For GE to Convince the World of the Benefits of Additive Manufacturing, It Must First Convince Itself

Can GE get divisions outside of Aviation to adopt the Additive Manufacturing technologies it is trying to sell to customers as a standalone product?

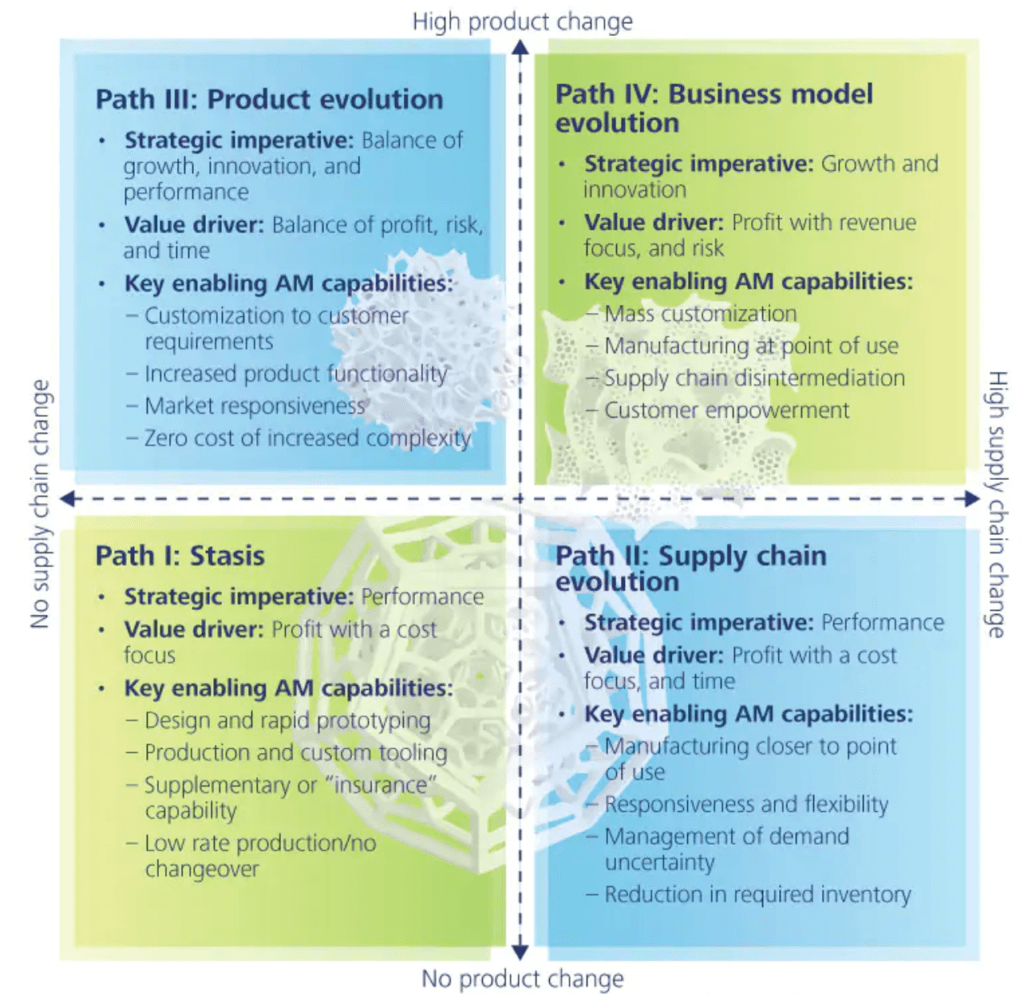

Additive Manufacturing (“AM”) broadly describes technologies that build 3D objects by adding layer-upon-layer of material [1]. Though potentially revolutionary, companies across industries have taken different approaches to the application of this breakthrough technology. In 2015, Deloitte outlined four paths companies take in leveraging AM [2]:

- Path I: Improve value delivery, product set and supply chain are unchanged.

- Path II: Improve economies of scale and revolutionize product supply chain.

- Path III: Enable top levels of performance across the product set.

- Path IV: Alter supply chains and products in pursuit of new business models.

Deloitte’s Framework for Understanding AM Paths and Potential Value

Though industrial conglomerate GE is typically thought of as a slow mover in innovation, its Aviation division has been an early adopter of AM technology, taking a Path IV approach to revolutionize the full-scale manufacturing of parts for its airplane turbine business.

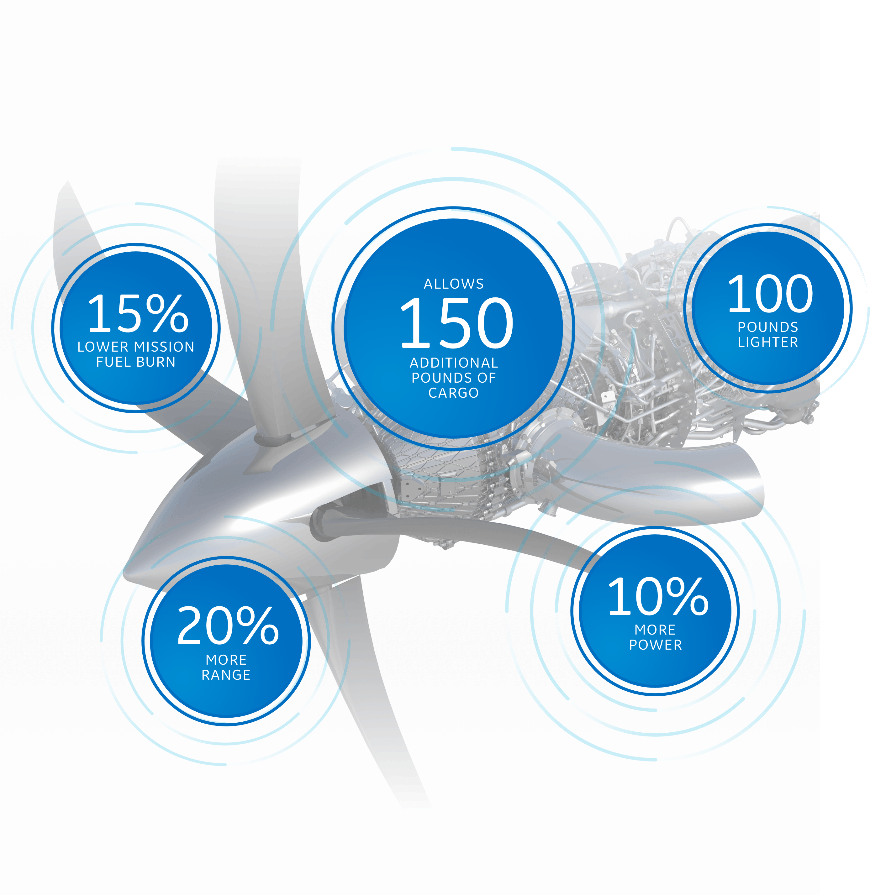

In 2017, GE enjoyed 70% share in engines that power narrow-body jets, the world’s most widely produced airplanes [3]. The company is investing heavily in AM to expand its dominant market position by widening the moat afforded to it by its production capabilities. As an example, in 2012 GE created a new, more fuel-efficient jet engine. In doing so, they had to overcome a key engineering challenge related to the engine’s fuel nozzle. The nozzle required 20 individual components to be welded together. After repeated failures, the team turned to AM to prototype a single piece of equipment that combined all 20 parts into one unit while weighing 25% less and being 5x more durable. In describing the technology, GE’s head of AM noted “The technology [is] incredible, in the design of jet engines, complexity used to be expensive. But additive allows you to get sophisticated and reduces costs at the same time.” By 2014, GE printed half of its engines with AM, reducing 900 components to 16 while delivering a product that is 40% lighter and 60% cheaper. Further, GE Aviation improved its supply chain by reducing reliance on sole-source suppliers and shifting production costs in-house. [4]

The Advanced Turboprop: Stronger, More Durable and Cleaner

Though the recent wins in Aviation demonstrated AM’s potential within GE, former CEO Jeff Immelt’s ambitions for the technology were much greater. In 2016, GE acquired two AM companies. In tandem with the acquisitions, GE opened the Additive Training Center to teach engineers across its end market platforms how to apply AM technology in their respective businesses. Further, Immelt noted in the 2016 Annual report that GE aspired to reach $1 billion in AM sales by 2020, believing the technology would become a $75 billion market over the long-term. Immelt further believed GE would be at the forefront of this industrial revolution by selling AM technologies as a standalone product, estimating only 10% of long term sales would go to GE internally. [5]

Though progress to date has been impressive in Aviation, the company has offered few details of the technology’s applications across its other businesses, aside from traditional Phase I-III applications primarily dealing with rapid prototyping [6]. Given GE management aims to scale this business by selling its AM capabilities across industries, it must first focus on applying the technology across its own businesses. The reasons for this are threefold. First, given GE’s expansive end market coverage (Healthcare, Oil & Gas, Power, Aviation, etc.), the company has an unrivaled testing ground for how the technology can be applied across different use cases. Second, AM applications are generally quite customized, requiring knowledge of materials, long-term production targets, and supply chain dynamics which must be iterated on throughout the manufacturing process. Thus, GE must first become a true expert in the technology and its application within its own portfolio, so it can approach clients with a more credible value proposition. Lastly, given GE’s current financial challenges and restructuring efforts, the company is in desperate need of cash. Leveraging AM to drive efficiencies across business units will allow them to climb the learning curve without having to invest capital dollars to scale a largely unproven technology outside of its core businesses to serve outside customers.

Though GE has demonstrated the potential of AM in Aviation, the company has not meaningfully adopted the technology in its other product lines. This lack of adoption internally will make it challenging to sell the service to outside clients who are likely skeptical of the technology’s benefits and broad applications beyond prototyping. The main question left unanswered is how can GE drive adoption of AM technology across its platforms internally, so it can convince others of its merits and attempt to compete in this emerging industrial category?

(Word Count: 769)

References

[1] “What is Additive Manufacturing?” (2018). Additive Manufacturing. Retrieved from: http://additivemanufacturing.com/basics/

[2] Michalik, Joyce, Barney, and McCune (2015). Deloitte University Press. “3D opportunity for product design Additive manufacturing and the early stage.” Retrieved from: https://www2.deloitte.com/insights/us/en/focus/3d-opportunity/3d-printing-product-design-and-development.html

[3] Josephs, Leslie (2018). CNBC. “Here’s why GE is holding on tight to its aviation business.” Retrieved from: https://www.cnbc.com/2018/06/26/why-general-electric-is-holding-on-tight-to-its-aviation-business.html

[4] Kellner, Tomas (2017). GE Company Website. “An Epiphany Of Disruption: GE Additive Chief Explains How 3D Printing Will Upend Manufacturing.” Retrieved from: https://www.ge.com/reports/epiphany-disruption-ge-additive-chief-explains-3d-printing-will-upend-manufacturing/

[5] General Electric (2016). 2016 10-K and Annual Report. Retrieved from: https://www.ge.com/ar2016/assets/pdf/GE_AR16.pdf

[6] General Electric (2017). 2017 10-K and Annual Report. Retrieved from: https://www.ge.com/investor-relations/sites/default/files/GE_AR17.pdf

I wholeheartedly agree with JK Rowling’s assessment that GE needs to develop applications of AM for its various business lines in-house to take advantage of manufacturing efficiencies. I believe its acquisition of two AM companies was in the spirit of vertical integration to increase efficiencies and reduce the number of parts required from others to reap the benefits that it has seen in its Aviation division. I am a bit concerned with Immelt’s estimation of only 10% of long term sales going to GE internally, because GE has received a lot of criticism recently for diversifying too far beyond its base business, which has resulted in their recent financial trouble. GE should lock down its application within its core business first before expanding to external clients. If they are not doing so already, I would actively advertise internally the success of Aviation to other business lines, especially oil and gas (including Baker Hughes), transportation, power, and renewable energy that likely have potential uses within their manufacturing processes. If they are at the cutting edge of these technologies, this could be a huge competitive advantage compared to their peers that can steer the corporation back in the right direction.

I agree that GE has a great opportunity to be a leader in developing applications for AM beyond prototyping and I agree with your assessment that they should look to adopt AM across its business lines as a means of proof of concept. To your question of how can GE accomplish more widespread adoption across the firm, I think GE should focus on AM as a strategy for cost reduction. As both you and Brett mention, GE has been facing financial challenges and finding ways to lower costs through AM could be a good incentive for other business lines within GE to adopt AM. Beyond costs, I think that GE leadership can also attempt to get the business lines excited about the opportunity to be at the forefront. As you mention, GE can be on the slow slide of innovation. I can imagine that this is likely frustrating for some employees. By giving the business lines the autonomy and encouragement to pursue AM, GE employees could get excited about the prospect of being on the cutting edge and look for ways to incorporate AM into their business lines.

I agree with AJB that employing a cost reduction strategy will help rapidly spread AM across the organization — and I think other options the company should consider are education programs and innovation competitions in order to encourage other business divisions to contemplate how their business units might be able to implement AM into their own workflows. Additionally, I think that GE needs to emphasize AM capabilities in their hiring practices — and after taking a look at their hiring website it looks like they are actively trying to acquire this talent today.

I do agree that GE “convincing itself” of the benefits of AM capabilities is incredibly important to gain credibility from outside actors. However, I am still unconvinced that “convincing itself” must necessarily involve applying the technology across its own businesses. Being an early adopter of AM within the Aviation business with successful outcomes could be conviction enough for GE, and in combination with announcing a (vague) intention to roll AM out across product lines, it could be sufficient for outside buy-in as well. The key is for GE to create a value proposition that is compelling enough. If GE clearly conveys that AM has been used successfully but is still in its early age, its value proposition would be that companies that buy the technology will embark upon a new era where they will gain strong competitive advantage (before widespread adoption) if they engage now. More risk-prone companies will possibly even see it as a positive signal that GE has not yet rolled it out, because it means that they are catching the wave before others when the proposition is still discrete.

I agree with Brett that GE needs to develop applications of AM beyond the aviation practice to take advantage of cost-reducing manufacturing efficiencies across other business units that would similarly benefit. The question you raise around how GE might leverage in-house adoption of AM technology to convince external partners of its merits is critical. This should be GE’s primary focus at this stage – to create targeted testing grounds across their portfolio. GE cannot go broad at the outset with this technology or they risk overspending and under-delivering results (and potentially unnecessarily upending production cycles). They need to focus on the two or three related areas in which cost-reductions will have the greatest impact and implementation will require the least amount of tweaking from what has already been gleaned from the aviation space. If they can successfully expand t a these additional spaces, they could have a convincing case to make to external partners – one that does not hinge on a single industry alone.

The perspective taken by the author is quite interesting – believing in something before trying to even sell it outside. In this case, GE could have several opportunities to leverage this trend internally, but this is not happening (or is happening at a limited scale). This issue is pretty common in large corporations, where different groups have different objectives and incentive-systems. Here, strong leadership and strategic vision is missing – leveraging this trends should start from a committed CEO and then cascade down to committed BU leaders and Operations leaders. Once the company can start with the right cultural approach, there could be a real impact on internal operations and then external proposition. Net, I believe strong factors contributing to the success of operations are strategy, leadership and culture.

Thanks for sharing this! I did not know that GE was using additive manufacturing in their product set. I was especially intrigued how much has actually moved to additive manufacturing, as well as the cost and weight savings. I would be curious to understand your thoughts on how this changes the barriers of entry to the marketplace. It seems that additive manufacturing could actually lower capital investments to get into the space and perhaps encourage more competition.