Goldman Going for Gold… through Digital.

Goldman Sachs: technology company or bank? Can it be both?

Believe it or not, Goldman Sachs is increasingly being mentioned in the same breath as technology behemoths Google, Apple, Facebook, and Microsoft – and not because it is advising on M&A or IPOs. Rather, given its increasing forays into digital initiatives, with a technology division of more than 9,000 people (close to one-third of the firm’s employees and the largest division at the firm), the storied bank is beginning to look and act much like the more archetypal technology companies we traditionally think of.[1]

What has it done?

Over the past few years, Goldman has made moves away from its core by building and investing in digital technology. For example:

- After acquiring GE’s online retail bank in April 2016, Goldman launched GS Bank, an online only bank with 1.05% annual yield and only a $1 deposit[2]

- Last month, ‘Marcus by Goldman Sachs’ launched as an online, consumer-friendly lending platform for prime credit consumers to avoid high-cost credit card debt through a “fixed rate, lower cost personal loan”[3]

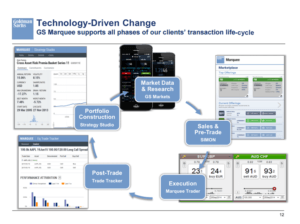

- In September, Goldman made its proprietary risk, pricing, and other tools ‘open-source,’ through a service known as Marquee.[4]

- Also in September, Goldman filed a blockchain patent for foreign exchange trading, which would allow it to circumvent the transaction processing intermediaries through blockchain’s transparent, general ledger.[5]

- Since 2009, it has been a part of “132 fundraising rounds in private technology companies”[6] One company the bank invested in, called Kensho, is “trying to build a machine…to reduce human decision-making in trading and investing by instantaneously analyzing slews of data that move markets”[7]

Why digital?

Why is Goldman is doing all of this when it already has a business that has been successful for over 100 years without a ‘digital transformation’?

Taking what Goldman’s leaders have expressed in public, one can assume that the above actions are not one-offs, but part of a larger strategy to transform the business’s long-term positioning in light of a changing economy. In fact, in the firm’s first ever podcast, CEO Lloyd Blankfein declared, “We are a technology company.”[8]

By making its tools open source, for example, it aims to provide a platform that will defend against entirely new entrants (like Google’s Android) by having developers build onto its existing system while creating cross-selling opportunities.[9] Additionally, investing in fintech companies allows the 147-year old company to learn from and ward off would-be disrupters and move away from risky qualitative judgement calls than can be made better quantitatively.[10] And, with blockchain, Goldman can disintermediate many of the businesses it now relies on to execute transactions as a way to cut costs and make its operation more secure.

In creating a digital bank and lending platform in the form of GS Bank and Marcus, respectively, Goldman is appealing to the millennial consumers who increasingly shirk traditional retail banks and who could eventually be cross-sold as they become wealthier.[11] Marcus’s fixed rate loan is especially attractive for consumers given a rising rate environment. Given regulation, consumer-focused businesses are “potentially more lucrative” and they help satisfy capital requirements.[12] Importantly, Goldman can do this relatively cheaply through digital platforms, while many of its competitors are now trying to rationalize their outsized real estate assets that are no longer needed to the same extent in a digital-first economy.

The branding benefits of these digital initiatives is not lost on Goldman, either. Positioning itself as a technology company – it even hosted its 2015 shareholders meeting in San Francisco – allows the firm to recruit a new generation of tech-savvy talent.[13] Along the same lines, the no-frills business models appear to be an effort to further remove itself from the shadows of the financial crisis, which unfairly or not, has muddied the reputation of the industry.

Looking ahead

Tactically, Goldman has chosen to pursue these efforts somewhat independently, and not as a wholesale change to the entire business. In the short-term, this is smart: it allows these new businesses to grow and learn unencumbered by the rest of the organization, while it doens’t distract or disrupt the core businesses. In the long-term, to begin seeing more ROI on its fintech investments, Goldman should begin more fully integrating them into its core businesses. As technology changes, these adjacent businesses may soon become central to Goldman’s competitive advantage. By starting now, it can get ahead of the competition to an even greater degree and protect itself from disruptions that even it doesn’t see coming.

Finally, while technology can help in daily activities and smaller businesses, Goldman should always keep in mind that is in a client service business and people are its foremost asset. Any maneuvering away from the high touch, intellectual capital-heavy customer promise will cause existing clients to take their business elsewhere – a risk that it certainly cannot afford.

(Word Count: 798)

[1] Jonathan Marino, “Goldman Sachs is a Tech Company,” Business Insider, [http://www.businessinsider.com/goldman-sachs-has-more-engineers-than-facebook-2015-4], accessed November 2016.

[2] Fitz Tepper, Goldman Sachs launches GS Bank, an Internet bank with a $1 minimum deposit,” Tech Crunch, [https://techcrunch.com/2016/04/25/goldman-sachs-launches-gs-bank-an-internet-bank-with-a-1-minimum-deposit/], accessed November 2016.

[3] Randall Smith, “Goldman Sachs, Bank to the Elite, Makes Pitch to the Masses,” The New York Times, [http://www.nytimes.com/2016/11/17/business/dealbook/goldman-sachs-bank-to-the-elite-makes-pitch-to-the-masses.html], accesed November 2016.

[4] Justin Baer, “Goldman Sachs Has Started Giving Away Its Most Valuable Software,” The Wall Street Journal, [http://www.wsj.com/articles/goldman-sachs-has-started-giving-away-its-most-valuable-software-1473242401], accessed November 2016.

[5] Ian Kar, “Goldman Sachs wants to put foreign exchange trades on the blockchain,” Quartz, [http://qz.com/779660/goldman-sachs-wants-to-put-foreign-exchange-trades-on-the-blockchain/], accessed November 2016.

[6] Katrina Brooker, “Goldman in Ventureland,” Bloomberg Businessweek, [http://www.bloomberg.com/news/features/2015-07-28/how-goldman-sachs-became-a-tech-investing-powerhouse], accessed November 2016.

[7] Ibid.

[8] Ibid.

[9] Simo Zerrifi, “Is Goldman Sachs ‘Going Tech’ the New Standard for Investment Banking?” Gartner Consulting, [https://www.linkedin.com/pulse/goldman-sachs-going-tech-new-standard-investment-banking-simo-zerrifi], accessed November 2016.

[10] Antoine Gara, “Wall Street Heavyweight Goldman Sachs Launches Its Consumer Lending Platform Marcus,” Forbes, [http://www.forbes.com/sites/antoinegara/2016/10/13/wall-street-heavyweight-goldman-sachs-launches-its-consumer-lending-platform-marcus/#2165bdd92013], accessed November 2016.

[11] Alan Royal, “The Goldman Sachs Effect on the Future of Banking is All About Millenial Digital Experience,” Banking CIO Outlook, [http://www.bankingciooutlook.com/cxo-insights/the-goldman-sachs-effect-on-the-future-of-banking-is-all-about-millennial-digital-experience-nwid-159.html], accessed November 2016.

[12] Randall Smith, “Goldman Sachs, Bank to the Elite, Makes Pitch to the Masses,” The New York Times, [http://www.nytimes.com/2016/11/17/business/dealbook/goldman-sachs-bank-to-the-elite-makes-pitch-to-the-masses.html], accessed November 2016.

[13] Katrina Brooker, “Goldman in Ventureland,” Bloomberg Businessweek, [http://www.bloomberg.com/news/features/2015-07-28/how-goldman-sachs-became-a-tech-investing-powerhouse], accessed November 2016.

Images sourced from Goldman Sachs website and Bloomberg article

Great article on Goldman’s move into digital platforms, very informative! Goldman is ahead of other major banks and is taking the right approach to a changing banking environment. While I absolutely agree that this is a response to changing consumer preferences and competition from newer digitally focused fintech companies, I also believe Goldman is responding to increased government regulation. After the Great Recession in 2008/2009 and the increased regulation that have come along with it, big banks like Goldman, Citi and Bank of America have struggled to increase profitability through their traditional business models. These banks may initially have thought (and hoped) that these more stringent regulations would be short lived, but nearly 10 years after Lehman Brother’s went bankrupt, it appears these regulations are here to stay. To increase profits and stay relevant, Goldman and other must adapt their business models and find new revenue streams in areas that are less regulated and competitive. Considering the risks associated with their traditional business model, Goldman may see its investment in digital platforms as a small price to pay for a chance to survive for another 150 years.

kz2018, great post!

I remember being shocked as a summer intern at Goldman Sachs when one of the firm’s leaders got up at orientation and declared, “this isn’t a financial services company; it’s technology company with expertise in financial services.” My sense was that this was only sort of true. Goldman invested meaningful amounts of money in technology and developed great tools to enable its employees to work effectively and better serve client needs. However, at its core, I agree with your assessment that the real economic engine of the firm is its talented work force that have great domain expertise as well as deep client relationships across its investment banking, investment management, sales and trading and lending businesses. I would consider it more a “tech-enabled” (or perhaps “tech-reliant”) company rather than a true technology company.

I also wonder if the emphasis on developing technologies “in-house” makes sense. It’s hard to be great a financial services firm and also be best-in-class at developing cutting edge technologies. These require quite different critical tasks. I wonder if Goldman would be better served focusing on financial services and then working closely with select partners to develop the technological solutions it needs.

Awesome post – it seems like Goldman is certainly leading the charge in FinTech among the major US banks.

What I find most interesting about all these moves, however, is how they target a fundamentally different type of customer than Goldman has typically gone after. Prior to the GE Capital / Marcus announcements, the firm’s only retail presence was focused on ultra-high net worth clients (normally $10M+ in assets). Though positioning as a technology company may help them attract talent and younger customers, I wonder if the core PWM business views these moves as dilutive to the Goldman brand.

The point about Open Source is really interesting too – banks have been talking for years about open source, but little has come of it (https://www.ft.com/content/6ee1921c-f14f-11e1-a553-00144feabdc0). I wonder if part of the reason is the approach – to access Marquee, you have to jump through a few hoops to register. Contrast this to a traditional open source project, where the code is easily accessible and open to anyone on GitHub. I suspect most developers who contribute to open source projects will view the Marquee project with a bit of skepticism as a result.

A couple of months ago I was talking to a CxO of a big european bank about technology. His answer to my question “how will bank stay competitive in the digital era?” scared me: “thanks to technology, we are transferring all the workload to the customer. That allows us to increase our margin”. As an MBA student I understand how this strategy makes sense financially speaking, but it scares me for my future. It sometimes feels like it is not possible to create a meaningful relationship with your local banker anymore because everything went digital.

I want to work in Fintech; I think that there are so many opportunities in that space and after reading your post I actually want to apply to Goldman, but I also hope that banks don’t forget that human interaction is something important. Not everything should be automated.