CostCo: Creating Membership Value in a Digital World

Can CostCo, the cheapest, happiest company in the world, succeed in a digital future?

Since 2010, while most retailers have struggled to adopt to the omnichannel transformation impacting the industry, CostCo generated 7% growth year-on-year from 2010-14. [1] But will CostCo be able to withstand challenges to its business and operating model driven by digital transformation to continue to drive perceived membership value?

Overview of Business and Operating Model

CostCo’s business model relies on three critical levers to drive perceived membership value:

- Low Price per Volume: CostCo achieves this by leveraging its supply chain power as the second largest retailer in the United States [2], minimizing labor and logistics costs, and selling items very close to cost. Profits are nearly completely driven by annual membership fees.

- Item Productivity: CostCo has thresholds for item productivity, measured by dollars sold per store per week of SKUs that are, in some cases, 100-times the requirement for grocery store items. For example, one SKU may sell $10/store/week in a grocery store but would need to sell $1,000/store/week in CostCo to keep its space. This stringent requirement keeps its product assortment highly efficient and maintains the least number of SKUs necessary to provide a valuable product assortment to club members.

- Operational Productivity: CostCo sells on ready-to-sell pallets which are delivered to stores in shrinkwrap and then moved with forklifts to their locations. This process minimizes labor per unit sold and optimizes shipping in its distribution network.

In sum, operational productivity enabled by item productivity generates low prices which generates membership value. The objective of the business and operating model is to continually drive perceived membership value as membership fees drive profit.

Digital Transformation Opportunities and Challenges

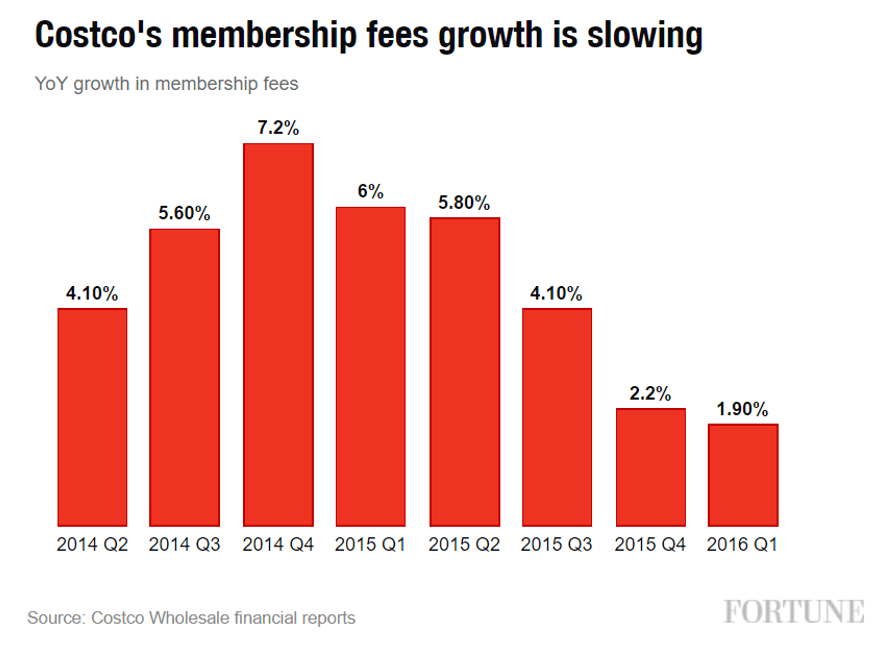

The key to CostCo’s future success is continually providing perceived membership value. As consumers seek efficiency while shopping in-store or move purchases online, the calculation of membership value changes. And signs of headwinds are apparent. While CostCo has appeared to be relatively immune to the growth of eCommerce players like Amazon, comparable stores sales in Q3 of 2016 were flat for the first time in six years and membership growth slowed to its lowest rates in several quarters. [3]

CostCo has integrated digital transformation into its operating model in two fundamental ways:

- Operational Efficiency

- CostCo has adopted sensor technology in 50 of its clubs in the US or Mexico to drive water usage efficiency. This helped cut water usage by 22% per club, cutting operational costs, and enabling lower prices for consumers. [4]

- CostCo has also developed advanced information tools to partner with supply chain partners and optimize operational efficiencies. Known as the CostCo Collaborative Retail Exchange, this platform enables suppliers to obtain daily sales metrics for their products to optimize supply and demand matching. [5]

- eCommerce Platform

- CostCo has a growing eCommerce platform that allows consumers to order select products online and have those delivered to their homes or apartments. Currently, eCommerce represents less than 5% of sales ($4.5 billion / $120 billion) total and CostCo is set-up to deliver well here as a component of membership value. eCommerce sales were up +19% in Q2 2016. [6]

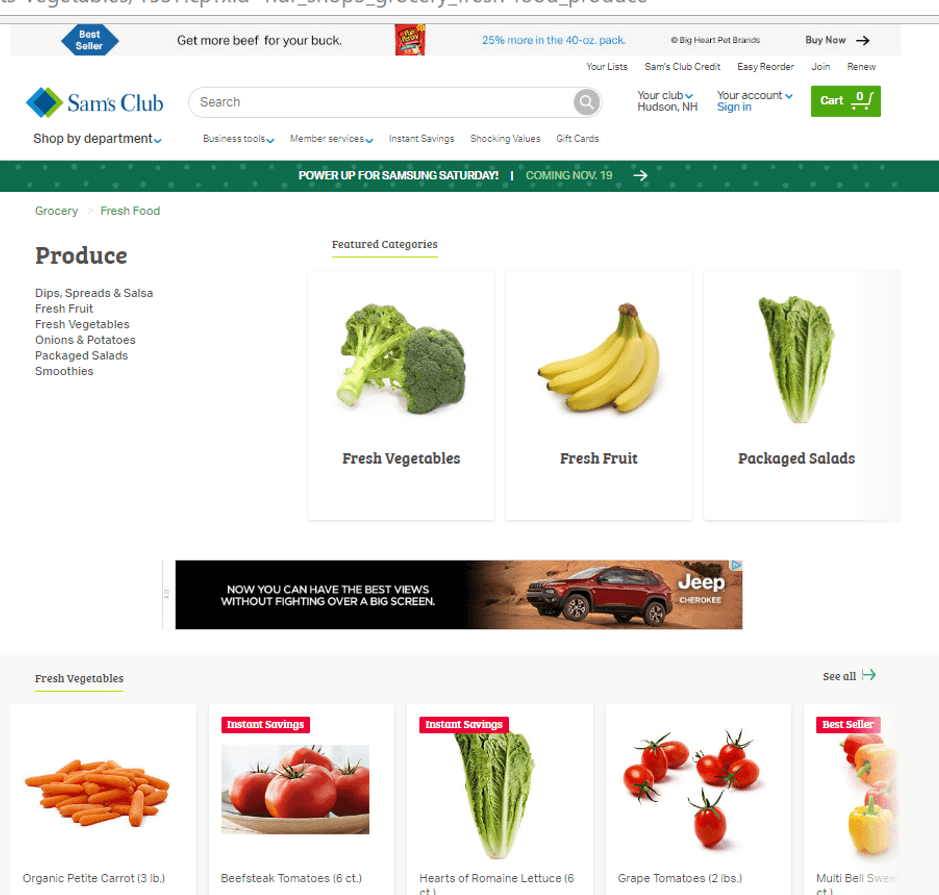

But CostCo’s direct competitor, Sam’s Club, has invested more quickly in digital technology. One popular trend in retail to bridge the physical and digital divide is pick-up in store which allows consumers to build a basket of items online or on mobile, set a pick-up time, and pick-up and pay for those goods when arriving at the store, eliminating time needed to spend walking aisles for planned purchases. Usage of Sam’s Club’s pick-up in store service was up +46% year-over-year during the 2015 holiday season. [7]

Moving Forward

While CostCo has done a successful job of building an eCommerce platform which generates $4.5B in annual revenue, I see two primary risks. One, only a select product offering is available online. A selection of what is already a select product assortment in CostCo’s club model could result in consumers feeling too limited in their options, thus lowering perceived membership value for those who prefer to shop online.

Two, CostCo should seek additional avenues to bridge the gap between the physical and digital world. The pick-up in store model is particularly useful for produce and other perishable goods since quality inspection can be accomplished in-store when making payment. I recommend CostCo consider implementing a similar program to match the service currently provided by Sam’s Club. The pictures below highlight Sam’s Club’s emphasis on produce compared to CostCo.

Conclusion

CostCo has proven its ability to create a world-class business and operating model capable of offering the best value to consumers to then drive perceived membership value. The critical question moving forward will be how CostCo adapts to changing calculations of membership value as the importance of bridging the physical and digital gap only increases.

Word Count: 789 words

Citations:

[1] Trefis Team. “Here’s What Will Drive CostCo’s Growth in the Future.” Forbes, November 24, 2015, http://www.forbes.com/sites/greatspeculations/2015/11/24/heres-what-will-drive-costcos-growth-in-the-future/#491125110915, accessed November 2016.

[2] Stone, Brad. “CostCo CEO Craig Jelinek Leads the Cheapest, Happiest Company in the World.” Bloomberg, June 7, 2013, http://www.bloomberg.com/news/articles/2013-06-06/costco-ceo-craig-jelinek-leads-the-cheapest-happiest-company-in-the-world, accessed November 2016.

[3] Wahba, Phil. “Danger at CostCo? Membership Growth Slowest in Years.” Fortune, December 9, 2015, http://fortune.com/2015/12/09/costco-membership-slows/, accessed November 2016.

[4] Fehrenbacher, Katie. “This is How CostCo is Using Data and Sensors to Cut Water Use.” Fortune, July 21, 2015, http://fortune.com/2015/07/21/costco-water-conseravation-system/, accessed November 2016.

[5] “IRI and CostCo Wholesale Announce Significant Enhancements to CostCo CRX Platform and Launch of CostCo CRX Mexico,” Business Wire press release (Chicago, IL and Las Vegas, NV, April 16, 2013).

[6] Wahba, Phil. “How Sam’s Club is Widening its eCommerce Lead over CostCo.” Fortune, April 18, 2016, http://fortune.com/2016/04/18/sams-club-ecommerce/, accessed November 2016.

[7] Wahba, Phil. “How Sam’s Club is Widening its eCommerce Lead over CostCo.” Fortune, April 18, 2016, http://fortune.com/2016/04/18/sams-club-ecommerce/, accessed November 2016.

I wonder if some of the erosion in Costco memberships has come from their openness to integrating with folks like Amazon Fresh and Google Express. I use both Google Express and have a Costco membership–I sometimes question my decision to get the Costco membership because Google Express allows me to buy non-perishable items from Costco without a membership. Perhaps other people are using that as justification for severing their membership?

That said, some of Costco’s best items IMO are it’s perishables–greek yogurt, spinach, etc. I would love to use a pickup offering as it would allow continued access to perishables and since the sheer size of the store means assembling a shopping cart can take a sweet eternity. 🙂

On the other hand, I wonder why Sam’s Club makes such a heavy emphasis on perishables, given that by nature unless you’re buying for a big group/family perishables are some of the most difficult things for consumers to purchase and economically use in bulk. Perhaps they see that more as their online differentiator, so it’s more a question of positioning?

Thanks for this post – I’ve used Costco’s online platform to order photos but never for groceries. Your point about the lower selection available online devaluing the membership is really interesting. I wonder if Costco could implement a cheaper pricing tier for online-shopping only. This way, people who want to shop online will recognize that not everything is available but not feel as though they are being “ripped off” by paying for a premium membership. Having an online-ordering-only membership might also have the added benefit of lowering congestion in the stores (which can get pretty crowded at peak shopping hours!).

Great post, Kent! I agree with your recommendation of pursuing the “buy online, pick up in-store” strategy. Many retailers have seen success with this strategy because it’s also effective in driving incremental sales – that is, customers that come to pick up their online order often pick up additional items as they walk to the pick up section of the store.

I was also interested to learn about Costco’s Collaborative Retail Exchange. Through the exchange, they seem to be leveraging big data to efficiently match supply with demand. It also reminded me of the beer supply chain simulation – allowing suppliers higher up the chain to have the same visibility to customer demand data that the downstream retailer has. I’m curious about the impacts that the exchange has had to both the suppliers’ and Costco’s operating models and bottom lines.

Thanks for the post Kent. I think it is interesting to think about Costco’s path forward in a digital world given they have made their whole existence based on brick and mortar stores. It is important for them to be on the forefront of this transition or else they will lose out to companies that are able to better capitalize on the trend towards digital.

One company that is trying to replicate Costco’s business but only online is Boxed. Boxed is an online only app that offers whole sale level prices to the consumer. It is only available through the app and does not have a brick and mortar presence. Costco should be really worried about the implications of companies such as Boxed that are better able to tap into consumers sentiment and desire for online. It looks like Costco is trying to push into digital but I think they can do more such as offering their services via an app.

Super interesting to hear how a bulk retailer like Costco has actually maintained its members and some growth in the age of digital giants like Amazon. I definitely see potential for Amazon’s automatic-style “recurring” purchases to be effective in the Costco model too, since Costco purchases buy in bulk at infrequent intervals. If Costco can use the supply chain infrastructure it’s developed to stay at the cutting edge of low-cost logistics for household items, this plus its reliable, user-friendly online purchasing platform could make it a competitor that is hard to beat.

As a loyal Costco consumer I found your article very interesting. Recently I’ve taken note of Costco’s ramped up efforts to develop their online business with a string of weekly emails in by inbox. It’s interesting that Sams Club is ahead of Costco in the online shopping space. I imagine being part of Walmart, Sams club has benefited from the significant investment Walmart has made in the digital retail experience. I think one major risk for both Costco and Sams Club is competition from online retailers like Boxed.com who are offering many of the bulk food items found at at the club stores (fresh and frozen too!) for convenience delivery to your home. Store-pick up sounds nice, but home deliver sounds even better.