bKash, BRAC’s venture into mobile banking

bKash – the story of how BRAC Bank introduced “transferring money by air” and developed the world’s second largest mobile money service in Bangladesh

In 2011, changes in government regulations allowed BRAC Bank, one of the leading private banks in Bangladesh, to launch the country’s first mobile money service, bKash. Mobile money is an electronic wallet service that allows users to store, send and receive money using their mobile phones. Bangladesh possessed key characteristics for mobile money’s successful adoption: universal wireless network coverage, widespread ownership of mobile phones, and a cash economy. Less than 15% of Bangladesh’s 160+ million inhabitants have accounts at formal financial institutions whereas over 68% have mobile phones[1]. The launch of bKash allowed the country’s unbanked to obtain access to a safe and convenient method of sending money via basic handsets. As of 2015, bKash was the second largest mobile money company in the world – its services were used by over 17 million Bangladeshis and it handled more than 70 million transactions a day[2].

In 2011, changes in government regulations allowed BRAC Bank, one of the leading private banks in Bangladesh, to launch the country’s first mobile money service, bKash. Mobile money is an electronic wallet service that allows users to store, send and receive money using their mobile phones. Bangladesh possessed key characteristics for mobile money’s successful adoption: universal wireless network coverage, widespread ownership of mobile phones, and a cash economy. Less than 15% of Bangladesh’s 160+ million inhabitants have accounts at formal financial institutions whereas over 68% have mobile phones[1]. The launch of bKash allowed the country’s unbanked to obtain access to a safe and convenient method of sending money via basic handsets. As of 2015, bKash was the second largest mobile money company in the world – its services were used by over 17 million Bangladeshis and it handled more than 70 million transactions a day[2].

What explains bKash’s fast growth?

To set up bKash, BRAC Bank had to establish a unique business and operational model which was fundamentally different from commercial bank structures. The success of mobile money is dependent on rapid adoption by customers as well as the establishment of a wide agent network which allows customers easy access. BRAC Bank tapped its base of small and medium enterprise borrowers (e.g. grocery store proprietors) to initially establish bKash’s agent network. The agent network grew from 500 in 2011 to over 135,000 by 2015[3],[4]. With the Central Bank’s support, bKash entered revenue-sharing agreements to access the USSD gateway with all four big mobile network operators, providing access to over 98% of mobile phone subscribers[5]. Partnerships with international investors such as the Gates Foundation allowed the founders to access international experts on agent network management and ensured that the company could make the necessary technology investments to ensure superior service[6].

bKash’s value proposition was particularly strong for the urban migrant population. Prior to the introduction of bKash, migrant workers sent cash monthly to their families in rural areas via acquaintances or courier companies. Cash got lost or arrived late, which led to significant hardships for rural families with no other sources of income. bKash’s broad distribution network and prolific advertising campaign thus led to rapid adoption rates.

How does bKash work?

bKash isn’t just for money transfers, it’s a payroll system, a mobile wallet and a savings account – it’s digital, affordable and regulated by the Central Bank[7]. Customers can open bKash accounts, which run on a fully encrypted VISA technology platform, for free. Its simple interface can be accessed by the cheapest (i.e. $15) handsets. Unlike a commercial bank, there are no minimum balance requirements and customers need minimal documents to open accounts – a photo and national ID are sufficient[8]. bKash earns revenues from service charges (1.3% – 1.8% for purchases (charged to merchants), 2% for cash-outs and Tk.5 ($0.06) for person-to-person transactions).

bKash isn’t just for money transfers, it’s a payroll system, a mobile wallet and a savings account – it’s digital, affordable and regulated by the Central Bank[7]. Customers can open bKash accounts, which run on a fully encrypted VISA technology platform, for free. Its simple interface can be accessed by the cheapest (i.e. $15) handsets. Unlike a commercial bank, there are no minimum balance requirements and customers need minimal documents to open accounts – a photo and national ID are sufficient[8]. bKash earns revenues from service charges (1.3% – 1.8% for purchases (charged to merchants), 2% for cash-outs and Tk.5 ($0.06) for person-to-person transactions).

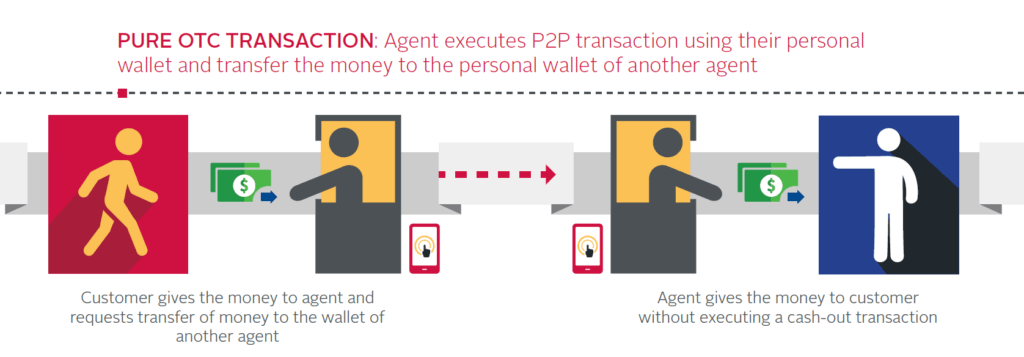

Although bKash provides multiple services, customers are less likely to use a registered account and typically make transactions over-the-counter (OTC)[9]. In an OTC transaction, both parties rely on agents for funds transfer. Many bKash users are unfamiliar with technology and consider it to be risky to use their own mobile wallets given the potential for human error. bKash’s additional services are thus underutilized, limiting revenue potential for the company.

Although bKash provides multiple services, customers are less likely to use a registered account and typically make transactions over-the-counter (OTC)[9]. In an OTC transaction, both parties rely on agents for funds transfer. Many bKash users are unfamiliar with technology and consider it to be risky to use their own mobile wallets given the potential for human error. bKash’s additional services are thus underutilized, limiting revenue potential for the company.

How can bKash expand its footprint?

Mobile money is considered to be the “perfect platform for Bangladesh to take financial services to the country’s largely unbanked population”[10]. How can bKash continue to use digital technology to transform the lives of the country’s unbanked?

- Partnerships with the ready-made garment (RMG) industry: Bangladesh’s RMG industry employs over 4.5 million Bangladeshis, who are typically paid in cash. Adoption of bKash’s services to pay wages (i.e. wage digitization) can increase payment efficiency and reduce the risk in handling large sums of cash on payday[11]. Wage digitization will lead to factory workers opening their own bKash accounts, which will have the added benefit of encouraging workers to save money on their mobile wallets.

- Provide better local language access: Since many mobile phones only have English menus, bKash could explore developing easy-to-use visual aids that explain English menus in Bangla and through pictures. bKash should consider offering interactive voice response (IVR) menus that customers can use to access their account, which will be beneficial in rural areas with high illiteracy rates[12].

- Introduce mobile based credit services: bKash should explore the potential for credit risk analysis and scoring using mobile phone usage data[13]. Introducing credit scoring services and micro-loan products tied to mobile wallets in Bangladesh could help to bridge the gap in formal credit access and allow Bangladeshis to build their credit history.

The steps proposed above may take years to implement. However, by continuing to innovate, bKash can increase its relevance and prove that financial institutions can have a positive social impact while turning a profit at the same time.

[1] https://www.bkash.com/about/company-profile

[2] http://www.wsj.com/articles/mobile-banking-provides-lifeline-for-bangladeshis-1435043314

[3] http://www.impatientoptimists.org/Posts/2014/06/Mobile-Money-in-Bangladesh-Shifting-from-Scale-to-Innovation

[4] http://www.cashlearning.org/downloads/mfsinbangladeshapril2015.pdf

[5] https://www.cgap.org/publications/bkash-bangladesh-fast-start-mobile-financial-services

[7] http://www.bloomberg.com/news/videos/2016-01-15/why-bill-gates-is-investing-in-mobile-banking

[8] https://www.bkash.com/support/frequently-asked-questions

[9] http://www.cashlearning.org/downloads/mfsinbangladeshapril2015.pdf

[10] http://www.wsj.com/articles/mobile-banking-provides-lifeline-for-bangladeshis-1435043314

[11] http://finclusion.org/blog/fii-updates/the-case-for-wage-digitization-in-bangladeshs-garment-factories.html

[12] http://www.cashlearning.org/downloads/mfsinbangladeshapril2015.pdf

[13] Ibid

Interesting post!

It seems that the expansion of bKash is best in class when compared to similar platforms in other countries. However I am a bit concerned by how their fees structures can affect their market penetration if attacked by competitors charging smaller fees (or even no fees). The main difference between bKash and Venmo is that bKash can be used as a savings account. Since it is free to perform most common operations in Venmo, (https://venmo.com/about/fees/) do you think that bKash should evolve towards a free model? They are in a business that hinges on the network effect and they are clearly the leader, but will this competitive advantage allow them to charge a premium for their services?

Hi there, thanks so much for the post. Interesting read.

I’ve spent some time research the impact of digitalisation on finance also – particularly in East Asia emerging markets (mostly China), so was very interested to look at this example in Bangladesh. I guess my main questions would be:

1) What would you say is the biggest risk to the business? For me, it has to be regulation – at least in the markets I’ve seen this. What do you think? Is it sustainable? Since the original change in regulation in 2011 that you mention, what has happened?

2) What would you say is defining about the technology that makes it so suitable to Bangladesh? Would you see it growing its business overseas, or is this much more of a domestic play?

3) Do you imagine they will try to do more partnerships like the Gates Foundation?

Thanks! Interested to learn more.