Environmental Policy Reshapes Oil/Gas Industry: Trading Houses are Another Victims of Global Warming

The essay analyzes the impact of strict environmental policy on oil/gas industry and how trading houses became victims under the background of global warming.

Nowadays, most of the energy consumed by the world comes from fossil fuels. Every day, humans consume 96 million barrels of oil and liquid fuels, of which 42 million barrels are shipped from one place to another through the global trading network[1]. As the world becomes increasingly concerned about global warming, governments have issued various stringent policies and regulations to control the emission of greenhouse gases, the action profoundly affects every participant in the trading system.

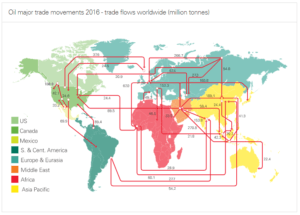

Graph 1: Oil Major Trader Movements 2016 – Trade Flows Worldwide (Million Tonnes)[2]

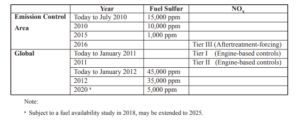

In 2010, The international Maritime Organization designated specific portions of U.S., Canadian and French waters as an Emission Control Area (ECA) in which stringent international emission standards will apply for ships. According to the standards, by 2015, ships operating in designated ECAs can only consume fuel that contains equal to or less than 0.1% fuel sulfur. The table below summarizes the standards that apply globally and within ECAs.

Graph 2: Areas of the North American ECA[3]

Table 1: International Ship Engine and Fuel Standards (MARPOL Annex VI)[4]

Since trading houses use tankers to ship oil and gas, they became victims of such regulation. To meet the new requirement, they need to use lower sulfur fuel oil, modify tankers for additional distillate fuel storage or equip them with exhaust gas cleaning devices (“scrubbers”). In other words, trading houses are faced with rising operating costs and falling profits and can hardly pass on these costs to buyers/receivers.

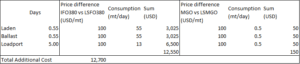

Take Liquified Petroleum Gas (LPG) as an example. After the shale gas revolution, Japanese trading house Itochu Corporation started to purchase LPG from U.S. and use Very Large Gas Carriers (VLGC) to ship the cargo to the Far East. To operate in ECAs, it needs to bunker the vessel with ultra-low sulfur fuel oil (ULSFO) or with low sulfur fuel oil (LSFO) and install scrubbers. Per the latest fuel prices, the additional fuel alone would cost approx. $13,000/voyage. The calculation is shown in the table below.

Table 2: Additional Bunker Cost for VLGC Operating in ECAs

U.S. seaborne LPG export volumes continue to grow, standing at approximately 8.1mm tonnes in Q1 2017[5]. Therefore, the projected export volumes would reach 32.4mm tonnes and would need 736 VLGCs to carry. To sum them up, the additional costs would mount to $9.6mm (736 voyages * $13,000/voyage). This is solely bunker and solely LPG, which provides less than 2% of the total energy the world consumes.

Trading houses in the oil/gas industry such as Itochu are “price takers”. Though reluctantly, they can only bear the extra costs brought about by environmental policies and regulations. For example, despite that the upfront cost of installing a scrubber could be as much as $5 million for some vessels[6], Itochu’s management promptly instructed their trading teams to charter new tankers with scrubbers, order expensive bunkers to conform to the new policy. In the medium term, the management must seriously consider questions such as how long it will take for the equipment to pay for itself and how to maintain the thinner-than-ever profit margin. In a narrow sense, the trading house’s interests have been compromised in exchange for a “better environment”. But in a broad sense, all human beings are beneficiaries of energy saving and emission reduction, provided global warming is a true statement.

Itochu also operates refineries in the midstream, which also became victims of global warming claim. Because of very stringent emission regulations in Japan and relatively outdated refinery equipment, refineries must choose to purchase more expensive low-sulfur crude oil and other feedstock. Refineries’ situation in developing countries such as China might be slightly better. First, because of newer plants, refineries can accept boarder specifications of feedstock without compromising the emission standards. Second, environmental pollution has become so profound that the entire country has put vast social resources to address the problem.

To promote energy saving and slow down the trend of global warming is a noble mission and vision. Yet not until working in oil/gas industry did I realize that not everyone in the world is the beneficiary of such initiative. Those working in traditional industries such as oil/gas are battered. Not only technology, but also new policies, regulations and initiative would cause disruptive impact. While almost everyone believes that global warming would not affect him or herself, is it fair that certain companies have to pay the bill for the entire world?

(Word Count: 798)

[1] International Energy Agency, “2016 IEA Oil Market Report,” https://www.iea.org/oilmarketreport/omrpublic/

[2] BP, “Oil Trade Movements,” https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy/oil/oil-trade-movements.html

[3] United States Environmental Protection Agency, “Designation of North American Emission Control Area to Reduce Emissions from Ships,” https://www.epa.gov/regulations-emissions-vehicles-and-engines/designation-north-american-emission-control-area-marine

[4] United States Environmental Protection Agency, “Designation of North American Emission Control Area to Reduce Emissions from Ships,” https://www.epa.gov/regulations-emissions-vehicles-and-engines/designation-north-american-emission-control-area-marine

[5] http://www.hellenicshippingnews.com/lpg-shipping-market-improves-in-first-quarter-but-outlook-still-cautious-says-ship-owner/

[6] Platts Marine, “Union Maritime to Fit Emissions-cleaning Scrubber Without Upfront Cost,” https://www.platts.com/ShippingNews/26557598

In complying with these regulations, are the costs not distributed between more than just the trading houses? They may be price takers, but they have a justification for passing the extra cost along to refineries, and if their margin decreases too low, wouldn’t they cease shipping in the regulated zones? Ceasing or drastically reducing operations is an issue for them no doubt, but if the market no longer operates after this regulation, economics would suggest it’s a more efficient market since all (at least more) costs are accounted for and actors factor them into their decisions

My exlanations are:

1) The margin is not yet “too low”. Typically for a physical trading house in oil/gas industry, the profit margin is 0.5% more or less. The volume is the key driver of profit.

2) Many players have quited the industry already. For example, many investment banks span off their physical trading business after the financial crises because of the regulations as well as the extremely low ROA.

3) Because of the thin profits, many trading houses must aquire assets to achieve synergies. They are also exposed to volitile price risks. As we can refer to what happend to Noble and Glencore.

4) It is very hard to pass on the cost to refineries. Most refineries in the world are losing money, so their profit margin is negative. Similarly, it is difficult for refineries to pass on the cost to end consumers like us. Therefore, it’s common to see oil companies use profits earned in upstream & downstream to subsidize their refineries and distributors.

I somewhat agree that certain companies should carry the bulk of the burden for climate change initiatives; those companies being the ones which is ‘easier’ to attribute the effect (i.e. tons of greenhouse gas emissions). However, I do not agree that these companies are the only that are fighting this fight. Many startups and big companies have surfaced the context with innovative actions to try to contribute in any way they can – try HBS for example, with their compost initiatives.

I’m with Jordan in that I don’t think I buy the premise that these companies are “paying the bill for the entire world”. While this may be a temporary state of being for the industry, free markets will not allow this to continue. If large players are able to provide these new sulfur free delivers in a profitable manner, and small companies are not, the small companies will exit the market. These exits will allow the larger players to raise their prices, which will then open the market back up to new entrants and we’ll reach equilibrium again. Therefore, ultimately these raised costs will be passed on to the end consumer of the products, though I do understand that a few companies may be paying the price for us all while the market adjusts to this new reality.

Have you considered that in cases where costs of enforcing safety regulations are high but customers’ willingness to pay more is limited so that a profitable business model cannot be achieved, but society still insists on the service being offered, government subsidization steps in (the example that comes to mind is airlines)? If the industry can’t profit, government subsidies will most likely be lobbied for and provided, which is the cost then being shared by all of society in the form of higher tax revenue needed to then pay for the greater government spend. In reality this cost can be shifted to future generations by financing government spend with government borrowing, but regardless I view this as the outcome most likely to occur if the trading houses really can’t pass costs along to its customer base.

Great article. I do think that these companies are not paying the bill for the entire world. For example, the commodities trading firm I was working for did pass on the increased cost to refineries as we shifted from using FO to LSO to MGO. These refineries then pass on the cost to the end consumers. So, in the end, everyone is paying the bill for this. Moreover, these costs can also be subsidized by the government which raised fund from taxes. Therefore, if the market corrects itself and is efficient enough, everyone will take some parts in paying such bill to the World.