturing the Ultimate Digital Customer – the Millennial Household

“Millennials are at the beginning of their careers and are starting to form households. This generation will shape our economy for

decades to come.”[7]

To attract millennials, Whole Foods announced further digitization efforts in 2016 – opening smaller stores in more ‘hip’ locations and with more technological integration. Whole Foods is testing out ‘smart carts’ which help customers navigate through the grocery store maze. Additionally, to counteract stockouts arising from the smaller store size, these stores use electronic shelf scales that alert employees when a product is running low.[8]

A smart cart. Source: Epicurious

A smart cart. Source: Epicurious

Next Steps and Recommendations

In addition to the initiatives the company has already undertaken, there are several tech-based opportunities Whole Foods could implement:

- In the store: To help customers buy more quickly, Whole Foods could turn to smartphone enabled self-checkout technology that’s already used in 10% of North American supermarkets to date[9]. This would allow customers with their own bags to check out as they go, saving time in the process. Stop & Shop has found success with their trials which shows promise in user uptake.[10]

- In the home: Whole foods could help households manage their pantries. With the advent of smart-refrigerators, customers are looking for services that take advantage of screens and food sensing capabilities. The move to smart devices in the home is nascent but the opportunity is real, as Houzz reports that 45% of renovations in 2016 incorporated some smart home technology[11]. A partnership with device makers could help Whole Foods have a presence not just in customers’ minds but physically in their kitchens as well.

Samsung Smart Fridge. Source: Samsung

Samsung Smart Fridge. Source: Samsung

It is clear that Whole Foods must adopt technology to defend against competitors and to grow their customer base. Groceries will continue to play a critical role in consumers lives and technology can enhance many parts of that experience.

(797 words)

[1] http://www.wholefoodsmarket.com/company-info/whole-foods-market-history

[2] http://www.computerworld.com/article/2997059/software-as-a-service/the-strangest-of-bedfellows-infor-and-whole-foods-partner.html

[3] http://www.wsj.com/articles/whole-foods-works-to-reduce-costs-and-boost-clout-with-suppliers-1455445803

[4] http://media.wholefoodsmarket.com/news/whole-foods-market-and-instacart-partner-to-offer-one-hour-delivery-across

[5] https://www.nielsen.com/content/dam/nielsenglobal/vn/docs/Reports/2015/Nielsen%20Global%20E-Commerce%20and%20The%20New%20Retail%20Report%20APRIL%202015%20(Digital).pdf (“Nielsen”)

[6] http://s21.q4cdn.com/118642233/files/doc_financials/2015/Annual/2015-WFM-Annual-Report.pdf

[7] Ibid.

[8] http://www.wsj.com/articles/whole-foods-to-launch-new-outlets-1431041549

[9] Nielsen

[10] https://stopandshop.com/shopping/shopping-tools/scanit/

[11] http://info.houzz.com/SmartHomeTrends.html

Much of the digitization you mentioned makes a lot of sense — the tech-enabled info systems allow for significant cost reduction, the online shopping improves access, and the self check-out reduces lines and potentially a need for human labor. However, efforts to increase digitization don’t all necessarily make sense. In particular, I was surprised by the “smart carts.” Unless Whole Foods is having problems with overcrowded stores, I don’t see why it would be in their best interest to help customers shop more efficiently. As we saw with Ikea, the maze-like layout can help increase sales. I’d imagine Whole Foods would want people to wander, to find things they had forgotten to put on their shopping list, to sample foods they might not have otherwise considered buying, and to add random items that pique their interest along the way. So, in general, I’d just warn against assuming that the use of more digitization is always better (not that this is something you had implied in your post).

Hi Erik,

Neat post, I was thinking through my own experiences in shopping at Whole Foods and other grocery stores. My main concerns are generally (1) price, (2) quality and variety and (3) convenience (most aptly measured by total amount of time I have to spend in the grocery store to get my weekly grocery supply). The checkout line is a constant source of frustration to me. You often wait in line 5-10 minutes which seems unnecessary and ripe for digital innovation. Do you know if there have been any grocery stores that have made efforts to either (a) decentralize check-out with digital scanner/check-out systems on each grocery cart so people can scan and pay as they go or (b) item-level RFID tagging so that you could have an instant accounting of your grocery cart’s items just by pushing the cart through RFID detectors? The first option (decentralized scanners) seems somewhat easier but I’m not sure grocery stores WANT their customers to know how much they’ve spent while wandering through aisles (i.e. I often get sticker shock at the checkout lane while in Whole Foods but by this time I’ve committed) as it may reduce their spending. The second option seems more optimal from a revenue perspective but also quite costly. I would imagine that item level RFID tags would need to be less than 2-3 cents per RFID to make this worth it for Whole Foods.

Taki

Thanks Erik. Your points on enhancing digitization in the home with the refrigerators were really interesting. I’m one of those grocery shoppers that hasn’t been able to get on board with grocery delivery. I much prefer going to the store, even if it’s inefficient! I think Whole Foods could integrate this “at home service” with their delivery service although this could cause a pretty big strain on their logistics. If they give the option for customers to order grocery delivery at any time based on their fridge status, this could create a huge surge in demand for delivery. I also think this could eventually reduce the importance of brick-and-mortar stores.

This whole smart fridge concept kind of reminded me of Amazon and their “Dash” offering. They’re starting to integrate this with their grocery offering, Amazon Fresh and it speaks to this concept of having a presence in the customer’s home and mind. See the article below. In the UK, they’re giving out these “Dash” gadgets to Amazon Fresh customers that have built-in bar code scanners that link directly to your Amazon Fresh account. Could be major competition for Whole Foods if they decide to further innovate in digital!

https://www.engadget.com/2016/07/28/amazon-dash-fresh-grocery-uk/

Whole Foods is headed in the right direction to attract millenial customers, who will be the basis of consumption. One difficulty all online retailers have to address is confining shopping to searches only; online retailers need to find a way to recreate the experience of walking down the grocery isles and buying something that catches the eye online.

Hi Erik,

I think it is a great article that highlights the different ways in which Whole Foods’ adoption of digitization allows it to be more competitive. In line with the mission to provide quality foods, I think Whole Foods can definitely respond to the likes of Amazon Fresh by marketing short lead times from farm to table. As rightly mentioned above, while consumers care for price and convenience, they care a lot about quality too. For fresh produce like meat and vegetables, people still want to look at the product before making the purchase. I think this is where WF may be able to differentiate itself. Taken to the extreme, WF may even track which farm each slice of juicy ribeye originates from and how that particular farm has fared in terms of environmental footprint before the steak arrived on the table. As sensor technology gets cheaper, I wonder if total inventory within the supply chain may be tracked, not only the ones on the shelf but also the ones in transit, on trucks and trains. Extremely high grade, temperature-sensitive perishables may also benefit from sensors that record the environments they were subject to while on the road. The future of digital groceries is exciting indeed!

I would like to comment on two things: 1. Whole Foods way of tackling online shopping, 2. being careful not to disserve the customer with technology.

1. I believe that the current way of working with Instacart, while beneficial to enter the digital space, cannot be a long-term solution. Having a person physically shop for you actually increases the total duration that a person spends shopping because you spend time online selecting and then the person has to find the items in the store. In my opinion, Amazon’s warehouse delivery model seems a more likely longer term solution (as shown in many other countries e.g. Germany where this is already the norm). Because building such an infrastructure takes a lot of time, Whole Foods needs to make sure it is not left behind by relying on Instacart.

2. During my most recent visit in Whole Foods in NYC, I experienced a technology enabled queuing system where customers don’t stand in one but multiple queues and are called by a machine. When I got to the beginning of the system, each of the 6 lines had 1 customer. I soon realized that the machine actually didn’t know who joined the line when and so by chance I was called after all the other lines’ later arriving 2nds had been called. My conclusion from this is that companies like Whole Foods need to be very careful when implementing new technology to not draw away its customers.

I think Sabine’s comment on increasing throughput time of a shopping experience via Instacart is a very, very good point. To leapfrog this issue, I have long believed that there should be a warehouse-to-consumer channel in groceries where the unpacking of a subset of pallet deliveries goes directly into being sorted for customer home deliveries. This can certainly be integrated into your #2 recommendation, where I think the long term use case is that smart home devices help shopping list construction and home ‘inventory’ management. Rather than shelve a bunch of groceries and then having a second ‘selector’ (Instacart) go through the shelves (with its own error rates…), Whole Foods should make use of the customer’s carefully selected digital shopping basket already specific to Whole Foods and disintermediate Instacart from its value chain.

Thanks Erik for the insight. Another initiative that Whole Foods just released is the use of digital coupons. Whole Foods, an upscale grocer that is known for its “whole paycheck” image, is attempting to use technology to increase its customer base. However, I am concerned that its focus on technology may be detrimental to Whole Foods in the long run. Similar to Natalie and Sabine, I am skeptical that its partnership with Instacart will be successful, and I think that the new initiative with coupons will dilute the Whole Foods brand. It will be interesting to see how Whole Foods leverages technology in the future and if its ventures will be successful.

https://www.theguardian.com/business/2016/feb/10/whole-foods-introduces-digital-coupons-app-shoppering

Thanks for this post, Erik. As a huge fan of Whole Foods, it’s helpful to think about how digitization has and will continue to impact everyday life.

In terms of suggestions to Whole Foods, I appreciate that you don’t suggest using self-checkout lines for two business reasons. First, according to Tensator, “one out of every three British shoppers polled had walked out of a store without the goods they intended to buy, simply because of a bad experience with a self-service checkout.” (1) This certainly suggests lost business. Second, self-checkout doesn’t account for theft. To avoid theft, super markets have to conduct random audits, which means use of an employee’s time ($$$). Similarly, while I appreciate your smart phone suggestion, I fear a similar theft problem.

Instead, a suggestion from the inventor of the self-checkout line himself – Dr. Howard Schneider – is no check out at all. He suggest using cameras to identify when items have been taken off a shelf and charge customers then. (2) While this sounds like an idea for the far future, I like this idea because it also makes ordering inventory more efficient.

(1) http://www.cbc.ca/news/business/marketplace-are-you-being-served-1.3422736

(2) http://www.npr.org/2016/10/20/498736760/self-checkout-could-soon-be-checking-out

Do you think there is more opportunity to upsell and increase customers throughput time with the use of the smartcart? Why are they currently only using this technology in their new smaller stores? Perhaps Whole Foods could use data on their consumers to integrate the online and in-store shopping experience so instacart knows what the customer purchased last time they were in the store and recommend these purchases again. Additionally, I like your suggestion to partner with a smart refrigerator company to ensure that Whole Foods is top of mind for all customers even when they aren’t planning a trip to the store.

I think that Whole Foods had no choice but to offer an online platform for grocery delivery, and I think that the partnership with Instacart makes alot of sense. More and more households and millennials are relying on grocery delivery, and it is important for Whole Foods to find a way to remain relevant with the growth in grocery delivery services like Amazon Fresh. To me, it seems like traditional brick and morter grocery store industry is going to find itself in a structural decline – similar to what is happening right now to the clothing retail industry.

I agree with your perspective that it may make sense to deploy smartphone enabled checkout technology that make the process of purchasing your groceries easier. I wonder if there could be some type of ‘tag’ on each item which gets automatically identified and automatically charges a credit card while passing through a checkout line, similar to how retailers have ‘tags’ on clothing that alert an alarm to prevent theft. Whether nor not this specific solution is feasible, I agree with you that this space is ripe for further digital transformation.

This is a great article Erik. Whole Foods is definitely a good example of an innovator within the grocery space, however I think they are an exception to the norm. From my experience working with some of the larger grocery chains in the US (Kroger, Ahold, Publix), a lot of these conventional mass grocers use incredibly antiquated ERP systems and are very slow at implementing technology. For instance, with the abundance of technology that is available (and cost-effective) in the retail food marketplace, the most advanced technology we see in most stores is the self check-out kiosk. I do wonder if these larger grocery chains are waiting to make the investment in this technology to see how the consumer responds to purchasing groceries online. While online grocery delivery services (Pea Pod, Fresh Direct) are really only feasible in an urban setting, I do think an increasing share of consumers will move to this method of grocery shopping, granted it is only in its infancy right now. With this in mind, I think that the big retailers will allocate capital into developing their online grocery infrastructure versus making major investments to improve the in-store experience. As a result, I think the pace of technological development in the store will be fairly slow.

I love the idea of smart refrigerators that can sense food shortages! The future is now. In terms of cellphone-based checkout, is theft a concern, and how can Whole Foods mitigate this risk without having to invest in personnel just for this purpose?