Doosan Heavy Industries & Construction – Shifting Away From Thermal Power Generation?

Electricity production is the largest single source of global climate-warming gases: all phases of the project—construction, operation, fuel supply and decommissioning—combined account for 30% of global greenhouse gas emissions in 2014. In the face of climate change and thus subsequent changes in electricity generation ecosystem, how can a power plant manufacturing and construction player like Doosan Heavy Industries & Construction Company respond?

Doosan Heavy Industries & Construction Company (DHI) is $6.7B engineering and construction company headquartered in South Korea. While the business encompasses a wide range of areas, its focus is on Power Generation (79%)—engineering, procurement and construction (EPC) of power plants and manufacturing main components such as boilers, steam turbines and generators. (See Exhibit 1 [1])

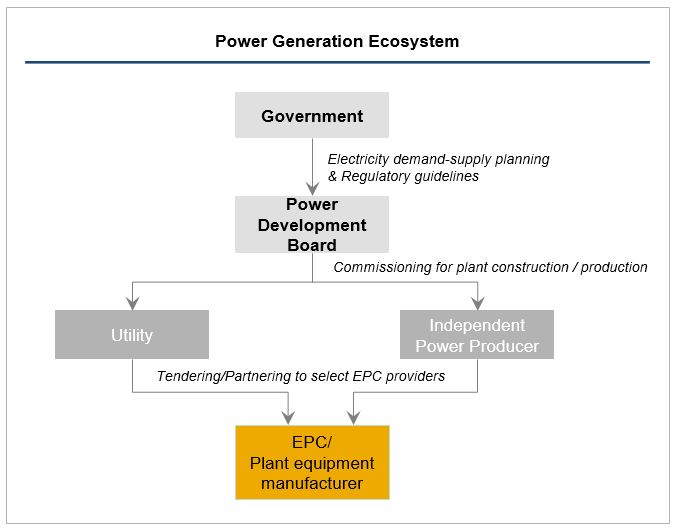

Power plants are generally commissioned by governments and power development boards (or equivalent agencies). While many stakeholders are involved in the process, they project long-term electric utility supply capacity and demand growth and build a plan to make up for the additional power generation needs by energy source. Utilities and independent power producers are granted for power station construction and operation. At the bottom of the value chain are EPC and equipment producer players like DHI, which bid to win the project and supply components (Exhibit 2)

Climate Change: Challenge ahead?

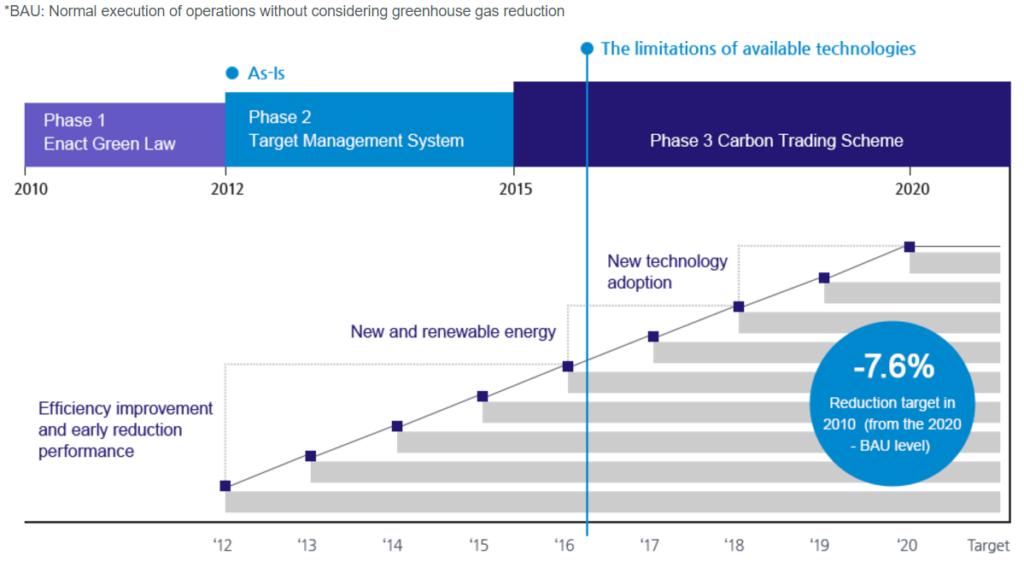

Climate change poses challenges to DHI in multiple dimensions. As a manufacturer heavily reliant on heat and steel in equipment production business, DHI recognizes sustainability as a core issue. In 2010, it developed a long-term roadmap to reduce greenhouse gas emissions by 7.6% from its ‘Business-as-Usual (BAU)’ level by 2020 (Exhibit 3). In addition to investment in high-efficiency machineries, the company has adopted new technologies to better optimize combustion level and minimize CO2 emission in its manufacturing process. Every month, a special dedicated committee at a business unit level monitors the status of initiatives and reports to the company-wide committee for updates.

Results are promising. Reduction in CO2 emission accelerated by three times over 2011-2013, while decreasing the operating cost by $107.3M at the same time [2].

Challenges ahead

However, the impact of climate change extends far beyond improving operational efficiency at a daily level. It has transformed the business environment in countries such as India and Vietnam where DHI plays strong at, with end-customers becoming more environmentally-aware and shifting away from coal-fired generation. For example, India recently issued an Intended Nationally Determined Contribution which set the goal of reducing CO2 emission by ~35% from 2005 levels by 2030 [3]. Given new renewable policy objective in India, DHI faces the challenge of not only increasing the energy efficiency of its existing products—boilers, steam turbines and other components—but also ultimately losing its addressable market due to the dropping demand for thermal production and its limited presence in renewable generation.

Doosan Heavy Industries is responding to such challenge by concentrating more resources on bidding for projects that require technical specs its products can satisfy. With shrinking battleground, the importance of each tender amplified exponentially. Doosan is honing its commercial sales capabilities through improving its tendering process. Hiring local experts with strong networks in utilities and power development boards, the company tries to deepen relationships with customers for better intelligence and influencing. Moreover, investing in social impact projects in target countries is also getting more traction.

Advancing thermodynamics efficiency

More fundamental response is inevitable on the product level. DHI is increasingly focusing its research and development efforts on advanced technologies to meet new requirements set by pressured governments. There are three pillars in its R&D roadmap: 1) Ultra Super Critical (UCC) Boiler, 2) Integrated Gasification Combined Cycle (IGCC) and 3) Circulated Fluidized Bed (CFB) Boiler [4]. Ultra Super Critical Boiler is the next generation boiler that endures higher temperature and higher pressure (265 bar and 610 degree Celsius) whereas IGCC turns coal to pressurized gas, through which greenhouse gas and toxics can be separated as byproducts. While the first two still rely on coal based fuels, increased thermodynamics efficiency reduces carbon dioxide gas emission significantly. CFB Boiler, on the other hand, enables the power plant to use traditionally ignored low-grade coal combined with biomass as fuels. These technologies will enable the company to take increasingly complicated different types of power plant projects that are currently out of reach.

More can be done?

While improvements in daily operational efficiency and technological advancements in its coal-based power generating components are commendable, Doosan Heavy Industries needs step changes in the long term. Many energy companies have been making progress on alternative energy resources, yet DHI’s presence is meager at best in the arena. How can Doosan prepare for the day where coal-fuels no longer become an option for power generation source albeit being a late-comer in renewable space?

(Word Count: 739 words)

Sources

[1] Doosan Heavy Industries & Construction, 2015 Consolidated Financial Statements and Independent Auditor’s Report

[2] Doosan Heavy Industries & Construction website, http://www.doosanheavy.com/en/csr/ehs/ehsGreenManage.do, accessed Nov 2, 2016.

[3] International Energy Outlook 2016, EIA, https://www.eia.gov/forecasts/ieo/electricity.cfm, accessed Nov 4, 2016.

[4] Advanced CFB Technology Gains Global Market Share, Dr. Robert Peltier, http://www.powermag.com/advanced-cfb-technology-gains-global-market-share/, accessed Nov 3, 2016.

You do a really great job of laying out the challenges Doosan faces as it relates to environmental concerns in the power generation industry, particularly in the coal-burning segment. Given Doosan’s high exposure to coal-burning plants and leadership in thermal technology, it’s clear that the quickest gains in environmental efficiency will come from enhancing the company’s core offerings in this legacy space.

On a longer-term time horizon, you mention the need for Doosan to extend its business into alternative sources of energy generation. Given that Doosan has already made considerable advancements into nuclear power technology (http://www.doosan.com/en/media/press-view/doosan-heavy-industries-construction-signs-a-deal-to-supply-main-equipment-to-shinkori-nuclear-power-plant-units-5-and-6-20140902175915132060), do you have a view as to whether nuclear is an attractive option for Doosan to expand its business in South Korea? From a technological perspective, I imagine that there might be valuable sources of overlap between thermal and nuclear power. That said, whereas nuclear was once considered a compelling alternate source for energy, many now question how viable nuclear is from a long-term environmental perspective (especially following the Fukushima disaster in 2011). Is going nuclear a good bet for Doosan to make?

I agree with Zach. Given the challenges that Doosan faces in the future with an uncertain future for coal power as the world moves towards low emissions energy sources, nuclear power seems like a reasonable place to bet. Through the construction of the Barakah nuclear power plant in the United Arab Emirates, Doosan has proven they already have the internal expertise to pull off such a project. While there are undoubtedly risks there as well, those accidents have been so few and far between with relatively little collateral damage in terms of loss of life (although accidents like Fukushima have undoubtedly been tragic) that I wonder if we would be willing to accept the tradeoff of a minor accident every 2-3 decades in exchange for a material decrease in dangerous emissions.