Bringing Robo-advising to the World, One Bank at a Time

SigFig looks to deliver robo-advising to banks…maybe.

Wealth Management and Robo-advising

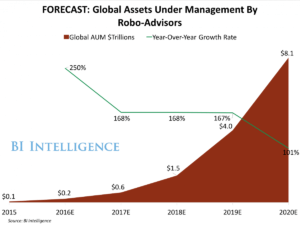

Globally, wealth managers had $74 trillion in assets under management (AUM) in 2014. The percentage of that managed by robo-advisors (automated, algorithm-based portfolio management advice) is currently only a small fraction, but expected to grow incredibly rapidly. [1]

SigFig – The Beginnings

SigFig is a robo-advisor hoping to reap some of the expected rewards during the digital transformation of the wealth management industry. Like its better known cousins Betterment and Wealthfront, SigFig started out with a business-to-consumer (B2C) business model, looking to get consumers directly onto its platform. SigFig, however, was late to the game, launching that service in early 2014, and by mid-2015 only had $69 million under management [2]. In this author’s humble opinion, SigFig had the best technology, so why was it doing so poorly?

The reason, of course, is that in a highly competitive industry, it is not just the best technology that wins. SigFig’s robo-advisor competitors had been around for longer and had raised more money, allowing for greater marketing. And from an operational perspective, there was limited differentiation from their competitors, who were all small tech companies who were built to iterate quickly and constantly to deliver what needy customers demanded.

A Change in Business Model to Survive

In mid-2015, SigFig changed its business model from B2C to business-to-business (B2B) [2]. By moving to a less competitive B2B space, SigFig could look to partner with banks who already had significant AUM and more effectively participate in the rapid transformation of the wealth management industry. I think the premise would be that big banks wanted to quickly offer robo-advising to their customers, as well as have a technology that can keep up with its customers’ demands. SigFig was able to build out its technological capabilities so its tech could integrate with the bank’s own system, which allowed for this business model transition.

SigFig’s DNA as a small tech company meant that it has an operating model that relied on real-time feedback from customers using their technology, and the ability to incorporate that feedback into technological improvement. Banks, on the other hand, were less nimble and in theory would be less comfortable developing their own technology, which may have trouble keeping up in the rapidly moving world of robo-advising.

SigFig struck its first deal with Cambridge Savings Bank, a $3.2 billion bank, who is calling its SigFig offering Connect Invest. [3] Since then, SigFig has engaged in partnerships with two much larger banks.

SigFig’s Major Partnerships

UBS Partnership

In May 2016, SigFig signed a partnership with UBS. Interestingly, UBS isn’t aiming to use SigFig’s technology to provide robo-advising to the masses. Rather the partnership is “designed to enhance and expand the services our advisers can provide to their clients and their overall digital experience,” according to the president of UBS Americas. [4] The use of this technology doesn’t seem to match SigFig’s robo-advising business model – it looks like its creating wealth management tools, and no advice is being given.

Despite that, UBS did realize the value of SigFig’s operating model in digital world, noting that “we wanted to partner with a player who was leading in the industry in the space, who had the ability to adapt rapidly, to prototype rapidly and to launch incremental capabilities in really short timeframes.” [5]

Wells Fargo Partnership

Within the last week, SigFig has engaged in a partnership with Wells Fargo that has a distinctively different flavor to the UBS partnership. Wells Fargo has noted that it hopes to use the partnership to bring robo-advising to its clients, and use this as the gateway for more expensive services. [7] This seems to fit perfectly with SigFig’s business model.

However, Wells Fargo also stated that the decision to partner rather than build a product in house was due to desire to bring a product to market ASAP, which doesn’t seem to recognize the value of SigFig’s operating model in enhancing technology. [7]

Next Steps for SigFig

I think fundamentally it doesn’t matter whether SigFig provides robo-advising to banks or not – banks’ customers are demanding snazzy tech interfaces and information transparency, and SigFig can position itself as the provider of whatever that tech is. What SigFig absolutely needs to do is demonstrate that their operating model allows them to become more intimate with their technology and what customers want, and reflect that understanding quickly in the next iteration of that tech. Whatever SigFig builds, a bank will be able to also build it if given enough time. But they won’t be able to keep it at the cutting edge in the same way a small nimble company like SigFig can. SigFig needs to convince all its partners (looking at you Wells Fargo) that’s the case – otherwise they won’t be around long enough to see the digital transformation. [Word Count: 799 words]

Sources

1 Sarah Kocianski, “THE ROBO-ADVISING REPORT: Market Forecasts, key growth drivers, and how automated asset management will change the advisory industry,” Business Insider, June 9, 2016, http://www.businessinsider.com/the-robo-advising-report-market-forecasts-key-growth-drivers-and-how-automated-asset-management-will-change-the-advisory-industry-2016-6, accessed November 2016.

2 Kelly O’Mara, “Why SigFig is shifting its focus to using banks as middlemen despite having captive consumer audience of $350 billion,” RIABiz, July 21, 2015, http://riabiz.com/a/2015/7/21/why-sigfig-is-shifting-its-focus-to-using-banks-as-middlemen-despite-having-captive-consumer-audience-with-350-billion, accessed November 2016.

3 Liz Moyer, “New Financial Investment Rules May Aid Robo Advisers,” New York Times, April 7, 2016, http://www.nytimes.com/2016/04/08/business/dealbook/new-financial-investment-rules-may-aid-robo-advisers.html, accessed November 2016.

4 Michael Wursthorn, “UBS Teams with Robo-Advice Provider, Wall Street Journal, May 16, 2016, http://www.wsj.com/articles/ubs-teams-with-robo-advice-provider-1463418199, accessed November 2016.

5 Janet Levaux, “The UBS-SigFig Partnership,” ThinkAdvisor, September 26, 2016, http://www.thinkadvisor.com/2016/09/26/the-ubs-sigfig-partnership?&slreturn=1479651345, accessed November 2016.

6 Michael Wursthorn, “Wells Fargo Goes Robo with SigFig Wealth Management,” Wall Street Journal, November 15, 2016, http://www.wsj.com/articles/wells-fargo-goes-robo-with-sigfig-wealth-management-1479242552, accessed November 2016.

7 Ryan Neal, “Wells Fargo Partners With SigFig to Develop Robo Advisor,” November 15, 2016, WealthManagement.com, http://www.wealthmanagement.com/technology/wells-fargo-partners-sigfig-develop-robo-advisor, accessed November 2016.

Great post Andrew! This is an especially interesting topic for me as my fiancee has been working in Wealth Management for the past 2 years. Your point SigFig’s transition to B2B is a good one, and a move that many other companies have been making (ex: Jemstep, Future Advisor, LearnVest, source: https://www.kitces.com/blog/robo-advisor-growth-rates-and-valuations-crashing-from-high-client-acquisition-costs/) and I personally think this is in part because of the “trust” aspect that is difficult to convey through a robo-advisor. I know that a lot of effort has been put into creating algorithms that generate superior returns, but I’d also be interested to see how robo-advisor companies work to cultivate this trust aspect in the future (partnering with existing institutions in one way) as I think this might be a powerful source of product differentiation going forward.

Great post! I’ve been considering moving part of my portfolio into a robo-fund because of the low cost structures and great automatic re-balancing. I think its very interesting that these companies are partnering with some of the bigger players. In response to DT’s point above, I think that having customers see this type of product being offered through a big name brand bank may help drive trust and adoption. Well maybe not anymore with Wells Fargo! However looking at big banks like Charles Schwab offering an automated portfolio (https://intelligent.schwab.com/) I am very willing to test the product.

Although robo-advisor AUM is growing, it appears that the growth rate is slowing down. I found this to be very interesting and wanted to see what you thought on this point.

It has been amazing to see an industry such as private wealth management beggining to be replaced by digital technology. Private wealth management has been an industry driven primarily by trust in the broker in managing your life savings, with very high commissions paid. The fact that robo-advisory AUM is growing so rapidly is a testament to how our society is embracing and trusting technology with managing something as important as our entire life’s savings. My thoughts about the likelihood of digital technology transforming the real estate broker sector also apply to the robo-advisory sector. I would suspect that individuals with relatively lower net worth will be the first to adopt and embrace robo-advisors because the stakes are generally lower. Once the industry is able to demonstrate that it can produce higher overall returns across portfolios over time (partially because of its lower management fees) than I believe that more sophisticated and wealthier individuals will being embracing the technology. In the very long term as the software that runs robo-advisors becomes smarter and competition in the space causes fees to drop, I would guess that physical private wealth managers will all but be entirely replaced.

Great post. Robo-advising is definitely going to reshape how most of us invest.

I think one of the main concerns for SigFig, its partner firms, and the robo-advising industry in general going forward will be how they can keep this new technology compliant with existing law and future SEC regulation. The SEC has stated a number of times that they are continuing to look at may of these new technologies and trying to ascertain whether they follow all best compliance practices for the retail investor. They have written guides for investors (https://www.sec.gov/oiea/investor-alerts-bulletins/autolistingtoolshtm.html) and just last week SEC chair Mary Jo White cautioned investors about robo-advisors limitations (https://www.sec.gov/news/statement/white-opening-remarks-fintech-forum.html).

For me, it is not a question of if someone will screw up, but when and how the industry will deal with it. I can imagine someone losing money in an investment with a robo-advisor, filing a class-action lawsuit, and in discovery, emails from the robo-advisor coming out saying something along the lines of, “these are retail investors, we can sell them anything and they don’t know any better.” While it is great that they can provide investment services for lower costs to individual consumers, I think they will have a harder time navigating the investment compliance landscape.

Thanks Andrew. I just wanted to challenge the ultimate commercial capacity of these robo advisors. You note that penetration of these products is still quite modest despite being on the market for some time. I think this is a product of the fact that robots simply cannot match the same fundamental analysis required in sound investing that humans can deliver. Not sure how commercial these products will ever get. That said, I totally agree that the transition from B2C to B2B was a great idea. Much less competitive market and it seems they have real traction with some well capitalized, respected banking institutions.

Really interesting article. The banks’ use of technology is certainly interesting and they’re clearly aware they need to get into this space. I’m a little concerned about the popularity of platforms serving wealth management businesses, and understand why UBS went about its lukewarm partnership with SigFig. While such a tool would be of excellent use for smaller customers in terms of providing market analysis or data, in practice it’s difficult to serve clients (particularly those in the high net worth bracket) without a significant amount of human interaction and relationship building.

Great post! Very interesting (byt maybe less straightforward) observation to me was seeing how the finance industry is reacting to quickly changing environment. Start-up and new technologies are popping up so fast, it hardly is possible for the old-style, brick and mortar businesses to keep up with the innovative pace of the modern, digitized World. From my private perspective, I just came from a Hackathon and I discovered that almost all the corporate sponsors of that event, were willing to mentor the start-ups that they considered potentially important or disruptive for their core business. To me the biggest lesson from this post is how to react to changing environment. If you can’t innovate yourself, you have to pay the premium to others to do that for you (by partnership of acquisition).

I think its great that SigFig altered its business model to partner with companies rather than directly to investors. Given banks already dominate the investment management business, SigFig would have had to devote significant capital to marketing in order to convince customers to remove their money from their current management accounts. This would be quite difficult, and so it seems like this is a perfect middle ground for the firm. I’d be interested in hearing more about the algorithm SigFig uses, although it is probably proprietary. As a retail investor myself, I am still skeptical of the value that would be offered by putting my cash into a fee-based, robo-investing system. I think a level of transparency is therefore necessary to convince consumers who SigFig would interact with through their partnerships to consider a SigFig managed firm. Unless it’s the most advanced machine learning-based algorithm that could beat a human at Go, I’m unlikely to give up even 1% of my cash just to follow the robo-investing fad.

Thanks Andrew!

I do believe this is a very viable alternative to human PWM’s and a logical consequence of the algorithmisation of trading in general, but I wonder whether this business model will in turn be disrupted, and pretty rapidly too. With the increasingly cheap computing power, it seems very feasible that somebody will come up with an app powerful enough to manage your finances without the need for a 3rd-party adviser.