Discovery: revitalising the (dull) insurance industry through digital transformation

While the insurance industry has traditionally been viewed as dull, Discovery Group is adopting digital technology to shake things up and deliver mutual benefit to consumers and insurers.

“Old, stuffy and antiquated.”

“Unbelievably dull.”

“Grudge purchases.”

While these characterisations of insurance hardly come as a surprise, the Discovery Group has taken a bold move to flip the script on the negative perceptions of the industry. Through a combination of behavioural economics, digital technology and data analytics, the US$5bn insurer has developed innovative incentive and reward programs to change the way customers engage with its products. [1]

Digital Disruption

Discovery was founded in 1994 and describes itself as a ‘shared value insurance company… that incentivises people to be healthier, and enhances and protects their lives.’ [2] The company’s shared value principles are demonstrated across its portfolio of health, life and car insurance products:

Health Insurance: Discovery Vitality

Vitality was launched in 1997 to incentivise members to engage in prevention and wellness promotion activities by awarding points that made them eligible to receive rewards including retail, airline and travel discounts. Vitality has shown significant results from a clinical outcomes perspective: members that are the most engaged with the program show a 10 percent reduction in hospital admission rates and a 14 percent lower cost per patient versus non-program participants. [3]

Vitality was launched in 1997 to incentivise members to engage in prevention and wellness promotion activities by awarding points that made them eligible to receive rewards including retail, airline and travel discounts. Vitality has shown significant results from a clinical outcomes perspective: members that are the most engaged with the program show a 10 percent reduction in hospital admission rates and a 14 percent lower cost per patient versus non-program participants. [3]

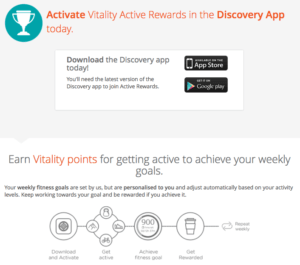

On the back of this success, Discovery launched Vitality Active Rewards (VAR) in 2015. Through this platform, members were given the option to synchronise approved wearable devices to the Discovery app on their smartphones, in order to track their physical activity and stand the chance to earn further rewards ranging from free smoothies to discounts on Apple Watch contracts. Under VAR, members receive a weekly fitness goal that is personalised and based on their prior activity levels as tracked by their wearables. Discovery is also injecting an element of social pressure into its model: members are able to form teams so that if each team member achieves his / her individual goal, all team members receive an additional reward.

Life Insurance: Vitality Integrator

Discovery Life insurance policyholders also have the option to link their life policies to VAR. Additional rewards for healthy behaviour apply, including discounts on premiums or increases in cover at no additional premium.

Car Insurance: Discovery Insure

Through a partnership with Cambridge Mobile Telematics, Discovery launched its car insurance product in 2011. Discovery Insure provides clients with the option to use a smartphone-enabled or standalone ‘Driver Quotient Tracker’ (DQ-Track) to monitor their driving in real time. The DQ-Track determines a monthly Driver performance score based on factors such as acceleration, driving speed, braking, taking corners, night time driving (between 23:00 and 04:30), distance and smartphone activity. Clients achieving high driver performance scores become eligible to receive discounts from Discovery partners on purchases of fuel, tyres, public transportation and even Uber trips [2].

Consumers’ response to Discovery Insure has been positive and the insurer has experienced rapid growth. In a competitive car insurance market that was dominated by four large players that underwrote 52% of the market’s gross written premiums, Discovery Insure is now in the top three and was recognised at the Gartner Annual Symposium in Barcelona in November 2015 as the “Most Innovative New Digital Product.” [4] [5]

Discovery has been studied by several actors as a benchmark for driving disruption in the insurance sector. Accenture classifies the model as a ‘tailor-made model’ which places emphasis on the customer relationship and creates a virtuous cycle by setting up a stream of valuable data that can be used to improve, expand and personalise the offering [6]. A win-win outcome emerges with customers benefiting from improved health, safety and rewards, and the insurer benefiting from reduced costs, customer loyalty and increased market share. There has been global appetite to adopt this innovative model with partnerships having been formed with John Hancock (US), PruProtect and PruHealth (UK), Ping An (China), AIA (Asia and Australia) and The Generali Group (Europe) [7].

Looking forward

The South African Competition Commission is currently conducting a market inquiry into the state, nature and form of competition in the private healthcare sector [8]. As part of this process, the World Health Organisation has criticized the country for having one of the most expensive private healthcare systems in the world. Consequently, only 17% of the population can afford private health insurance such as that provided by Discovery [9]. While Discovery has already made strides in offering low-cost health insurance under the brand name ‘KeyCare’, continued digital transformation provides an opportunity to accelerate its efforts in accessing this largely untapped market in a commercially viable way.

Overall, Discovery should also proactively address consumers’ privacy concerns. According to an EMC global privacy survey, 81% of consumers around the world expect privacy to erode over the next five years [10]. With the success of Discovery’s model necessarily relying on customers’ willingness to share their activity data, the company should organise around providing uncompromising data security.

[796 words]

References

[1] Reuters: http://www.reuters.com/finance/stocks/overview?symbol=DSYJ.J

[2] Discovery website: https://www.discovery.co.za/portal/individual/about-us

[3] KPMG – Staying Power, Success Stories in Global Healthcare: http://www.kpmg.com/IT/it/IssuesAndInsights/ArticlesPublications/Documents/staying-power-success-stories.pdf

[4] Ten biggest insurers in South Africa: https://businesstech.co.za/news/banking/131568/top-10-biggest-insurers-in-south-africa/

[5] Gartner Eye on Innovation Awards: http://www.gartner.com/technology/eye-on-innovation-awards/financial-services/

[6] Accenture – The Digital Insurer: http://ins.accenture.com/rs/accenturefs/images/HP-Digital-Insurer.pdf

[7] Key Discovery Milestones: https://www.discovery.co.za/discovery_za/web/logged_out/about_discovery/our_milestones.html

[8] Competition Commission Market Inquiry into Private Healthcare: http://www.compcom.co.za/healthcare-inquiry/

[9] SA has one of the world’s most expensive private healthcare systems – WHO: http://www.health24.com/News/Public-Health/sa-has-one-of-the-worlds-most-expensive-private-healthcare-systems-who-20160217

[10] The Privacy Paradox, Finweek (Jessica Hubbard)

Thank you Crystal for this post! It was very fun and interesting to read — I had no idea that these guys were so big. My main concern with this type of insurance is the possibility of people outsmarting the system, which can lead to unintended consequences that make honest people pay more.

There are many tested and proven ways to cheat systems like these. For example, this Frotune article shows how people can be very creative http://fortune.com/2016/06/10/fitbit-hack-cheat/. I believe that similar problems could threaten Discovery’s app. Do you know if Discovery has faced such issues, and how they have reacted to them?

Even as methods like these attempt to solve the adverse selection issues inherent in any insurance scheme, they, too, can fall victim to adverse selection without the right pricing structure changes.

In all insurance, people with higher risk for incident are more likely to take on insurance contracts. Traditional pricing prices that in, and even attempts to allocate some price discrimination into the premiums, but overall, low risk people are subsidizing high risk people to some extent. If a traditional insurance company kept traditional pricing constant and allowed customers to opt into a metrics-based pricing scheme, the already low risk people will be the ones who adopt and end up paying less. Since they are already getting their discount by maintaining their lifestyle, there is little incentive to further improve their behavior, thereby decreasing revenue and maintaining costs. Insurance companies could offset this by instituting faster price increases on traditional contracts than they otherwise would such that, in the long run, they end up in the same place, but that is risky and takes some short term pain. This gets harder to analyze once you look at the pricing actually changing behavior, but there will still be a segment of high risk customers who know they will never reach the threshold and therefore will not opt in.

However, if the entire company’s business model involves this granular risk-based pricing, the adverse selection issue can go away. If everyone who signs up for the insurance is required (through choice of insurer) to do this type of pricing, the company can start with an appropriate price and work from there. The adverse selection just becomes selection, such that while the company may be charging lower prices overall, they will have a lower-risk clientele and can therefore maintain their margins.

Great post! It’s interesting how technology can be helpful for companies to create incentives for good behavior. There’s significant potential for insurance companies in this area. However, it requires a lot of commitment from the company to put a good product in place. The product should be attractive for the user, protect the company from “crazy coupon ladies” that outsmart the system as Catherine Brown mentioned in the previous comment, and protect personal information from unauthorized use. All of this require a lot of resources that many companies have not been willing to invest until now…

I also found very interesting that it’s a South African company the one that it’s leading the innovation in the insurance industry. Insurance is the next frontier for large insurance companies, who see the emerging African economies and the rising African middle class as the next big market for general and life insurance [1] [2]. Developing great add-ons for the public will certainly help Discovery face the competition and they can also be a competitive advantage entering other African market.

[1] https://www.towerswatson.com/en/Insights/Newsletters/Global/emphasis/2016/emphasis-2016-1-sub-saharan-africa-insurances-new-frontier

[2] https://www.ft.com/content/bc87016a-2430-11e6-9d4d-c11776a5124d