Hershey’s Chocolate: Has Climate Change Made It Bittersweet?

Chocolate makes everything better… but what if it no longer existed? Can climate change eliminate chocolate forever?

Imagine a world where hot chocolate costs $20, and chocolate-chip cookies are a rarity. Given the impacts of climate change on cocoa beans, this could be the future. Hershey Company is sitting on the forefront of this crisis and witnessing the world’s supply of cocoa melt away. How did we get here, and can we fix it?

Where does life’s most wonderful pleasure come from?

Chocolate comes from cocoa trees called Theobroma, which, like other plants, are sensitive to water, sunshine, temperature, and soil conditions. The high fat-content in beans is harvested and then ground before being mixed with sugar and other ingredients to create cocoa-based products such as drinks, bars, and powder [1]. Harvesting is labor intensive since beans are extracted by splitting cocoa pods and sun-dried for several days prior to packaging and shipment [2].

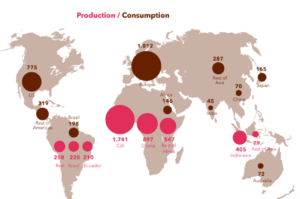

In 1874, cocoa production moved from Brazil to Nigeria, which soon became the largest producer of cocoa in the world.

Recently, however, West African production has declined due to climate change impacts on the plant’s growth phases [3].

- Drought: water deficit is directly correlated with decreased pod sizing, which affects bean size and fat-content ratios

- High temperatures: warmer temperatures increase survival rates for capsids (insects that damage cocoa trees) and other pests which were previously eliminated by colder winters

- Longer wet season / cloudy days: prolonged wetness leads to decreased atmospheric evaporability, which impacts the drying process for cocoa beans. Additionally, unnaturally long wet periods have increased landslides and soil nutrient depletion [4]

A look at Hershey’s: America’s original “sweetheart”

The Hershey Chocolate Company was established in 1894 by Milton Hershey. What had begun as a small chocolate producer soon expanded into a chocolate empire. With net sales of $6B, Hershey is one of the world’s largest producers of chocolate and sells products in 70 countries.

Despite being one step removed from cocoa production (it purchases its beans from the world exchange), Hershey is highly sensitive to bean price fluctuations, since cocoa accounts for a significant portion of Hershey’s raw material costs. With prices soaring by 60% in the last four years alone, Hershey is facing dire impacts on its business. Global chocolate demand to expected to exceed supply by 980,000 tons in 2020 [5].

If this trend continues, costs of goods sold will increase such that either Hershey’s profit margins will narrow or price hikes on consumers will be necessary. If margins thin, the company will slash costs elsewhere, either by employing cheaper labor or consolidating its product portfolio. If the company chooses to pass costs onto consumers, it will find itself battling to keep its market share dominance with the price-sensitive “everyday man.” Further, increased prices will force Hershey’s products to directly compete with gourmet European chocolatiers. Both outcomes are detrimental to Hershey, which is scrambling to mitigate climate change effects on its key ingredient.

Unwrapping Climate Change

Hershey has taken action in several key areas to alter cocoa production trends. First, Hershey created a position of “foresight manager” to analyze climate change impact on cocoa trees and forecast weather effects on cocoa supply. Like the Beer Game exercise, Hershey is attempting to understand its ability get its raw materials orders filled. The foresight manager collaborates with other stakeholders to understand these trends [6]. Second, Hershey has invested $10M in capital for R&D projects working to find innovative ways to make irrigation systems more efficient. Irrigation systems are the only means to water plants if rainfall volumes are not sufficient. Third, Hershey has encouraged farmers to plant tall trees around shorter cocoa plants to shade them from the sun [7]. Finally, Hershey launched CocoaLink, a mobile phone project that allows farmers to receive texts and phone calls regarding pests, weather conditions, and contact a real-time hotline to chat with cocoa experts [8].

Some additional things that Hershey can do:

- Stockpiling: encourage farmers to have a seed stockpile in case natural disaster wipes out seedlings. This can create a seed inventory buffer which serves as an emergency seed stash

- R&D for Soil Retention: invest capital for research to understand whether chemicals or nutrients can be added to the soil to enhance water-retention. This can completely change the African landscape and may not be too costly to implement on a mass scale

- Technology: genetically modifying cocoa plants for more heat and disease resistance

- Government: work with the Nigerian government to create more regional dialogue between farmers to share best practices, resources, or expensive technology. While this is somewhat achieved through CocoaLink, more knowledge-share can be created by rotating various cocoa farmers across different farming communities

Overall, cocoa production remains at high-risk, and given continued global warming, cocoa farmers will indefinitely face pressures unless corporations and governments can agree to come together and fight back. Otherwise, Hershey may have to blow chocolate a kiss goodbye.

(796 words)

[1] Läderach, P., Martinez-valle, A., Schroth, G. & Castro, N. (2013). “Predicting the future climatic suitability for cocoa farming of the world’s leading producer countries, Ghana and Côte d’Ivoire”, Climatic Change, vol. 119, no. 3-4, pp. 841-854.

[2] Baird, H., Guevara, N. & Karpechenko, A. (2012). “The Hershey Company and West African Cocoa Communities,” Daniels Fund Ethics Initiative, www.danielsethics.mgt.unm.edu/pdf/hershey case.pdf.

[3] Oyekale, A. S., Bolaji, M. B., & Olowa, O. W. (2009). “The effects of climate change on cocoa production and vulnerability assessment in Nigeria”, Agricultural Journal, vol. 4, no. 2, pp. 77-85.

[4] Nieburg, O. (2015, December 21). “Devastating impact of climate change on cocoa can’t be ignored, says Rainforest alliance”, Confectionery News, www.confectionerynews.com/Commodities/Climate-change-Impact-on-cocoa-production-devastating.

[5] Yasin, S. (2014, November 20). “Why climate change could mean the end of chocolate”, www.salon.com/2014/11/20/why_climate_change_could_mean_the_end_of_chocolate_partner.

[6] Meyer, R. (2014, February 21). “Hershey’s is hiring a chocolate futurist”, The Atlantic, www.theatlantic.com/technology/archive/2014/02/hersheys-is-hiring-a-chocolate-futurist/284010.

[7] Gerrard, J. (2016, June 02). “Cocoa, chocolate companies unite to address climate change”, Food Engineering Magazine, www.foodengineeringmag.com/articles/95784-cocoa-chocolate-companies-unite-to-address-climate-change.

[8] Beckman, J. (2012, January 30). “Hershey expands responsible cocoa community programs in west Africa”, Business Wire, www.businesswire.com/news/home/20120130005249/en/Hershey-Expands-Responsible-Cocoa-Community-Programs-West.

You present a really great overview of an interesting issue here. As an avid chocolate connoisseur, I was unaware that this issue was such a big deal for Hershey. I was surprised to see what few innovations Hershey was taking to make their business more sustainable. As a leader in the industry, I would have hoped to see them be more innovative in their approach to addressing sustainability. I would be curious to see what progress they have made thus far against these goals.

What do you believe are the risks associated with switching to genetically modified cocoa beans? My understanding is this may be quite risky given the public perception that they are an “untested science experiment” and the movement of companies such as Whole Foods to ban genetically modified ingredients.

Fascinating article and worrying for us chocolate lovers!

Given Hershey’s buys its cocoa beans on exchanges, could the company consider hedging to limit input risk? The following article seems to suggest that Mars has been heding cocoa for several years: https://www.ft.com/content/e197cf1c-6c81-11dd-96dc-0000779fd18c

It would seem that if:

a) Production truly will fall

b) Consumers are not willing to spend more on Hershey’s

c) Competitors are hedging

d) Hershey’s does not already hedge

…then Hershey’s may not have a choice but to follow?

Great topic! Can’t imagine a world with $20 hot chocolate! This makes me wonder what competitors are doing – perhaps those (if any, although I’m sure there are some) who have a larger local presence in the affected areas. I know you mention that Hershey can stand to maintain market share, but I wonder whether competitive dynamics have changed in favor of competitors with easier access (despite dampened supply, which I understand impacts the whole industry). Could they benefit from intervening locally by acquiring these operations?

Excellent post. I am most impressed by Hershey’s launch of the CocoaLink app since lack of information exchange tends to be a big contributor to several issues that developing markets face. I am interested in knowing what the adoption rate for the app has been and whether Hershey has quantified the results of any of these sustainability efforts. One recommendation that I have for Hershey is to assess the role that Fair trade can play in combatting climate change’s effect on cocoa farmers. Fair trade premium funds from sales allow farmers to invest in their businesses. One example according to the Fair World Project is the “Coocafe, a coffee co-operative in Costa Rica, used its fair trade premium to greatly reduce the amount of water wasted on washing the beans allowing for other farmers to plant trees around their crop as shade, which is good for the quality of their crop and for the environment.” (http://fairworldproject.org/) If Hershey is not engaging in these practices, will consumers tastes change to focus on brands that are offering Fair trade?

Fascinating (and potentially-alarming) post! There are some parallels between almonds in California and chocolate in Nigeria and SSA (sub-Saharan Africa) countries with drought. I really like the four proposed solutions you list but would be curious to know what you think about their investments in irrigation and what exactly they are? For example, investing in drip-irrigation and soil maintenance can make farmers more efficient with their water usage.

Another idea is to set an international market for water rights credits (e.g., the BEF WRC credits; https://store.b-e-f.org/products/water-restoration-certificates-blend/). What do you think about these more efficient marketplace type solutions?

Great post. While reading, a few additional things came to mind related to what Hershey might be able to do (see below). It would be great to hear your thoughts.

First, I am curious if Hershey is purchasing futures contracts for cocoa beans, allowing them to purchase these beans at a fixed price at a later point in time? While this doesn’t help them directly reduce climate change, it will help temporarily mitigate the problem for the next 10-20 years. This article will help explain how it works: http://www.investopedia.com/university/commodities/commodities1.asp.

Second, should Hershey start diversifying its operations into different types of confectionery so it is not so dependent on chocolate? Given the long-term trends on cocoa production described in your post, it probably makes sense for them to invest heavily in R&D now to develop new types of product offerings.

Lastly, what do you think about Hershey starting to buy and operate its own production farms? While this won’t solve the entire problem long-term, it will allow them to withstand some of the near to mid-term pricing shocks when demand in the market is considerably higher than supply.