Driving Evolution in Nordstrom’s Customer Service Model through Shared Inventory Visibility

An increasingly competitive retail landscape and the need to better serve constantly changing consumer demands will force Nordstrom's inventory management model to evolve.

Context

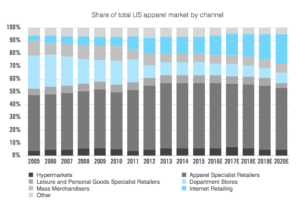

It is no secret that today’s retail landscape is more crowded and competitive than ever before. Online merchants and specialty retailers have forced consolidation and store closures among traditional big box chains and department stores, with some retailers expected to shutter nearly half of their existing doors in coming years [1]. Amazon, which is redefining convenience and the shopping experience through an ever expanding branded and private label apparel assortment as well as through new offerings like Prime Wardrobe [2], remains the single greatest threat on the competitive spectrum to traditional retail. On the flipside, specialty retailers and boutiques are also capitalizing on consumers’ increasing tendency of eschewing big brands. So what is a department store to do to remain competitive in the face of this shift toward online and differentiated, convenience driven retail [3]? Nordstrom is trying to answer that question, and has begun to do so by investing in inventory visibility across its e-commerce site and brick-and-mortar fleet.

Nordstrom was among the first in the industry to recognize the value of providing consumers with inventory visibility across the entire network of its stores as well as its online platform [4]. In doing so, the company was able to effectively leverage its network of brick-and-mortar locations as mini distribution centers, providing consumers with immediate product visibility and access, and consequently preventing potentially lost sales. While that strategy proved timely and prescient, Nordstrom (and department stores more generally) face a much greater threat going forward as Amazon becomes poised to overtake Macy’s as the largest apparel retailer in the U.S. [5].

What Has Nordstrom Done?

In the near term, Nordstrom has addressed this marketplace shift by connecting the digital and in-store experience with its style boards. This digital-selling tool leverages the company’s core expertise in customer service and enables consumers to receive personalized product recommendations on their phones [6]. The company has also attempted to refresh its assortment by collaborating with other highly sought after brands such as Warby Parker, Goop, and Everlane. Nordstrom has also partnered with key digital influencers such as the popular fashion blog, Something Navy, to launch an exclusive collection with its in house Treasure & Bond brand.

In the medium to long term, Nordstrom has chosen to address the threat of online and specialty retail by increasing investment in differentiated retail experiences such as its value-oriented Nordstrom Rack doors and Nordstrom Local [7], which are small format brick-and-mortar doors that will not carry any inventory, but rather act as style salons for consumers to work with personal stylists to trial and select product for later delivery. Consistent with its historical emphasis on service and convenience, Nordstrom will allow consumers to buy online and pick up in store at Nordstrom Local locations.

Recommendations

In addition to the steps that Nordstrom has publicly announced, the company should consider other ways in which it can differentiate its retail experience, assortment, and supply chain to improve its competitive advantage. As more well renowned brands like Nike begin to sell on Amazon [8] at the expense of other channels, Nordstrom should proactively seek to partner with some of its top vendors to create a more integrated consumer experience, broader assortment, and flexible inventory model across the entire marketplace, beyond just its own stores and website. One recommendation of how Nordstrom could do this is by partnering with brands to offer a broader (or even complete) assortment of their products on its website via a seamless drop-ship model [9]. In doing so, Nordstrom would be able to offer an enhanced and more competitive assortment at little to no incremental inventory carrying cost, while its vendors would be able to generate additional sales via the traffic Nordstrom generates to its site.

A second potential recommendation would be to partner with some of those same vendors to hold centralized pools of inventory, the logistics and fulfillment of which could be run by either Nordstrom or the vendor, or a third-party logistics provider. This pooled inventory model would have the effect of: seamlessly and strategically broadening the total assortment Nordstrom is able to offer; allowing both Nordstrom and its partner to gather more consumer data on shopping behaviors (which incidentally Amazon is able to do well because of its scale and reach); driving margin expansion through an affiliate based reimbursement model [10]; and lowering aggregate inventory carrying costs across the marketplace [11] by capitalizing on shared consumer and POS data that can drive more informed merchandising and buying decisions.

Open Questions

Practical concerns arise from either proposal: Would partnering with certain vendors preclude Nordstrom from working with others due to data sharing concerns? Do the benefits (e.g. revenue upside) outweigh the costs of the back-end investment necessary to integrate the inventory management systems of Nordstrom and these vendors?

(798 words)

[1] Kapner, Suzanne. “Department Stores Need to Cull Hundreds of Sites, Study Says.” WSJ. April 24, 2016. Accessed November 12, 2017. https://www.wsj.com/articles/department-stores-need-to-cull-hundreds-of-sites-study-says-1461520952

[2] Thomas, Lauren. “The Amazon effect is hitting the apparel industry.” CNBC. July 10, 2017. Accessed November 15, 2017. https://www.cnbc.com/2017/07/10/heres-how-the-amazon-effect-is-hitting-the-apparel-industry.html

[3] Petersen, Chris. “Commentary: Why retail must differentiate or die.” Retail Customer Experience. July 8, 2013. Accessed November 15, 2017. https://www.retailcustomerexperience.com/articles/commentary-why-retail-must-differentiate-or-die/

[4] Clifford, Stephanie. “Nordstrom Links Online Inventory to Real World.” New York Times. August 23, 2010. Accessed November 12, 2017. http://www.nytimes.com/2010/08/24/business/24shop.html

[5] Peterson, Hayley. “Amazon is about to become the biggest clothing retailer in the U.S.” Business Insider. October 25, 2016. Accessed November 14, 2017. http://www.businessinsider.com/amazon-becomes-the-biggest-clothing-retailer-in-the-us-2016-10

[6] Nordstrom. Q3 2017 Earnings Transcript. November 9, 2017. Accessed November 14, 2017. http://investor.nordstrom.com/phoenix.zhtml?c=93295&p=irol-quarterly

[7] Thomas, Lauren. “Nordstrom to roll out smaller stores with no merchandise, more experiences.” CNBC. September 11, 2017. Accessed November 15, 2017. https://www.cnbc.com/2017/09/11/nordstrom-to-roll-out-small-nordstrom-local-shops-with-no-inventory.html

[8] Wahba, Phil. “Nike Makes It Official: It Will Sell on Amazon and Instagram.” Fortune. June 30, 2017. Accessed November 14, 2017. http://fortune.com/2017/06/30/nike-amazon-instagram/

[9] Shopify. Accessed November 14, 2017. https://www.shopify.com/guides/dropshipping/understanding-dropshipping

[10] “Affiliate Marketing 101: Part 1.” Acceleration Partners. November 5, 2014. Accessed November 14, 2017. http://www.accelerationpartners.com/blog/affiliate-marketing-101-part-i

[11] Swinney, Robert. “Inventory Pooling with Strategic Consumers: Operational and Behavioral Benefits.” Harvard Business School. September 2011. Accessed November 12, 2017. http://www.hbs.edu/faculty/Lists/Events/Attachments/163/Pooling.pdf

Fascinating that it has taken retailers so long to adapt to this trend; it makes complete sense what Nordstrom has done by connecting the digital and in-store experience with style boards. Another retailer that has done this extremely well is Sephora (not so much with outside brand partners, more so with influencers and their internal operations). While inventory/supply chain visibility is extremely important, I almost begin to think of AMZN more as a logistics/fulfillment company (as opposed to a retailer). Nordstrom could effectively deliver shopping experiences in its stores and allow customers to have an educational conversation with a human, in real time, which also allows them to glean insight into how customers interact with a product. Contrast this with an AMZN where customers may simply “spearfish” (enter what they are looking for in the search bar, and buy that one item). Consider this an additional benefit that Nordstrom would be able to provide to others, allowing them to maintain some semblance of a value proposition.

Nordstrom is in a precarious position. I have trouble seeing how Nordstrom can beat Amazon at its own game (supply chain excellence). If Nordstrom is embracing a digital supply chain, in my opinion it should be in service of better customer experience / focused on its retail space. In that context, creating showrooms and focusing on in-store stylist experiences, as you mention they have done, makes a lot of sense. But a world of showrooms and in-store stylist experiences is very different than the big retail footprint they have today.

If it’s a game of logistical expertise, Nordstrom will go the way of Barnes and Noble. Nordstrom needs to convince customers not only to come into their stores to try clothes on, but also to buy clothes in store vs. showrooming and completing the purchase on Amazon. For example, could Nordstrom’s in-store experience focus on personalization of clothing? Tailoring a suit or a dress is the first step here, are there other items of clothing that might be better if they were more personalized? Is there a way to do this at low cost? Or could Nordstrom’s focus more on exclusive deals with retail brands that agree not to sell the same products online? I don’t see how Nordstrom’s wins in the long-term if it’s selling the exact same products you can find on Amazon. In-store shopping matters, but Nordstrom’s stores are still huge and result in big inventory holding costs. While Amazon might not kill retail, I’d think it will kill department stores as smaller showrooms that don’t hold inventory replace them. It’s not clear to me how Nordstrom’s competes.

I was intrigued by the final question that you posed in your challenge. With regards to the potential benefits (i.e. revenue upside), I think it is important to consider that real-time inventory visibility has significant implications for pricing / discounting, in addition to providing value to the consumer. More specifically, if Nordstrom invests in ship-from-store capabilities (as many retailers/department stores are doing), they will be able to use their own stores as “mini-warehouses” to fulfill their robust e-commerce business. If inventory isn’t moving within a certain store (either due to macroeconomic conditions, poor buying/merchandising decisions at the store level, etc.), it can be routed from stores and shipped to the customer who placed an e-commerce order. Ideally, the item is still sold at full-price, and doesn’t need to be marked down in order to clear the store inventory to make room for the next season. This flexible fulfillment, enabled by the digitization of inventory, has the potential to significantly increase revenues by maintaining margins!

I like your comments about Nordstrom needing to reevaluate what is can deliver to its customer to maintain a competitive advantage. In many of the circumstances where an incumbent company is now trying to maintain relevant when a disruptive competitor has entered, I think it is better to not try and beat the competitor at its own game, but to find something new and unique to promote. So in this example, Amazon will win the convenience game, and though Nordstrom should take certain actions to improve convenience too, such as digital dressing rooms, etc. they have to think critically about what other value they can provide to their customers that’s unique and something that Amazon is not able to provide so that they are not trying to beat a competitor at what they do best.