Ford: Building a Cleaner Fleet of Vehicles

Ford is making bold moves to improve vehicle fuel economy in the face of environmental regulations.

In 2014, Ford Motor Company re-invented its most successful product, the F-150 pickup truck, part of its F-Series truck which had been the best-selling vehicle in the United States for more than three decades.[1] Ford sought to make the F-150 lighter, which would increase its fuel economy and reduce greenhouse gas (GHG) emissions. This bold change was spurred on by new fuel economy targets established by U.S. regulators in 2010 in response to the growing threat from climate change. Making the F-150 lighter is one of several strategies Ford has implemented in the wake of this regulation. Continued execution on these strategies will be required for Ford to successfully meet the new targets and develop a cleaner, more environmentally friendly fleet of vehicles.

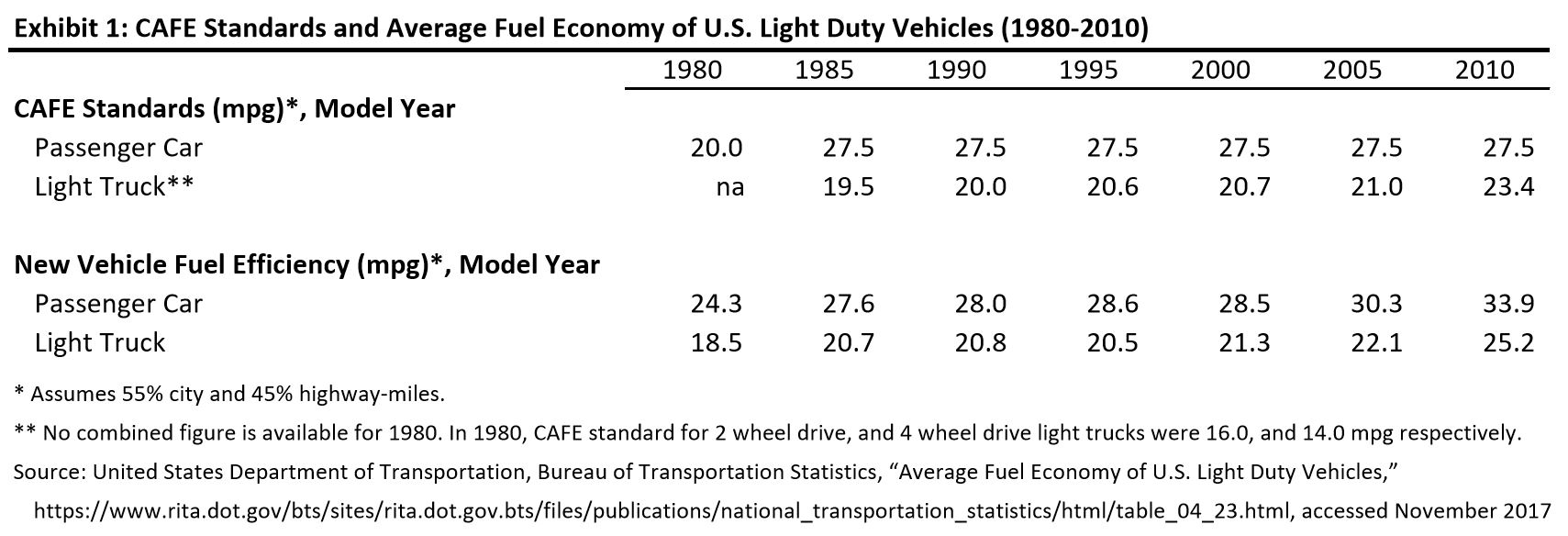

In 1975, the U.S. Congress established Corporate Average Fuel Economy (CAFE) standards, which set the average fuel economy, as measured in miles per gallon (mpg), that U.S. automakers must achieve across their fleets of new vehicles (cars and light-duty trucks).[2] For decades, the CAFE standards remained static and average fuel economy in the U.S. showed only modest improvement (Exhibit 1).[3]

As the auto industry has grown in the decades since CAFE was established, so have resulting GHG emissions. To reduce the industry’s impact on climate change, fuel economy standards were revamped in 2010, with regulators setting an ambitious target for U.S. automakers to meet: average fleet-wide new vehicle mpg of 54.5 in 2025.[4] The 2025 target is nearly double the 27.5 mpg that was required for new cars under the CAFE standards in place prior to the new regulation.

To meet these new emissions standards, Ford has implemented a multi-pronged strategy. First, it is re-designing its vehicles to be lighter and, thus, consume less fuel. “Light-weighting” requires both material science innovation and significant investment in production capabilities. The pay-off can be large, with a 10% weight reduction resulting in a potential fuel economy improvement of 3% – 4%.[5] Ford has boldly pursued this strategy, investing more than $1 billion to re-tool production of its top-selling vehicle, the F-150 pickup truck, changing its body from steel to lighter-weight aluminum[6] and reducing overall vehicle weight by 700 pounds.[7] The company continues to pursue light-weight material innovation, partnering with suppliers to develop more advanced aluminum alloys, carbon-fiber and other alternatives for use in future vehicle applications.[8]

In addition to making vehicle bodies lighter, Ford has improved technology under the hood. Innovative engine and transmission technologies improve overall gas-powered vehicle performance, resulting in greater fuel economy.[8] Finally, Ford has invested heavily in the production of hybrid and electric vehicles, committing to spend $4.5 billion through 2020 to produce 13 new hybrid and fully electric models, which will reduce total fleet GHG emissions, helping Ford to reach the new fuel economy standards.[9]

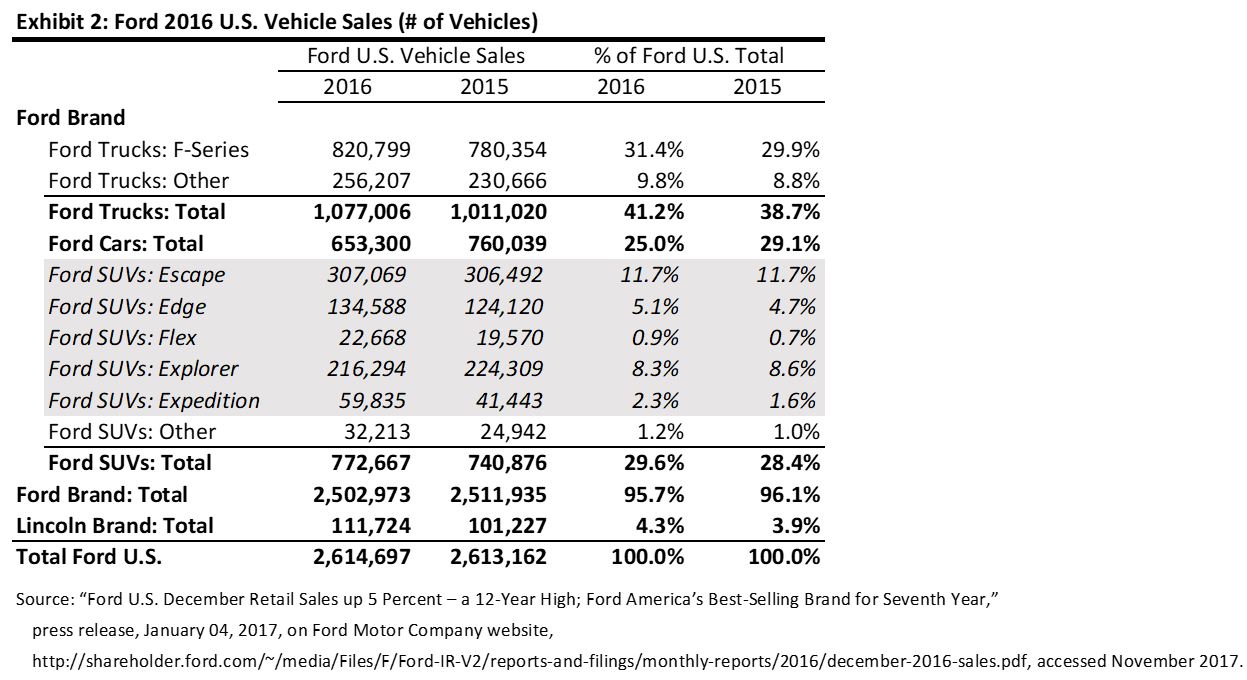

Overall, Ford has taken significant strides to position itself to meet the 2025 fleet-wide fuel economy target. However, there are additional steps Ford can take over the short and medium term to supplement its existing strategy. First, it should take a hard look at its portfolio of vehicles. If the company wants to be a leader in building a cleaner fleet, it should consider discontinuing production of some larger, less fuel-efficient models. While the F-series trucks are critically important to Ford’s survival, there may be an opportunity to rationalize its SUV portfolio. The company has 5 consumer SUV models (Escape, Edge, Flex, Explorer, Expedition), which collectively represented 28% of 2016 sales (Exhibit 2).[1]

Going from five models down to one or two would allow management to better focus investments in fuel-efficiency in the remaining models. Ford should also accelerate its light-weighting program across other vehicle models by leveraging the capabilities and know-how already acquired from transitioning the F-150 to aluminum. Lastly, the company should consider developing strategic partnerships within the industry to accelerate its hybrid and electric vehicle efforts. A JV with another U.S. auto manufacturer may be an attractive way to achieve synergies and scale benefits which would allow both companies to move up the electric curve faster, getting them closer to the fleet-wide 2025 mpg targets.

Several external factors may also have an impact. The current U.S. administration is reviewing the emissions standards adopted in 2010, and there exists the potential that these targets are rolled back. Such a change in regulation may impact Ford’s strategy given the large investments required to achieve these mpg targets. It is also an open question what role California state regulations will play if its 2025 targets remain at elevated levels irrespective of the federal standards. Finally, if oil prices remain low, will consumers be incentivized to buy cleaner vehicle technology when improved fuel economy has less of a financial benefit? Each of these variables may impact the pace of fuel economy improvement over the next decade.

(Word Count: 795)

End Notes:

[1] “Ford U.S. December Retail Sales Up 5 Percent – a 12-Year High; Ford America’s Best-Selling Brand for Seventh Year,” press release, January 04, 2017, on Ford Motor Company website, http://shareholder.ford.com/~/media/Files/F/Ford-IR-V2/reports-and-filings/monthly-reports/2016/december-2016-sales.pdf, accessed November 2017.

[2] National Highway Traffic Safety Association, “Corporate Average Fuel Economy,” https://www.nhtsa.gov/laws-regulations/corporate-average-fuel-economy, accessed November 2017.

[3] United States Department of Transportation, Bureau of Transportation Statistics, “Average Fuel Economy of U.S. Light Duty Vehicles,” https://www.rita.dot.gov/bts/sites/rita.dot.gov.bts/files/publications/national_transportation_statistics/html/table_04_23.html, accessed November 2017.

[4] Center for Climate and Energy Solutions, “Federal Vehicle Standards,” https://www.c2es.org/content/regulating-transportation-sector-carbon-emissions/, accessed November 2017.

[5] Sue Callaway, “How Ford is Innovating with Materials Science,” Fortune, October 28, 2015, http://fortune.com/2015/10/28/ford-materials-science/, accessed November 2017.

[6] Associated Press, “Ford Starts Production of New Aluminum F-150,” USA Today, November 11, 2014, https://www.usatoday.com/story/money/cars/2014/11/11/ford-new-f150/18837911/, accessed November 2017.

[7] Bengt Halvorson, “The Ford F-150 Is 700 Pounds Lighter Than It Used To Be,” BusinessInsider.com, January 13, 2014, http://www.businessinsider.com/the-ford-f-150-is-700-pounds-lighter-2014-1, accessed November 2017.

[8] Ford Motor Company, “Improving Fuel Economy,” https://corporate.ford.com/microsites/sustainability-report-2016-17/customers-products/emissions/fuel-economy.html, accessed November 2017.

[9] Ford Motor Company, “Alternative Fuels and Powertrains,” https://corporate.ford.com/microsites/sustainability-report-2016-17/customers-products/emissions/alternative.html, accessed November 2017.

Photo Credit: Ford Motor Company (sourced from Ford’s website)

Thanks for putting together this interesting article.

A few thoughts:

With regards to investing in hybrid and electric vehicles, this only makes sense if the energy source supplying the electricity is clean. There are many parts of the U.S. that still rely on coal so I think its a multipronged approach that not only requires better technology for hybrid vehicles but also government regulation to reduce coal. And I’m a little skeptical that there will be any government regulation to move beyond coal and other “dirty” energy sources in the next few years with this administration.

In terms of investing in new technology and more fuel-efficient car design – my understanding is that companies have technology to make cars nearly twice as efficient as they already are (and they could have taken these steps long ago to improve efficiency but chose not to until regulations were put in place). I agree that consumers are currently less likely to be interested in such vehicles. First I think that people perceive these lighter, fuel efficient vehicles to be less powerful and less sturdy. They are in fact usually made from lighter material, etc. Therefore people interested in – either functional or for their image – in a sturdy / powerful car or truck are turned off by a lot of the more fuel efficient vehicles. If fuel prices were high, some of this might be mitigated. But currently that is not the case. Thus with low fuel prices I think there is little incentivizing consumers who would currently buy large inefficient trucks to be interested in instead purchasing a more fuel efficient vehicle. Ultimately Ford needs to strike that balance and despite all of its interests in improving efficiency, it needs to make and sell cars customers ]want to buy.

So I wonder how much we can expect to change in the next decade with the current administration and current fuel prices? But maybe that’s just my pessimistic view.

Thanks so much for sharing this!

Thanks for pulling this together.

If you’re Ford, I think you continue to invest in fleet fuel-efficiency. I would argue that the trend for the foreseeable future, outside of the current administration, is likely to be more of the same (i.e., more strict emission standards) and the risks associated with reducing investment (e.g., falling behind versus competition, etc.) likely outweigh the temporary cash flow benefit Ford could realize.

With respect to gasoline price impact on demand for more fuel-efficient vehicles, consumer data would support the thesis that current prices aren’t high enough to cause a substantial shift. [1] That being said, I think Ford, amongst other automakers, should still strive to deliver both fuel efficiency and performance for the larger vehicles in their fleet. Policymakers can always evaluate using tax breaks or other mechanisms to incentivize a change in consumer behavior with respect to overall fleet mix.

[1] Jon LeSage, “Fuel economy: This key data points at strong U.S. oil demand, ” https://www.usatoday.com/story/money/2017/10/13/fuel-economy-key-data-points-strong-u-s-oil-demand/752601001/, accessed November 2017.

Thanks for a great article!

As a consumer, I like both the shift to lighter-weight metals and electric power in vehicles. But not all consumers would agree. Since Aluminum is known by most truck-buyers to be a weaker metal than steel, Ford has made a point to only advertise it as “military-grade” aluminum. Meanwhile, competitors have attacked the use of aluminium in commercials, emphasizing that their trucks are made from stronger stuff [1]. In reality, the Aluminium is going to work just as well, but there may be a lasting perception on the part of consumers that by making the F-series more eco-conscious, the product is not as good.

I wonder if the same goes for building hybrid trucks. I don’t believe Ford has ever released a hybrid F-150, although they have a number of other hybrid models. Actually, I’m not aware of any hybrid full-sized trucks, despite some car companies offering hybrid powertrains in SUVs. Trucks would likely be great as hybrids–torque, which is essential in trucks, is actually better delivered through electric motors than internal combustion engines. I would guess that development of hybrid trucks has been stalled, however, due to perception. No truck owner wants to be seen as driving a glorified Prius.

[1] https://www.youtube.com/watch?v=76NUSwNQa7Q

It’s interesting to think about, as you mentioned, rollbacks in the emissions standards from 2010 affecting a company’s corporate strategy. I really like Kyle’s point about the consumer response to these design changes in Ford’s cars. To that end, I wonder what Ford is doing to help change actual consumer behavior to appreciate lighter-weight design, hybrid vehicles, etc. Maybe this is the marketer in me, but I think they should be sharing the changes in their vehicles with the public in an effort to push consumers to accept these slightly different vehicle designs and hybrid cars. Ford should even consider partnering with other automotive companies — but not necessarily for vehicle design purposes as you mentioned. I think some of these larger automotive manufacturers should band together in a coalition and agree to set certain emission standards (and achieve those by light-weighting, or focusing on hybrids, etc.). This coalition would literally force consumers to change their habits, and could also help educate consumers about the danger of climate change and the way the automotive industry needs to and is responding. The American Beverage Association has done something very similar to help change consumer taste profiles and push them to purchase less sweet drinks across the board. It is working well for the soda industry, so I’d be curious to know if it could be translated here.

It is very interesting to learn more about how one of the major players in the automobile industry is trying to respond to challenges posed by climate changes. As the leader that started the modern mass production, Ford may once again establish their competitive advantage by improving the fuel economy of their fleets – not just as a response to regulatory requirement but also as a way to answer to changing consumers’ preference.

I agree with you that Ford should first focus on their development on few models and improve the fuel efficiency of these models. The lessons learnt can then be transferred to other models to other Ford models that continue to have strong market demand. I think a JV with another energy firm – such as startups that specialize on clean energy – can be helpful in quickly advancing the clean technology for Ford, since some of these tech start-ups can be cheaper acquisition targets.

Given the low gas prices currently, Ford should incentivize consumers to switch to the new models of fleets with other features. For instance, Tesla electric cars lead not only with its innovative clean technology but also other features, such as the self-driving technology.

I am particularly worried about your suggestion to reduce production of Ford’s large models, because the demand for larger car models seem to stay strong (reference: https://www.theatlantic.com/business/archive/2017/04/tesla-future-of-driving/523224/). Instead of cutting the larger, heavier models, Ford should think of innovative ways to improve the fuel efficiency of these models as well.

This is a great case-in-point for the short-term and long-term trade-offs that a company has to grapple with to address a problem. There are multiple layers to it. Shorter-term, light weighting is effective, but as CAFE standards get progressively stricter, electrification would make more sense, because 1) light weighting can only go so far and 2) battery cost is coming down and is increasingly attractive relative to internal combustion engine vehicles.

What I see as a key to the issue (also environmental related issues in general) is that fuel efficiency is a supply-side problem i.e. consumers are not asking for it and are hence not willing to pay for it. What that means is that all the automakers have to make investments into the transition without the ability to charge more. So the timing of the investment is very important – you don’t want to invest ahead of the competitors in new emission reduction technology when the cost curve has not come down; you also don’t want to invest after your competitor where you lose competitive edge.

Take electrification as an example. Investing too earlier means 1) electric component supplier ecosystem is not mature yet; leaping into the electric vehicle age might mean having to make certain key components in-house 2) battery cost might be so high that profitability suffers until battery/combustion engine cost crossover happens, where the crossover point is out of your control. Investing too late means that you might lose the opportunity to have a seat at the table where key supplier relationships are established and industry standards are set. You also might lose the mind share among consumers when competitors have electric vehicle brands and you don’t. Technological transitions are good times for market share to reshuffle. Electrification is the biggest innovation that the auto industry has seen since Henry Ford as far as engine technology is concerned, and is already creating new winners. Hence, investing in electrification is strategically important even if financially it doesn’t make sense yet. Therefore, I feel that timing is a very tricky issue. This goes back to the many short-term and long-term trade-offs that the post highlighted.