Do You Mind If I Take Notes? — McKinsey Turns an Eye to Digital

Management consultants are known to be many things – bright, resourceful, and hardworking guides through countless strategic challenges. But as Sherpas through the age of digital transformation?

“Our mission is to help our clients make distinctive, lasting, and substantial improvements in their performance…[1]”

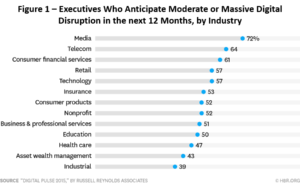

If we assess McKinsey & Company’s mission through a modern lens, it becomes clear that to help business leaders achieve sustainable competitive advantage, data and analytics must drive advisory. The influx of data-driven needs across industries (Figure 1[2]) comes with tremendous implications to the traditional consulting model[3]:

- Rapid feedback cycles – consistent engagement with clients

- Modularized products and services – a greater need for specialization

- Enter the CTO/CDO/CMO – conversations with a wider client base

- An implementation orientation – recommendations alone become insufficient value drivers

- Bespoke solutions with a focus on individual consumers

- Data structure and analytics platforms as key competitive levers

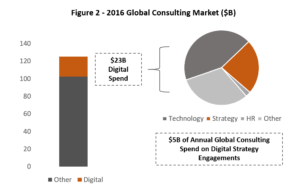

The longstanding clients of McKinsey – Fortune 500 C-Suites – are feeling the pressure. 71% call themselves “tech companies”. Within technology, they are most interested in mobile computing, cloud computing, and AI/machine learning, all of which require advanced data analytics capabilities. 73% cite the rapid pace of technological change as their “greatest fear”[4]. Figure 2[5] underscores this trend, illustrating global digital consulting spend of $5B in 2016.

A Traditional Supply Chain

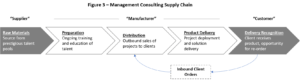

The consulting supply chain (Figure 3) is like many others: materials (talent) are sourced from suppliers (leading universities, prestigious firms), a product is developed (bright, resourceful problem-solvers) and delivered to the customer (strategic solutions). In this context, several areas of McKinsey’s supply chain are vulnerable to digital disruption[6]:

- Raw Materials – do traditional sources of talent satisfy needs of an increasingly technical, specialized world?

- Preparation – do existing training methods and frameworks prepare “inventory” (consultants) for the digital world?

- Orders / Distribution – will customers associate McKinsey with complex data-oriented solutions?

- Product Delivery – Can McKinsey own best-in-class talent to justify price? Will standalone strategic recommendations constitute sufficient deliverables?

- Delivery Reception – is the existing “descend and depart” model sufficient in the future?

“The Firm” Responds…

McKinsey has made several splashy moves in preparation for the digital wave. These efforts fall broadly into two camps: (1) short term, awareness generation and (2) long term, proof-of-competency.

McKinsey has produced hundreds of articles, research papers, and case studies communicating their unique point-of-view and capabilities in the digital arena. High visibility projects also serve to drive awareness (e.g. in November 2017, McKinsey Digital was selected to advise Sri Lankan on building countrywide digital infrastructure[7]). While these efforts begin to address the credibility gap and increase client awareness, publications and headlines alone fall short in proving competency.

Long-term plans center around making numerous small bets for more opportunities to observe, learn, and iterate. McKinsey New Ventures houses these efforts, with a focus on incubating and commercializing packaged digital solutions for clients. Currently, there are over 800 data scientist and analysts under the New Ventures umbrella[8].

Further, since 2013, McKinsey has acquired over a ten data/analytics firms, with the hopes that new capabilities can be tested with clients as digital needs continue to rise.[9] These include: Pricemetrix, a wealth management analytics solution, 4tree, a big data analytics firm for retail, and QuantumBlack, a data analytics and visualization firm.

The Future Ahead

If we return our eyes to Figure 3, of critical importance is “raw material sourcing”, or access to talent (as a predeterminant of product quality). The traditional talent pools are likely underpreparing students for the next 30 years, where a lack of data and analytics familiarity will spell failure. Look, for example, to top-tier MBA programs, a key supplier to McKinsey, with hundreds of new hires each year. None of them have incorporated basic data and analytics education into their core curriculum. McKinsey (and other consultancies) wield tremendous lobbying power over the universities which they frequent come hiring season – it’s incumbent upon the “purchaser” to demand that their materials are up to specifications.

Beyond structured recruiting, McKinsey must explore more flexible talent acquisition to broaden access beyond their traditional field of influence. Rethinking the talent pool with the gig economy in mind and exploring JVs with industry partners, large and small, may become necessary (e.g. PWC Talent Exchange, a platform for independent consultants[10]).

Lastly, we must consider the implication of faster feedback loops on product delivery. Current engagement models are lumpy, with fixed contracts over short periods of time. In a world where customer needs and millennial attention spans are equally fleeting, should clients put up with fixed-term, fixed-fee, fixed-time advisors?

Further Considerations

- Is McKinsey the best owner of complex, data-driven solutions? Does the risk of moving into a foreign, highly-technical space jeopardize their core, market-leading position?

- In a world of startups and tech giants, how can McKinsey attract the best in class digital/analytics talent? What are the implications if they can’t?

Word Count [800]

Sources:

[1] McKinsey & Company. (2017). About Us. [online] Available at: https://www.mckinsey.com/about-us/overview [Accessed 16 Nov. 2017]

[2] Grossman, R. Harvard Business Review. (2017). The Industries That Are Being Disrupted the Most by Digital. [online] Available at: https://hbr.org/2016/03/the-industries-that-are-being-disrupted-the-most-by-digital [Accessed 16 Nov. 2017].

[3] Vermeulun, F. Harvard Business Review. (2017). What So Many Strategists Get Wrong About Digital Disruption. [online] Available at: https://hbr.org/2017/01/what-so-many-strategists-get-wrong-about-digital-disruption [Accessed 16 Nov. 2017].

[4]Murray, A. Fortune. (2017). Fortune 500 CEOs See A.I. as a Big Challenge. [online] Available at: http://fortune.com/2017/06/08/fortune-500-ceos-survey-ai/ [Accessed 16 Nov. 2017].

[5] UK Consulting Industry Statistics 2017. (2017). [online] London: Management Consultancies Association. Available at: https://www.mca.org.uk/news/updates/insight-interview-stephen-pollard-arup/ [Accessed 16 Nov. 2017].

[6] Christensen, C., Wang, D. and Van Bever, D. (2017). Consulting on the Cusp of Disruption. [online] Harvard Business Review. Available at: https://hbr.org/2013/10/consulting-on-the-cusp-of-disruption [Accessed 16 Nov. 2017].

[7] Lanka Business Online. (2017). McKinsey to prepare strategies for Sri Lanka’s Digital Economy. [online] Available at: http://www.lankabusinessonline.com/mckinsey-to-prepare-strategies-for-sri-lankas-digital-economy/ [Accessed 16 Nov. 2017].

[8] McKinsey & Company. (2017). New Ventures. [online] Available at: https://www.mckinsey.com/about-us/new-ventures [Accessed 16 Nov. 2017].

[9] : McKinsey & Company. (2017). Digital blog | Digital McKinsey. [online] Available at: https://www.mckinsey.com/business-functions/digital-mckinsey/our-insights/digital-blog [Accessed 16 Nov. 2017].

[10] Talentexchange.pwc.com. (2017). [online] Available at: https://talentexchange.pwc.com/ [Accessed 16 Nov. 2017].

The author raises several insightful points on recruiting and engagement models.

First, a professional services firm focused on leading digital transformations needs a different talent pool. Focusing recruiting efforts on top Business Schools will no longer suffice. Hiring more developers won’t do the trick either. Digital transformations need design thinkers, who can translate a line of code into a unique user experience. Designers (like Jonathan Ive at Apple) are needed to lead these efforts.

Second, attracting this new talent pool is merely a start. Next comes retention. Partnership models, common in large consultancy firms, incentivize employees to stay for their full careers if they want the big paycheck. It is likely that designers and / or developers will not wait until the age of partner in order to receive significant remuneration, and that large tech companies are willing to pay higher salaries earlier on. Consultancy firms will need to take a closer look at their remuneration schemes in order to make this work.

Third, as the author describes, the engagement models need to change as well. Less stringent models, with better work/life balance, and more tailored customer needs based approaches are a start.

The key challenge to solve I believe lies in driving forward a clear “delta” in expertise between McKinsey professionals and client needs. As long as you stay ahead of your client, you can help them lead the way.

This is an interesting topic to think about. The author defines “digitalization” very broadly, but one could argue that new technologies have been changing the way business gets done for decades, and McKinsey has survived in a rapidly changing business landscape for almost 100 years. So the big question is: is this time different? Will this latest “revolution” render traditional management consultants obsolete in a way that previous ones have not?

I tend to think that it will not – at the end of the day, management consulting of the type McKinsey focuses on is a people business, and as long as CEOs want advice from smart external advisors with broad industry experience who can handle the qualitative as well as (if not better than) the quantitative, the industry will survive. That said, the nature of some of the work might change as data science becomes more of a separate field and some projects without the need for a strong strategic viewpoint get shifted to internal teams or other types of moe specialized consultants.

Adding to Noemie’s second point, I also agree that that cultivating a strong talent pool will be McKinsey’s biggest challenge. Up until this point, the Firm has done a marvelous job in crafting an organization that has healthy uplift and turnover. Through its up or out model, frequent review cycles, and clear criteria for promotion, McKinsey is a well-oiled machine.

However, I wonder how well this model can be adapted to a more complex org, consisting of UX Designers, Data Scientists, etc. Adding in the fact that tech firms often compete for the same talent with generous stock-based compensation packages, I am curious how McKinsey will deal with the challenges of assessment, advancement, development, and compensation.

I guess it comes down to whether you think that consulting firms will increase headcount or decrease headcount in the coming years. I can see an outcome in which these firms invest lots of time / money into developing their talent pipeline. Whether this is by reworking business schools’ curriculum, or by targeting workers in industries that are being disrupted and no longer need the same level of people. I doubt that professional services firms are immune to disintermediation / the threat of digitalization, although it is probably one of the more insulated sectors due to the level of interaction with clients and need for original thought.