Highway to the danger zone? Machine learning at DHL

Machine learning represents both a key opportunity and a critical threat to the shipping industry. How will the current players react?

Machine learning is having seismic effects on the shipping and logistics industries, and Deutsche Post AG (DHL) is sprinting to keep up. [1] In the near term, DHL is applying machine learning algorithms to a) predict demand and disruptions, b) optimize staff time and resources, and c) streamline the steps for package processing. Looking ahead, they hope that autonomous vehicles and robotic delivery will play an increasing role in reducing costs, accelerating delivery, and limiting emissions. However these advances double edged. It is not clear that DHL or its competitors will be able to maintain their market position as machine learning becomes central to their business. [2] It is also possible that most of the driving and delivery staff will lose their jobs as the company transitions. [3] As such, machine learning represents both a key opportunity and a critical threat.

Machine Learning in Shipping and Logistics

The shipping and logistics industry is based on networks of interconnected and highly variable steps. This makes supply chains exceptionally vulnerable to delays and fluctuations. [4] This variability plays a major role in increasing the costs and reducing the capacity of the logistics business.

The inherent promise that DHL and its competitors make is that they can overcome this variation to deliver with speed, affordability, and predictability. As such, any innovation that increases companies’ ability to predict and streamline their steps is deeply valuable. Helpfully, shipping steps generate a wealth of data that can be used to train and apply machine learning. With only 10% of current shipping systems using machine learning analysis and results, [5] the industry is ripe for change.

DHL’s Approach

DHL is using machine learning to streamline shipping in three key ways: i) predictive network management, ii) predictive demand planning and iii) predictive risk management.

To improve network management, the company uses a machine learning algorithm that analyzes 58 parameters of internal data and predicts the average daily transit time up to a week in advance. To improve demand and capacity planning, DHL has developed a Global Trade Barometer that uses operational logistics data, statistical modeling and a machine learning algorithm to asses 240 million variables across 7 countries and give a three-month outlook for trade. [6] To improve predictive risk management, DHL has developed the Resilience360 platform to algorithmically assess and surface issues in DHL’s delivery steps by crawling through as many as 8 million online posts per day and using natural language processing to detect potential problems. [7] Together these three initiatives represent DHL’s approach for the next 1-2 years. DHL sees these approaches as a way to “increase their throughput and…capacity by a multiplier.” [8]

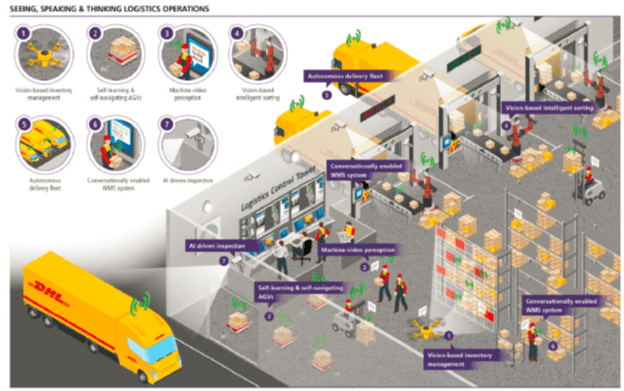

In the medium term, DHL’s major play is to head into autonomous vehicles and robot-enabled delivery. The goal is to incorporate these technologies in their warehouses and in their external deliveries. [9] As an intermediate step, DHL plans to begin with semi-autonomous platoons where 2-5 autonomous vehicles follow one human driver. These will begin piloting in Great Britain next year and then roll out more broadly. [10] The full vision is for the warehouse and delivery approach is outlined in Figure 1 below.

Figure 1 – DHL’s medium term vision.

Source: Artificial Intelligence in Logistics IBM and DHL Report. 2018.

Gaps and Recommendations

The benefits of autonomous vehicles are substantial – they can get more freight in process at any given time, they improve fuel and wind efficiency through machine-controlled driving, and they reduce labor costs. The challenge is that it is not clear that a logistics company can maintain its current position in a future of self-driving and robot-enabled deliveries.

Google, Amazon and Uber are pushing the envelope on machine learning in general and self-driving vehicles in particular. [11] Amazon is a particularly large threat to DHL and its American counterparts because so much of their own business depends on shipping. The risk is that this becomes an arms race to DHL’s own destruction – much like the one that brick and mortar retailers are in at the moment.

Keeping these dangers in mind, the immediate priority is for DHL to improve its efficiencies with machine learning and compete as effectively as possible against its current competitors. In the medium term however, it is critical that they plan for how they will compete if the tech players start entering the shipping space. These incentives all lead to a sprint down the path of machine learning and the advantages that it brings.

Open Questions

Taking a step back from DHL and even shipping as an industry, the most important open question is what, if any, obligation these companies have to their employees. The McKinsey Global Institute estimates that 49% of all activities that people are paid to do today could be automated by adapting currently demonstrated technology. [12] That number is likely to grow as machine learning develops. One theory is that this will create more human-enabled jobs as it creates more efficiencies but it will have to do so at an unprecedented rate if it is going to compensate for job losses. What needs to be done so that we get the benefits of these innovations and minimize the costs? Whose responsibility is it to act?

(Word count 763)

[1] DHL and IBM. Artificial Intelligence in Logistics. DHL Customer Solutions & Innovation. 2018

[2] Woyke, Elizabeth. FedEx Bets on Automation as It Prepares to Fend Off Uber and Amazon. MIT Technology Review. February 3, 2017.

Dudash, Stephen. Amazon Takes On UPS, FedEX Hints That Driverless Car Program Is Further Along Than Many Believe. Forbes. February 13, 2018.

[3] McKinsey Global Institute. Harnessing automation for a future that works. 2016.

[4] Govindan, Kannan et al. Big data analytics and application for logistics and supply chain management. Transportation Research Part E: Logistics and Transportation Review. June 2018.

[5] DHL and IBM. Artificial Intelligence in Logistics. DHL Customer Solutions & Innovation. 2018

[6] DHL Global Trade Barometer.

www.logistics.dhl/global-en/home/insights-and-innovation/insights/global-trade-barometer.html

[7] DHL Resilience360.

www.resilience360.com/risk-management-products/supply-watch/

[8] Quote from Ben Gesing, Project manager in DHL’s Innovation and Trend Research division. Burt, Jeffrey. DHL Gets Logical and Logistical About Machine Learning. Next Platform. April 18, 2018

https://www.nextplatform.com/2018/04/18/dhl-gets-logical-and-logistical-about-machine-learning/

[9] Ibid

[10] Ibid

[11] Dudash, Stephen. Amazon Takes On UPS, FedEX Hints That Driverless Car Program Is Further Along Than Many Believe. Forbes. February 13, 2018.

[12] McKinsey Global Institute. Harnessing automation for a future that works. 2016.

Well written, and interesting questions. As with any industry, technological innovations in this space will theoretically remove the need for human workers to perform certain tasks. However, with the advent of said technological innovations, new roles should also emerge in capacities that support the integration of those innovations into pre-existing industries. For example, perhaps the use of machine learning may replace the need for junior analysts at certain financial institutions as algorithmic trading becomes more prevalent. Despite the fact that those jobs will no longer exist, new jobs -such as coders, developers, etc- will replace them. I don’t think the responsibility to accommodate for shifts in the job market fall on any single company, but on professionals to ensure they choose a learning path that keeps them ahead of the tech curve.

You raise an important point in this essay. Similar to any technological innovation there will be a short term impact of job losses. In the medium term people will have to retrain themselves and learn about AI and machine learning to remain employable. However, I believe ML will be a net job creator in the long run as more job opportunities will open up as a result of ML. This is a specially difficult question for governments in developing countries where various industries are still labor intensive. In a country like India which relies on low innovation services jobs, AI and ML could replace a lot of jobs. For example, the Indian government is restricted the adoption of driverless vehicles because of the potential job loss to millions of people who work as drivers in India.

Very interesting article. I think you are exactly right about the long term risk of playing in a space that is so dominated by tech firms with higher margins and R&D budgets than in the shipping industry. I can easily see a future in which shipping companies invest heavily in AI and then Amazon simply goes to a different shipping company and offers to improve their operations by integrating their own (Amazon’s) AI. In this relationship Amazon would provide the “competitive advantage” to the shipping company via their AI. And the shipping company would simply hold all of the large assets (e.g. trucks) and thus most of the risk. I think this is an inherent problem with investing in AI right now. It is very unlikely that AI developed right now will be a sustainable advantage over the long run, especially for non-technical firms.