Big Missiles + Big Data = Small(er) Price Tags?

How can big data and a digitized supply chain transform a business? See what happens when Raytheon Company, a $23 billion defense contractor, goes all in on a digital future.

Digital to the rescue?

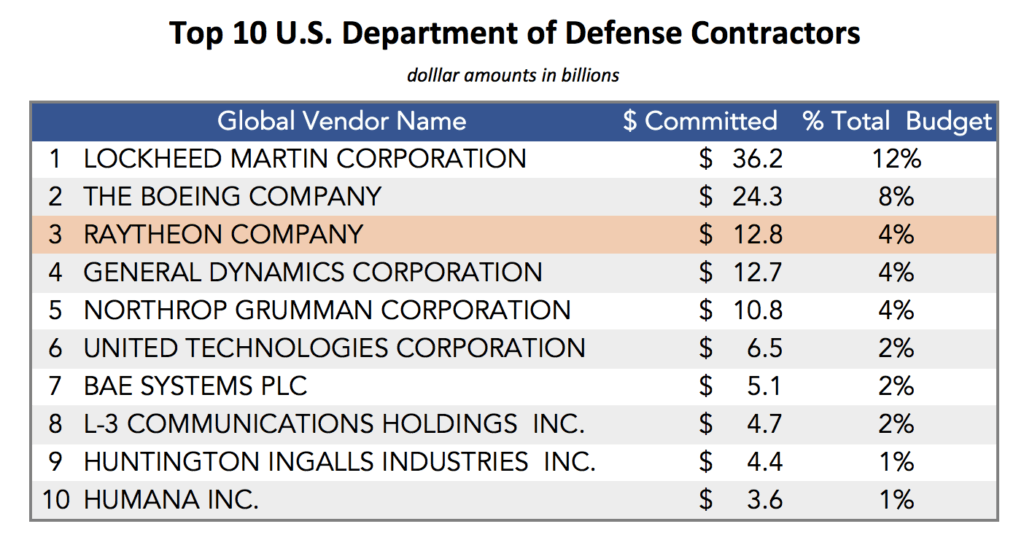

Can big data and a digitized supply chain help reduce costs in the defense sector? Raytheon Company, the third largest U.S. defense contractor, is betting big that they can [1]. I think they are right, and here’s why.

First, why does the supply chain even matter?

Because they can’t win without improving it. Raytheon is competing in a defense sector where contractors are increasingly being asked to do more for less. The global financial crisis and the widespread reduction in many national defense budgets that followed have created an environment of immense price scrutiny [3][4]. From 2010 through 2014, the compound annual growth rate (CAGR) of sales for US-based defense contractors declined by an average of 1% each year [5]. Despite this price pressure – emerging threats have kept demand for innovation high, just look at German demand for a new missile defense system due to concerns over threats posed by North Korea, Iran and Russia, as well as insurgent groups [6].

What does this have to do with the supply chain you ask? Well, roughly 70% of Raytheon’s project costs come from materials [7]. It doesn’t take complex financial analysis to see that sourcing more efficiently would have a huge impact. Raytheon is frank about their reality,

“Sourcing at Raytheon has undergone a seismic shift in recent years as we explore and adopt new strategies for helping our customers tackle the geopolitical and budgetary challenges they face. That includes holding ourselves accountable for delivering the solutions we promised, at the price we promised, when we promised.” [8]

Ok – what are they doing about it?

They created a VP of Supply Chain position and are betting big on big data analytics and innovative collaborative technology to get them to a vision of a simplified supply chain, working with a smaller group of suppliers on a more strategic basis [9].

Big Data Systems – with 8,000 programs and more than 10,000 suppliers, Raytheon is moving to take advantage of their behemoth status by building out a data analytics platform which integrates company and external data and enables them to predict and respond to complicating factors such as a wildfire, hurricane, or earthquake that may affect suppliers’ ability to meet a deadline, as well as run strategic analysis on key factors for suppliers’ performance and financial stability. This enables them to look across programs and suppliers for ways to reduce costs, and empowers them to better negotiate terms by reducing total number of suppliers and engaging in long-term contracts for multiple programs.

Innovative Communication Tech – on top of analysis to inform better strategy and contracts, Raytheon is investing directly in how they operate with suppliers to improve transparency and efficiency. They launched a 3-D, immersive environment to drive product excellence and accelerate time-to-market through co-development and co-production of products. Users wear goggles to interact with virtual models of products projected into the room, and large-scale 3-D immersive data visualizations. This enables alignment between suppliers and engineers that is no longer constrained by need for work (and rework) expensive physical prototypes, or by physical location [9].

Good for them. But how do they stay ahead? What’s next?

The focus on supply chain efficiencies is promising, but it is still early days at Raytheon for big data-driven supply chain decision making, and the path to a simplified supply chain with a smaller group of suppliers and more strategic working relationships needs further innovation.

Here are my recommendations:

Expand Data Capture to Competition– use the analytical chops you’ve built to better track the competition. Map the marketplace for all available contracts – and know what happens when you lose one. Build a picture through time and use this to inform your strategy.

Scale Your Supplier Learning – double down on the power of scale and increase supplier performance data capture with an eye toward developing abstract-able insights that can be shared across suppliers to improve individual supplier performance. Creat

Expand Communication Tools – move beyond communication for improved prototyping, to a deeper level of problem exposure and solving with suppliers. Build new tools to enable real time problem exposure and solving with suppliers. Package these tools as a product and offer them to your suppliers to improve their working relationships with suppliers upstream from them. You win by making them more efficient.

Identify Untapped Partnerships – analytics on current suppliers is great, but future product innovations will undoubtedly come from outside sources. Raytheon needs to develop their big data analytics to better identify the small innovative partners before their competition does.

So… What do you think?

How would you use big data analytics to maintain a competitive edge? What additional technology investment would you make to drive supply chain efficiency?

(782 words)

[1] Federal Procurement Data System. (2017). Top 100 Contractors Report – Fiscal Year 2016. [online] Available at: https://www.fpds.gov/fpdsng_cms/index.php/en/reports [Accessed 15 Nov. 2017].

[2] Rowlands, D., & Kabongi, D. K. (2017). MILITARY EXPENDITURES, ALLIANCE MEMBERSHIP, AND FISCAL RESTRAINT. Geopolitics, History and International Relations, 9(2), 55-79.[online] Available at: http://dx.doi.org.ezp-prod1.hul.harvard.edu/10.22381/GHIR9220173 [Accessed 15 Nov. 2017].

[3] Hensel, N. (2016). The defense industry: Tradeoffs between fiscal constraints and national security challenges. Business Economics, 51(2), 111-122. [online] Available at: http://dx.doi.org.ezp-prod1.hul.harvard.edu/10.1057/be.2016.16 [Accessed 15 Nov. 2017].

[4] F-de-Córdoba, G. and Torres, J. (2014). National security, military spending and the business cycle. Defence and Peace Economics, 27(4), pp.549-570.

[5] https://www.bcg.com. (2016). A New Procurement Strategy for Defense Contractors. [online] Available at: https://www.bcg.com/publications/2016/engineered-products-infrastructure-new-procurement-strategy-defense-contractors.aspx [Accessed 15 Nov. 2017].

[6] Financial Times. (2015). Lockheed and Raytheon face off over European missile deals. [online] Available at: https://www-ft-com.ezp-prod1.hul.harvard.edu/content/5b0535a4-c187-11e4-8b74-00144feab7de [Accessed 15 Nov. 2017].

[7] Communications, R. (2015). Big Data, Smart Strategy – The supply chain techniques that create competitive advantage. [online] Raytheon.com. Available at: https://www.raytheon.com/news/feature/david_wilkins.html [Accessed 15 Nov. 2017].

[8] Communications, R. (n.d.). Raytheon: Sourcing at Raytheon. [online] Raytheon.com. Available at: https://www.raytheon.com/suppliers/sourcing/index.html [Accessed 16 Nov. 2017].

[9] Investor.raytheon.com. (2017). Raytheon: 2016 Annual Reports. [online] Available at: http://investor.raytheon.com/phoenix.zhtml?c=84193&p=irol-reportsannual [Accessed 15 Nov. 2017].

I think this is a really interesting application on the prompt. I think you’ve done a great job of making a case for action given the size of the investment and huge percentage of Raytheon’s costs that come from its materials/ supply chain.

Your point about expanding their reach is a particularly poignant one – reducing their suppliers costs will in turn reduce their own costs. In fact instead of packaging and selling their software/ operating model, perhaps they could enter a revenue sharing agreement.

My question is how could blockchain also help to increase the efficiency of this system? Putting all of their suppliers onto the same ledger seems like it would have tremendous benefits in finding efficiencies.

Pcoats, great write up. Incredible headline photo. I’m always interested in learning how incredibly complex pieces of machinery get built. I can only imagine the amount of parts that have to come together to build many of the products that Raytheon provides.

And you’re right, supply chain efficiency obviously seems like the biggest point of optimization for a company that sources from over 10,000 suppliers. Multiple different types of suppliers isn’t something we really got into when we did the beer game simulation. It was always just 1 Factory => 1 Distributor => 1 Retailer => 1 Customer. I can see how big data would be able to streamline Raytheon’s process even moreso.

One question I have though is about limiting the number of suppliers that Raytheon sources from. There’s obvious benefits from a logistics perspective for consolidating that number down, but I’m wondering if in some instances that might be counterproductive because you’re eliminating competition between your suppliers. For instance, if big data says to definitively source one product from Supplier A instead of Supplier B and you then sign a long term contract with Supplier A for that product, you’ve effectively eliminated Supplier B from offering a superior product at a cheaper price some years down the road. If you were able to keep Supplier B in the game by still buying, say 25%, of that product from them and then promising that they could earn more market share if they were to compete or surpass Supplier A’s price/quality then that would encourage development and innovation between both Supplier A and B. I’m not sure if this is anywhere close to a real life example, but it was something I thought about when seeing that the number of suppliers decreased.

Tommie C – I hear you on the concern of supplier concentration eliminating productive price competition; however, I think it this case it is about how significant the cost savings from closer partnerships with suppliers can be. Because there is a cost to developing and maintaining these more involved relationships with suppliers to gain these efficiencies, you can’t do it for 10,000 of them. I think you have to pick your battles, and focus your energy/capital. But I agree that keeping in mind competition and optionality is key to not letting the supplier pool grow too small.

Raytheon has huge costs associated with its supply chain, so identifying ways to reduce costs is critical. Given the US’ massive military spending, I was thinking that companies like Raytheon wouldn’t be too concerned with their costs. But I suppose there are several other customers around the world that are more price sensitive. I think your suggestions to reduce supply chain costs are good — particularly around developing communication & prototyping tools and then packaging them together for suppliers to use. By getting suppliers on your same system, you can realize efficiencies and make sharing information that much easier.

Very interesting topic, thanks for sharing!

I did the complex financial analysis and realized that, yes 70% of Raytheon’s costs coming from materials is a HUGE amount. With such a large fragmented group of suppliers, I think that the work Raytheon is doing with big data systems and improving communication tools are worthwhile investments that can really boost the firm’s bottom line. As you mentioned, there is an increased demand for defense with the increasing tensions in the global political climate, so I believe that although revenues have been relatively flat recently, the industry will continue to adapt.

Something I thought throughout all of this was – what is the competition doing? With a lot of the revenues from these firms come from long-term and very large contracts from the government, I would suggest that Raytheon work with its competitors in sharing big data analytics to make all their suppliers more efficient. I assume that many of their suppliers also work with other large defense companies and with a growing overall pie, it could be beneficial for them to work together in sharing big data and innovation to reduce all of their costs more than they would be able to on their own.

One concern I have with the increasing digitization of supply chains, especially in the case of Raytheon, is the cybersecurity implications. I’m sure that this is already a massive expense for a defense company like Raytheon, and rightly so. This is probably the highest risk situation for stealing trade secrets that one could imagine. But of course, much of Raytheon’s information is already available digitally. What concerns me is the increasing digital connections to their >10,000 suppliers. Surely these companies currently don’t deal with the same level of cybersecurity risk that Raytheon does, so increasing the amount of digital information sharing between them opens up a whole new world of cybersecurity risk. These concerns don’t change the potential benefit from supply chain digitization, but they certainly make me worried about the amount of cost required to implement these changes.

I found this article fascinating because I had no idea such a huge percentage of Raytheon’s costs came from supplies. It is very easy for companies to say that they will use big data to improve efficiencies, but pcoats does a good job giving concrete examples of how Raytheon can actually do this. Companies must be strategic in creating clear objectives with their big data initiatives, and I especially liked the author’s suggestion to use this data to improve communication between Raytheon and its suppliers. Strong communication flow through the supply chain is the key to decreasing costs between suppliers and their customers. I would also suggest that they can use the insights from their data analytics technology to improve other aspects of their business, like production processes or customer demand.