Can a digital life translate to digitizing Life (Insurance)?

Embracing digitalization is imperative for Life insurance companies to capture much needed supply chain innovations

Can a digital life translate to digitizing Life (Insurance)?

The life insurance industry has been one of the slowest to adopt the increasing digitization of our society. As smaller fintech and insuretech companies look to enter the space, investing in digital experiences and supply chain management will be table stakes for the survival of large insurers. John Hancock, a life insurance company in the US (part of ManuLife Financial), has made significant strides in creating wellness programs linked to the purchase of a life insurance product. By tapping into the growing trend of smart, connected products (e.g. apple watch, fit bit, etc.) Hancock is able to turn the life insurance sale around to focus more on the living benefits of the product. However, the real potential is unlocking the massive amounts of data through connected devices to digitize the entire life insurance supply chain: streamline product development, speed up underwriting, and simplify distribution to deliver more bespoke products, more quickly, and at a lower cost (to both the insurer and customer).

Currently, Hancock has used the digitization of wellness as a means to attract and engage their customers (and build brand awareness). Specifically, they have developed a program where customers can share data from their connected device showing steps walked (or other activity indicators) and healthy spending habits, and in turn “earn rewards towards their insurance premiums and discounts with health-based retailers.”[1] Hancock’s near-term plans remain at the “monitor stage”[2] of the capabilities of smart, connected products. Their near-term focus is on creating partnerships with manufacturers of connected devices (e.g. recent partnership with Apple watch to reward customers) and with health retailers. Hancock has correctly identified the opportunity to optimize risk management “Sensor technology could be used to help develop a more proactive approach to risk management and customer support by allowing your business to monitor policyholders’ health in real time and alert them to any early signs of illness. Your business would benefit from reduced liabilities and could offer lower premiums in return.”[3] Their program offers the opportunity to re-assess underwriting at each policy anniversary, an improvement from the once and done traditional underwriting model, however without a clear link between wellness activity and improved mortality outcomes, the data being shared by customers with Hancock offers limited insights and does not create any efficiencies in the life insurance supply chain. Furthermore, by focusing on “wellness” the company has missed an opportunity to drive meaningful product innovation for customers who need it the most – those who are at risk for developing serious chronic conditions and who are most penalized during the life insurance underwriting.

My recommendations for Hancock’s management team are to 1) shift their focus from “wellness” to disease management, and 2) invest in data capture platforms and new underwriting and policy admin systems. For the first, Hancock has the opportunity to partner with medical device companies like Medtronic, to offer life insurance solutions for customers struggling to manage diabetes. While these devices are arguably still in the “monitor” category, they involve actual sensor technology and provide meaningful biometric data – a step up from step trackers.

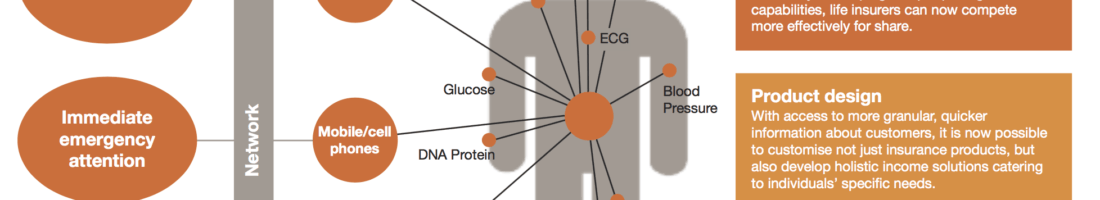

See attached image: Sensor technology enhances insight and prevention[4]

In the near term, a program like this can capture greater risk management upside by improving mortality outcomes for customers that need more active health management. Longer term, Hancock can use this data to enrich their product pricing, and create sophisticated predictive underwriting models to significantly reduce the time and pain points associated with underwriting. This dovetails into my second recommendation, investing in the analytics capabilities needed to ingest, interpret, and harness data from multiple sources.

In order to survive and thrive in the next 10-20 years, Hancock must capture biometric, social network, geographic, financial data etc. and evolve towards an information eco-system and supply chain where “the core decision-making and the analytics engine that supports decisions are likely to converge at a single point.”[5] This will result in a much more efficient supply chain with products tailored to specific needs, more direct to consumer distribution networks, significant reduction in time and cost associated with complex underwriting.

Key question:

- Is Hancock too far behind the technology and digital curve to meet the increasingly exacting demands of customers who are “accustomed to the choice and accessibility of retail sites, such as Amazon and the one click interaction of an Apple app”[6]?

Word Count: [791]

[1] Manulife, 2016 Annual Report, p. 35

[2] Michael E. Porter and James Heppelmann, “How Smart Connected Products are Transforming Competition”, Harvard Business Review (November 2014)

[3] PWC, “Life insurance 2020: Competing for a future”, p. 7

[4] PWC, “Life insurance 2020: Competing for a future”, p. 19

[5] Digital McKinsey, “Digital disruption in insurance: Cutting through the noise”, p. 80

[6] PWC, “Life insurance 2020: Competing for a future”, p. 14

I agree that this could help Hancock succeed in the long term but I worry about the implications of sharing health data with these life insurance companies. There are already strict regulations around handling patient data that is collected at a doctor’s office and consumers are aware of their need to be secretive about their health information. Given that biometric data is so much more revealing than height and weight taken once a year in a medical record, would the financial reward Hancock could offer be enough to entice customers to take on this risk of sharing their data? In implementing these plans, Hancock needs to be aware to position this program appropriately to consumers to get their buy in.

Really enjoyed this, Mayra! One question I have with these sorts of programs is: Is this just a disguised form of “skimming” healthier customers? Or is there real value being created? Regarding “skimming,” you can imagine an offering where customers who participate in the program and report healthy outcomes are provided substantial discounts, while prices are maintained or increased on unhealthy customers or those unwilling to participate. These discounts and programming targeted are used to attract and retain healthy participants, driving down the company’s cost of claims given their lower risk profile. On the other hand, you can imagine a program that is successful at motivating customers to live healthier lives through rewards, gym discounts, gamification of healthy behavior, etc. This model would drive down claim cost by creating healthier customers, not just attracting them. Given public and regulator’s uncertainty around this sort of data collection, I think proving the latter is happening (creation not just skimming of healthy customers) will be critical to winning acceptance from society and preventing regulatory barriers.

Great piece. Your note on the focus on wellness is important. I’ve read about the advent of these programs for life insurance companies, and it always comes back to this piece of wondering if tracking steps and sleep is really allowing life insurance companies to reward behaviors that, in turn, lower their payouts.

However, I don’t think the biggest worry are the people with chronic conditions you mention. I think the primary area of focus should be in between — people who have bad health behaviors that are harder to track via a device. There is a growing body of evidence that discusses the link between chronic stress and leading causes of death [1]. However “stress” is hard to track on a wearables device. How can insurance companies nudge wearables companies to develop the technology to track the byproduct of stress in the body more closely? I think that is an important question. Investment or acquisition in the health tracking space both seem like options to explore, which you discuss.

[1] http://www.miamiherald.com/living/article1961770.html