Ford is no longer ‘just an auto company’

Digital disruption has forced Ford to reconsider its core business model; the organization is moving from an “auto company, to an auto and mobility company”. To enable this, the Ford has created a wholly owned subsidiary, Ford Smart Mobility LLC, based in Silicon Valley, which is developing next-generation transport solutions

“The auto industry is poised for more change in the next five to ten years than it’s seen in the past 50.”

– Mary Barra, CEO, General Motors [1] (speaking in 2015)

Digital transformation will fundamentally affect how automotive businesses create and capture value

The IBM Center for Applied Insights recognize that “for more than 100 years the automotive industry has created competitive advantage mainly through engineering excellence. Going forward, this will no longer be sufficient” [2]

The industry is now on the brink of significant change. This change is due in large part to the digital revolution brought about by a perfect storm of technological influences such as big data and analytics, cloud computing, the socialization of business through mobile devices, and at the eye of the storm, the Internet of Things (IoT).

This digital progress will lead to four disruptive technology-driven trends in the automotive sector: 1) diverse mobility, 2) autonomous driving, 3) electrification, and 4) connectivity. “Most industry players and experts agree that these four trends will reinforce and accelerate one another” [3]

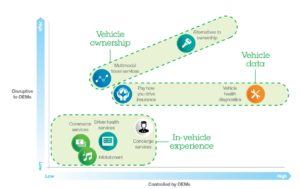

The following infographic from IBM highlights a number of emerging digital services and their expected level of disruption to the auto industry:

The most disruptive threat automakers face is to car ownership itself. Although car sharing (popularized by the likes of Zipcar) has been around for some time, it is becoming more widespread as automakers enter the market (examples include Daimler Car2Go and BMW DriveNow). One estimate suggests that each car available for sharing leads to 20 vehicle sales being deferred [4].

Cars are an expensive asset (that depreciate significantly) and also highly inefficient; private vehicles spend roughly 95% of their time unutilized [5]. As innovative transport solutions become available from new players (such as Uber, Apple, Google, Tesla), the complexity of the competitive landscape will intensify. McKinsey believe that this will lead traditional automotive players, who are faced with myriad other challenges (such as improving fuel-efficiency, reducing emissions, deploying capital efficiently etc.) to respond with consolidation or new forms of partnerships amongst incumbents. [6]

Ford is evolving its business model to stay relevant

This is exactly the approach adopted by Ford, who many would consider an embodiment of the “old guard” of the industry. Speaking at CES 2016 CEO Mark Fields acknowledged that Ford is “transitioning from an auto company, to an auto and a mobility company.” [7] This evolution is outlined in the Ford Smart Mobility Plan [8] which is underpinned by 5 pillars (see figure below):

Examples of recent initiatives include the acquisition of Chariot, a private, crowdsourced shuttle service based in San Francisco, that uses algorithms to develop transit routes based on user demand. Using the app, customers can book a seat in one of the company’s shuttle vans for around $4 a trip. Ford plans to expand the service to 5 additional cities over the next 18 months [9].

The company also invested in Motivate, the largest operator of bike-share programs in the US. Ford will add 7,000 new “Ford GoBikes” to San Francisco’s bike-share infrastructure which will be available to users of the Ford Pass app.

This is all progress towards Mark Fields’ goal of evolving Ford’s business model; Ford Smart Mobility “is not about moving from an old business to a new business. It’s just moving to a bigger business as we expand the business model from number of units sold to number of units sold plus vehicle miles traveled.” [10]

This evolution in business model requires an overhaul of Ford’s operating model

In order to allow these projects to thrive, Ford is pursuing its next-generation initiatives under a wholly-owned subsidiary, Ford Smart Mobility LLC, which is based in Silicon Valley (2.5k miles from Ford’s HQ in Dearborn). The aim of this is to prevent these radical new projects from being “overwhelmed by the Ford bureaucracy” and “give them the flexibility and the operating structure to be able to be competitive with other technology and mobility services companies that move really fast.” [11] Locating in the Valley gives Ford access to the talent and ecosystem of ideas it will require to compete with the likes of Apple, Google, Uber et al.

To the future

Ford is educating consumers on the repositioning of its brand through the “Unlearn Ford” campaign. It will be interesting to see if, through this campaign and the exciting work that is doing, whether one of the oldest names in the automotive business is able to convince both customers and collaborators that it holds the aces in the most high-stakes game of poker the industry has ever seen.

Will one of the titans of physical transport be able to effectively re-position itself against young upstarts in the battle for digital dominance of the mobility industry?

(words: 790)

It will be interesting to see how Ford continues to develop its business model as technological disruption continues to influence the transportation industry. With increasing urbanization worldwide, I would expect the number of vehicles globally to decrease as autonomous taxi-services become more prevalent and, in tandem with other methods of transportation, the requirement for a car diminishes. However, I do wonder how the adaptation of such technology will be offset in parts of the world where personal transportation is a must (e.g., much of the United States outside of densely populated areas). I also wonder how Ford’s operating model will shift as electric vehicles become more prevalent and interconnected with the Internet of Things across the power, infrastructure, and home/commercial landscape. Ford and other large automotive companies do have a large role to play in the future of transportation as demand continues to increase. However, they may need to revise their approach in a more holistic way and even find methods of making the entire transportation value chain work together more efficiently (e.g., car, plane, train, etc.) with the increasingly scarce resources needed to power those vehicles.

You state falling car ownership is the biggest risk to OEMs, but I would agree with Ward’s point and say that there is a limit to how useful car-sharing services are in non-urban environments.

I would instead argue that autonomous driving is actually the bigger medium-term danger. The questions in my mind around autonomous driving are (a) who owns the vehicle and (b) is the software built on a closed or open ecosystem. On (b) I suspect the pressure will be to have an open ecosystem on which a dominant software provider will emerge (as happened with Microsoft on PCs). The alternative is for each OEM to have a closed ecosystem and its own autonomous driving software, something that may become very confusing and complex for consumers and may create barriers to communication between autonomous cars on the road. The risk for Ford of embracing an open ecosystem is that they may sacrifice part of their profitability and customer relationship to the software provider.

Very interesting article on the future of Ford, but also applicable to many other car manufacturers across the world. Ultimately, the success of these companies will be determined by how they can move from being car manufacturers to providers of transportation solutions, i.e. how they can redefine their market to remain relevant in a changing world.

Another big stakeholder to be impacted by the change is public transport. As OEM, as well as companies like Uber, disrupt the transport industry, the role played by public transport will change. Its model, usually requiring heavy infrastructure and overall quite inefficient (buses and trains are either empty or completely full), might actually benefit from these technological advances, such as Uber-like algorithms to better forecast demand. At the same time, however, the shift of passengers to more convenient forms of transportation might decrease overall demand for public transport, making it costlier to local administrations who might in turn start cutting some services [1]. This is surely a big threat to public transport agencies, but a huge opportunity for the new providers of transport solutions, including OEM like Ford. Once again, history confirms the old adage “mors tua, vita mea”…

[1] https://www.bloomberg.com/news/articles/2016-08-15/uber-and-lyft-want-to-replace-public-buses

While I think the shift away from personal car ownership is an interesting discussion, I think it is largely confined to a small demographic. This demographic can be characterized as one that lives in a city with excess disposable income. While the purchase of a car is a high barrier to entry and ultimately depreciates quickly, paying for these costs plus commission through ride sharing will ultimately be more expensive and does not have any resale value. Additionally, while ride sharing is a great way to address cost and emission concerns, it is only practical in a highly condensed city. Because of this, these benefits can only be realized by a small percentage of the population. I view the lion share of these plans as CSR based marketing and not something that we will see forever. I would think these automakers would be incentivized to increase operational efficiency, reducing costs to make auto purchases more accessible. Additionally, they should invest further in R&D for electric cars.