Disrupting Wealth: Bettering the Wealth Management Industry

Disruptive technology innovation from startups like Betterment has shaken up the wealth management industry

Since the financial crisis, digitization has disrupted the traditional wealth management industry with new startups gaining market share and incumbents forced to revisit their business models in the face of increasing competition and pricing pressure. Betterment has emerged from this wave of innovation as the leading player.

Founded in 2008 by Jon Stein, a Harvard University graduate, Betterment is the largest independent robo-advisor managing over $5.6 billion in assets under management across more than 185,000 customers1. Robo-advisers like Betterment are online, automated services that use an algorithm to provide investors with wealth-management advice. Betterment was named to the CNBC Distruptor 50 list in 2014 and 2015. In the article, Founder and CEO, Jon Stein was quoted as saying, “We’d like to put target date funds, annuities and mutual funds out of business. There’s no good reason for them to exist anymore.”2

Figure 1: Betterment Mobile Application3

In addition to disrupting traditional investment funds, robo-advisors like Betterment have had a significant impact on the traditional wealth management industry. Traditional wealth managers like Merrill Lynch have come under scrutiny from their clients in recent years for several reasons: (i) high required minimum account balances, (ii) high fees, (iii) inability to produce differentiated investment returns, and (iv) a lack of technology solutions that facilitate ease of use and information transparency. Robo-advisors have attempted to create solutions to address these issues.

Betterment’s business model creates and captures value by offering a simple, transparent digital interface that produces optimal investment returns at a lower cost and is accessible to everyone. Betterment’s platform offers clients access to its platform for a tiered annual fee between 0.15%-0.35% depending on investment amount with no minimum investment. This compares to traditional wealth managers who have a minimum account balance requirement of $250k or more and charge 1%-2% annual fees. On a $250k account, this translates to a Betterment client saving $2,125 in annual fees prior to considering any impact from return performance and compounding over time4.

To deliver on this promise, Betterment’s operating model: (i) provides investment diversification based on Nobel Prize winning research, (ii) invests in low cost investment funds reducing the fees clients pay at the fund level, and (iii) employs a tax harvesting strategy to maximize the tax efficiency of each client’s investing strategy5.

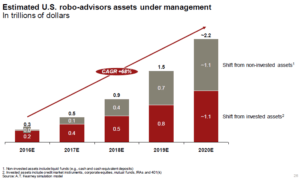

What does this all mean? In short, there will be continued disruption in the wealth management industry. In a recent survey administered by Investopedia, 78% of financial advisors in the U.S. indicated that they believe technology will greatly impact their practice in the next five years6. A.T. Kearney estimates that robo-advisors will grow from $300 billion (<1% of assets) in 2016 to $2.2 trillion (~6% of assets in 2020)7.

Figure 2: Estimated U.S. Robo-Advisors Assets Under Management ($ in Trillions)7

Some traditional wealth managers such as Charles Schwab, Vanguard, BlackRock and Fidelity8 have attacked the proliferation of robo-advisors head on by acquiring robo-advisory firms while other such as Bank of America Merrill Lynch9 and Morgan Stanley10 have announced plans to build in-house robo-advisor capabilities. In a worst-case scenario, robo-advisors could take significant business away from traditional wealth managers. At the very least, robo-advisors should put pricing pressure on traditional wealth managers – estimated by A.T. Kearny to decrease industry revenues by at least $8-$12 billion over the next five years7.

However, the impact of Betterment and its peers should not be all bad for the industry. Booz & Co published a presentation in 2013 that opined on how the industry can use digitization to its advantage: (i) creating new technologies that enable enhanced interaction between advisors and potential clients and (ii) enabling advisors to reach a broader base of potential clients. In my opinion, this last point is the most important11.

In the short-term, Betterment and other robo-advisors should continue to attract new clients to their platform as well as partner with large corporations (such as Uber12) to be their low-cost retirement provider. However, to build a sustainable long-term business, I believe that robo-advisors should partner with large wealth management platforms as part of a customer segmentation strategy. Nearly all large traditional wealth managers are moving towards their own robo-advisor solution that will increase competition with Betterment. Inevitably some of these will fall short in their offering, however, partnering with traditional providers to manage their robo-advisory platform should be a win-win for all parties. There will always be a need for customized financial advice for wealthy individuals and that will require professional, human advisors for the foreseeable future but a customer segmentation strategy that expands the opportunity for professional wealth management strategies to a broader audience of consumers is a compelling value proposition and one that can be facilitated by Betterment.

Word Count: 778 words

Sources

1 Betterment. 2016. Betterment Announces the Latest Breakthrough in Tax-Smart Investing: Tax-Coordinated Portfolio™. [ONLINE] Available at: http://www.prnewswire.com/news-releases/betterment-announces-the-latest-breakthrough-in-tax-smart-investing-tax-coordinated-portfolio-300334678.html. [Accessed 18 November 2016].

2 CNBC.com staff. 2016. Betterment 2015 Disruptor 50. [ONLINE] Available at: http://www.cnbc.com/2015/05/12/betterment-disruptor-50.html. [Accessed 18 November 2016].

3 Listen Money Matters. 2016. Acorns vs Betterment vs Wealthfront: Epic Robo-Advisor Battle . [ONLINE] Available at: https://www.listenmoneymatters.com/acorns-vs-betterment-vs-wealthfront/. [Accessed 18 November 2016].

4 Betterment. 2016. Our Pricing – Betterment. [ONLINE] Available at: https://www.betterment.com/pricing/. [Accessed 18 November 2016].

5 Betterment. 2016. Our Portfolio – Betterment. [ONLINE] Available at: https://www.betterment.com/portfolio/. [Accessed 18 November 2016].

6 Investopedia. 2016. Nearly 80% of Financial Advisors Expect Robo Technology to Upend Wealth Management Industry. [ONLINE] Available at: http://www.prnewswire.com/news-releases/nearly-80-of-financial-advisors-expect-robo-technology-to-upend-wealth-management-industry-300326916.html. [Accessed 18 November 2016].

7 Teresa Epperson, Bob Hedges, Uday Singh, Monica Gabel. 2015. Hype vs. Reality: The Coming Waves of “Robo” Adoption . [ONLINE] Available at: https://www.atkearney.com/documents/10192/7132014/Hype+vs.+Reality_The+Coming+Waves+of+Robo+Adoption.pdf. [Accessed 18 November 2016].

8 For Investors: 7 Things You Should Know About a Robo-Advisor | The National Association of Active Investment Managers – NAAIM. 2016. For Investors: 7 Things You Should Know About a Robo-Advisor | The National Association of Active Investment Managers – NAAIM. [ONLINE] Available at: http://www.naaim.org/for-investors-7-things-you-should-know-about-a-robo-advisor/. [Accessed 18 November 2016].

9 Lisa Beilfuss. 2016. Merrill Lynch Unveils Plans to Launch Robo Adviser – WSJ . [ONLINE] Available at: http://www.wsj.com/articles/merrill-lynch-unveils-plans-to-launch-robo-adviser-1475610410. [Accessed 18 November 2016].

10 Business Insider. 2016. Morgan Stanley’s digital strategy relies heavily on robo-advising – Business Insider. [ONLINE] Available at: http://www.businessinsider.com/morgan-stanleys-digital-strategy-relies-heavily-on-robo-advising-2016-7. [Accessed 18 November 2016].

11 Kunal Vaed. 2013. How Digitization is Transforming Wealth Management. [ONLINE] Available at: http://cdn.americanbanker.com/media/pdfs/Mobile13-Vaed.pdf. [Accessed 18 November 2016].

12 Betterment. 2016. Uber and Betterment Drive Together Toward Better Financial Management – Betterment. [ONLINE] Available at: https://www.betterment.com/resources/inside-betterment/uber-and-betterment-drive-together-toward-better-financial-management/. [Accessed 18 November 2016].

Great post! I think the debate we had in class about weather Watson will replace doctors in medicine is quite applicable here also: what decisions are these investors making that are purely computational and inferring from past data that machines can do better versus what decisions need higher order thinking skills and dealing with ambiguity that computers are still not competent at.

Regardless of what the future holds, roboadvisors and how they’re affecting the wealth management industry right now is fascinating. These advisors are very appealing to millennials (especially young people in the tech industry) who don’t want to think about building their own portfolios, can’t afford to pay exorbitant fees to wealth managers and are comfortable with the idea that algorithms are managing their money.

Thanks for sharing! Robo-advisors are a positive development for investors as they put more pressure on banks and wealth management experts to actually provide value to justify their fees. That said, these upstarts are definitely facing obstacles in widespread adopting. Through their success, many of these upstarts have appeared to encourage incumbents to get into the ring with their own robo-advisor offerings (created in-house or through acquisition) [1]. What’s even more difficult is that some industry experts project that standalone “robo-advisors need between $16 billion and $40 billion in assets under management to break even” [2]. Incumbents can offer robo-advisors at a loss to cross-sell customers on a variety of other financial products whereas most robo-advisor startups lack the breadth of financial products and existing customer base to remain competitive and survive without large rounds of funding. I’m curious to see how this plays out!

Sources:

[1] http://www.cnbc.com/2016/06/25/big-banks-are-fighting-robo-advisors-head-on.html

[2] http://www.cnbc.com/2016/06/14/is-the-twilight-of-the-robo-advisor-already-at-hand.html

This post is very interesting! As Robo-advisors can provide us easy and affordable was to reach globally diversified investments, many people will shift their money not only from existing funds to robo-advisors but also from saving accounts to investments. We saw in LEAD that Bridgewater was trying to eliminate bias by thorough discussion to find truth, robo-advisors are perfect to pursue unbiased decision as long as its program is not unbiased, so with the capability to deal with tremendous historical data and financial theories, robo-advisors would flourish in future. Though asset managers would try to acquire/develop own robo-advisors, I think other technology company like Google or IBM can possibly join in this market. I wonder who would develop the best robo-advisor. Is that who know finance best, or who know technology best?

Thanks for the post @HBS123! I agree with all the points you and my fellow commenters make about the obvious benefits to robo-advising. There’s no question that it only makes sense to lower unnecessary costs and investor biases where possible. That said, it’ll be interesting to see how well firms will be able to integrate this technology before consumers start commoditizing the service. Do companies risk joining in on a race to the bottom? Going forward, even while embracing automation, firms will have to market the benefits of the professional, human advisor more than ever.

Great post. It is something that all wealth management firms are facing now and each have various ways of dealing with it, as you mentioned.

In addition to what you wrote, I see two main concerns that could come from this switch. The first is ensuring that all of these advisors are fully compliant with not just the letter of the law, but the spirit too. If you ask firms like Merrill and MSSB why their fees are high, they will quickly point out that it is not just the investment advice they give, but also their robust compliance systems that ensure all of their financial advisors are giving investment advice in accordance with the 1940 Advisors Act and SEC guidance. If these robo-advisors are able to provide similar investment advice alongside top grade compliance programs, that would really be a game changer.

The second thing I think about is how the wealth management industry will divide even more between high net worth individuals and retail investors. If robo-advisors are able to replace most traditional financial advisors, the only ones who will probably have access to standard wealth management providers are more high net worth individuals. While it may be ok for typical investments, there are many things that robo-advisors are still not really capable of doing. For example, if a child or family member contracts an illness and I need to know how to reshape my investment portfolio to provide liquidity over a short period of time, or if I am planning to leave my job in the near future, human financial advisors are more likely to learn more valuable information to help lead you to a better outcome.

This is so interesting! Wealth management industries particularly hedge fund and mutual funds are facing massive secular headwinds as millennials are increasingly distrusting active investing managers with high-fee structure and opting for DIY. Robo-Advisors actually do not present any new investing strategies, but rather create an interface and its own diversification algorithms to invest in passive ETFs, which are already accessible to everyday investors with an even lower fee structure. But the value that Robo-advisors provide is an easy-to-use online interface, further lower capital requirement (by pooling all smaller lots of investments), additional layer of diversification ( its so-called “algorithms”), and a popular mobile app concept that appeals to millennials. This approach reminds me of Lending Club model, which provides an easy-to-use online platform to pool different borrowers and lenders with diverse risk profiles together. I also agree with Ari’s comments that I am bit skeptical of the robustness of its compliance and risk control system in case of any adverse events in the market. As we know, we have been in a super long cycle of bull market since 2009 which creates the illusion that layman investors should simply buy passive funds and will generate returns without paying much fees. This illusion has also given rise to the fast growth of the passive investing we are seeing today. However, when we enter the bear market, risk control becomes the most important aspect in wealth management. I am a bit skeptical of what mechanisms are in place for such online apps which emphasize on automation and limited human intervention… During a market crash, a low fee structure is no longer relevant compared to loss of original capital….

Very interesting post! In my mind, wealth managers still provide some significant value adds vs. a robo-adviser: (i) access to alternative investments such as infrastructure, HFs, or PE, and (ii) tax, estate, and family financial planning. Also, robo-advisers are very different from mutual funds in that they are not performing any fundamental due diligence on investments. Studies have shown that active mutual funds do not out-perform passive fund (such as Betterment), but in a world where investors increasingly choose passive vehicles, active investors may find more opportunities to out-perform.

Thanks for the interesting post.

I am interested in Ari’s second point about the need for a human in addition to Roboadvisors to accommodate specific individual circumstances that may deviate from the norm. I guess, following on from the Watson case, it is possible that AI will be able to tackle even the most specific and nuanced situation in the near future?

I think it will be interesting to watch the growth in roboadvisors as we watch population demographics shift from mostly baby boomer investors to largely millenial investors. I would imagine that one of the biggest hurdles for our parents generation is trusting that a computer can really manage their money to meet their needs and would guess that the older population is more willing to pay the higher fees to a human wealth manager just for some peace of mind. As investor demographics shift to include more of our peers who have more comfort with computers and higher value sensitivity when we buy, I would imagine this barrier goes away and the pace of roboadvisor growth accelerates tremendously.