Chase Cashes in on Mobile Banking

A Check in on Chase and Mobile Banking.

Banking and Mobile

Today’s competitive environment has made large legacy institutions such as banks susceptible to being disrupted by small up-start companies looking to shake up how banking is done. Thus, banks are exploring ways to convert to a more digital business [1]. For these banks to remain viable, and create value for consumers, they will be forced to get innovative and rely on the digitization of their processes. 95 percent of banks see a need to create more value-added services for their consumers [1]. Consumers are increasingly demanding their customer experience be seamless, convenient, and ideally have it take place on their phones. Digitization of the banking industry will become more disruptive as value chains break apart, with an emphasis around customer interaction [1].

What Chase Bank Is Doing About It

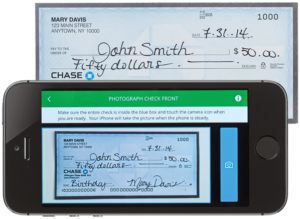

Chase bank has recognized the changing demands of their consumers and is working to adapt. More than 75 million U.S. consumers use their smart phones for mobile banking [2]. Chase Bank launched a new, innovative mobile banking platform that has created value for its customers. As of Q3 2016, Chase has 26 million active mobile users, the most of major banks in the US [3]. Chase’s mobile banking features include: the ability to deposit a check by taking a picture with your phone, to instantaneously transfer money between accounts or to another party and to make or schedule future bill payments. As a Chase customer, I can say that the digitization of some of the banking processes has been immensely useful for me. Going to the bank can be time consuming and inconvenient. Many times, I would have a check that needed to be deposited but it would just sit on my desk for weeks at a time as I would put off going to the bank day after day. Now, if I receive a check I can take a picture of it with my phone and it will hit my account the following day. The digitization of this process is a win-win for both the bank and their customers. The customer is happy because they can save an hour out of their day and avoid a trip to the bank. The bank is happy because they can cut down costs of operating the bank as they will need less tellers. Also, if Chase customers are depositing their checks in a timelier basis, Chase will have more deposits to loan or invest. An additional feature which is useful and meets the new consumer demands is Chase QuickPay. Chase QuickPay enables you to instantly transfer money to other parties who have chase accounts. This is an incredibly useful tool for both the sender and recipient. Under the old banking process, if you needed to send a friend of family member money, you would have to write a check, mail or deliver the check, and then the recipient would have to go to the bank to either cash or deposit it. This could be a time-consuming and lengthy process. Now, all it takes to send money is a click of a button on your phone. The ability to conduct a large portion of banking either online or via your phone will help with customer turnover. Prior to coming here for school, I lived in NYC and Chase branches were everywhere. Here in Boston, Chase does not have a presence. Without Chase digitizing their banking processes, I would have needed to switch banks. If I received a check, it would be impossible for me to deposit it. Knowing I can deposit a check with my phone made me willing to keep Chase as my bank. Chase which has been the industry leader in mobile banking also has had a lower attrition rate with their customers [3]. The ability to attract and retain customers without needing a strong presence of brick and mortar stores will create tremendous opportunity for banks that have a strong digital platform.

(654 Words)

Sources:

[1] “Banking in a Digital World,” accessed November 18, 2016, https://www.atkearney.com/documents/10192/3054333/Banking+in+a+Digital+World.pdf/91231b20-788e-41a1-a429-3f926834c2b0.

[2] “Pros and Cons of Mobile Check Deposit,” July 29, 2014, accessed November 18, 2016, http://www.consumerreports.org/cro/magazine/2014/10/pros-and-cons-of-mobile-check-deposit/index.htm

[3] “Chase’s Rivals Could Narrow the Mobile Banking Gap,” Business Insider, October 17, 2016, accessed November 18, 2016, http://www.businessinsider.com/chases-rivals-could-narrow-the-mobile-banking-gap-2016-10.

Great post, Alex! I completely agree with your assessment of mobile banking as an obligatory service banks need to offer in this rapidly digitizing industry. I have recently completely shifted to digital with my banking and bank with CapitalOne, which has less than 900 branches (compared to players like Chase with 5,550 or Wells Fargo with 6,238) [1].

The concern I have for banks is how to balance the need for a physical footprint with this growing trend. Branches are closing rapidly, but there may yet be value in a physical presence for major product “purchases” such as a mortgage or auto loan, and a physical footprint also ensures brand presence and awareness. How will banks find that optimal balance of physical and digital presence going forward?

[1] Jeff Cox, “For the future of banking, it’s all about the apps”, CNN. Accessed 11/20/2016. http://www.cnbc.com/2015/11/25/for-the-future-of-banking-its-all-about-the-apps.html

I agree – this really is a win-win for both the bank and the consumer. Others like Bank of America are doing this too, and the impact is significant. Routine tasks like depositing checks are extremely simplified and reduce labor and costs on the bank’s end. There’s a big effect on the security side too. Tailored notifications can be set up which allow the user to take a more active role in the monitoring of their account with minimal effort. In the case of a suspicious credit card purchase, the bank can easily send a push notification to the user. In turn, the user has the ability to confirm the purchase without having to call the bank, removing what has traditionally resulted in a cumbersome process for the user and costly for the bank. If this trend continues, it will be interesting to see how the resulting lower infrastructure requirements change the competitive dynamic in the space, opening the doors for smaller banks to serve a broader pool of customers.