Can Ford truly transform itself from a car manufacturer into a smart mobility company?

Given the high level of disruption in the automobile manufacturing industry, Ford has decided to transform itself into a smart mobility company. However, it is not clear if this transformation is the best move forward strategy for Ford.

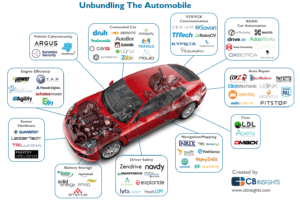

In 1894, large cities, such as London and NYC, were suffering from a major horse-manure crisis. A Times writer even forecasted that “in 50 years every street in London would be buried under nine feet of manure” (Davies, 2004). Thanks to the ingenuity of Henry Ford our modern civilization was never buried in horse-manure. However, a century later, society is concerned with the impact of the continuously increasing number of automobiles (For instance, traffic, environmental impact, cost). Ford wants to respond to this challenge by transforming itself from a car manufacturer to a smart-mobility company. Though Ford’s transformation initiative likely spurs from a preservation desire rather than a pure social impact perspective (Ford’s net income from operating activities from 2013 to 2015 has declined at -13% CAGR) (Yahoo Finance, 2016). The traditional automobile manufacturing is being highly disrupted from all directions – new technologies & players (e.g., Google, Tesla), changing consumer behaviors (e.g., decreasing purchasing cycle), and sustainability policies (McKinsey, 2016) (See Figure 1 – Unbundling The Automobile). But is Ford’s transformation strategy truly the best respond to its current operating environment?

Figure 1 – Areas of Disruption

Ford’s Smart-Mobility Efforts

In January 2015, Mark Field, Ford’s CEO, announced its Ford Smart Mobility plan to “use innovation to take it to the next level in connectivity, mobility, autonomous vehicles, the customer experience and big data” (Ford, 2015). This plan started with 25 mobility experiments taking place around the globe to test breakthrough innovative ideas (see Figure 2 – Ford Smart Mobility).

Figure 2 – Ford Smart Mobility

Ford’s experiments addressed different potential opportunities that would enabled Ford to:

Ford’s experiments addressed different potential opportunities that would enabled Ford to:

- Optimize its core products – Fleet Insights, one of the 25 experiments, is a partnership with HP to track the driving behavior of 100 vehicles used in US by HP employees and use the data to optimize the cars

- Expand existing businesses into new areas – Ford Car Sharing in Germany was the first manufacturer-backed, nationwide car-sharing program incorporating dealerships, that offers car sharing to more than 1,100 dealer customers

- Develop breakthroughs – Innovative Mobility Challenge Series calls for innovative mobility solutions for transportation challenges (e.g., reducing traffic congestion)

However, in March 2016, Ford decided to concentrate its multiple individual smart mobility efforts into separate subsidiary – Ford Smart Mobility (FSM). This organization will now act essentially as Ford’s innovation smart mobility R&D arm with a focus on connectivity, mobility, autonomous vehicles, consumer experience, and data & analytics. Ken Washington, Ford’s R&D engineering, stated that “it became clear within the company that it’d be difficult to build business models around those ideas and scale them within the confines of the main company” (Bigelow, 2016). This approach would help Ford to pursue riskier and aggressive projects that may not be profitable in the short term without impacting the parent organization.

In September 2016, FSM acquired Chariot, a San Francisco based commuter ride-sharing startup. This acquisition strengthens FSM’s mobility programs, which includes car sharing initiatives (Etherington, 2016). It is likely that FSM will continue to grow through acquisitions as Ford tries to accelerate its move from experiments to commercialization.

Potential Strategic Advantages of FSM

- Business Amplification – Discover new consumer needs and desires around mobility, and distill implications for Ford’s existing products

- Product Optimization – Develop the ideal “connected car” based on consumer’s feedback of different interactive technologies

- Business Diversification – Create new service businesses that push Ford beyond automobile manufacturing (e.g., data provider to insurance companies)

Potential Risks for FSM & Mitigation Strategies

- Prioritization – FSM has as several key focus areas, which could impact time-to-market. Therefore, FSM should balance growth objectives, risk levels, and strategic relevance across all initiatives.

- Organization – Given its aggressive growth targets, FSM needs to have the right balance of existing Ford and new talent in order to foster ties between the Ford & FSM, incorporate institutional knowledge, and avoid building products in a vacuum.

- Scalability – Ford realized that its smart mobility innovation strategies were not scalable if developed within the constraints of the parent organization. A separate entity such as FSM will likely help to avoid this issue. However, FSM still needs to determine if their products are scalable within Ford. Hence, a FSM should have a formal mechanism to encourage fast iteration and integration.

So what do I think?

Given the current disruption in the automobile industry, it is critical for Ford to evolve. Ford’s efforts are commendable and its competitors are taking notice. Ford’s competitors have not only started similar efforts but have also partnered with well-established market disruptors (E.g., GM’s partnership with Lift). I believe Ford’s smart mobility strategy could be successful if FSM further prioritizes its initiatives, has the right old & new organizational talent, and is able to quickly scale its products. Nonetheless, I believe that in the short term, partnering with established disruptors rather than developing brand new products could help to speed up Ford’s transformation.

(791 words)

References

Bigelow, P. (2016, March 13). Why Ford Decided to Create a ‘Smart Mobility’ Subsidiary. Retrieved from Autoblog: http://www.autoblog.com/2016/03/13/ford-smart-mobility-company-technology-transportation/

Davies, S. (2004, September 1). The Great Horse-Manure Crisis of 1894. Retrieved from Foundation for Economic Education: https://fee.org/media/4495/547_32.pdf

Etherington, D. (2016, September 9). Ford Smart Mobility acquires Chariot to boost its smart city transit plans. Retrieved from Techcrunch: https://techcrunch.com/2016/09/09/ford-mobility-solutions-acquires-chariot/

Ford. (2015, January 6). The Ford Company – Media Center. Retrieved from Media Ford: https://media.ford.com/content/fordmedia/fna/us/en/news/2015/01/06/ford-at-ces-announces-smart-mobility-plan.html

McKinsey. (2016, January). Disruptive trends that will transform the auto industry. Retrieved from McKinsey.com: http://www.mckinsey.com/industries/high-tech/our-insights/disruptive-trends-that-will-transform-the-auto-industry

Yahoo Finance. (2016, 11 17). Ford Motor Co. (F). Retrieved from Yahoo Finance: https://finance.yahoo.com/quote/F/financials?p=F

I agree with a lot of this, but I just wonder if, by partnering with others, you leave yourself vulnerable to being subsumed by them.

Interesting article. Creating a “Ventures” program is actually quite common in oil & gas as well – you see a lot of large organizations like Chevron, for example, who have Ventures programs designed to both acquire and create new technologies that will hopefully transform their business over time. I think this also helps the company attract top young talent to the firm as well.

While I certainly agree that transportation as a whole is transforming in the wake of digitization, I think there are certainly trade-offs for Ford here. Recently you’ve seen a lot of investors bailing on the stock (down ~20% this year, despite record U.S. auto sales), given all of the new programs / initiatives and lack of focus on the company’s core auto business.

Great post, thank you! Interesting to see that the company’s positioned Ford Smart Mobility as a subsidiary. It will be interesting to see how the company incorporates this area’s work into its traditional model and how senior management will weigh short vs. long-term objectives, especially given the pressure that investors are already putting on the stock (as Alex mentions above). As you point out, communication between the two divisions will be key to success.