GE and the Industrial Internet of Things

GE's investment in the industrial internet makes it a leading technology company

Digital transformation has created an opportunity for General Electric to differentiate its manufactured products through data-collecting sensors, the Industrial Internet of Things (IIoT), and smart machines. Interestingly, this old economy company is a leading innovator in the cutting-edge Internet of Things (IoT) space. By using GE machine with dozens to thousands of sensors mounted on them collecting data, customers can perform analytics to improve asset performance and minimize unscheduled downtime.[1] For example, in wind farms the turbines in the front affect those placed behind them. This can lead to vibrations in the rear turbines that cause stress fractures in the blades, sometimes resulting in blade failure. However, by using blades with sensors on them and collecting the data, wind farms can perform analytics that allow the turbines to adjust in real time to prevent stress fracture. These analytics improve wind farm efficiency 2 to 5 percent, according to GE. However, this requires the transmission, storage, and analysis of tremendous amounts of data. For example, one sensor on one blade collects 520GB of data per day, and there are 20 sensors per blade.[2]

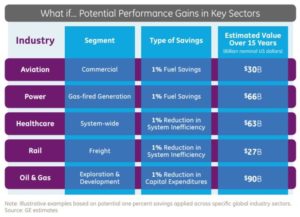

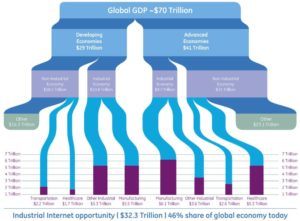

The efficiencies gained from IIoT-driven data analytics can create tremendous value in the economy. See the graphs below:

Source: GE per http://www.nanalyze.com/2016/10/ge-industrial-internet-of-things-company/

Source: GE per http://www.nanalyze.com/2016/10/ge-industrial-internet-of-things-company/

Increasingly, software will allow GE’s machines to self-manage through artificial intelligence, producing smarter machines and smarter factories. However, the change to smart factories is not happening overnight. This year, GE’s goal is to transform 75 of its 500+ factories to IIoT, but it faces challenges. One challenge is how to get legacy equipment connected, as sensors already present on the equipment are made for maintenance and repair, not real-time data streaming.[3] This equipment cannot merely be replaced because of the large unanticipated capital expenditures associated with replacing equipment prematurely.

General Electric has delved deeper into the technology business by creating a software platform for the Industrial Internet of Things called Predix. Predix is a cloud PaaS (platform as a service) that enables machines, data, and people to connect on a standard platform.[4] This means that GE is effectively in the cloud computing business – datacenters and all – like an Amazon Web Services for IIoT applications.

GE appears to be succeeding in this new technology offering. On Tuesday, it announced that its software and services business was projected to hit $6 billion in revenues for 2016, a 20% increase from 2015 (compared to total revenues of ~$140 billion). GE seems to be on track to hit its goal of $15 billion of software and services revenue by 2020. GE also announced industry-specific Predix software for the energy industry, machine operators, and other specialized applications. GE is working hard to build an ecosystem around Predix, and noted that there are 19,000 developers building software applications on top of the Predix platform.[5]

GE has also been acquiring companies to bolster its technology chops. On Tuesday, GE announced it acquired two artificial intelligence startups – Wise.io and Bit Stew Systems – which will help it compete with the likes of IBM’s Watson. Wise.io has machine learning technology well-suited for industrial applications. Bit Stew uses machine learning to analyze big data from utilities, aviation, oil and gas production, and manufacturing.[6] GE also recently acquired ServiceMax, a cloud provider of software for inventory and workforce management, for $915 million.[7]

General Electric has historically been a manufacturer of mechanical and electrical hardware, what some might consider “low tech.” This shift into computing, software, and data analytics shows how important computing has become to the modern economy. In some sense, every company is becoming a technology company. I believe this is a great strategy. GE is using its scale to invest in technology that smaller competitors cannot afford while moving the industry and world forward. This will give it new revenue streams and cache, differentiate its legacy products, and build barriers to entry around its business and a long-term advantage over competitors.

(774 words)

SOURCES:

[1] Arc Advisory Group, “GE’s Industrial Internet of Things Journey” (PDF file), downloaded from General Electric website,https://www.ge.com/digital/sites/default/files/GE%20Industrial%20Internet%20of%20Things%20Journey%20(1).pdf, accessed November 2016.

[2] Cliff Saran, “GE uses big data to power machine services business,” ComputerWeekly.com, January 2013, http://www.computerweekly.com/news/2240176248/GE-uses-big-data-to-power-machine-services-business, accessed November 2016.

[3] Christopher Mims, “How U.S. Manufacturing Is About to Get Smarter,” The Wall Street Journal, November 13, 2016, http://www.wsj.com/articles/how-u-s-manufacturing-is-about-to-get-smarter-1479068425, accessed November 2016.

[4] https://en.wikipedia.org/wiki/Predix_(software), accessed November 2016.

[5] Matthew Weinberg, “GE says its software for smart factories and the ‘Internet of Things’ is now a $6 billion business,” Business Insider, November 15, 2016, http://www.businessinsider.com/ge-predix-6-billion-business-2016-11, accessed November 2016.

[6] Alwyn Scott, “GE Acquires Two Artificial Intelligence Startups,” Reuters, November 15, 2016, http://www.nytimes.com/reuters/2016/11/15/business/15reuters-ge-m-a-startups.html?_r=0, accessed November 2016.

[7] Ankit Ajmera, “GE Buys Software Company ServiceMax for $915 Million,” Reuters, November 15, 2016, http://www.nytimes.com/reuters/2016/11/15/business/15reuters-servicemax-m-a-ge.html, accessed November 2016.

I wrote about a very similar company (Siemens), that has had an approach towards digitalization very similar to GE’s. Siemens launched a tool called Sinalytics, with the same goal of collecting data from Siemens systems installed all across the globe and helping its clients optimize performance of such systems. My main concerns – applicable to GE as well as to Siemens – are the following:

1. How to ensure that the aggregation and the treatment of huge amounts of very sensitive data happen in a secure manner? Exchange of many terabytes of data between GE’s servers and client’s sensors should be dealt with the utmost care. Are investments in cyber security going to increase substantially?

2. How to attract and retain the human capital required to thrive in this new context? Once GE starts to become more of a “tech company”, it will need to attract a different profile of professionals (e.g., coders, software architects). These professionals, today, very likely feel more attracted to employers like Google, Facebook or Amazon. How can GE improve its value proposition for employees, to attract this new profile of people?

In addition to investing in other companies that have expertise in the areas in which GE aspires, the company should also invest in-house research and development toward this goal as well. Despite being an “old economy” company, GE has a great deal of technical know-how built on a long history, upon which it could capitalize to develop unique products for the industrial internet. From their website (see https://www.ge.com/about-us/research/factsheet) it appears that this is an area of interest, but as you mention, if they are serious about this corporate shift, their internal R&D budget in this domain should be serious as well.

Super interesting post.

Software, technology and services will surely be the main drivers of growth in the industry. European players such as Siemens and ABB are facing the very same issues and are focussing on shifting revenue and profits towards software and technology.

The main question here once again is organic vs M&A growth. Can multi-hunderd-billion dollar conglomerates such as GE still be at the forefront of technological innovation. Are they agile enough or will these conglomerates mostly use their ability to provide the distribution infrastructure and to raise capital in the capital markets to acquiring the new and promising assets?