For AT&T, It’s (DirecTV) Now Or Never

AT&T can control the supply chain by owning programming (Time Warner) and distribution (DirecTV) but should not sacrifice one for the other to gain DOJ approval.

AT&T vs. the DOJ

Last week, news broke that the Department of Justice asked Randall Stephenson, CEO of AT&T, to divest either Turner Broadcasting or DirecTV to gain approval for the AT&T-Time Warner acquisition[1]. Although Stephenson claims he intends to keep all assets intact, his ultimate decision will reveal AT&T’s strategic priorities related to the ownership of discrete parts of the supply chain.

In November 2016, AT&T placed a major bet on the future of digital television when the company launched DirecTV Now. Given AT&T’s growing stake in online television and the potential to enhance the customer experience by combining Time Warner content with AT&T’s distribution channels, selling DirecTV for Time Warner would be ill-advised.

Acquisition Goals: Owning Programming & Distribution

AT&T’s business model has evolved since the company acquired DirecTV for $49B in July 2015. The combined scale of the two distributors (+26M subscribers) has given AT&T greater bargaining power with media networks, reducing overall programming costs.[2]

In October 2016, AT&T announced an additional acquisition of Time Warner for $85B. Regulators pushed back, claiming that AT&T’s ownership of the programming and distribution function would put consumers and competing networks at a disadvantage.[3] The transaction, Stephenson argued, was all about the consumer – “from content creation and distribution to a mobile-first experience that is both personal and social.”[4]

Both investments will help AT&T position itself for success as technology shifts viewership habits. In the medium term, AT&T is seeking greater access to consumer insights generated across its digital TV, mobile and broadband platforms to improve execution across the supply chain including content creation and acquisition, addressable advertising and customization of the user experience across screens. [5] In the short term, AT&T is focused on scaling its online TV streaming platform to gain data insights necessary to enhance the customer experience.[6]

Digital TV Landscape

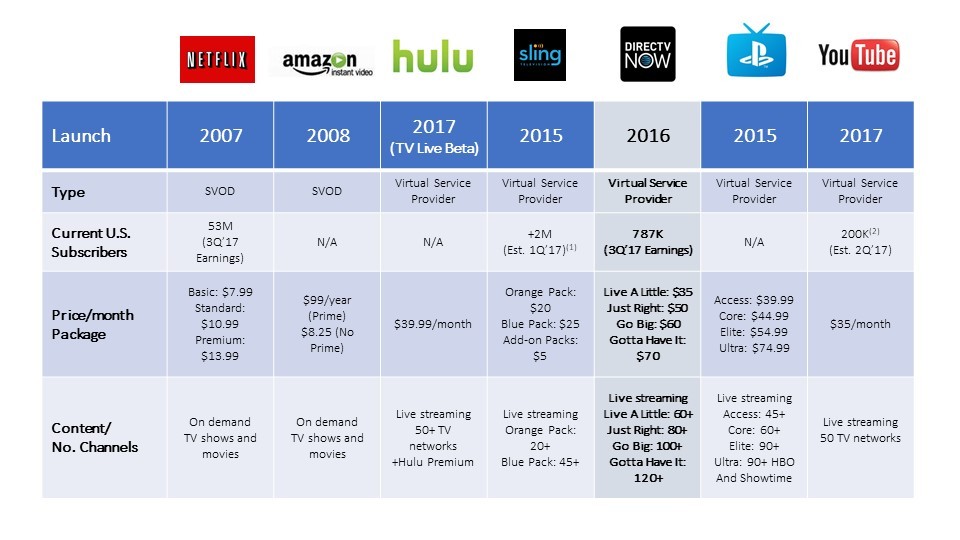

Amid AT&T’s integration of DirecTV and Time Warner merger negotiations, AT&T launched DirecTV Now live streaming service in November 2016. At the time, the online video landscape included subscription video on demand (SVOD) services and virtual service providers (Exhibit 1). Improved high-speed internet and the proliferation of connected devices, gaming consoles and smartphones, allowed consumers to adapt to streaming television online and on-the-go.

Exhibit 1: Key Digital Players in Current TV Distribution Landscape

Source: Company filings and websites unless otherwise noted

Digital Disruption

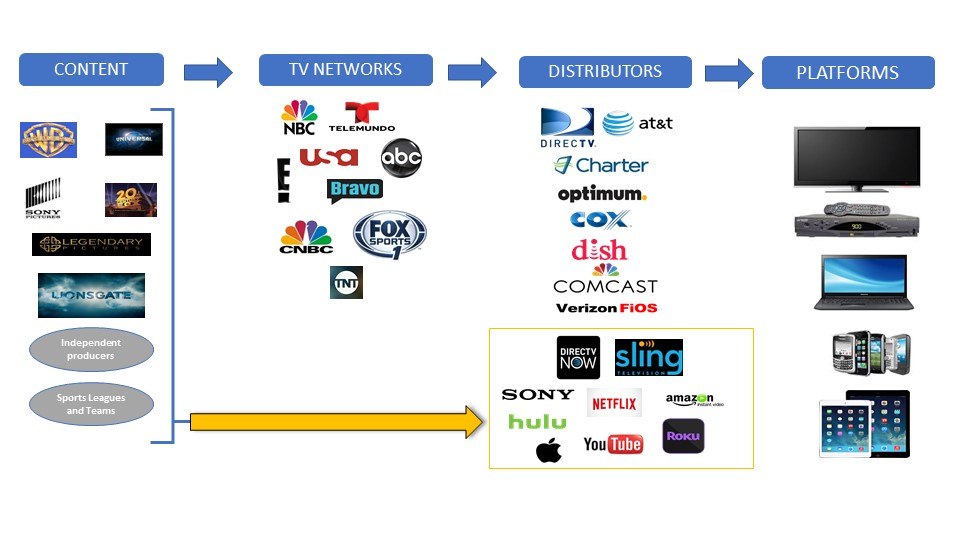

For the past three years, direct-to-consumer models have caused massive disruption across the content supply chain. Historically, studio content was sold to TV networks, programmed to air live, bundled and licensed to distributors and sold as part of a package to cable subscribers (Exhibit 2). Services like Netflix leapfrog the distributor by marketing and delivering digital packages directly to consumers.

In response to the leapfrogging effect and “cord-cutting”[7] trends, satellite TV providers, DirecTV and Dish, launched digital alternatives to their traditional TV packages. Diverging from the “on-demand” model, these packages offer live online television streaming. The downside of offering cheaper digital TV packages is the inevitable cannibalization of traditional, high-margin video subscribers. Regardless, the future of television is online, and incumbents must respond to stay relevant. AT&T had no choice but to enter the digital distribution game to mitigate subscriber losses to Netflix and Sling in the short-term and prepare itself for the future of video distribution, which favors direct engagement with the consumer.

Exhibit 2: The Content Distribution Model

Note: Logos from company websites

Controlling the Content Flow

AT&T should abandon the Time Warner merger unless the Justice Department changes its terms of approval (unlikely in current political environment) and select an alternative target that will allow AT&T to enhance its control over the digital supply chain. AT&T should focus on expanding its digital video business and re-assess its programming partners during upcoming negotiations. Remember, many “cord-cutters” were burdened with enormous monthly cable bills for 200 channels when they only viewed 10.

In the medium term, AT&T should expand into other areas of the supply chain by acquiring online content producers and platforms. Big Tech companies like Facebook are quickly gaining traction in the online video space by producing and delivering content to members. Integrating the right digital tech content partner could enhance AT&T’s ability to engage consumers through its existing video and mobile platforms.

Question for Discussion:

How should AT&T respond? Should AT&T consider an alternative target?

(796 words)

Sources:

[1] Michael de la Merced, Emily Steel, Andrew Ross Sorkin and Cecelia Kang, “Justice Department Says Not So Fast to AT&T’s Time Warner Bid,” The New York Times, November 8, 2017, https://www.nytimes.com/2017/11/08/business/dealbook/att-time-warner.html, accessed November 14, 2017.

[2] Trefis Team, “AT&T Closes DirecTV Acquisition: Reviewing the Concessions and Benefits,” Forbes.com, July 27, 2016, https://www.forbes.com/sites/greatspeculations/2015/07/27/att-closes-directv-acquisition-reviewing-the-concessions-and-benefits/#208f209052cc, accessed November 15, 2017.

[3] Timothy Karr, “How the AT&T/Time Warner Deal Could Hurt Low-Income Families” TIME, October 27, 2016, http://time.com/4547740/att-time-warner-merger-deal-prices/, accessed November 14, 2017.

[4] AT&T Inc. “Newsroom: AT&T to Acquire Time Warner,” http://about.att.com/story/att_to_acquire_time_warner.html, accessed November 14, 2017.

[5] Ibid.

[6] John Stephens, Senior Executive Vice President and Chief Financial Officer, AT&T, 3Q’17 Earnings Call, October 24, 2017.

[7] “Cord-cutting”: When consumers drop their existing cable subscription, typically in favor of an over-the-top subscription (i.e. Netflix) or subscription to a virtual service provider (i.e. DirecTV Now)

Exhibits:

[1] ComScore Research, “State of OTT,” ComScore OTT Intelligence Report, April 2017.

[2] Johanna Bennett, “Alphabet’s YouTube TV Isn’t Profitable…Why it Doesn’t Matter,” Barrons.com, October 3, 2017, http://www.barrons.com/articles/alphabets-youtube-tv-isnt-profitablewhy-it-doesnt-matter-1507053228, accessed November 15, 2017.

This is a super interesting issue. At the core, AT&T and Time Warner don’t compete, since AT&T is a communications company whereas TW is a content business. Such a suit as the one proposed by the DOJ is pretty uncommon for this kind of merger. I think a lot of the pushback, however, is directly tied to what you refer to frequently throughout the prompt: DirecTV. If AT&T and TW were to merge, that gives the company tremendous leverage in programming – both in content and distribution. Having said that, I wonder if this deal is even worth it for AT&T. The markets didn’t react all that well to the announcement as investors thought the price was too high. Couple that with a legal battle with the DOJ, and you’ve got a very expensive (and arguably overvalued) transaction as well as an extremely levered company (~$180bn of debt). Why not, as you suggest, use the capital elsewhere in its digital video business to better compete with direct-to-consumer players?

This suit immediately calls to mind the AOL-Time Warner merger in 2000 — at that point in time, AOL was the U.S.’s top internet service provider (source: http://money.cnn.com/2000/01/10/deals/aol_warner/). The difference is that this merger was allowed to move forward, although it arguably posed the same risks to competitors and customers as the proposed AT&T-TW merger does. The fact that the DOJ is taking a more active role in this case reflects just how much larger a piece of our lives and our economy internet and digital media is today, nearly 18 years later. Another interesting lesson the AOL-Time Warner case can provide when analyzing this latest merger attempt is that ultimately, the AOL merger failed and many of the expected synergies never materialized.

However, as Barry Volpert mentioned to our class, “content is king” now — as your Exhibit 2 shows, Netflix, Hulu, and Amazon Prime are all investing in the content creation business now. Arguably, apps / distribution in digital media is now commoditized and content is the only real differentiator to encourage subscribers to utilize one distributor over another. This is probably one reason why AT&T is pursuing the merger. However, to your point and HJ’s point above, there are probably more efficient ways to employ this capital and to create content for proprietary distribution.

This is indeed a very interesting situation in corporate mergers. My opinion is that this acquisition is actually critical for AT&T’s entertainment business and they should continue to march ahead with it.

Given the intense competitive pressure in this industry, AT&T needs a differentiating edge. The acquisition of Time Warner could very well provide them this edge. Time Warner has valuable long-term sports contracts with the NBA, MLB and NCAA and also a diverse library of content with TNT, TBS and CNN. Adding to that, HBO offers a good growth opportunity with HBO Now [1].

Further, the AT&T management seems confident of winning the DOJ lawsuit. As you mentioned in the article, Randall Stephenson, the AT&T CEO, has clearly expressed that the company would not be willing to sell any strategic assets to complete the merger [2]. The market also believes that the DOJ lawsuit may not have strong argument against the merger [3]. Moreover, AT&T and Time Warner have extended the deadline for their merger agreement, which implies their confidence of winning this battle.

References:

[1] https://seekingalpha.com/article/4128634-t-time-warner-will-close-time-warner-valuable-regardless

[2] http://variety.com/2017/biz/news/randall-stephenson-att-time-warner-makan-delrahim-1202625893/

[3] https://seekingalpha.com/article/4128933-t-time-warner-merger-2-points-dojs-case-probably-read-anywhere-yet