Cedar: Making Paying Doctors Much Easier

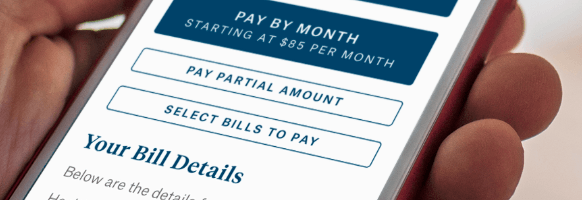

Sick of receiving confusing hospital bills in the mail that take hours to interpret and process? Through the use of machine learning and modern payments technology, Cedar addresses this major pain point by saving the patient and hospital valuable time, while significantly improving hospital collection rates and customer satisfaction.

Paying doctors can be a very frustrating experience for patients. A standard hospital bill, a multi-page paper statement, is typically difficult to interpret and execute, translating to very low collection rates for healthcare providers. As the share of payment responsibility has significantly shifted from the insurance company to the patient via high deductible health plans, this collection issue is becoming increasingly problematic for providers’ bottom lines [1]. A recent study suggests hospitals collect less than 20 cents on the dollar on out-of-pocket patient invoices [2]. Moreover, cumbersome payment experiences have meaningful consequences for future volume, as patient satisfaction typically drops by ~30% through the billing process, convincing patients to seek care elsewhere for their next visit [3]. Various technology vendors have recently entered the market to capitalize on this opportunity by offering an online payment experience. However, most of these technology vendors assume a “one size fits all” approach with one outreach strategy and billing experience for all patients. Cedar, a New York-based technology firm founded in 2016, has differentiated itself in the market by leveraging machine learning to create personalized outreach strategies and billing experiences for different types of patients. For example, a certain patient may be most likely to respond to a text in the morning while another patient is more likely to respond to a call in the evening and will convert based on different online billing designs and payment methodologies. Cedar’s personalized approach has translated to >30% increase in collections vs. status quo and 95% patient satisfaction with the tool [4].

Cedar relies on a combination of internal and external patient-level data in its machine learning process. Internal data from the client, such as prior payment history, level of engagement and prior communications is paired with external data such as demographics, location and various other proprietary data points to fit a given patient into a “user segment”. Each user segment has a tailored outreach (medium for hospital to communicate with the patient) and billing design based on an iterative data gathering process which allows for progressive learning about these patient cohorts to identify the ways that maximize payments conversion. As the company scales and accesses more concentrated regions, Cedar gathers more data supporting more tests, and in turn, enriches its algorithms. In the near term, the Company is focusing on growing its market share in post point-of-service payments for hospitals and physician groups. As noted in a September press release, the company is developing a new front-end solution, Check-In Plus, to effectively engage with and educate patients prior to their visit [5]. Cedar has intelligently recognized that another pain point for a patient is the poor and fragmented dissemination of information prior to a visit; with Cedar’s robust machine learning capabilities and existing data coverage on the patient population, it can effectively tailor a communication method to streamline the registration process for a patient while simultaneously providing meaningful cost savings and efficiencies for the provider.

Cedar’s infrastructure can be repurposed for many additional use cases in healthcare, an industry that is consistently undergoing major transformation to address various inefficiencies in the system. Two areas Cedar can deploy its consumer-centric approach to optimize yield and engagement could be (i) insurance plan to patient communication and (ii) doctor to patient communication in a value-based reimbursement setting. Firstly, communication between a patient and its insurance plan faces many similar issues as the communication between a patient and a provider for payments (i.e. opaque statements, manual payment processes, etc.) [6]. Furthermore, by combining these two payment types into one platform, the patient “drop-off” rate would drop considerably as all healthcare-related payments are now in one place with one user-friendly design and payment process. Additionally, this allows Cedar to capture even more data further enhancing the core product. Secondly, as healthcare’s revenue model shifts from a fee-for-service model to a value-based care model, doctors become more incentivized to maintain close contact and monitoring of the patient so it does not need to bring the patient back to an expensive care setting [7]. To address this need, Cedar can also leverage its machine learning capabilities to create a personalized messaging and tracking system between these two constituents. Cedar has the data on user segment response rates for different mediums and strategies – this can be repurposed to direct communication between a doctor and a patient to optimize engagement.

To sustain its differentiation, Cedar will be pushed to capture more data points on a given patient to improve its algorithms. Will patients be comfortable sharing deeper insight if it results in a better overall customer experience? Secondly, what are the key limitations of machine learning as Cedar potentially pursues other use cases as mentioned above? Is data in these areas too fluid? Is increased human intervention required for more subjective decisions?

(Words: 797)

References:

[1] Kieman, Maren, “Patient Payments Responsibility Has Skyrocketed as Providers Look To Implement Financial Solutions.” December 18, 2017. https://www.intermedix.com/blog/patient-payment-responsibility-has-skyrocketed-as-providers-look-to-implement-financial-solutions

[2] Lapointe, Jacqueline, “Patient Collection Rates Drop as Out-of-Pocket Costs Go Up.” March 30, 2017. https://revcycleintelligence.com/news/patient-collection-rates-drop-as-out-of-pocket-costs-go-up

[3] Beckers Hospital Review, “Patient satisfaction and the revenue cycle: Improving the billing process to generate ‘net promoters’ for your organization.” August 18, 2015.https://www.beckershospitalreview.com/finance/patient-satisfaction-and-the-revenue-cycle-improving-the-billing-process-to-generate-net-promoters-for-your-organization.html

[4] Cedar Website. Accessed November 11, 2018 https://www.cedar.com/

[5] “Cedar Unveils the Next Evolution of its Patient Payment and Engagement Platform.” Cedar Press Release (New York, NY, September 20, 2018). https://www.cedar.com/2018/09/20/cedar-unveils-the-next-evolution-of-its-patient-payment-and-engagement-platform/

[6] Heath, Sarah, “Complex Health Plan Benefits Give Rise to Surprise Medical Bills.” September 6, 2018. https://patientengagementhit.com/news/complex-health-plan-benefits-give-rise-to-surprise-medical-bills

[7] Medical Economics. “Value-based Rx: How physicians can manage affordability, adherence.” August 25, 2017. http://www.medicaleconomics.com/medical-economics-blog/value-based-rx-how-physicians-can-manage-affordability-adherence

I agree with the suggestion that Cedar should consider incorporating insurance communication to the patient as a part of their platform because that this maintains the core competency of their product on simplify the patient’s understanding of cost of care and easing payment process. One of the primary reasons patients may have difficulty paying and interpreting medical bills today is because of the lack of central billing ‘authority’. In one given patient encounter, coming into contact with a few different providers in a hospital could entail multiple bills as independent physicians may choose to bill for professional fees separately from the facility (hospital fees). This is complicated by the fact that the insurance company may act as an intermediary and cover some portion of these bills, resulting in a plethora of statements that are difficult for the patient to navigate.

The article also left me wondering about Cedar’s own system for driving revenue growth. I think there is a value proposition that Cedar could provide to health systems by suggesting profit sharing arrangements for increases in collections.

While this sounds like great technology and a promising product, I worry since a lot of these applications have failed in the past, despite seeming to satisfy a need. The market is becoming saturated with healthcare technology solutions meant for improving workflows around engagement, health management, and payments. “Personal health records” seem to increasingly be picking up traction and insurance companies are investing significantly to improve their mobile applications in an effort to differentiate their product to consumers. And of course, the traditional Electronic Health Record industry is actively trying to maintain their dominant market share in this space. I think the real challenge for Cedar is figuring out how to market itself. Is this a B2B product, a B2C product, can it be both? Are there additional features they should incorporate to make the product “stickier”? Can they partner with one of these other players to grow their product and reach a critical mass of consumers?

Thank you for the thoughtful piece of work. Cedar certainly seems to bring some very interesting and impactful technology to bear, and I agree the applications of such technology can be broad-reaching. I wanted to pick up on your question regarding patient privacy, as this has routinely presented a roadblock for technology-based B2C solutions in the healthcare realm. I am skeptical that such a solution can ever be forced upon a patient against their will, even if the hospital or physician community embraces it. In the end, it will still be an opt-in/opt-out model. For me, the key will be demonstrating product efficacy, to enhance the cost-benefit in the eyes of the patient. Cedar and others will need to quantify the improved health outcomes from sharing incremental data, and convince customers that the “price” they “pay” for improved coordination of care is a tradeoff worth making. I certainly agree with your point– there are benefits to scale as well as network effects in this business. Frankly, I’m shocked that when coming to HBS, I needed to piece together my vaccination history from various disparate physicians and clinics I’ve seen over the years – there’s a clear unmet need for centralization and customization.

Of course though, this efficacy will then need to be supported by demonstrated iron-clad privacy controls and encryption capabilities, particularly in the wake of well-publicized cybersecurity breaches that have made the US population increasingly skittish of big tech. I do think we will ultimately get there as a society as more tech-savvy millennials and their descendants become a greater proportion of the population. Perhaps Cedar is well-positioned to take advantage – only time will tell.

Fascinating! I can see that Cedar is addressing an unmet need–there is a clearly a lot of inefficiencies in medical collections. It will be interesting to see whether this technology becomes embedded in the medical ecosystem as service models begin to shift with companies like Karuna Health and ONE Medical, and with the growth in roles like Physician Assistant. Could Cedar’s technology be applied to other collections industries?