Banking across borders: Goldman Sachs in London – or Frankfurt?

Banks in London face a volatile, uncertain, complex and ambiguous (VUCA) situation in the face of Brexit. How will Goldman Sachs cope with the regulatory challenges ahead?

Banking across borders: Goldman Sachs in London – or Frankfurt?

In a nationwide referendum held in June 2016, British citizens voted for the United Kingdom to leave the European Union. In the wake of the controversial Brexit vote, financial markets nosedived and Prime Minister David Cameron, who led the campaign to stay in the EU, resigned[1].

Following the referendum, concern intensified around the impact of Brexit on business – especially the financial services industry, which contributed 7.2% of total UK GVA (Gross Value Added) in 2016[2]. Banks have historically set up their businesses in Britain and then used its right to “passport” into the rest of the 28-member bloc – the ability to access all EU markets if approved to enter any one of them. Their lawyers, however, have since warned that they would likely need a new legal home after Brexit[3].

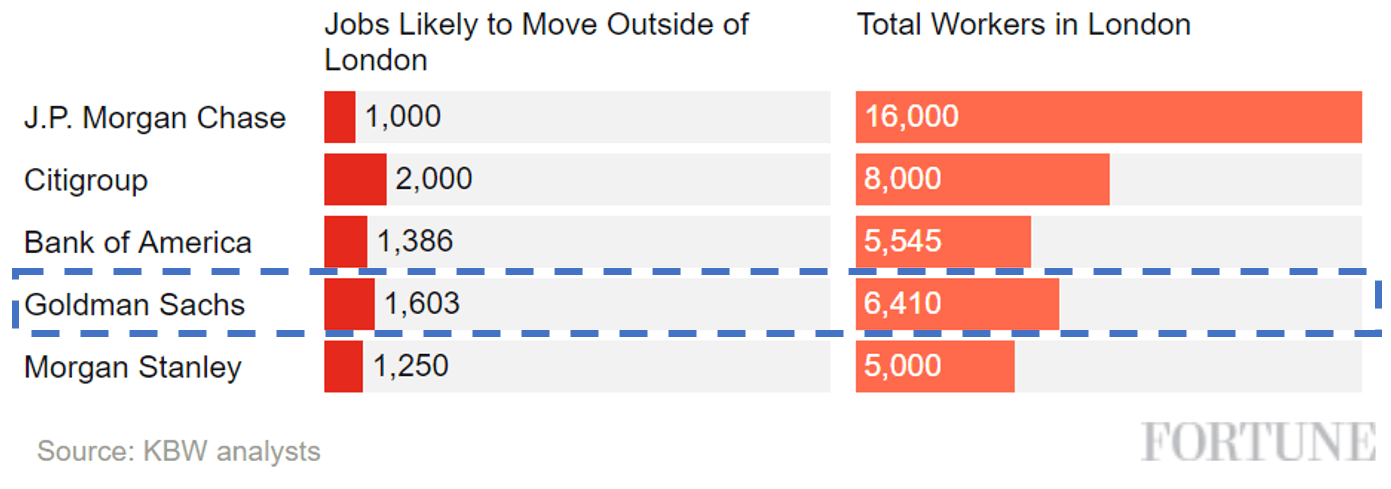

Consequently, Goldman Sachs is one of many banks wary of losing access to the single market. Uncertainty around the Brexit negotiations and costs associated with conducting business across regulated borders have caused the bank to prepare to shift a portion of its work to mainland Europe, as seen in Figure 1[4].

Figure 1 – Brexit impact on financial services jobs in London[5].

Given the uncertainty around how the negotiations will conclude, the bank has now initiated its near-term contingency plan in the event it will lose its passporting rights into the single market[4]. According to Richard Gnodde, Goldman Sachs’ Europe CEO, “Goldman Sachs will begin moving hundreds of people out of London before any Brexit deal is struck as part of its contingency plans for Britain leaving the European Union”[4] .

Its medium-term plans, however, remain uncertain; Knodde has conceded that “What our eventual footprint will look like will depend on the outcome of those [Brexit] negotiations, and what we are obliged to do because of them”[5].

In the longer term, several options are available to the bank. Goldman Sachs could legally shift operations to the EU but keep its actual workforce in London. Alternatively, the bank could move the majority of its front-office roles to EU cities such as Frankfurt, given the nature of its current contingency plan. This will likely result in the bank incurring significant costs, as it will have to pay for moving highly paid professionals across borders in addition to having to bear costs associated with new office leasing contracts, licensing, back-office and infrastructure development.

The former option is undeniably more attractive due to its lower cost and risk profile, but its feasibility will depend on the negotiation outcome and, more specifically, decisions made by EU regulators. Many have not only vocally opposed Brexit, but specifically warned financial services firms against “any attempts to game the system” following the UK exit[6].

Given the costs associated with an unfavorable negotiation outcome, or “hard” Brexit, Goldman Sachs management should minimize uncertainty and risk associated with any potential move, and maximize its chances of UK and EU negotiators reaching a deal that is beneficial to the bank.

As such, Goldman Sachs could join forces with its competitors and invest in lobbyists to represent the banks’ interests during the Brexit process. Lobbyists could not only argue in favor of “soft” Brexit solutions, such as a UK exit from the EU but not the European Economic Area, but also scrutinize major developments to allow the bank to adjust its contingency plans as negotiations progress.

In addition, it could pre-emptively secure banking licenses in EU as it prepares to move operations to an EU member country; according to Damian Carolan of Allen & Overy, “it would typically take banks 2-3 months to put a license application together. They would then have to wait for about six months for approval for an investment bank”[3]. The bank stands to lose much in terms of opportunity costs and losing first-mover advantages if it leaves the licenses until negotiations conclude.

The discussion above, however, gives rise to questions concerning the ability of banks to influence the post-Brexit regulatory process. How can Goldman Sachs best approach its lobbying efforts?

(785 words)

[1] Pruitt, Sarah. 2017. History. March 29. http://www.history.com/news/the-history-behind-brexit.

[2] Tyler, Gloria. 2017. “Financial services: contribution to the UK economy.” Parliament.uk. March 31. http://researchbriefings.files.parliament.uk/documents/SN06193/SN06193.pdf.

[3] Noonan, Martin Arnold and Laura. 2016. Banks begin moving some operations out of Britain. June 26. https://www.ft.com/content/a3a92744-3a52-11e6-9a05-82a9b15a8ee7.

[4] Worstall, Tim. 2017. Goldman Sachs Does The Obvious – Moves Staff From London To EU Over Brexit. March 21. https://www.forbes.com/sites/timworstall/2017/03/21/goldman-sachs-does-the-obvious-moves-staff-from-london-to-eu-over-brexit/#784e92b57fb3.

[5] Burton, Lucy. 2017. Goldman to add ‘hundreds’ of jobs in Europe ahead of Brexit as it starts to move staff out of London. March 21. http://www.telegraph.co.uk/business/2017/03/21/goldman-add-hundreds-jobs-europe-ahead-brexit-starts-move-staff/.

[6] Cohn, Huw Jones and Carolyn. 2017. EU Regulator Warns UK Insurers to Avoid ‘Fronting’ in Post-Brexit EU HQs. September 28. https://www.insurancejournal.com/news/international/2017/09/28/465870.htm.

Great post! In my opinion, the lobbying effort by Goldman Sachs and the other large banks will be a very difficult battle. The EU is reluctant to let the UK come out of Brexit with favorable economic terms, in fear that other countries will follow suit. In other words, the EU has an incentive to make an example out of the UK, and since banking is such a significant portion of UK GVA, I find it unlikely that Goldman and other banks will be able to remain in London with access to the rest of the EU. As you write, I see the preemptively securing banking licenses in and moving certain employees to Frankfurt as the safest option for the banks to survive this shift.

Excellent topic and content!

I will agree with “James Shaw” that lobbying will be a very difficult battle (not to say it is already a lost war). I feel Goldman Sachs needs not to think about IF it needs to reorganize their business because of Brexit, but HOW to do so. I liked both your options, and although I agree keeping everyone in the UK and “operating remotely” would result in smaller costs, I would go with the latter option.

Moving everyone to Frankfurt will be costly, but by doing this, GS avoids any misconception regarding “gaming the system”. Besides that, accepting Brexit and moving out will end with most uncertainties, instead of just postponing the seemingly unavoidable decision to move out. Should GS move quick, they might enjoy several benefits of being first-movers on this industry reorganization: for example, workforce availability might play in their favor. First, because as other banks move, less qualified industry experts will be available for hire. Second, by ensuring they have a straightforward strategy that is less dependent on the Brexit outcomes, they might be able to attract talents from their competitors, mainly those who fear for their future careers.

As a watch aficionado, I really want to think that mechanical wristwatches are not going extinct. While smartwatches have undoubtedly shaken the ground for Swiss watchmakers, I believe that they satisfy fundamentally different customer needs than luxury mechanical watches. People do not pay thousands of dollars for a Rolex or Patek Philippe because they want to know the time or date, but rather because the physical attributes and craftsmanship of the watch itself has timeless value and meaning. Therefore, I believe that lower-end watch brands are more susceptible to disruption, while the higher-end ones will retain their standing as jewel-like luxury items. TAG Heuer may be stuck somewhere in the middle, and it needs to tread carefully to avoid becoming a technology accessories firm and lose its Swiss watchmaking cachet.

You touch on an important point regarding TAG’s technical expertise. As a traditional Swiss watch brand, TAG is faced with the decision of whether to develop in-house digital expertise, or to continue its current strategy of partnering with Google and Intel to produce smartwatches (The Economist: Swiss watchmakers try to keep pace). I am inclined to recommend that they continue the partnership route in order to ensure that their smartwatches keep up with technology and can interact with the other digital devices that consumers use. However, if TAG wants to continue being a luxury brand, it is critical that the brand retains its credibility by continuing its mechanical watchmaking operations.

Regarding an action plan, I agree with you that they should be proactive about lobbying to minimize the implications of Brexit. But, given that human capital is a critical asset for the bank, they should also consider preemptively expanding their EU-based operations in order to gain access to the leaders that can manage the business locally.

Oops, copy/pasted the wrong comment. See the correct one below:

You make an excellent illustration of how Brexit could impact Goldman Sachs from an HR perspective. Indeed, GS would be forced to convince and pay many of its London-based bankers, IT professionals and other staffers to move to EU countries. Additionally, should GS choose to remain in London, it would no longer be able to serve clients in the other 27 EU countries, and instead would be forced to establish operations locally, significantly operating the costs of operating across Europe (The Economist: Banks and Brexit – Wait and Hope).

I would also be interested to learn about what the impact would be from a financial perspective. For example, would the trading volume of fixed income and derivative securities (two of GS’s biggest money-makers) decrease if the company moved its sales & trading operations to Frankfurt? Would GS lose access to the funding that it requires to fund sales & trading operations as well as the underwriting of debt & equity placements?

Regarding an action plan, I agree with you that they should be proactive about lobbying to minimize the implications of Brexit. But, given that human capital is a critical asset for the bank, they should also consider preemptively expanding their EU-based operations in order to gain access to the leaders that can manage the business locally.

Outside Borders (Michael Reichard?), I thought your essay was well-researched and well-defended.

I would not only agree with your contentions, but also assert that there are secondary and tertiary effects to a mass exodus of bankers out of London to a new home, perhaps Frankfurt. Specifically, though Canary Wharf would dry up, this would be a boon to the various financial centers in the EU that find themselves with a flood of newly-displaced bankers.

This would stimulate the local economy, (likely) raise rents in the area, and contribute to a trickle-down effect of wealth creation locally. Indeed, major news sources are already covering this shift (such as the below):

https://www.bloomberg.com/news/articles/2017-10-04/brexit-to-test-frankfurt-s-already-overstretched-housing-market

This would not only impact rents in CBD (central business district) commercial real estate, but also the surrounding residentaial neighborhoods. One may view this as a positive effect of globalization, in the face of a highly disruptive, expensive, and attention-dominating phenomenon of moving a bank’s regional headquarters.

I believe this is nearly a zero sum game – with London losing out and Frankfurt gaining. Friction / transaction costs in the process would represent the difference.

Great article! I tend to agree with James that the EU will aim to make an example out of the UK likely resulting in a hard Brexit outcome. If this was the case, it’s interesting to consider how a move of banking to Frankfurt would effect the fintech innovation. Bankers may be unwilling – or depending on the deal outcome, unable – to relocate for their work, and numerous key players have already stated intentions to relocate headquarters. With the UK having one of the most innovative regulatory environments globally, the transition of financial players to new markets may slow the rate of innovation in fintech globally. I’ll be curious to see if other countries respond with changes to their regulatory framework to attract financial players looking for a new home.

Very interesting article, OSB!

I think that at this point it’s extremely hard to say what will be required of UK bankers as part of the pending Brexit. This is particularly the case given the massive tensions and unaligned incentives between other European centers (Frankfurt, Paris, Dublin, etc.) that are vying to be the chosen ones of the EU financial capital lottery. Since such a designation would be a massive boon to any city from a fiscal and prominence perspective, all are incentivized to make concessions that allow them to come out as the winner.

It could be argued that Goldman and its peers should expect a “hard” Brexit, and lobby based on that expectation; however, I would contend that they could potentially arrive at a less punitive outcome if they were to choose a city, and work with it to jointly petition the European Banking Authority (EBA) to allow for a less disruptive outcome. While such a lobbying effort likely would not carry much weight if done on their own, it could have a substantial impact if the industry worked with a city and together pitched the regulators for exceptions to existing passporting rules. With that said, doing so would require not only a joint effort between banks, but also an agreement with a new host city – easier said than done given the number of individuals involved!

Dear Mr. OSB, I find your article and analysis very interesting. Brexit is definitely a big issue for banks as well as other industries who are heavy in London. To me, a ‘hard Brexit’ is unlikely as the whole country becomes more rational now after the controversial referendum. In the near term, it is still hard to imagine large banks moving out from London to elsewhere. It is also something Britain doesn’t want to see that GS can leverage as its lobbying chips, maybe together with other banks. Somehow I think it is difficult to see GS try to game the system or make policy arbitrage, due to how much they care about reputation risk.

Very interesting read. I believe that the impact of Brexit on Banks and London’s status as Europe’s financial capital depends on the actual terms of “Brexit” deal. Financial institutions are important for UK’s economy and hence “too big” to let down. Hence I strongly believe that UK delegation will work with industry lobbyist to arrive at least disruptive terms for the industry. On the other hand, it is also an economic opportunity for other European cities.