Fitbit: Will Machine Learning Help Fitbit Change Consumer Health and Regain Leadership in Tech Wearables?

Fitbit has recently been passed by Apple as the leader in tech wearables. In response, Fitbit has been shifting its strategy towards Healthcare aided by the use of machine learning to develop new product offerings. Will this change be enough for Fitbit to win back its leadership position?

The fitness tracking and wearable technology industry is poised to radically change the healthcare landscape for consumers and insurers. Indicative of this, US consumers have increased the use of wearables for health purposes from 9% in 2014 to 33% in 20181. Additionally, 90% of consumers are now willing to share wearable device data with their doctors and 72% are willing to share with this information with their insurers1. This shift represents an opportunity for leading wearable companies, such as Fitbit, to leverage its vast data set and utilize machine learning to develop new products that will differentiate it from the competition.

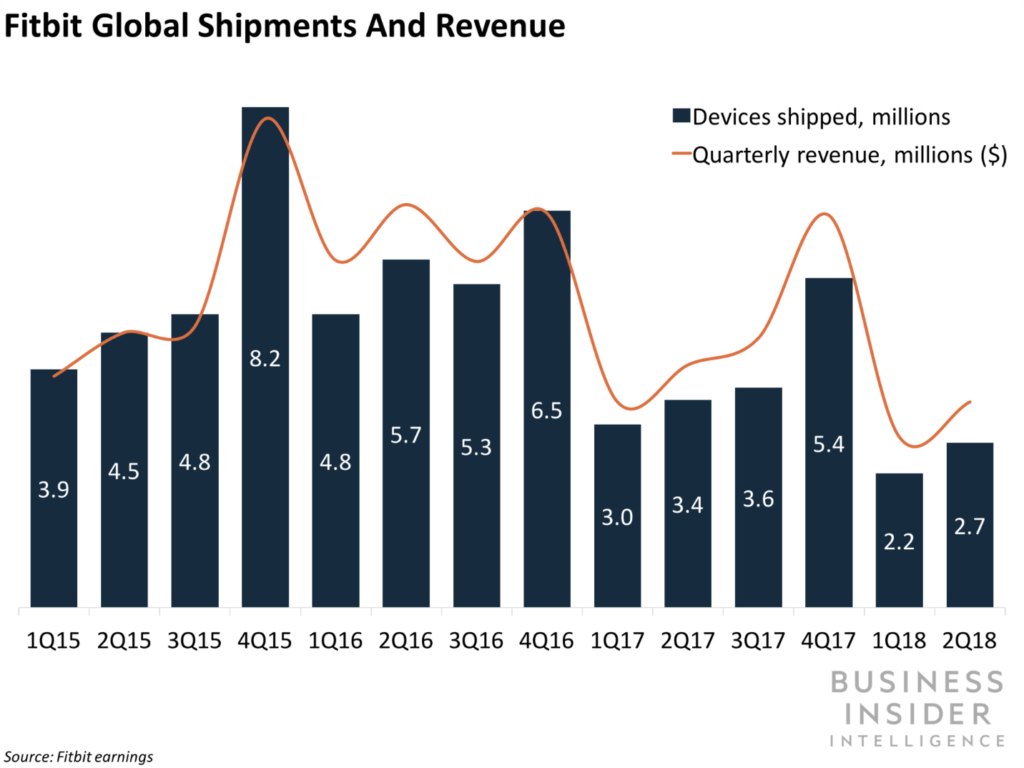

Fitbit has been facing recent profit declines since 2015 and was passed by Apple as the leading tech wearable company in Q2 2018. The value proposition of providing step and sleep tracking is no longer enough to excite and retain customers. Instead, Fitbit needs to continue to develop products that will integrate with the healthcare system, forging a long-term relationship with its customers by helping them prevent, identify, and manage illness and disease more effectively than ever before. Furthermore, Fitbit needs to continue to partner with healthcare insurance providers to produce incentives for consumers to lower costs by living a healthier lifestyle. Machine learning will play a critical role in the product development of services needed to achieve these goals. If handled properly, Fitbit will be able to utilize its large data set from its existing customer base to identify patterns and trends that will produce actionable insights. Weaving a link between its products and a consumer’s healthcare journey will result in significantly higher customer lifetime valuation.

Figure 1: Fitbit Global Shipments and Revenue5

Fitbit has already shown proof that its data set is well positioned to benefit from machine learning. Fitbit has been the partner of choice in healthcare research, used in twice as many research validation studies than any other fitness tracker between 2014 and 20172. An example of this came from a February 2018 Washington University study that applied machine learning to step, sleep, and heart rate data. The study showcased a 96% accuracy in predicting clinical deterioration in recently discharged heart failure patients2,3.

Recently, Fitbit began shifting its strategy towards enhanced machine learning and healthcare solutions by offering two new product services: Fitbit Coach and Fitbit Care. Fitbit Coach, launched August 2017, is a personalized training app that uses machine learning to create individualized workouts. The service leverages exercise data from Fitbit’s large customer base coupled with individual feedback to develop highly customized training routines4. Fitbit Care, launched September 2018, is a component of Fitbit Health Solutions, the company’s corporate health and wellness arm that has partnerships with over 1005. Fitbit Care acts as an engagement platform for the employees of companies that use Fitbit Health Solutions, offering services such as health coaching and data tracking6. While still a new product offering, the future potential for this service is enormous as Fitbit will be able to access third party data such as blood pressure levels5. As Fitbit expands its data set beyond what its own wearables can detect, the possibilities of new insights from machine learning increases drastically.

Figure 2: Fitbit Coach Application4

Fitbit has also been focusing on partnerships that will help it win in the long term. In April 2018, Fitbit partnered with Google to gain access to the machine learning tools within the Google Cloud Platform in an effort to enhance the insights gained from its wearable data7. Fitbit has also been aiming to increase its insurer relationships via new partnerships with Blue Cross Blue Shield and Humana in August and September of 2018, respectively. The Blue Cross Blue Shield Partnership gives Fitbit access to 60 million members8; the Humana Partnership yields access to another 5 million members5. While there will not be an immediate diffusion with these members, they represent a large potential of future customers for Fitbit to pursue. Furthermore, the merging of Fitbit and insurers’ data will allow for new and more powerful insights gained from machine learning.

The future of wearables will be won by companies that can bring in as much relevant data as possible, allowing machine learning to continue to improve the product’s predictions and insights. As Fitbit progresses into the Healthcare space, its management team needs to consider other ways it can improve its product device offerings by gaining access to even more data. Can Fitbit develop new products that collect additional metrics needed to produce superior insights? Additionally, Fitbit has recently been passed by Apple as the leading wearable product5. Will it be able to beat such a fierce competitor who is able to utilize third party apps to enhance its product?

Wordcount: 778

Endnotes

1 Nicky Lineaweaver, “THE WEARABLES IN US HEALTHCARE REPORT: How insurers, providers, and employers can harness new market opportunities using wearables”, Business Insider, August 28, 2018 https://intelligence.businessinsider.com/post/the-wearables-in-us-healthcare-report-how-insurers-providers-and-employers-can-harness-new-market-opportunities-using-wearables-2018-8

2 Nicky Lineaweaver, “How healthcare providers can use wearables to reimagine the delivery of care”, Business Insider, August 13, 2018

https://intelligence.businessinsider.com/post/the-wearables-in-us-healthcare-report-how-insurers-providers-and-employers-can-harness-new-market-opportunities-using-wearables-2018-8

3 “Predicting Clinical Deterioration of Outpatients Using Multimodal Data Collected by Wearables”, Washington University, June 1, 2018

https://arxiv.org/pdf/1803.04456.pdf

4 Fitbit Premium, https://www.fitbit.com/fitbit-premium

5 Nicky Lineaweaver, ”Fitbit looks to steal Apple’s market share”, Business Insider, September 21, 2018

https://intelligence.businessinsider.com/post/fitbit-looks-to-steal-apples-market-share-retail-pharmacies-could-stymie-amazon-health-firms-lobby-congress-to-unlock-opioid-data-2018-9

6 Fitbit Health Solutions, https://healthsolutions.fitbit.com/wellness/

7 Laurie Beaver and Nicky Lineaweaver, “Fitbit unveils new health solutions”, Business Insider, May 7, 2018

https://intelligence.businessinsider.com/post/fitbit-unveils-new-health-solutions-allscripts-strengthens-patient-platform-garmin-ku-medical-explore-health-data-usecases-2018-5

8 Nicky Lineaweaver, “Fitbit lands 60M member insurance deal”, Business Insider, August 10, 2018

https://intelligence.businessinsider.com/post/fitbit-unveils-new-health-solutions-allscripts-strengthens-patient-platform-garmin-ku-medical-explore-health-data-usecases-2018-5

Jake, very interesting update on Fitbit, and I’m somewhat disappointed to learn that the Apple watch seems to have knocked off Fitbit as the top tech wearable. My instinct is consumers love the versatility of the Apple Watch and how it not only tracks useful data like Fitbit does but also integrates with their iPhone and other Apple products. In a world where share of the wrist is a real competition, I worry about Fitbit’s and other comparable products’ chances of survival. Focusing on more relevant data especially related to healthcare makes sense, but I am not sure if that is compelling enough to convince a consumer to opt out of an Apple Watch. I also wonder how does a newer product like Whoop compete with Apple and Fitbit? Do you see any machine learning aspects which Whoop can leverage to gain a competitive advantage?

Great piece – appreciate the update on a product I used to wear! I find it really interesting to think back 5-10 years ago to when FitBits were all the rage and seem to have a monopoly on top tech wearables. I agree with both your and Hill’s sentiments that given Apple’s reach and integration with other apps via the Apple Watch and iPhone, Fitbit finds itself an extremely difficult position in the battle to win share of wrist. As Apple continues to amass more data on its customers, it seems to me FitBit’s struggle to stay relevant and access data will only increase. In conjunction with its FitBit Coach product, I wonder if developing a product line that targets a more serious athlete, akin to a Garmin, might help FitBit position itself as an augmented product that adds additional value. Further, could FitBit partner directly hospitals or senior housing to expand their customer reach? Or partner directly with phone companies to bundle their products with the sale of mobile phones aside from Apple?

Jake – I really enjoyed reading your article and learning more about the direction that FitBit is taking. I agree with the above comments that FitBit is in a difficult position in the competition for wrist share. It seems that the winner will likely be the company that can not only deliver the most services on a single platform, but that will integrate most effectively into the daily lifestyle of the consumer. I think FitBit is realizing this, and as you point out, is changing course into a direction where it has (until now) had a leg up on its competitors – the healthcare delivery space. I see a great potential for FitBit being used by patients and insurance companies to incentivize healthy behaviors. It is a win-win for both parties: the consumer wants to become healthier, and the insurance companies benefit from having a healthier pool of patients that are less likely to require acute medical interventions. The future of healthcare is trending towards preventative medicine. This will be an area where FitBit will thrive given its historic success in the clinical community and also, where machine learning will be most useful as hospitals realize the importance of collecting more patient data and making that data available to improve outcomes and reduce health care spending.

Jake, you hit the nail on its head in respect of possible causes and remedies for recent sales trends of Apple Watch and Fitbit devices. Fitbit is traditionally known as more a healthcare device than an urban lifestyle “smart” watch (a space primarily occupied by Apple Watch). As such, I agree that healthcare is where Fitbit has a competitive advantage over Apple Watch (despite the sales data). However, as you suggested, Apple Watch has various third-party app developers all too willing to enhance Apple’s healthcare capabilities through Apple Watch.

I believe that Fitbit has the ability to build a whole suite of health-related features into its devices using all the data collected from existing Fitbit users and insurance companies. One way to expand is by working with third-party component producers on diagnostic methodologies. For example, Fitbit is pairing up with Dexcom to sync certain Fitbit devices with a separate Dexcom sensor to monitor the user’s blood glucose level for diabetic risks. This way, Fitbit can rely on other parties who have already reached a sophisticated level of data analytics in specific healthcare areas.

What Fitbit needs to improve on, however, is the speed of rolling out these new machine learning features. For example, when Fitbit started selling the Ionic range around one year ago, the company claimed that the device had built-in hardware to detect sleep apnea and would eventually be a feature of the Ionic watch. However, there is still no sign as of today that this feature will be rolled out anytime soon. It may be because the application of machine learning in detecting sleep apnea is more complex than originally anticipated, but if Fitbit cannot back the enormous hype, consumers will sooner or later leave the brand. Perhaps Fitbit can adopt the same approach in the future as it did with diabetes detection to overcome the high initial cost and learning curve in a machine learning process.

As someone who bought a Fitbit, I agree that it has changed my perception of several aspects in my health. I can only imagine if every person on the planet had access to their cumulative data and to services that could empower them to improve their lifestyles. I have not often seen Fitbit contacting me to offer upgrades on the services I can use my information on. Maybe their strategy is to be less aggressive about it, but I would definitely think about buying these services more if I was shown what new ones have come out. Maybe the answer to win share back is showing what more we can get out our health trackers.