How Machine Learning is Transforming the Largest Purchase You Will Ever Make

How Machine Learning is disturbing the world of Real Estate.

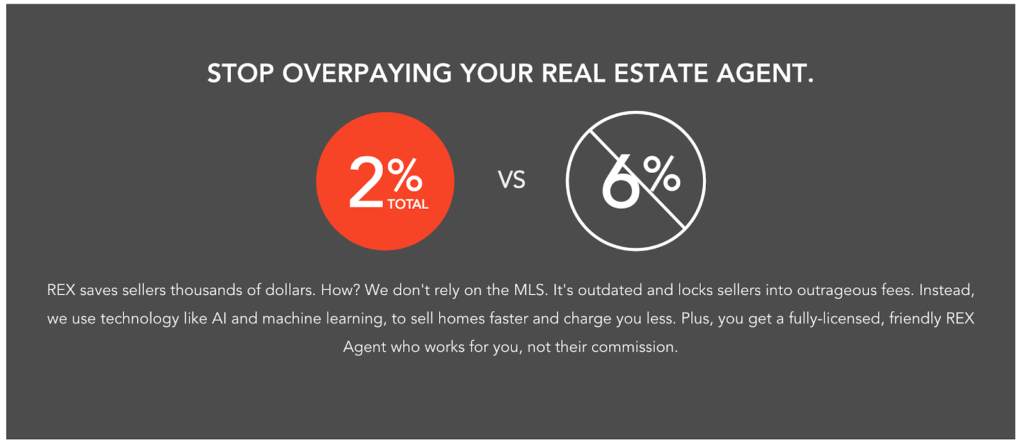

REX Website [1]

The Real Estate Market is Evolving

Buying or selling a home is very likely to be the largest transaction most people will ever make throughout their lifetime, and today’s residential brokers charge an average 6% transaction fee. Why? Do brokers provide a value in the transaction worth such a high-percentage fee? Residential Real Estate is one of the largest asset classes in the US. Zillow estimated that in 2017 the total value of US homes was $31.8T[2]. In 2017 an estimated 5.51 million homes were sold for a median price of roughly $360,000, which yields an annual transaction volume of $1.92T [3][4]. At a 6% commision rate, this yielded a Total Addressable Market (TAM) of $118.8B in broker commissions in 2017. Beyond high transaction costs, another issue in the field is that agents had different incentives from buyers and sellers, and therefore did not always construct optimal deals for clients[5].

Jack Ryan, former Goldman IPO Partner, founded his startup REX (Real Estate Exchange) with an aim to transform the industry by applying Machine Learning to provide superior personalized services to clients. REX has has focused initially on creating an online brokerage platform that is mostly automated using powerful Machine Learning technology to reduce transaction costs for their clients from 6% to 2%, and provides non-commission-based agents for the human part of the process[6]. An Oxford study about the future of employment surveyed 702 jobs in the US and computed their likelihood of being computerized and ranked the real estate broker job as 97% likely to be automated[7]. As we can see, this is a very hot field now, and REX is not without competition:

CB Insights Map of Real Estate Startups[8]

REX Leading the Transformation

REX is using Machine Learning and Artificial Intelligence in two distinct ways in order to become a Machine-Learning-driven broker: 1. REX learns the profiles of people who would be interested in a home, and then actively shows that demographic the home. 2. REX partners with third-party vendors who supply data about their users so REX can identify when they are ready to buy a home. How does this work under the hood? In the first case, REX builds a profile using Machine Learning for all the types of people who have clicked through an ad for a home. Once it knows the characteristics of the interested buyer for the home, it can then actively show this home to buyers with similar profiles who were generated by the algorithm[9]. This creates superior targeted ads for people who have a higher likelihood of buying the specific home. The second technique REX employes is partnering with third-party vendors to learn about the readiness of their customers to buy a house and then deploy targeted ads[10]. For example, if REX learns that a customer just purchased a TV and furniture for a large sum of money, they can deduce that the customer probably just moved into a new home and should not be targeted with ads for homes. The flip case might be a customer starting to buy baby supplies, which might indicate an open-mindedness to moving to a larger home.

Next Steps

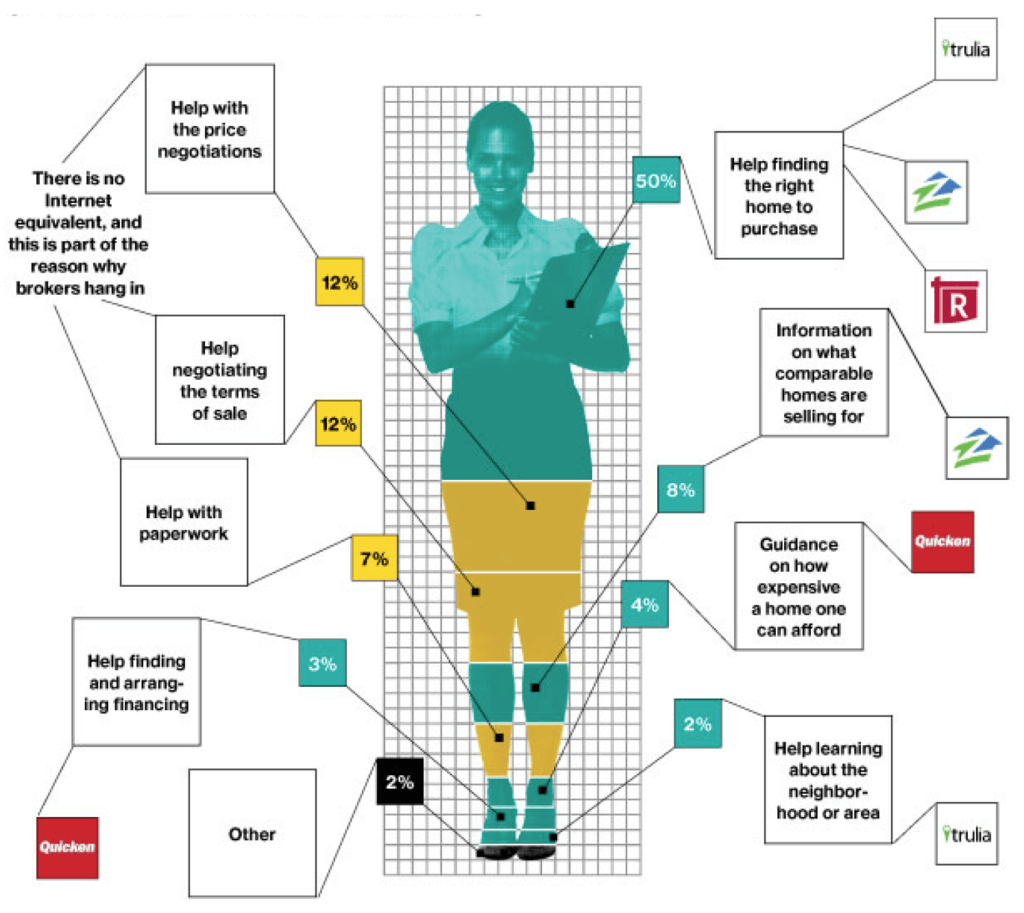

REX has done a terrific job of being one of the pioneers leading the digitization of the real estate industry and empowering their clients with a “smart” online digital broker. As the eyes of the industry are watching REX and its recent successes, I would recommend that REX moves quickly to expand into other services related to purchasing a home, which is part of its long-term goal of covering all user needs before other competition moves into the space. Here is an example of some of the needs of a buyer who is interested in buying a home:

What Buyers Want From Real Estate Agents [11]

As we can see, the services a buyer needs are complex, and we can add many more services once the transaction is completed. For example, once a buyer buys a home, he needs insurance, new furniture, financing, and more. There is a whole bundle of services around the activity of buying a home that REX could engage in, and I recommend they begin adding these additional capabilities to their existing platform to have a first-mover advantage in the 360-degree space versus continuing to focus on gaining market share of online housing sales. By experimenting with these additional services, they can understand which ones will provide more value for customers and gain a first-mover advantage in providing services X,Y,Z to home buyers online.

Question to Think About

Today most of REX’s process is automated, while a small part of finalizing the transaction is assisted by a human. Can the process of buying a home be 100% automated? Or should we always have a human involved in the process?

[780]

References:

[1] – 2018. Rexchange.Com. https://rexchange.com.

[6] – 2018. Rexchange.Com. https://rexchange.com.

[9] – Zhao, Helen. 2018. “Artificial Intelligence Is The Latest Competition For Real Estate Agents”. CNBC. https://www.cnbc.com/2018/03/20/artificial-intelligence-the-latest-competition-for-real-estate-agents.html.

[10] – Ibid

This is very interesting and I agree that REX is in such a great space and at a point in time when they need to position themselves so that competition doesn’t catch up quickly. I wonder if in addition to deducing which buyer to show a specific house to, REX could also do more conspicuous learning. For example, a customer looking for a home wants assistance, so once the REX platform has an idea of what the user may want it can present it with suggestions based on that home profile/type in order to narrow down from the vast selection within its databases.

I definitely think the price negotiation part could be automated. I wonder if the adoption of blockchain in the near future will help make the remaining customer needs such as price negotiations, financing, and paperwork easier for REX to dominate. Blockchain would allow the mutual trust we need when making such a big investment. Blockchain would reduce the mistrust of doing something online and REX could be the one stop shop for all home purchasing needs.

Super interesting! I was not aware that brokers had such a large market ($118.8B per year) and that 97% of their offered services could be automated. This indeed represents a massive opportunity for startups to be first-movers and develop ways to serve customers with a reduced need for expensive human interactions.

Answering your question, I believe that 100% automated process should only be pursued if that ultimately creates value. I would argue that employing humans to augment what machines can deliver and charging more for those services can be value-accretive to the firm. Ultimately, Rex could have different offerings with varied levels of human involvement/interaction, serving a wide array of customer profiles.