HATSUN Agro – Milking the IoT opportunity in Indian Dairy

Over 4 decades, Hatsun Agro, India’s largest private dairy, has succeeded by building an intricate supply chain to the highly scattered Indian market. But as milk prices continue to fall globally, and consumer becomes increasingly demanding, will it be enough?

Every morning in South India, over 320,000 dairy farmers visit one of Hatsun Agro Product’s 10,000 milk banks (HMBs) in 13,000 villages to deposit fresh milk. Building this elaborate supply chain is its moat – as it runs 1100+ milk procurement routes, hundreds of chilling centers and dozens of procurement centers. But most of this runs on largely traditional systems – what can it do to usher in the new era?

Supply chain complexity in Indian Dairy:

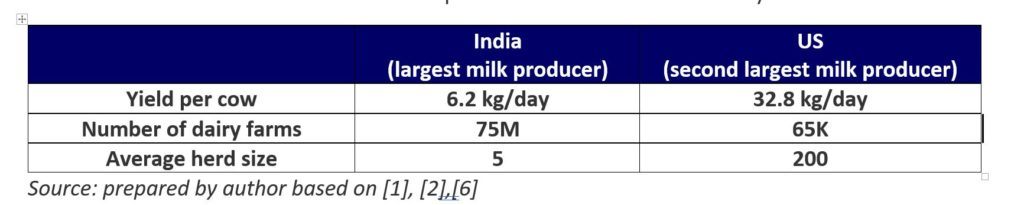

While, India is the largest milk-producing nation in the world with 18.5% [1][2] of the milk production, this is entirely due to the sheer number of milch animals in India (yields per animal are among the lowest). This large animal population is extremely scattered in 80,000 of villages and owned by low-income dairy farmers in very small herds – resulting in a very unique and complex dairy supply chain in India.

Table: The #1 and #2 milk producers in the world are starkly different

Key challenges across the supply chain:

Production challenges – low and poor quality yield: Yield days for Indian cows are fewer because (1) farmers are unable to identify leading indicators of sickness and treat them promptly (2) low success of insemination (1/5th of that in developed countries) due to inability to accurately estimate ovulation– resulting in fewer pregnancies.

Collection and distribution troubles – milk of diseased cows, poor infrastructure: At the milk banks, milk can only be measured for fat and SNF parameters and not for disease agents. This milk then gets mixed with healthy milk and contaminates the batch only to be identified 1-2 days later when the milk is tested before processing it at the hub milk processing centre – resulting in wastage. Additionally, it becomes impossible to identify the source of the contamination and the cycle continues. Currently, this wastage is being viewed as a cost of doing business.

Electricity outages across the supply chain in rural areas result in spoilage. Often, the operators of the milk banks themselves switch off electricity to save costs. It is impossible for Hatsun to currently track this remotely impacting the quality of milk it receives.

Limited current efforts:

1) Farmer database: Hatsun tracks each of its farmers, however currently uses this only for sales and payment tracking.

2) Piloting IOT: Hatsun has rolled-out a limited pilot of using IOT in partnership with an India-focused agri-tech startup. At its milk banks, IOT sensors measure milk conductivity to test for diseased cow milk before accepting it from farmers. Additionally, sensors in chillers track regular cleaning. All these devices are designed to suit the infrastructure challenges of India.

It is also the first company in India to implement low-cost RFID tagging for cows in its network – eventually hoping to use this data to track cow health and educate farmers, get cluster-wide data on cow health, implement veterinarian schemes, etc.

Recommendation – Digital disruption. Its time to mooo-ve: While the company has taken a few initial steps, some of these pilots have been on for a long time and there is a strong business case for a full-scale roll-out.

1) Since it completely owns the supply chain from collection to distribution, it should implement IOT sensors in its all its storage and transportation components to track quality, cleaning and refrigeration.

2) However, the real gold lies in yield and insemination improvement. It should roll-out the milk screening, ovulation tracking and movement tracking for each cow in its network. These sensors track cow temperature and movement to identify milk quality, onset of illness and ovulation. This will also enable them to effectively conduct programs to educate farmers, maintain cow health, cross-sell insurance schemes,etc.

Additionally, there is a massive untapped opportunity for Hatsun to run big-data analytics on all the data that it currently collects and will potentially collect from its initiative.

Risk: As Hatsun does not own these animals, it has limited control on the implementation. Additionally, farmer is not bound to Hatsun and there is a risk of them not getting the full benefit of their investments. Any attempts to contractually bind poor dairy farmers would incite government intervention thus Hatsun will have to rely on creating farmer loyalty.

Questions:

How should Hatsun roll-out this digitization endeavor? Across the value-chain or on part of it? Immediately or in phases?

Should Hatsun involve the government in its efforts to improve the livelihood of the farmers in order to de-risk itself?

Word count: 798

[1] Govt. of India, Ministry of Finance http://pib.nic.in/newsite/PrintRelease.aspx?relid=136849

[2] World Bank Blog https://blogs.worldbank.org/taxonomy/term/15970

[3] Hatsun Annual Report http://hap.in/pdf/annualreport/2017.pdf

[4] Stellapps (one of Hatsun’s IOT vendors) http://www.stellapps.com/

[5] Food and Agriculture Organization of the UN http://www.fao.org/docrep/012/i1522e/i1522e02.pdf

[6] USDA Dairy industry report http://usda.mannlib.cornell.edu/usda/current/USDairyIndus/USDairyIndus-09-22-2010.pdf

[7] http://www.thehindubusinessline.com/opinion/indian-cow-may-your-yield-increase/article5835726.ece

Thank you for sharing this Nidhi. The sole fact that Hatsun Agro has built a milk supply chain that works in rural India should be considered a huge success. It also speaks to their ability to execute the complex strategies that challenging environments demand. To try and answer your question on the merits of government involvement in rolling-out the IoT sensors, my answer is a big YES! I believe that this is a good case of alignment of interest/goals between the public and private sectors that it would be a pity not to leverage. All things equal, healthier and higher yielding cows will translate into higher incomes and improved living standards for farmers while also improving the quantity and the quality of the milk supply to Hatsun Agro. Early engagement with public authorities will also spare you any miscommunication or misunderstandings that may arise further down the line. Finally, I see a tremendous benefit of having local government partners on the ground to facilitate and share the costs of program monitoring and evaluation.

In my opinion, it will be hard to engage with hundreds of thousands of farmers at the same time. Therefore, the more challenging piece of the equation would be for Hatsun Agro and its public sector partner(s) to identify and engage with the farmers who demonstrate the highest chances of success for the program. While it is very hard to get people to part from their old ways of doing things, you will generally find in the crowd a few who are naturally driven and growth-oriented. In this particular case, I would try and find those farmer-entrepreneurs and place a concentrated bet on helping them increase yields and heard sizes. As local governments may be inclined towards a more inclusive approach based on their electoral agendas, Hatsun Agro would probably be better off conducting the farmer selection phase on their own and only involving the public sector in the implementation phase of the program.

I fully agree with Abdoulaye’s point that creating a singular supply chain across so many small actors with limited digitization is very impressive. (I also feel a bit sorry for the U.S. cows who are producing so much milk!) It seems to me that there are four primary problems here:

1. Low yield

2. Poor quality yield

3. Inability to detect disease in milk (and perhaps no incentive of farmers to tell Hatsun that the milk came from a sick cow)

4. Frequent outages of refrigerators (and perhaps perverse incentives of milk centers to turn off electricity)

As you point out, it seems like Hatsun is already implementing IoT to address items 3 and 4, but there are major gains to be made by addressing items 1 and 2. My understanding is that the best way to increase yield is through close management of dairy cows’ estrous cycles through artificial insemination. While I agree that Stellapps’ Activity Meter could provide Hatsun with data of when the farmers’ cows are in estrus, they would still need to provide artificial insemination services to the farmers. Based on the physical dispersion and low concentration of the herds, I worry that this could become cost prohibitive.