“Eco Ship”: Future of Japanese Shipbuilding Industry

International regulation on ship’s emission, which is tightened year by year, brings huge opportunities to shipbuilding industry. In August 2016, four large Japanese shipbuilding companies announced they had started discussing operational cooperation for "Eco Ship" business.

International Regulation on Ship’s Emission

Ship is one of the most influential vehicles on climate change. In 2012, the CO2 emissions from international shipping were 800 million tons, 2.2% of the total CO2 emissions in the world, and an equivalent of Germany’s emissions. Also, given the global economy’s growth and development of economic globalization, the demand for international shipping is expected to increase in the future.

The industry’s regulatory authority, the International Maritime Organization (IMO), has tightened regulations on emissions from international shipping1.

- In January 2013, IMO adopted the first mandatory Energy Efficiency Design Index (EEDI) for all the new and existing vessels. By 2025, all new ships built will be 30% more energy efficient than those built in 2014.

- In October 2016, IMO adopted a new mandatory requirement, under which ships of 5,000 gross tonnage and above must collect consumption data for each type of fuel oil they use so that IMO can consider further measures to enhance energy efficiency.

Japanese Shipping Industry

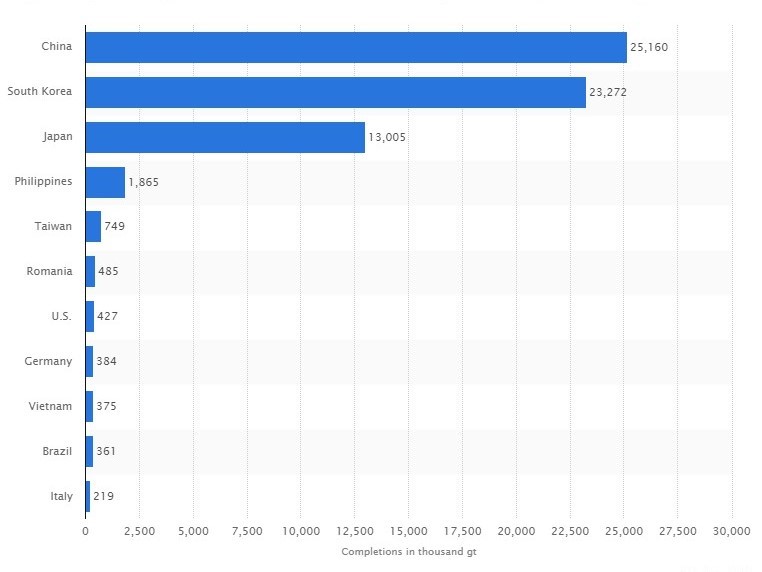

Japan’s shipbuilding industry is the third largest in the world after China and South Korea (Exhibit 1), and 125,000 people are hired in this industry.

Exhibit 1: Largest shipbuilding nations in 20152

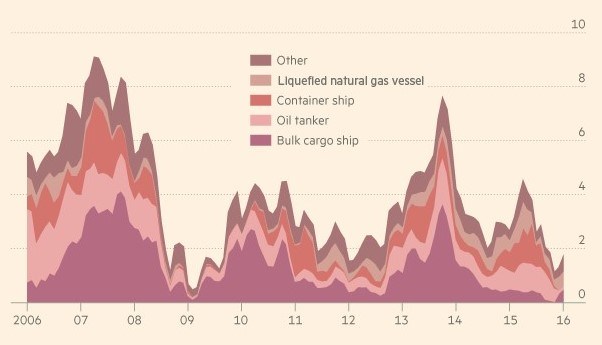

After the global financial crisis, it has long suffered from significantly declining demand (Exhibit 2, 3). Moreover, despite their strength in technical capabilities, Japanese shipbuilding companies have experienced fierce cost competition with China and South Korea, and lost its global share.

However, strict international regulation against CO2 is offering huge opportunities to shipbuilding companies in Japan. Now, more and more ship owners are interested in investing in energy efficient ships so that they can meet the required EEDI, while saving energy costs. In such a high-value-added product, there is a large room for Japanese shipbuilders to fully leverage their technical capability and R&D resources. Can they effectively adopt to this new market trend, and regain both order volume and margin?

Exhibit 2: Global Ship Orders3

Exhibit 3: Ship Prices4

Innovation for Energy Efficient Ship

Given the introduction of EEDI regulation in 2013, Japanese shipbuilders have individually developed energy efficient ships.

Particularly, in December 2013, Mitsubishi Heavy Industry (MHI), the largest heavy industry in Japan, launched its new LNG carrier, called “Field Pea”, which is 25% more energy efficient than previous models (Exhibit 4). By covering the spherical tanks with streamliner wall, like a field pea, and by installing an innovative engine, MHI could achieve such an energy efficiency.

Exhibit 4: The New LNG Carrier “Field Pea”5

Why did MHI develop energy efficient products in LNG carrier, rather than more common products such as bulk carrier? Again, it’s climate change. MHI forecast that the demand for LNG shipping would significantly increase in the future because CO2 emission of burning LNG is much lower than oil and coal.

The biggest concern of building “Field Pea” was its manufacturing cost. To enhance productivity and lowering cost, MHI dramatically changed its allocation of docks. It designated one of its docks in Nagasaki prefecture as a dedicated dock for “Field Pea”. Given the complexity of building LNG carrier, building it repeatedly in one dock was helpful for enhancing productivity. MHI also constructed a new warehouse near the dedicated dock so that it can effectively distribute thousands of parts that were necessary for “Field Pea”.

Based on these engineering and operational efforts, “Field Pea” was a success; during the first year after its launch, MHI constantly gained eight “Field Pea” orders from various ship owners.

What’s Next?

In August 2016, MHI announced it had started discussing operational cooperation with three large shipbuilders in Japan; Imabari, Oshima, and Namura. Although the details and objectives of this potential cooperation are not published yet, I highly recommend that MHI should cooperate with the three companies.

The three companies currently focus on producing simple ships like bulk carriers, and have competitive advantage in its capacity and productivity. Particularly, the production volume of Imabari has been the largest in Japan for many years. If MHI can effectively combine its engineering skill with Imabari’s capacity and productivity, it can scale up its production of energy efficient ships, and lower the cost further. From the perspective of Imabari, Oshima, and Namura, they can diversify their product line, and mitigate their fierce competition with Chinese and Korean companies, whose main products are also low-margin bulk carriers. Therefore, this cooperation will be a win-win deal. Finally, all the four shipbuilders’ docks are in the south-west part of Japan, so it will be easy for them to integrate their supply chains, human resources, and other capitals.

In the future, global climate change might unite four shipbuilding giants, and change MHI’s business model from a ship manufacturer to a ship engineer. (799 words)

1: http://www.imo.org/en/MediaCentre/PressBriefings/Pages/MEPC-70-2020sulphur.aspx

2:Shipbuilders’ Association of Japan

3:Financial Times (https://www.ft.com/content/d74127ac-3140-11e6-8825-ef265530038e)

4:Financial Times (https://www.ft.com/content/d74127ac-3140-11e6-8825-ef265530038e)

5:Mitsubishi Heavy Industry (http://www.mhi-global.com/index.html)

Interesting perspective about shipbuilding industry! It was surprising to know MHI successfully develop energy efficient LNG carrier and already signed many contracts.

However, as far as I know, some of the Korean shipbuilding companies such as DSME, world 3rd largest shipbuilding company, have also developed energy efficient LNG carrier as well. And they also decided to concentrate on the LNG carrier market. Therefore, competition among competitors is inevitable.

To win the competition, MHI should have clear technical advantage over their competitors or should reduce their construction cost. It looks like they have technical advantage. However, can they achieve price advantage as well? Shipbuilding industry is labor-intensive industry and average salary of Japan is higher than that of Korea or China. Can MHI lower their cost significantly only with the suggested methods? It would be interesting to see the result in the future.

Thanks Sotaro, interesting take on how climate change regulations are de-commoditizing industries such as ship-building. I’m curious how you think this plays out in the long-term among two dimensions–first, the enduring competitive advantage of Japanese ship-builders in this arena, and second, the size of the total shipbuilding industry profit pool going forward.

It strikes me that environmentally friendly ships is not a “I need the best one” product, but more of a “good enough” product. As long as a ship hits a certain level of environmental friendliness that is required by regulation, it doesn’t really matter how much MORE environmentally friendly it is. This makes me think that the Japanese manufacturers’ technology edge is less of a competitive advantage than at first blush. What are your thoughts on that?

Second, I’m curious if ship buyers have been willing to pay requisite price premiums for environmentally friendly ships. Given the competitiveness of the market and how stagnant prices have been historically, is the implication that industry profits are shrinking as a whole as similar prices are being charged on ships that are more expensive to build? I cannot imagine that is a net positive overall and speaks to the potential destructive potential of climate change even where there appears to be opportunity. Curious your take on this!

Great read, Sotaro. I found it most-interesting that international shipping was only 2.2% of the total world’s CO2 emissions as I would expect that number to be much higher. It’d also be interesting to see how that percentage is trending over time, as hopefully through efforts such as this one, there have been decreases across the board–both in the shipping emissions and the emissions from the manufacture of the ships.

I agree with your recommendation that MHI partner to scale. It looks like ship prices have come down significantly in the past decade and partnering will only further that reduction while also reducing the number of bulk carriers on the ocean and also doing some good for the environment. I look forward to seeing how this develops.