Digitization at Pfizer

What Pfizer is doing to digitize its supply chain.

Word count: 713

Digitization in the pharmaceutical industry

Imagine your smartphone transmitting information about your consumption of personalized medicine to a pharmaceutical’s manufacturing plant thousands of miles away. Once received, this information initiates the manufacturing of medicine. In another week, you receive the next dosage of your personalized medicine at your door step. This is an outcome of the digitization of the pharmaceutical supply chain.

The digitization of the pharmaceutical supply chain includes virtual sensors that can relay information to physical manufacturing facilities [3].

The digitization of the pharmaceutical supply chain includes virtual sensors that can relay information to physical manufacturing facilities [3].

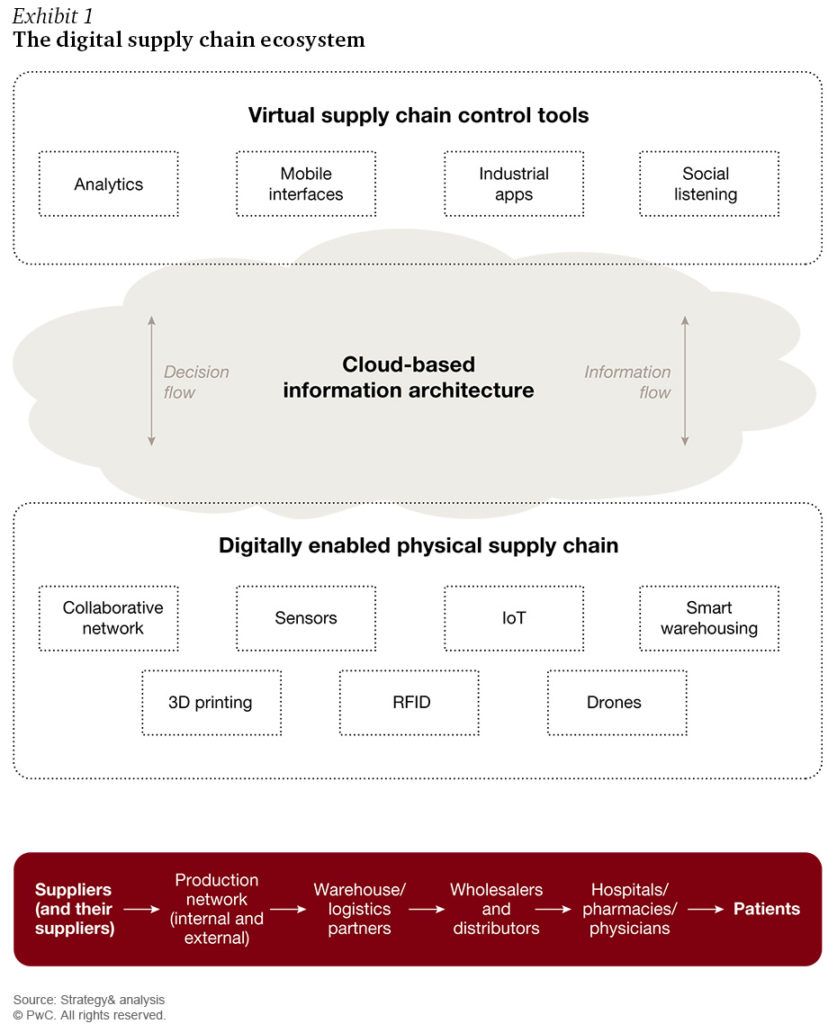

Digitization is a positive disruptive force within the pharmaceutical industry. As demands in medicine fluctuate due to unforeseen factors, including epidemics or competitor activity [1], digitization allows a pharmaceutical company to quickly adapt by fully integrating their operational process [2] (Exhibit 1). Consequently, this more transparent process could better assess demand and provide a more accurate supply to the global market.

Such responsiveness will help companies improve planning accuracy, manufacturing efficiency and productivity, inventory levels, and service levels [3], which ultimately can lead to increased profits of up to 60% [4]. These changes will also help address evolving challenges within the industry, including increased SKUs and supply chain partners, more complex product portfolio mixes due to personalized medicine trends, need for competitive pricing with the globalization of medicine, a growing abundance of counterfeit drugs, and need for increased transparency by regulatory agencies [3].

However, although benefits can be clearly ascertained, pharmaceutical companies–as of this point in time–are slow to digitize its operations likely due to regulatory issues including patient privacy [5]. Nevertheless, the pressures of increasingly complex healthcare demands, including the need to produce cost-effective low volumes of personalized medicine in the near future, will force pharmaceuticals to eventually adopt such digitization.

Pfizer embraces technology

At Pfizer, one of the world’s largest pharmaceutical companies, recognition of industry challenges has spurred digitization within its supply chain. Within the past few years, Pfizer has formed relationships with innovative partners, including GEA and G-CON Manufacturing, to create a first-of-its-kind manufacturing system known as the Portable, Continuous, Miniature and Modular (PCMM) system [6]. This system not only takes about 70% less space than a traditional manufacturing facility and costs 25-50% of a traditional facility to build [7], but gives Pfizer increased flexibility and speed of production to quickly deliver customized quantities of drugs. Furthermore, the same equipment would be used in development, clinical trials and commercial manufacturing, resulting in reduced costs across the company. Pfizer already has brought one such facility in CT, USA to full operation in 2016, and started construction on a second facility in Freiburg, Germany that is expected to come online in early 2018.

Additionally, in 2015, Pfizer introduced its Highly Orchestrated Supply Network (HOSuN) [6], which has fused their global physical supply chain with a global information supply chain, enabling complete visibility into the status of products at all times. They plan to use this network to help identify medicine demand throughout the world, and especially for biologic and vaccine products that may require manufacturing lead times of 9-15 months so that medicine demands are met.

For the long-term, Pfizer has invested in the Internet of Things—one form of digital sensors in its products—to gain better visibility on point-of-sale [5], a previous area with an information gap due to the highly regulated industry. With such tracking technology for their products, Pfizer can better predict changes in demand without other stakeholders, such as hospitals or pharmacies. This information will help Pfizer position itself to better service its ultimate end consumer, the patient. Perhaps not too far in the future, we will have a seamless experience of drones arriving at our doorstep with our next dose of medication when needed.

However, to fully embrace such technology, Pfizer needs to pass the major hurdle of receiving approval from regulatory agencies with respect to patient privacy. This is integral for the improvement of its on-demand medicine delivery and personalized medicine manufacturing processes. Furthermore, as Pfizer may move into vertical integration for distribution, Pfizer needs to invest in technology to improve the delivery process, such as cold chain technology for the temperature-controlled requirements of personalized medicine.

Open question

Looking to the future, Pfizer will need to consider potential issues arising from changing its operations. What challenges could Pfizer face as a result of digitizing? Identification of such issues may help Pfizer strategize its implementation to reduce the risk of these problems.

Citations

[1] Shah, N., 2004. Pharmaceutical supply chains: key issues and strategies for optimisation. Computers & chemical engineering, 28(6), pp.929-941.

[2] Champagne, D., Hung, A. and Leclerc, O., 2015. The road to digital success in pharma/McKinsey&Company. Vancouver

[3] Behner P and Ehrhardt M. “Digitization in pharma: Gaining an edge in operations.” Strategy&, 2016, 4-18.

[4] Accenture. “Pharmaceuticals that digitize grow more.” 2016-11-15 https://www.accenture.com/us-en/insight-highlights-life-sciences-pharmaceutical-grow

[5] Internet of Business. “Digitizing the supply chain: Why Pfizer is investing in IoT, drones and personalized medicine.” 2017-01-31 https://internetofbusiness.com/digitizing-supply-chain-pfizer-iot/

[6] Pfizer. “2016 Annual Review: Transforming Delivery of High Quality Products.” 2016 https://www.pfizer.com/files/investors/financial_reports/annual_reports/2016/transforming-delivery-of-high-quality-products/index.html

[7] Pfizer. “2016 Annual Review: Manufacturing, Quality and Supply Chain.” 2016 https://www.pfizer.com/files/investors/financial_reports/annual_reports/2016/our-business/manufacturing-quality-and-supply-chain/index.html

It seems impossible for pharmaceutical companies to avoid digitization at this point in time. As you listed, the benefits of digitization are endless – not only for Pfizer and other pharmaceutical organizations, but also for consumers. That said, many consumers do not believe that the reduced costs and increased convenience outweighs the invasion of privacy. You mentioned the biggest issue at hand are the regulatory barriers, however, I would argue that consumer perception is an even bigger barrier. Even if regulations were passed to allow the highly effective supply chain you described, do you believe consumers would be on board to send details regarding their consumption behavior to companies notoriously known for ripping patients off? Personally, I believe organizations such as Pfizer should focus on convincing consumers to buy into digitization – using this tactic, consumers can also act as influencers and put pressure on regulatory bodies as well.

Great article! I agree that digitization is a huge disruptive force that will bring tremendous benefits to the pharmaceutical industry – despite the difficulties that you and Regina Phalange (who commented above) highlight.

Regarding the problem of counterfeit drugs, which you mention in the first section of your article, Pfizer is doing some very interesting work using blockchain – here is a link to my article where I discussed it: https://d3.harvard.edu/platform-rctom/submission/can-blockchain-help-solve-the-problem-of-counterfeit-drugs/.

Seems like Pfizer may be able to pry their way into patients’ homes to track medication consumption and usage, but I think they’ll have a very difficult time personalizing the medications for a given patient. Without lab quality metrics and a thorough interview to elicit side effects that won’t readily visible to any electronics we have available, personalizing dosages or medication balancing will be very challenging and comes with lots of liability on Pfizer’s end. The physician has typically assumed liability for any changes in medication, and I can’t imagine Pfizer will want to assume that role and the risk that comes along with it.

Pfizer can collaborate with other big Pharma companies to lobby regulators aggressively to relax policies on patient privacy so as to access valuable information of consumers. They can argue that this will make their supply chain more effective and reduce wastage, hence lowering drug prices. This will put the ball in the regulators’ court who will have to balance the benefits of affordable medication for their constituents (and insurance companies) against the risk of privacy breaches. Regulators will hence need to think innovatively about how they can achieve both. This may involve pushing boundaries on information that can be shared and strengthen/stiffen punishment for breach of privacy on data that cannot be shared.