Bitcoin Mining and the War Between Digitalization, Environmentalism and Profitability

Bitcoin and cryptocurrencies have become one of the hottest industries in the global markets today, but do the little-known underlying environmental costs of producing them challenge the existence of the industry?

So What About Bitcoin:

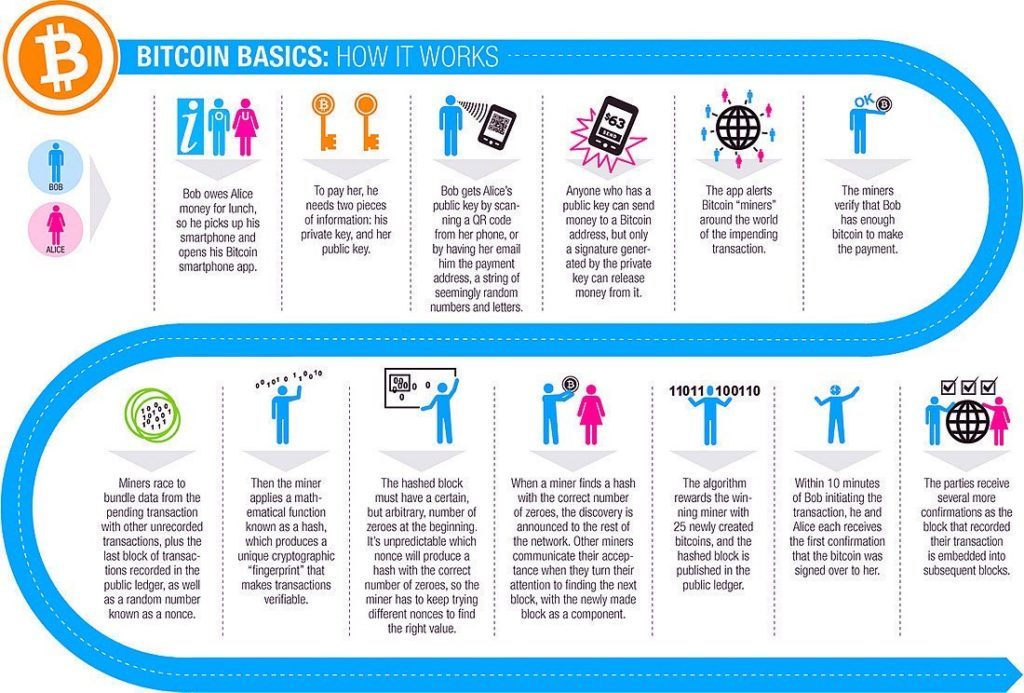

The digitalization of currency represents one of the most exciting and evolving dynamics in today’s global economy. Through blockchain peer-to-peer electronic cash systems, Bitcoin and other cryptocurrencies add material benefits to transactions, including rapid payments, elimination of intermediaries and fees, immutability, and anonymity.[i] As a result, Bitcoin popularity has risen substantially and an ever-increasing number of e-commerce organizations, including Expedia, Microsoft, and Overstock.com, are now accepting Bitcoin.[ii]

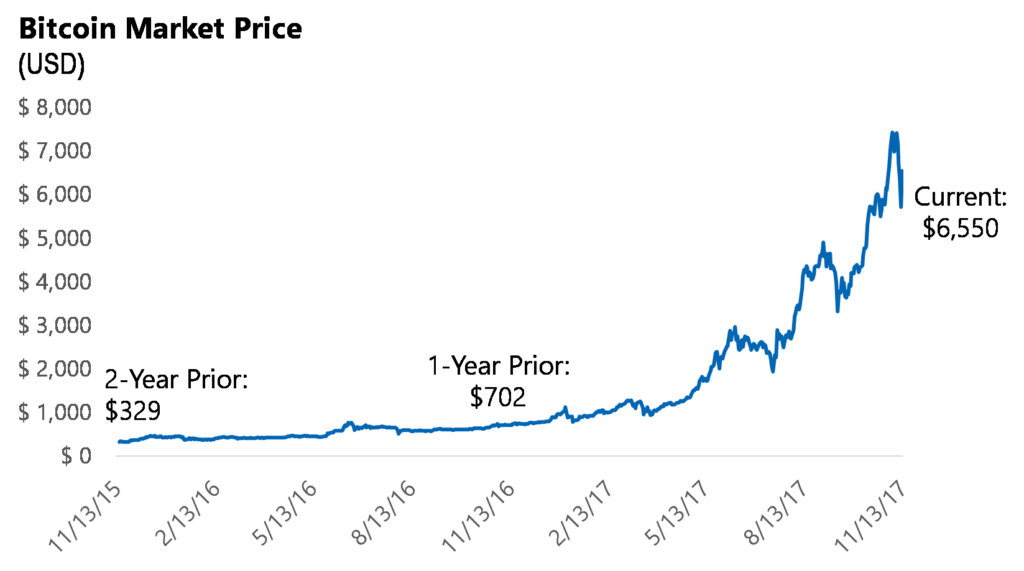

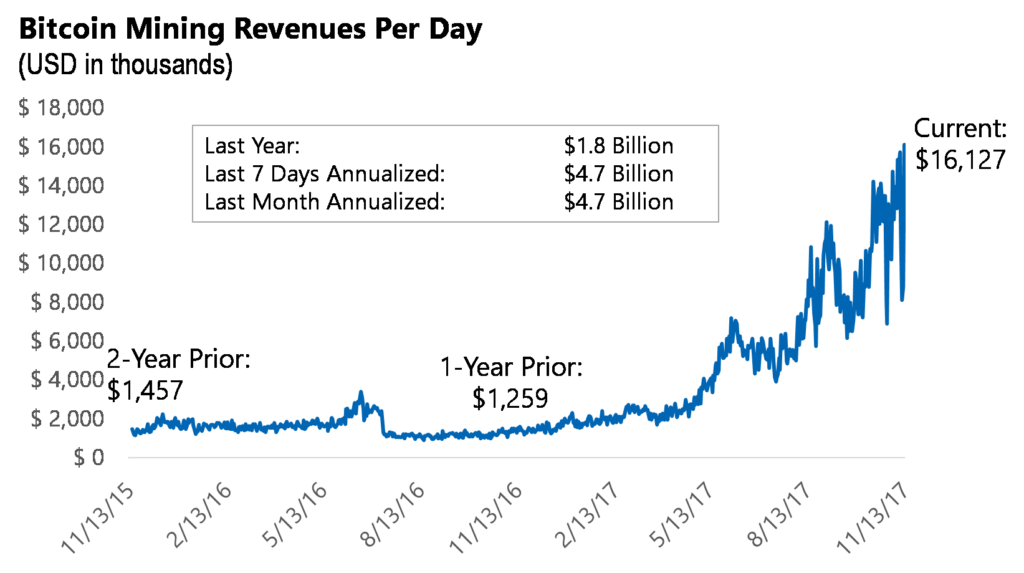

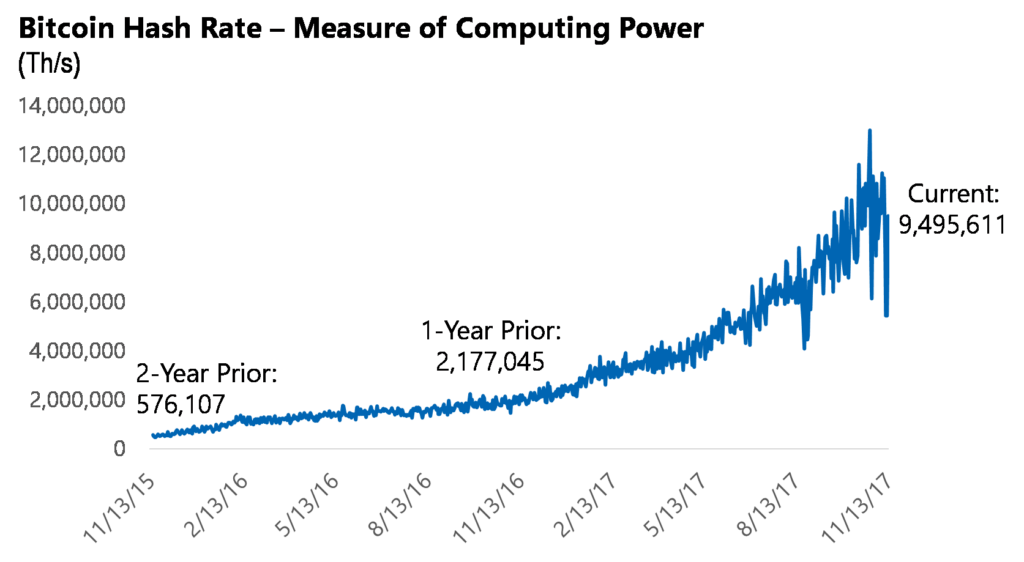

Moreover, increasing interest in non-centralized cryptocurrencies has driven up the price of Bitcoin exponentially to $6,550 currently, an 833% increase year-over-year.[iii] This has given rise to the thriving bitcoin mining industry that now generates approximately $4.7 billion annual revenues.

Not Without a Cost:

While the increasing adoption of Bitcoin creates numerous cross-industry opportunities, it also presents unique environmental and cost challenges for Bitcoin supply chain participants. The system is designed to maintain a steady rate of currency production by adjusting problem complexity based on speed solved. The rapid rise in prices has caused a corresponding rise in dedicated computing power, and thus a commensurate exponential increased puzzle difficulty.

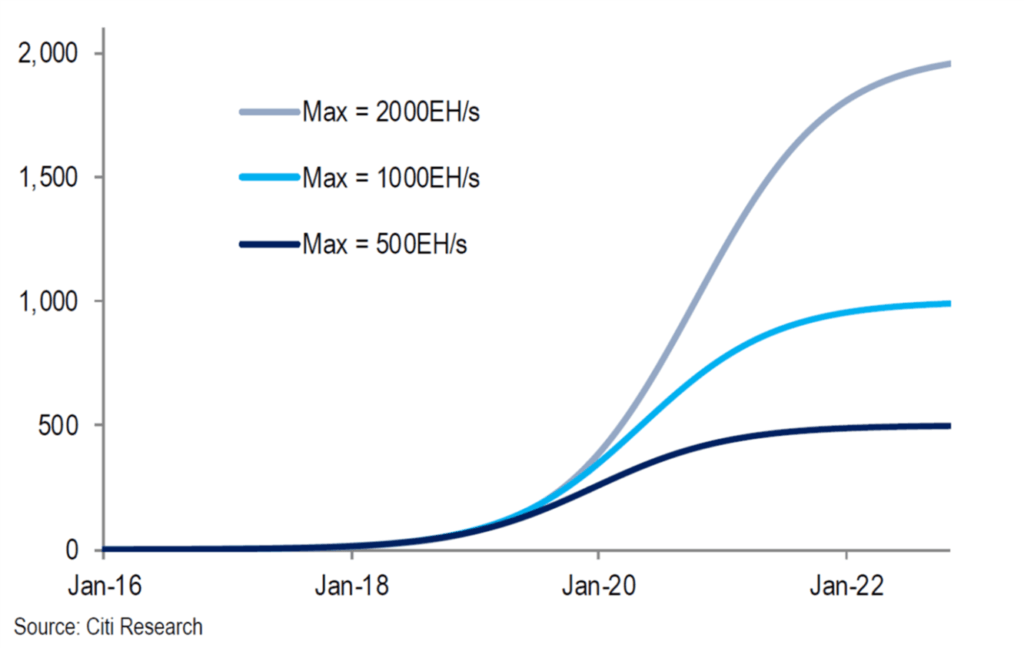

The dark consequence of this proliferation has been the rise in energy consumption required to mine bitcoin. The numbers are staggering. As computing power has increased, average energy usage per transaction – ~90-95% of mining costs – has risen to 215 kilowatt-hours, enough to power a US household for a week. [vii],[viii]

China-based Bitmain, the world’s largest miner, exemplifies the breadth of these challenges.[ix] Bitmain’s largest mining operations are located in Inner Mongolia, China, where it benefits from 30% tax-subsidies on power.[x] However, these mines utilize coal-plants to power their consumption, generating an estimated 24-40 tons of CO2 per hour per plant, roughly the emissions of running a Boeing 747 over the equivalent timeframe.[xi] This generates significant risk of regulatory action in the future, which could include elimination of subsidies as the Chinese government has recently been evaluating its stance on Bitcoin.[xii]

Taken holistically, the numbers are even more ominous. Annualized mining power consumption now equals ~27.3 TWh, overtaking Ireland as the world’s 65th largest consumer.[xiii] Moreover, at this rate, by 2022 mining consumption will equal that of Japan.[xiv] This growth not only would imply a highly-unlikely required trading price between $300,000-$1,500,000 for mining profits to breakeven, but also exacerbates the risk of global regulation or taxation initiatives to limit such power usage, clamping the viability of the industry.[xv]

May the Best Chip Win:

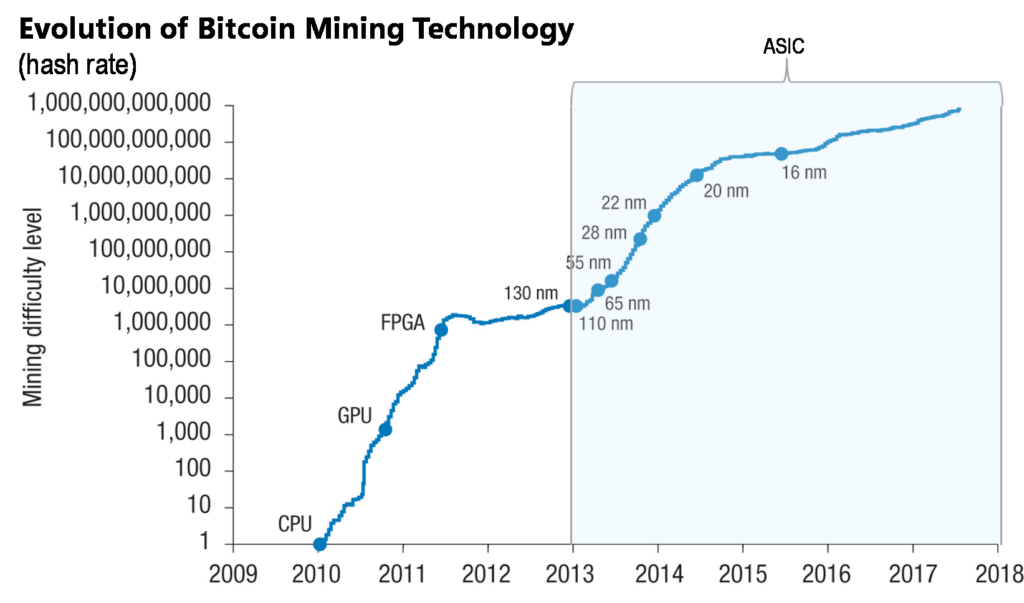

Bitmain and other miners have already acted to address some of these problems. As energy intensity increases, sophisticated miners have invested heavily in processing technology, moving from CPUs to GPUs to application specific integrated circuits (ASICs) specifically designed to improve mining capacity and heat content by orders-of-magnitude versus prior technology.

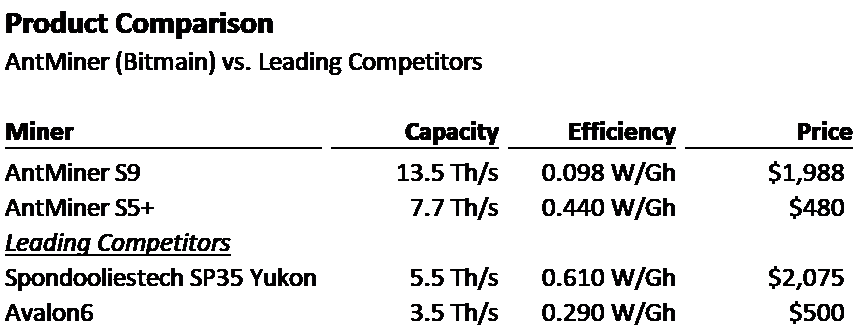

As one of the first miners to introduce ASICs into its operations, Bitmain has remained at the forefront of ASIC development, with its latest Antminer S9 ASIC offering best-in-class capacity and efficiency, positioning it well to remain the world’s largest miner. [xvii]

[xvii]

An Evolution into Machine Learning:

In an effort to diversify its business model, Bitmain also recently announced plans to enter the AI sector. Leveraging its core ASIC capabilities and vertical integration, Bitmain introduced its Sophon BM1680 chip, modeled after Google’s Tensor Processing Unit (TPU)[1], for execution and training of deep learning algorithms.[xviii] This move represents a natural strategic entry for Bitmain into a related, potential $5 billion annual market, as the Sophon is expected to offer significant advantages versus incumbent GPU-based AI accelerators.[xix] Further, this should also shield Bitmain over the long-term from potential environmental and cost risks associated with Bitcoin described above.

A Call for Geographic Diversification:

Bitmain should consider moving its mining operations to colder regions with cleaner, cheaper energy, such as Iceland. Various global bitcoin mining companies have offshored operations to Iceland to take advantage of reduced energy costs through cheap renewables generation dual-sourced from Iceland’s geothermal and hydroelectric capacity.[xx]

Additionally, these companies are able to take advantage of Iceland’s perma-cool temperatures to cool their servers – a process typically comprising 30-40% of energy consumption – without electricity to further lower costs.[xxi] While Bitmain has attempted to improve cooling costs through evaporative coolers, its Inner Mongolia operations still experience summer temperatures reaching 97°F, which exacerbate the heat generated from its servers.[xxii] As energy requirements continue to rise, Bitmain should realize significant savings over the medium and longer-term that render the investment worthwhile.

Final Thoughts and Additional Questions:

Overall, the question remains as to what impact, if any, the increasing environmental toll will have on the Bitcoin system. Will governments intervene and what impact will that have on Bitcoin adoption? With these challenges on the horizon, can changes be made to the system to adjust the currency distribution model without compromising the integrity and intent of the currency as a whole?

[Total Word Count: 800 Words]

Footnotes:

[1] For more information regarding Google’s development of TPU capabilities visit https://cloud.google.com/blog/big-data/2017/05/an-in-depth-look-at-googles-first-tensor-processing-unit-tpu

Endnotes:

[i] Nakamoto, Satoshi. “Bitcoin: A Peer-to-Peer Electronic Cash System.” Bitcoin.org, 24 May 2009, bitcoin.org/bitcoin.pdf.

[ii] Nishanian, Mariam. “8 Surprising Places Where You Can Pay with Bitcoin.” Business Insider, Business Insider, 11 Oct. 2017, www.businessinsider.com/bitcoin-price-8-surprising-places-where-you-can-use-2017-10/.

[iii] https://www.coindesk.com/price/ (as of November 13, 2017)

[iv] “Blockchain Charts.” Blockchain.Info, 13 Nov. 2017, blockchain.info/charts/. As of November 13, 2017. Annualized revenues based on last 30-day average.

[v] ICPFonline. “How Bitcoin Works [Infographic].” https://twitter.com/ipfconline1/status/868331047272017920.

[vi] “Blockchain Charts.” Blockchain.Info, 13 Nov. 2017, blockchain.info/charts/. As of November 13, 2017.

[vii] Kelly, Jemima. “Bitcoin ‘Miners’ Face Fight for Survival as New Supply Halves.” Reuters, Thompson Reuters, 8 July 2016, www.reuters.com/article/us-markets-bitcoin-mining/bitcoin-miners-face-fight-for-survival-as-new-supply-halves-idUSKCN0ZO2CW.

[viii] Malmo, Christopher. “One Bitcoin Transaction Now Uses as Much Energy as Your House in a Week.” Motherboard.com, Vice, 1 Nov. 2017, motherboard.vice.com/en_us/article/ywbbpm/bitcoin-mining-electricity-consumption-ethereum-energy-climate-change.

[ix] “Blockchain Pools.” Blockchain.Info, 13 Nov. 2017, blockchain.info/pools/. As of November 13, 2017.

[x] de Vries, Alex. “A Deep Dive in a Real-World Bitcoin Mine.” Digiconomist.net, Digiconomist, 25 Oct. 2017, digiconomist.net/deep-dive-real-world-bitcoin-mine.

[xi] de Vries, Alex. “A Deep Dive in a Real-World Bitcoin Mine.” Digiconomist.net, Digiconomist, 25 Oct. 2017, digiconomist.net/deep-dive-real-world-bitcoin-mine.

[xii] Buck, Jon. “China May Cut Off Cheap Power to Bitcoin Miners.” Cointelegraph.com, 14 Nov. 2017, cointelegraph.com/news/breaking-china-may-cut-off-cheap-power-to-bitcoin-miners.

[xiii] de Vries, Alex. “Bitcoin Energy Consumption Index.” Digiconomist.com, Digiconomist, 13 Nov. 2017, digiconomist.net/bitcoin-energy-consumption.

[xiv] Chapman, Christopher. “Global Credit Strategy View: Crypto’s Power Play.” ThompsonOne.com, Citigroup, 7 Nov. 2017.

[xv] Chapman, Christopher. “Global Credit Strategy View: Crypto’s Power Play.” ThompsonOne.com, Citigroup, 7 Nov. 2017.

[xvi] Khazraee, Moein. “Specializing A Planet’s Computation: ASIC Clouds.” IEEE Computer Society, May 2017, cseweb.ucsd.edu/~mbtaylor/papers/micro_asic_cloud.pdf.

[xvii] “Bitcoin Mining Hardware Guide.” Bitcoinmining.com, www.bitcoinmining.com/bitcoin-mining-hardware/.

[xviii] Moore, Samuel K. “Bitcoin’s Biggest Tech Player to Release AI Chips and Computers.” IEEE Spectrum, 6 Nov. 2017, spectrum.ieee.org/tech-talk/computing/hardware/bitcoins-biggest-tech-player-to-release-ai-chips-and-computers.

[xix] Global Artificial Intelligence Chips Market 2017-2021: Top Drivers and Forecasts by Technavio.” Technavio, Business Wire, 17 July 2017, www.businesswire.com/news/home/20170717005538/en/Global-Artificial-Intelligence-Chips-Market-2017-2021-Top

[xx] Popper, Nathanial. “Into the Bitcoin Mines.” DealBook, The New York Times, 21 Dec. 2013, dealbook.nytimes.com/2013/12/21/into-the-bitcoin-mines/.

[xxi] Peck, Morgan E. “Why the Biggest Bitcoin Mines Are in China.” IEEE Spectrum, 4 Oct. 2017, spectrum.ieee.org/computing/networks/why-the-biggest-bitcoin-mines-are-in-china.

[xxii] de Vries, Alex. “A Deep Dive in a Real-World Bitcoin Mine.” Digiconomist.net, Digiconomist, 25 Oct. 2017, digiconomist.net/deep-dive-real-world-bitcoin-mine.

[iv]

[iv] [v]

[v]

The energy consumption related to Bitcoin mining is certainly astronomical. I read the article below a few days ago which stated that Bitcoin mining now consumes more electricity than 159 individual countries (including 20+ countries in Europe).

I’m also curious how much of the rapid growth in prices for Bitcoin is driven by increasing costs of energy required to mine for them vs other factors. Certain “altcoins” (alternatives to Bitcoin) such as Ripple or Litecoin are supposed to be more energy-efficient than Bitcoin, so I’m wondering if the value of those altcoins will appreciate faster over time as energy costs are brought into the spotlight. However, while some of these lower-energy-consumption blockchains save on mining costs, they may not find favor among security-obsessed cryptocurrency users.

Sources:

https://thenextweb.com/hardfork/2017/11/23/bitcoin-mining-electricity-africa/

You bring up a very interesting topic. Indeed, the energy consumption of Bitcoin mining is worrisome. I believe that another key question to consider is redesigning the Proof of Work protocol that relies on miners cracking cryptographic puzzles through millions of trial and error iterations. So long as this protocol continues, any improvements in processor technology will likely be marginal.

However, the cryptocurrency community has already come up with alternate protocols that circumvent this increasing energy consumption. In particular, the Proof of Stake protocol relies on the fragmented ownership of cryptocurrencies, rather than on brute processing power, to determine which miners get to process transactions. This new protocol does not require the extensive number crunching that the Proof of Work protocol does, and therefore is much more energy efficient.

Take a look in the following link: https://www.investopedia.com/terms/p/proof-stake-pos.asp

Great topic. I’m doubtful Bitcoin will change its current habits though. As Alberto mentioned, Proof of Stake is a massively upgraded consensus protocol over Proof of Work that largely limits electricity expended by miners. POS also provides upgraded functionality and security (removes threat of so-called “51% attacks” that hackers hypothetically could employ).

HOWEVER, it is not so easy to just switch from POW to POS. By nature of Bitcoin’s decentralized governance, it is quite tough to build consensus among various stakeholders (i.e., core developers, open source developers, miners, traders). Ethereum has successfully built consensus for POW and is in the midst of scaling this solution into its operating code via its Casper network upgrade.

As Ryan alludes to, one solution to limit energy expenditures is to make the network more efficient. One of bitcoin’s main deficiencies (or positives depending on whether you ask a Bitcoin technologist or evangelist) is its limited block size. In simple terms, block size is correlated to the number of transactions the network can process. Bitcoin only has a 1-megabyte block size, and thus can only process around 6 transactions per hour. Bitcoin has intentionally decided to keep a slower network as there are already tons of other cryptocurrencies with larger block sizes and faster transactions times (Ethereum, Litecoin, etc.). But Bitcoin is unlikely to bulge as its value proposition is to be a store of value (“digital gold”) rather than a store of utility.

Exciting times in the crypto world…

Fascinating topic WL. For me, the most interesting aspect of the current cryptocurrency craze is that the core of bitcoin/cryptocurrency strategy conflicts slightly with the direction that many technologies are going – towards centralized processing (e.g., cloud computing). For Bitcoin to work well, buyers and sellers need to have trust that their payments/transactions will be executed fairly/reliably and the decentralized ledger facilitates this trust by creating millions of copies of the ledger (and related transactions) and therefore, restricting manipulation by bad actors. The downside of this decentralization is that ALL the nodes in the blockchain (vs. one centralized point) hold copies of the ledger and receive updates for all the transactions. As inferred above by Justin, this constant updating extends the time period for moving data through the network which (coupled with the electricity consumption) creates another scaling issue.

There’s more discussion on this topic here:

https://www.cbinsights.com/reports/CB-Insights_Blockchain-Explainer.pdf

Thanks WL for helping me learn more about cryptocurrencies and begin to understand the somewhat unexpected amount of energy they consume as part of mining bitcoin. While consumer-facing companies can have their bottom line hurt by revelations of irresponsible negative environmental consequences of their operations, there seems to be no such incentive for Bitmain, especially given the anonymity surrounding bitcoin.

While some managers may be environmentally conscious, I expect that only economic incentives have and will convince companies to move to places like Iceland. Regulating cryptocurrency creation seems difficult given the manner in which it is created. China, Mongolia, etc. shifting their energy production away from coal would likely help more. However, given there may be a massive bubble around cryptocurrency right now, there is a chance that the environmental issues become less relevant should bitcoin crater and other less computing intensive cryptocurrencies replace them.

Have always heard how expensive the mining of bitcoin becomes as the network increases, but never thought about those cost coming from the electricity cost of cooling the servers. Not as aware of the technicalities of the various energy types, but do wonder why several data centers or heavy server businesses aren’t based in Iceland or colder countries? I would imagine the cost of not being based in the major country of use offsets the savings from the cooling. Will be interested to see at what cost the energy will need to be for it to make economical sense for a majority of miners to move to colder nations.

Based on the explosion in Bitcoin’s price in just the time since this essay was written, I’m also doubtful that behaviors will change with regard to energy consumption for mining Bitcoin. It’s actually shocking to see just how much energy is consumed through the mining of cryptocurrencies. It’s probably even more so shocking when you consider the high level of uncertainty that surrounds the future of cryptocurrency. It would be an incredible waste if all of this energy were expended mining cryptocurrency and it eventually just goes away. Even when you consider the burning of fossil fuels and the impact it’s had on the environment, you can point to the advancement it’s had in industry and in transportation. You can’t really do the same for cryptocurrency. The link below is an article on Mashable that agrees with your argument about Bitcoin’s energy consumption: it’s shocking and probably not sustainable. However, he suggests that Bitcoin may start imitating practices by Ethereum to use less energy and to allow for a higher volume of transactions. That being said, if Bitcoin is going to just do what Ethereum does, will that encourage people to use Ethereum more or will Ethereum replace Bitcoin as the lead cryptocurrency? I think it would also be interesting to see how energy consumption changes when all of the existing Bitcoins have been mined.

http://mashable.com/2017/12/01/bitcoin-energy/#_nqLKMfeEPqG

You make a very interesting point on the energy consumption of Bitcoin. From a supply chain standpoint, I think the largest Bitcoin producers will have to optimize production based on what proportion of costs are from energy, personnel, and government regulation. Right now, energy may be the main factor, however, I think that in the future the optimization will have to be more sophisticated. As we saw in the Fuya Glass case, choosing a location for production of any product can be complex. I wonder if the breakdown of costs will shift in the future. For example, if machine learning becomes the main competitive advantage, players with access to engineering talent may be in a superior position. Alternatively, if lack of regulations is a competitive advantage, players in those countries will accel.

One of the most interesting topics I have read in TOM challenge. Thanks.