BHP Billiton: Unearthing a response to climate change

Examining how the world's largest mining company thinks about climate change.

The mining industry, in many ways, is synonymous with climate change. Mining activities by their nature, are highly environmentally invasive and energy intensive. As the world’s largest mining company, BHP Billiton leads an industry that is being pushed to regulate and reduce its carbon footprint at an increasingly urgent pace.

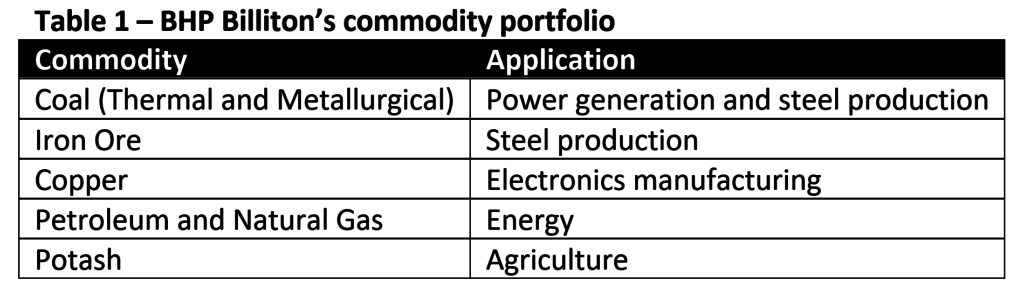

BHP Billiton operates in five commodity segments spanning six continents with an asset portfolio that reflects commodities needed for global growth [1 & 4]. These commodities and their typical application are contained in Table 1.

By its own design, BHP Billiton has tied its future to global economic growth [2]. Understanding this gives insight into the way the company views the risks of climate change.

Climate change – a cause for concern?

Global Growth Stagnation

Research has shown global warming leads to an increased frequency and severity of extreme weather events [5]. Such events are viewed as significant inhibitors of global growth translating to lower consumption of key commodities and thus poorer future earning potential for BHP Billiton [2].

Damage to property plant and equipment

BHP Billiton has invested heavily in large scale infrastructure including ports, roads, processing facilities and railway lines (Exhibit 1). Both the quality and location of such infrastructure are sources of competitive advantage and extreme weather events pose a significant threat to its integrity. This risk has prompted the company to make increasingly large mitigatory investments [2].

Exhibit: BHP Billiton’s Port Hedland facility in Western Australia [1]

Cost of Carbon

Although no global consensus for a cost on carbon has been reached, there is widespread acknowledgement that polluters will be required to pay for their emissions in the future. Any cost is likely to be proportional to the amount of emissions generated by a company and hence, as a major producer and consumer of fossil fuels, BHP Billiton is particularly at risk [2].

Digging up solutions

BHP Billiton is combating climate change on three fronts [2]:

- Reducing greenhouse gas (GHG) emissions;

- Increasing preparedness for climate impacts within the business; and

- Investing in research to enhance the global response to climate change.

Reducing Operational Emissions

The first step in reducing GHG emissions was to establish benchmarks on which to measure performance. After attending the 2015 Paris Climate Convention (COP21), BHP Billiton made a public commitment to restrict absolute FY2017 GHG emissions below their FY2006 baseline [2].

With both internal and external visibility on their emissions target, the company set about reducing emissions via their productivity agenda. This program touches all aspects of the company ranging from increasing emphasis on preventative maintenance practices (leading to more efficient equipment) to reducing truck idle time. It also looks at opportunities to invest in the latest advancements in low-emissions mining technology (e.g. use of bio-fuels as a substitute for diesel) [2].

Increasing Preparedness

As previously mentioned, BHP Billiton is proactively investing in projects that mitigate the risks inherent with extreme weather events (e.g. HPX3 Project, mitigating the risk of damage to port facility) [6]. They are also stress-testing their portfolio through sensitivity analysis to identify likely financial impacts under different climate change scenarios. This information is helping the company identify shortfalls in their risk management system [2].

Investing in Research and Development

BHP Billiton continues to invest in partnerships with leading research and development companies, including:

- REDD+ – US$5M commitment to Alto Mayo in Peru protecting 182,000 hectares of threatened forest.

- Great Barrier Reef Foundation – US$0.5M enables scientists to develop globally applicable Reef Resilience Framework.

- Carbon Capture and Storage (CCS) Knowledge Center – US$7M project to address technical, policy and economic barriers to deployment of CCS technology in Chinese steel sector.

Partnerships are designed to demonstrate a credible response to climate change as well as yield technology that can be deployed across multiple industries [2].

Room to improve

Although BHP Billiton has made progress in reducing its carbon footprint, there remains significant scope for improvement. Other potential avenues to decrease GHG emissions include:

- Lowering fuel consumption through optimized mine design and haul road construction;

- Hastening the adoption of driver-less technology which has demonstrated significant reductions in emissions through improved efficiency;

- Increasing proactive gas drainage practices (applicable to coal and petroleum operations); and

- Divestment of emissions intensive assets (i.e. thermal coal mines).

In an industry that is both energy intensive and environmentally disruptive, BHP Billiton is doing its best to unearth the most appropriate response to climate change.

Word count: 723 (excludes sources)

References

[1] BHP Billiton, (2016). Global Locations. [online] Available at: http://www.bhpbilliton.com/businesses /globaloperationsmap [Accessed 11/03/16]

[2] BHP Billiton, (2016). Climate Change: Portfolio Analysis. [online] Available at: http://www.bhp billiton.com/~/media/5874999cef0a41a59403d13e3f8de4ee.ashx [Accessed 11/03/16]

[3] BHP Billiton, (2016). Climate Change: Portfolio Analysis View after Paris. [online] Available at: http:// www.bhpbilliton.com/~/media/bhp/documents/investors/reports/2016/bhpbillitonclimatechangeporfolioanalysis2016.pdf [Accessed 11/03/16]

[4] McKinsey, (2013). Resource Revolution: Tracking global commodity markets. [online] Available at: http://www.mckinsey.com/~/media/mckinsey/not%20mapped/test%20copy%20of%20resource%20revolution%20tracking%20global%20commodity%20markets/mgi_resources_survey_full_report_sep2013.ashx [Accessed 11/03/16]

[5] Henderson R et al, (2016). Climate Change in 2016: Implications for Business. Harvard Business School.

[6] BHP Billiton, (2016). Latest News. [online] Available at: http://www.bhpbilliton.com/investors/news/ new-bma-hay-point-coal-terminal-boosts-queenslands-coal-exports

During my career as an environmental consultant I performed an environmental review (required to receive operating permits) for a BHP Billiton Coal mine located on the Navajo Nation in the United States. The mine was directly connected to a coal fired power plant. Our Environmental Review for BHP Billiton included a first-of-its-kind analysis of the social costs of carbon, even though no Federal, tribal, or state rules or regulations currently limit or curtail emissions of GHGs from the project. One of the most difficult elements of the analysis was determining an appropriate discount rate, especially because of the very long time horizon of mine operations. Monetizing the costs and benefits of GHG emissions is also exceedingly difficult. Despite the uncertainties, BHP Billiton took the initiative better understand the social cost of carbon associated with their coal mine project.

It is interesting to know that BHP is conducting sensitivity analysis under different climate change scenarios to prepare for climate change as an external factor. Such preparation as upgrading technologies would incur investment but I assume doing cost-benefit analysis wouldn’t be too complicated; perhaps decision-making could be done based on quantitative rationale. On the other hand, I guess that investment in REDD+ or Great Barrier Reef, for instance, would require a different methodology of justification since “return” from these investments would not appear as clear. Organizations which I witnessed in the past frequently struggled at this point: how to measure and screen investment opportunities which have less clear financial impact but could potentially generate significant sustainability benefit. I wondered how the world’s leading company like BHP is making decisions in these areas.

I thought the analysis of costs and threats to BHP resulting from climate change was very interesting, particularly the connection between increasing severity of weather events and the overall cost to BHP through the mechanism of decreased economic output as a driver of commodity demand. Although certainly limited (I’m not convinced the overall cost to business is sufficient / quantifiable to drive material and potentially costly changes in decision making), but it is an interesting framework through which policymakers may consider developing appropriate regulatory structures.

The issues surrounding climate change will certainly have an impact on all mining companies, particularly for BHP as you outlined. I was wondering what, if any, collaboration existed within the industry to collectively reduce their impacts on climate change and reduce their risk to other impacts of climate change. This may be an area where that would be viewed as a competitive advantage; however, I think it could also be an outstanding opportunity. Has BHP pursed anything along these lines to reduce its internal carbon emissions or reduce it risk overall? If not do you think that there is potential for this with BHP as they are the largest mining company in the world?