Canyon Bikes – delivering outstanding value by cutting out the middle men

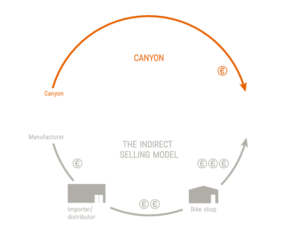

Canyon Bikes are one of the leading direct-to-consumer bike brands – through the use of digital technologies they are able to cut out the downstream segment of the supply chain and deliver excellent bikes to consumers at a much lower price point.

In 2017, Canyon Bikes, the Germany based bicycle manufacturer will enter the US market for the first time, having achieved 30% sales growth year-on-year over the past six years [1]. Their direct-to-consumer business model has had a transformational effect on both the road and mountain bike industries, bringing elite level components to an audience who have never experienced them before, however their role is not without controversy however.

Traditional bike supply chain [2]:

1) RETAILERS

Dominated by independent one-store companies, local bike stores have been the life blood of the industry, selling whole bikes as well as components, offering servicing to customers and, increasingly in some parts of the world, being hipster hang-outs (as I’ll return to later).

2) DISTRIBUTORS

In the USA, companies such as Gita Sporting Goods Inc., who supply Pinerello bikes to the US market, (used by three times Tour de France winning rider Chris Frome) are responsible for distributing bikes to retail stores, holding larger volumes of inventory than the retailers are able to.

3) OEMs

Behind the distributors lie the Original Equipment Manufacturers or (OEMs), such as Pinerello or Cannondale, who act much in the same way as computer OEMs and effectively assemble together components made by separate specialists (for example the Japenese firm Shimano who make a large proportion of all bicycle gears). Other than assembly, the only other role which the OEMs play is the design of the bicycle frame.

4) AGENTS

With compenents overwhelmingly being made in the far-east (Taiwan alone reportedly accounts for 80% of all high-end carbon fibre frames [3]), agents play a leading role in facilitating the efficient use of factories

5) COMPONENT MANUFACTURERS

Most components are built to generic specifications with only the frame being built to the OEM’s design.

Canyon bikes digital supply chain

Through the use of digital means Canyon Bikes has been able to vertically integrate downstream, cutting out both distributors and retailers. Their direct-to-consumer business model uses a best in class website [4] as the point of sale, with the company only two physical retail stores, both of which are in Germany. By cutting out two layers in the supply chain through this digital innovation, Canyon are able to deliver bikes with specifications identical to those of other OEM bikes at significant reductions, often thousands of dollars cheaper for high end models.

[5]

In addition to being able to deliver at a lower price point, the digitally supported canyon supply chain also enables other points of differentiation versus the competition. Firstly, buyers can make modifications to the size of some components in addition to the frame size alone, potentially enabling a better fit for the customer. This is facilitated through a digital tool called the Perfect Position System [6] on the website where riders can input their body dimensions and calculate the best fitting choices. Secondly, purchasers have visibility of stock levels and so can make informed decisions on how long they will have to wait to receive their bikes.

Canyon have also impressively been able to overcome the fact that the digital point of sale prevents customers from ‘trying before you buy’ as is the case in the traditional supply chain. This has been done primarily through two means. Firstly, they have expansively courted the cycling media and have received numerous excellent reviews. Secondly, they sponsor two elite level professional teams, including the Spanish team MoviStar who regularly win many of the sports premier competitions. This link to pro-sports is made all the more real by the fact that Canyon sell bikes which have been used by the pros directly on their website. For instance currently a bike ridden by Nairo Quintana, winner of this years Vuelta Espana, in 2014 is on sale.

Changing the industry

Whilst many consumers may benefit from purchasing a bike online from a direct-to-consumer brand such as Canyon, there is also a downside from such a purchase. Many cyclists rely on the regular service of professional mechanics to keep their bike in good, safe condition. However, by taking away the principle revenue source from the bike shops which they will rely on in future, online consumers are causing real headaches. An interesting way which some bike shops are reacting to this problem however is by becoming hang-outs [8] for the cycling obsessed such as me. After all what’s better than to drink coffee whilst reading cycling magazines, surrounded by other bike nerds to the pleasant soundtrack of mechanics doing all the hard work – often much more pleasant than actually cycling!

[755 words]

[2] http://www.slowtwitch.com/mainheadings/features/bikebiz.html#Anchor-MANAGER-49575

[3] http://taiwaninfo.nat.gov.tw/ct.asp?xItem=30031&CtNode=92&htx_TRCategory=&mp=4

[4] https://www.canyon.com/en-us/welcome.html

[5] https://www.canyon.com/en-gb/shop/information/

[6] https://www.canyon.com/en-gb/tools/pps/

[7] https://www.canyon.com/en-gb/factory-outlet/original-pro-bikes/

[8] http://www.marketwatch.com/story/bike-shops-the-new-starbucks-2013-08-29

Loved the article – being a bike nerd myself. By the way, I feel that I am increasingly encountering a breed of cyclist who just buys a bike so he can hang out in lycra shorts and sip coffee… more to follow.

I thought the ‘try it out’ problem was going to be more significant that it appears to be. The use of brand ambassadors – current pro cyclists – is certainly a compelling value prop for the businesses. Have you seen any type of return policy, or try-it-out model a-la Casper matresses? Another key service that the bike shops provide – albeit with dubious accuracy – is recommendations. Many new entrants to the sport start doing research only to find that they’re overwhelmed by the tremendous variety and wholly unknown vernacular of the sport. LBS’s serve to educate and assist (and upsell – lets be honest) the new customer and I feel that Canyon is missing this entire segment. Any thoughts on how they’ll get around that?

In the meantime, I’ll continue servicing my own bikes at my house – where I serve high-end scotch as well!

This was a great read!

From a consumer psychology perspective, it does make sense that Canyon Bikes has been able to increase sales as consumers are increasingly used to higher-risk purchases through online channels. I agree with the previous comment that for new customers the risk of buying online is even greater and it will be interesting if Canyon Bikes develop a solution to educate and upsell new customers.

As Canyon eliminates retailers and distributors, they seem to take on greater inventory risk that was previously pushed down the supply chain. I wonder if features on their website, such as the visibility of stock levels, influence consumer behavior and reduce this risk. I also wonder if this limits the product portfolio they can carry, or if they would do better with a just-in-time production model, like Dell.

I also worry about the inventory risk that Canyon now needs to take on. The traditional model provided great value to Canyon in that the distributors and retailers generally carried the risk of shifting consumer demands. Unless the lead time for cycles is very short, Canyon will now need to carry safe levels of inventory for all of their offerings to ensure supply/demand matching. Since the majority of components are purchased through agents and far-east suppliers – it is likely that the lead time is significant and Canyon will be taking on an increase in finished goods inventory.

In addition, I worry about distancing yourself from your prime brand evangelists (the retailers). From my prior experiences in bike purchases, these retailers play a huge part in promoting your brand and fostering sales of your products. I also imagine that these retailers are the best equipped to provide Canyon with information on market trends, customer perceptions, quality issues etc. that are critical to the forward success of the company. For a purchase of this value I tend to believe that the retail experience is critical for first time buyers and brand recruiting. The DTC model should be targeted towards the more experienced, loyal consumers who know exactly what they are looking for.