Does the brand with no name have the best supply chain game?

The consumer packaged goods (CPG) industry is concerned about digitalization, or at least it should be. Enter Brandless, a direct-to-consumer (DTC) e-commerce start-up that has leapfrogged the traditional supply chain approach of CPGs and believes it has a strategy to succeed in the digital world via speed and increased efficiency.

The consumer packaged goods (CPG) industry is concerned about digitalization, or at least it should be. Innovative start-ups and non-traditional CPGs are invading their space, and in order to remain contenders, CPGs need to adapt. One way they can adapt is by digitalizing their supply chain. For those who do so, the potential short-term impact is significant. “Expectations include up to 30 percent lower operational costs, 75 percent fewer lost sales, and a decrease in inventories of up to 75 percent.[1] So why haven’t more CPGs jumped on the digitalization supply chain bandwagon? Because it isn’t that easy. What’s required, as Strategy& puts it, is quite complex:

“[The digital supply chain] extends the vertical integration of all corporate functions to the horizontal dimension, knitting together relevant players — the suppliers of raw materials and parts, the production process itself, warehousers and distributors of finished products, and finally the customer — through a network of sensors and social technologies, overseen via a central control hub, and managed through an overarching data analytics engine.”[2]

What makes this move so challenging is that most pure CPG companies are based on decades-long investment in building the value of their brand, and they are deeply rooted in traditional supply chain. This operating model stands in stark contrast to what consumers expect today. Companies need to be faster, more flexible, more granular, more accurate, and more efficient.[3]

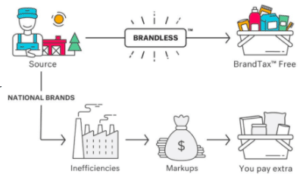

Enter Brandless, a direct-to-consumer (DTC) e-commerce start-up that offers high-quality low-cost ‘unbranded’ products across a range of everyday staples.[4] The brand, a form of ‘private label,’ has leapfrogged the traditional supply chain approach of CPGs and believes it has a strategy to succeed in the digital world via speed and increased efficiency. For starters, it has eliminated the need for a traditional supply chain by eliminating the ‘brand tax,’ “…the premium you pay for branded versus unbranded products.”[5] Brandless believes that a company’s ‘brand tax’ requires a complex supply chain. “[T]he people making [the product] have to create a brand, market that brand, identify a distributor to get that brand into stores, find a broker to get it in front of the merchants, and then in the store you have labor and inventory costs…there’s a lot of complexity in the supply chain that we’ve eliminated.”[6]

Brandless is implementing its no ‘brand tax’ strategy in the short term by operating as a direct to consumer (DTC) model and selecting distribution centers with proximity to customers in all fifty states. “[G]oods [are] shipped from two distribution centers, one in California and one in Indiana, and delivered mostly within two days.”[7] Moreover, all of the brand’s products are logo-less, and it has set a single price of $3 for all items. These strategies allow Brandless to avoid the middleman, the necessity of adding a price tag to each item, and, based on experience, the accompanying, dynamic logistical system-wide updates required with price changes and markdown updates.

In the medium term, Brandless plans to realize the efficiency gains that accompany digital management of distribution centers, as automation allows easier logistics and inventory management. Further, it is looking to maintain its pricing advantage by partnering with key suppliers to recognize greater scale, reduced costs, and receive higher margins on its 115 standardized units, a simplified assortment of skus.[8] The result? Reliable suppliers, cost-savings, greater visibility to where the product lies in the supply chain, faster delivery time, and less variability in product assortment.

https://brandless.com/about

While Brandless’ innovative approach is commendable, a few key factors will impact its ability to survive. In the short term, the brand must be strategic with its approach to customer acquisition. One could argue that this cost can be high for DTC; while there’s more reach and a growing familiarity in having an online presence, Brandless doesn’t have an established brand tied to it to suggest high-quality and/or trustworthiness.

In the medium term, Brandless must evaluate if it should expand its target market beyond the millennial consumer, who may not be as loyal as anticipated. One option is to partner with other retailers to expand their reach, à la Harry’s and Target.[9] The company will also need to determine whether or not it needs to reconsider its pricing model and product assortment. While these two elements function as the company’s main value proposition, they suggest less flexibility to dynamic retail and product adjustments utilized by key players like Amazon and Jet, who are able to adjust item-level prices based on P&L analysis.[10]

While Brandless’ approach is creative in its logo-less nature, simple pricing approach, and DTC model, it’s fair to ask: what will happen to customer loyalty as a result of a changing product mix – or lack thereof – and as new brands enter to compete on a similar pricing promise? Will they miss out on consumers who make purchasing decisions based on brand?

[1] Knut Alicke, Daniel Rexhausen, and Andreas Seyfert, “Supply Chain 4.0 in consumer goods,” McKinsey & Company, April 2017, https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/supply-chain-4-0-in-consumer-goods, accessed November 2017.

[2] Philipp Berttram and Stefan Schrauf, “Industry 4.0: How digitization makes the supply chain more efficient, agile, and customer-focused,” Strategy&, 2016, p. 7, accessed November 2017.

[3] Knut Alicke, Daniel Rexhausen, and Andreas Seyfert, “Supply Chain 4.0 in consumer goods,” McKinsey & Company, April 2017, https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/supply-chain-4-0-in-consumer-goods, accessed November 2017.

[4] Graham Hotchkiss, “Brandless tackles online FMCG with simplified pricing model,” Planet Retail, September 2017, https://www.planetretail.net/NewsAndInsight/Article/160910, accessed November 2017.

[5] Melissa Kvidahl, “Q&A: Brandless, an online retailer with a mission and a $3 price point, arrives amid buzz,” New Hope Network, August 2017, http://www.newhope.com/people-and-company-profiles/qa-brandless-online-retailer-mission-and-3-price-point-arrives-amid-buzz, accessed November 2017.

[6] Ibid.

[7] Paul Page, “Today’s Top Supply Chain and Logistics News From WSJ,” The Wall Street Journal Business: Logistics Report, July 2017, https://www.wsj.com/articles/todays-top-supply-chain-and-logistics-news-from-wsj-1499856779, accessed November 2017.

[8] Graham Hotchkiss, “Brandless tackles online FMCG with simplified pricing model,” Planet Retail, September 2017, https://www.planetretail.net/NewsAndInsight/Article/160910, accessed November 2017.

[9] Ibid.

[10] Ibid.

Word Count: 800

This article leaves me with two questions. First, do you think something like Brandless can only succeed as direct-to-consumer, and that the company will ruin it’s entire supply chain advantage by eventually selling in retail stores (like we’ve seen other DTC companies do)?

Is “Brandless” just really a new brand that is opening up a margins race to the bottom? The company is trying to be a low-cost provider by eliminating internal overhead and retail mark-up, but there are plenty of low-cost incumbents in their space (mainly store-brand generics). Brandless will ultimately need to beat these companies on quality (associated to their ‘brand’) since they are unlikely to match their production and distribution scale while getting started. In an industry like food and beauty products, Brandless will need to rely on the quality of it’s products, and must win on simply lower cost distribution to a price-sensitive consumer.

Brandless writer, thank you for your article, it was a very interesting read. Given that I had never heard about them before, the first thing I did before publicly expressing my opinion is going to the Brandless website to gain a first hand insight of what “a brand with no name” means. And I loved the idea (I actually placed an order that will hopefully arrive soon!). Reflecting on the business model, though, I see some strategic challenges that the company will need to address going forward to ensure consumers like me buy at brandless.com more than once.

In an era where Amazon has become the “everything store”, with enormous cross and up selling opportunities, I believe it is increasingly difficult to succeed as a single “brand” whose products are only available for purchase on its own website. Industry reports indicate that consumers increasingly value simplicity on the purchase process and therefore are keen on using platforms that aggregate a relevant product array. Given this scenario, I believe that the long term growth of brandless.com might be tied to the Amazons of the world.

If my hypothesis is correct, the following question emerges: how do companies differentiate themselves on Amazon? And brand is inevitably the answer. In an online world where price comparison is so evident, brands become increasingly important. Even if Brandless claims its products are cheap as it gets rid of the “brand tax”, price could be easily match via scale. As a result, as paradoxical as it might sound, I believe that Brandless future growth can only come via brand differentiation.

I came across Brandless back in the spring and was immediately intrigued. I have two thoughts:

1) They associate the expense of the current distribution network of Walmart, etc. with the “Brand Tax.” I think branded companies can pursue this model pretty easily but haven’t transitioned because such a large part of their customer base is Walmart and the like. These large retailers would be none too thrilled if a company does go direct to their consumers and by-pass them. It can work if a company starts e-commerce only vs. transitioning. Point being I feel like it has less to do with being “branded” and more to transitioning models.

2) I think the pricing strategy is unsustainable based on their product mix/quality aspiration. I went on their website when I first discovered them and found some of their products well under-priced and some well over-priced. I think the low margin products will cause them to migrate to a different mix while the over-priced products won’t sell. Overall, I think it’s a simplicity play that doesn’t add value for their target consumer. This channel is very unlike the dollar store channel customer who is budget focused and looking for a smaller overall basket price. I’d advise they drop it, but keep their overall “fair-priced” focus.

Brandlesswriter, I am so glad you decided to write about this company! Brandless has tapped into a fundamental trend in our society that has been brewing in recent years. Even in religion and jobs, loyalty to particular “brands” is waning throughout our culture – adults who identify as atheist or agnostic constitute 23% of the US population today and the US Bureau of Labor Statistics projects that 60 million people (or 40% of the total workforce) working for themselves by 2020. (1) There is a fundamental shift away from brands and toward “newness” and “change” in the information age.

Your prescription for Brandless’ strategy entails actively moving the business beyond the millenial consumer through alternate channels (i.e. Target), but I wonder about Target’s willingness to carry Brandless products in its stores. Target currently benefits from branded CPG products actively fighting for shelf and display space and moving to a “commoditized” CPG industry reduces margins for Target. I can see how this suggestion may work in the long run however, as Target may benefit from consumers tastes shifting to store brands and may demand Target-branded products as “brandless” shopping becomes normalized and popular.

(1) Kusek, Kathleen. The Death Of Brand Loyalty: Cultural Shifts Mean It’s Gone Forever. Forbes. https://www.forbes.com/sites/kathleenkusek/2016/07/25/the-death-of-brand-loyalty-cultural-shifts-mean-its-gone-forever/2/#4e73e06f39df