Easier Than Shoplifting: How Amazon Go is Revolutionizing Brick & Mortar Retail

Amazon’s application of machine learning to e-commerce transformed customers’ buying behaviors forever; the firm’s newest brick-and-mortar offering threatens to similarly revolutionize consumers’ retail experiences.

“You could just grab stuff and walk out. It’s such a foreign concept to me…it feels like I’m shoplifting.”[i]

– Customer Melody Coleman describing Amazon Go

Amazon Go is a cashier-less convenience store that leverages, “hundreds of cameras on the ceiling, plus sensors in the shelves…[to] record what each person picks up, so they can walk out without having to visit a checkout” (see Exhibit 1).[ii] The concept represents a strategic shift for Amazon as it looks to address the 90% of U.S. retail transactions occurring in physical stores.[iii]

Exhibit 1: Amazon Go Launch Video[iv]

Machine Learning’s Impact on Amazon Go’s Process Improvement & Product Development

Amazon Go’s utilization of hardware and machine learning algorithms represents a step-function change in process improvement relative to traditional retailers. Customers enter an Amazon Go store, “by scanning a QR code in [its] mobile app.” Sensors then track each customer, dynamically updating their basket as items are added and automatically bill them upon exit, thus eliminating the traditional process bottleneck (checkout lines) and improving throughput times.[ii] As described by Dilip Kumar, Vice President of Technology for Amazon Go, “You control the amount of time that you’re actually spending at the store.”[v] Additionally, Amazon Go’s machine learning algorithm enables superior inventory management as it can, “make demand forecasts based not just on historical sales data but also on other influencing parameters: internal factors such as advertising campaigns and store-opening times, and external factors such as local weather and public holidays.” McKinsey observed similar technologies reduce out-of-stock rates by 80% and improve gross margins by 9%.[vi]

The technology underlying Amazon Go’s operating model also has implications for product development. Amazon drives 35% of its e-commerce purchases through product recommendations generated by machine learning algorithms.[vii] Similar potential exists at Amazon Go as the company can generate customer-specific recommendations and personalized marketing messages by leveraging data associated with users’ unique QR codes. Such data will enable Amazon to design new food offerings based on consumer preferences and perform highly-focused product trials by targeting discrete customer segments.

Management’s Short- and Medium-Term Strategy

In the short-term, Amazon’s management is looking to aggressively build Amazon Go locations to gain share in the $28.5B U.S. convenience store industry.[viii] There are currently 6 locations across Seattle, Chicago, and San Francisco, with ambitions for 10 by year end, 50 by 2019, and 3,000 by 2021.[ix] [x] Adding scale will be critical to the project’s success as powering Amazon’s predictive model with increasingly large data sets will enhance statistical power and improve product recommendations, furthering customer loyalty.

In assessing management’s medium-term strategy for Amazon Go’s technology, we must consider the firm’s $13.7B acquisition of Whole Foods, an organic grocery chain, in June 2017.[xi] IBIS World estimates that the U.S. grocery industry is $633.2B, over 20x larger than the U.S. convenience store market.[xii] The Whole Foods acquisition provides Amazon with a sizable brick-and-mortar footprint representing over 470 locations.[xiii] Upon demonstrating proof of concept within the Amazon Go stores, management is likely to target rolling out similar technology across the Whole Foods network to drive innovation against a largely complacent competitive set.

Recommendations to Management

To achieve its ambitious strategic vision, Amazon must approach traditional problems in an innovative way. Below are a few recommendations that would facilitate management’s objectives.

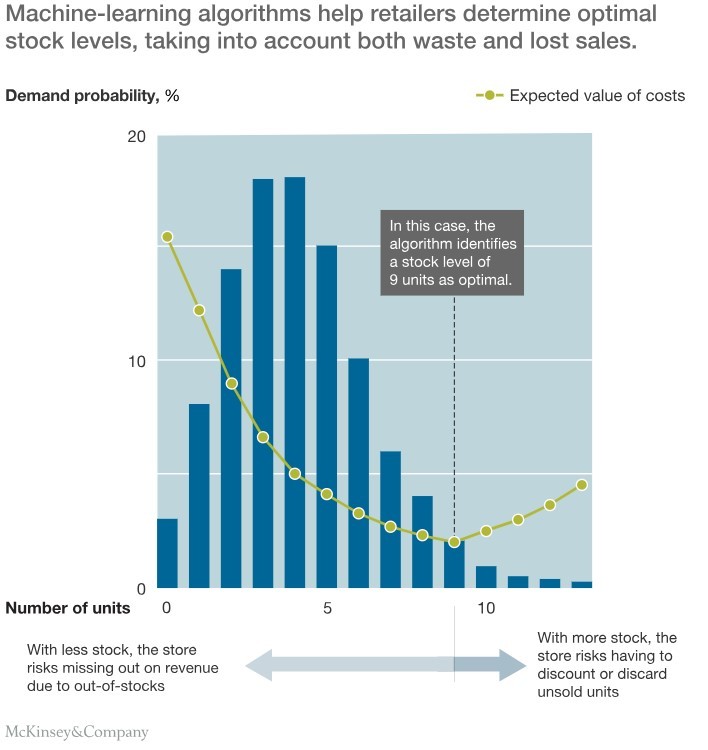

- Drive Inventory Management with Machine Learning – Inventory shrinkage resulting from food spoilage and product theft costs U.S. retailers $46.8B in 2017.[xiv] Grocers experience the impacts of shrink particularly strongly (3.6% of sales vs. 1.4% on average), which provides Amazon an opportunity to leverage machine learning to predict demand and lower costs relative to competitors.[xv] Exhibit 2 summarizes how machine learning algorithms can leverage demand probabilities and expected costs to determine optimal inventory levels.

Exhibit 2: Inventory Management with Machine Learning[vi]

- Reduce Capex Investment – The inaugural Amazon Go store in Seattle required a $1M investment in hardware alone.[x] Meanwhile, grocery stores can be up to 100x larger than the 1,800-square-foot Amazon Go store with exponentially more customers and products to monitor simultaneously.[i] Management should focus on lowering the upfront investment to make scaling the technology feasible.

- Personalized Recommendations – Management should introduce location-based item recommendations to spur impulse add-on purchases. Research shows that grocery stores’ profitability could increase ~40% if each customer purchased one additional item on impulse.[xvi]

- Experiment with Store Design – Amazon should leverage its data on customer paths through a store to test different layouts and product placements to maximize basket size.

Outstanding Questions

Given the formidable, entrenched competition in the convenience and grocery segments, I continue to wrestle with two key questions:

- How can Amazon develop a sustainable competitive advantage against other data-driven competitors such as Walmart (the world’s largest retailer and grocery chain by sales)?[xii]

- What are the implications of a shift in consumer preferences to ordering groceries online instead of purchasing in-store?

(Word Count: 798)

[i] Bullinger, Jake. “Amazon’s Checkout-Free Store Makes Shopping Feel Like Shoplifting.” The Atlantic, January 24, 2018. https://www.theatlantic.com/business/archive/2018/01/amazon-go-store-checkouts-seattle/551357/, accessed November 9, 2018.

[ii] Simonite, Tom. “Stepping into an Amazon Store Helps it Get Inside Your Head.” Wired, October 23, 2018. https://www.wired.com/story/stepping-into-amazon-store-helps-get-inside-your-head/, accessed November 5, 2018.

[iii] U.S. Census Bureau News. “Quarterly Retail E-Commerce Sales: 2nd Quarter 2018.” August 17, 2018. https://www.census.gov/retail/mrts/www/data/pdf/ec_current.pdf, accessed November 9, 2018.

[iv] Amazon. “Introducing Amazon Go and the world’s most advanced shopping technology,” YouTube, published December 5, 2016. https://www.youtube.com/watch?v=NrmMk1Myrxc&t=8s, accessed November 5, 2018.

[v] Metz, Rachel. “Amazon’s cashier-less Seattle grocery store is opening to the public.” MIT Technology Review, January 21, 2018. https://www.technologyreview.com/s/610006/amazons-checkout-free-grocery-store-is-opening-to-the-public/, accessed November 5, 2018.

[vi] Glatzel, Christoph, Matt Hopkins, Tim Lange, and Uwe Weiss. “The secret to smarter fresh-food replenishment? Machine learning.” McKinsey, November 2016. https://www.mckinsey.com/industries/retail/our-insights/the-secret-to-smarter-fresh-food-replenishment-machine-learning, accessed November 5, 2018.

[vii] MacKenzie, Ian, Chris Meyer, and Steve Noble. “How retailers can keep up with consumers.” McKinsey, October 2013. https://www.mckinsey.com/industries/retail/our-insights/how-retailers-can-keep-up-with-consumers, accessed November 11, 2018.

[viii] Source: Convenience Stores in the US, IBISWorld, accessed November 8, 2018.

[ix] Amazon.com Inc. “Amazon Go.” https://www.amazon.com/b?ie=UTF8&node=16008589011, accessed November 12, 2018.

[x] Soper, Spencer. “Amazon Will Consider Opening Up to 3,000 Cashierless Stores by 2021.” Bloomberg, September 19, 2018. https://www.bloomberg.com/news/articles/2018-09-19/amazon-is-said-to-plan-up-to-3-000-cashierless-stores-by-2021, accessed November 5, 2018.

[xi] Debter, Lauren. “Amazon Is Buying Whole Foods For $13.7 Billion.” Forbes, June 16, 2017. https://www.forbes.com/sites/laurengensler/2017/06/16/amazon-to-buy-whole-foods-for-13-7-billion/#10c2d7719589, accessed November 12, 2018.

[xii] Source: Supermarkets & Grocery Stores in the US, IBISWorld, accessed November 8, 2018.

[xiii] Amazon.com, Inc. December 31, 2017 Form 10-K. https://www.sec.gov/Archives/edgar/data/1018724/000101872418000005/amzn-20171231x10k.htm, accessed November 5, 2018.

[xiv] National Retail Federation, “2018 National Retail Security Survey” (PDF file), downloaded from NRF website, https://cdn.nrf.com/sites/default/files/2018-10/NRF-NRSS-Industry-Research-Survey-2018.pdf?_ga=2.88235231.557395974.1542055811-36604989.1542055811, accessed November 12, 2018.

[xv] National Retail Federation, “The 2016 National Retail Security Survey” (PDF file), downloaded from NRF website, https://cdn.nrf.com/sites/default/files/2018-10/NRF_2016_NRSS_restricted-rev.pdf?_ga=2.118200269.557395974.1542055811-36604989.1542055811, accessed November 12, 2018.

[xvi] “Amazon Go: Stores Worth Less Than Tech,” The Battle of Giants (blog), Seeking Alpha, May 18, 2018, https://seekingalpha.com/article/4175386-amazon-go-stores-worth-less-tech, accessed November 12, 2018.

Interesting article on a totally different format of in-store purchases – keen to visit a store myself 🙂 Your recommendations on personalized experience and increasing basket size based on altering product locations was particularly relevant. If we consider the customer segment that comes to a store like this, it would be the millennials who are extremely digitally-adept and care about their time. In addition to your recommendations, perhaps Amazon could also monitor this location pattern to see if there are ways in which the customer’s time inside a store can be reduced? For example, if most customers buy milk and bread, placing them next to each other can reduce time – something that the consumer will care about a lot! Moreover, as Amazon decides to take over the entire retail business of the world, would be interesting to see if Amazon is willing to sell this technology to other brands who will perhaps never merge with Amazon and sell through them – e.g., luxury brands, drug companies etc.? Could Amazon gain revenues through selling technology, given its vast research in this space?

Great post Samuel. As an admirer of Amazon and the innovation we continue to see from them, I’m excited about this proof of concept. However, I am skeptical of Amazon’s rumored plans to expand this format to 3,000 locations nationally for several reasons. First, as you’ve called out, this will require a significant capex investment in a very crowded competitive space. I’m not convinced the cost-benefit is there just yet. Second, a superior customer experience is not enough to make up for undesirable locations. Amazon is new to the brick and mortar game and will need significant expertise to build it’s retail footprint.

When it comes to Whole Foods, I anticipate a slower adoption timeline based on the results from the Amazon Go proof of concept. I’d expect to see a few pieces of technology focused on improving labor productive pop up in Whole Foods in the short-term.

Great post Samuel! As the world continues its shift towards instant gratification, Amazon enabling its customers to control the shopping experience puts it ahead of the curve, and is aligned with the company’s core competency. One small nitpick – my view is that this ‘experience’ will widen the moat with customers rather than leveraging statistical power to improve product recommendations, as you note above. This is because I believe many people shop for groceries by habit, often purchasing the same products, thus inflating the value of product recommendations. Additionally, with this new grab and go model, will the risk of inventory shrinkage from product theft decrease or increase (e.g., less rigorous check-out process)? Amazon will have to keep a close eye on this in the beginning of its scale efforts, and develop measures to combat it.

Thanks for sharing, Sam! The thought of revolutionizing brick-and-mortar commerce seems like a daunting challenge, but could we expect anything less from Amazon? One part of your article that really struck me was the potential impact that machine learning could have on inventory in this setting. The constant stream of data and the power of predictive analytics seem like optimal tools to find ideal inventory levels. The potential impact to the $46.8B in inventory shrinkage alone could be game changing. One thought that comes to my mind – would Amazon be better served commercializing some of these technologies and providing them to other retailers, rather than building out more brick-and-mortar themselves?

Thank you for a great read, Sam. Super relevant trend in retail and these unmanned convenience stores have been popping up in China in large quantities over the last 2-3 years as well. To the question you posed, I think the key competitive advantage Amazon has and should maintain over Walmart is consumer data. Because of its ecommerce nature, Amazon knows significantly more about each unique consumer than Walmart, that allows them to make personalized offerings and promotions, driving up LTV per customer. As to your second question, I agree with your observation and think Amazon should refrain from overinvesting in brick-and-mortar. While some retail footprint is helpful to capture consumers with immediate grocery needs, overtime I can see Amazon transitioning towards a subscription model on most items wherein goods are shipped before consumers run out of stock, thus eliminating any need for grocery runs.

I really enjoyed this article, Sam! I’ve been thinking about your second question, about the implications of grocery shopping shift to online from brick-and-mortar, and think this is an interesting thought experiment. As most HBS students are high-earning millennials, we are predisposed to online shopping having been ‘raised online’, but I wonder if older generations will ever adopt this. I also think this is a very city-centric concept – is it even feasible for grocery delivery to happen in the rural community? Amazon Go in general seems like an infeasible concept to expand rurally just because of the sheer amount of infrastructure required, as you noted. It’s possible that this will be a short lived concept store.

Great work Sam! I wrote on this topic from the the perspective of a Canadian grocery store who will soon be competing with Amazon’s grocery business. Amazon’s accomplishment with Amazon Go certainly makes them more intimidating for current and future competitors. On your recommendations for reducing CAPEX and experimenting with store designs, I am curious if there are ways for Amazon to leverage its machine learning capabilities to accomplish this. The applications for machine learning seem like they have potential to be applied more broadly across all aspects of business.

Thanks for the interesting information, Sam. Cameras and censors in lieu of checkout booths make the lives of customers easier, while also helping Amazon decrease its labor costs and better understand its customers.

From the read I didn’t quite follow how filming customers can help predict optimal inventory levels, above and beyond just using POS data. Is it because Amazon will now have a way to tell whether a customer glances at an in-store advertisement before picking up a product? Are they tracking facial expressions, sentiment, etc?

My belief is decoding human sentiment, feelings, and the like is far too complex of a task for machine learning. In the article, “How to Tell if Machine Learning can Solve Your Business Problem”, good business problems suited for machine learning are one’s that “require prediction rather than causal inference”. [1] Thus, I believe machine learning should not be used to predict how a person’s facial expression (or the like) can predict sales. Rather simple POS data (which could be gathered either from a checkout booth or cameras/censors), combined with logic (i.e. weather trends) seems more reliable.

[1] Fedyk. How to tell if machine learning can solve your business problem. Harvard Business Review Digital Articles (November 15, 2016).

Thank you for sharing, Mr. Ford. I believe Amazon can continue to build a sustainable competitive advantage against other data-driven retailers like Walmart partially due to the fact that it can leverage huge amounts of existing data. Unlike Walmart, Amazon has Prime members, access to each of its customers addresses and payment methods, and now, rich data feeds from its brick-and-mortar stores. Not to mention the huge quantities of seller-generated data as Amazon has virtually no limit on the “inventory” it shows on its website. All in all, I believe Amazon was built with a focus on data collection from its origin, and that will allow it to continue building a sustainable competitive advantage in which machine learning will play a greater role over time.

Thanks for the great post Sam. Following the Whole Foods acquisition, Amazon has thus far held off on making significant changes to the brand or strategy. How do you think an integration as radical as the one you outlined above would play out in an established brand? regarding your question about the shift in consumer preferences towards online grocery shopping vs. in store, I think this innovation allows Amazon to capture a part of the majority of the grocery market as it shrinks while being in a perfect position to dominate the online delivery market when it matures.

An ever relevant article, thanks Sam! I found your open questions interesting, especially the consumer shift from purchasing groceries in store versus online. The United States is still relatively analog in terms of grocery shopping and far behind China, the global leader in online grocery shopping. I think Amazon Go is best positioned to help consumers make this transition and leverage their data. As consumers consider this shift, they can frequent Amazon Go stores, experience a seamless transaction process, be targeted by online Amazon marketing offering to deliver their last purchases automatically, and then gradually move into a pure online purchase model. Walmart is the competitor with far more to lose as they are still not capturing as much data on consumers in store and integrating with their online storefront (due to their legacy systems). It will be interesting to see how they respond to this with further technological integration!