American Express and The Shift To Digital Payments

What the digital revolution and the rise of mobile payments mean for American Express

As stated by Harvard Business School Professors Marco Iansiti and Karim Lakhani, “Adapting to ubiquitous digital connectivity is now essential to competitiveness in most sectors of our economy” (1). There is no doubt that the digital revolution is transforming industries and businesses around the world, and the financial services industry is no exception. American Express, which has been in business since 1850 is a great example of an organization that has been able to maintain its position in the marketplace by altering its business and operating models in response to technological developments/changes. Specifically, American Express has responded to the shift to digital payments, a changing competitive landscape and better leveraging the data from their closed loop system.

The Shift to Digital/Mobile Payments

The rise of digital and mobile payments has resulted in a decrease in the number of consumers who are swiping their credit cards and using cash to complete transactions. America Express has anticipated that this shift to mobile payments will continue in the future, and therefore, the company has focused on integrating its services into the platforms where consumers are already choosing to make payments. For example, American Express has partnered with both Uber and Airbnb to make it easier and more appealing for their customers to pay for these services using their American Express cards (2). As platforms like Uber and Airbnb have gained significant market share in their respective industries and have significantly shifted the way consumers make payments in those industries, American Express has altered its operating model to ensure that is can continue to deliver value to its customers despite the changing technological landscape.

https://www.emarketer.com/Chart/US-Adult-Mobile-Phone-P2P-Payment-Users-2015-2018-millions-of-smartphone-users/200203

https://ehotelier.com/global/2015/11/04/american-express-integrates-loyalty-program-with-airbnb-bookings/

http://thepointsguy.com/2014/06/uber-and-amex-team-up-earn-2x-or-use-points-for-rides/

A Changing Competitive Landscape

Not only has technological advancement changed the way people make payments, but it has also changed the competitive landscape for American Express. The rise of alternative payment technologies such as Apple Pay and Square, have served as both sources of revenue for the company and as competitors (3). It’s a tricky balance. On one hand, both Apple Pay and Square facilitate an increased number of transactions for American Express, and so the company has been quick to partner and develop solutions that are compatible with both platforms. But, on the other hand, Apple Pay and Square are competitive threats that American Express needs to defend against. Although American Express has decided that the current benefits of leveraging these new payment platforms outweigh the costs of competing with them, this is something that the company will need to reassess on an ongoing basis.

https://www.americanexpress.com/us/content/apple-pay/

http://www.eyeonmobility.com/2013/square-businesses-canada-now-accepting-american-express/

Leveraging the Closed Loop System

The evolution of artificial intelligence and machine learning has transformed a number of industries including facial and speech recognition and autonomous vehicles. American Express has incorporated machine learning to better leverage the data generated from the company’s “closed loop system”. Because American Express is able to issue its own cards to consumers and doesn’t need to partner with an issuing bank, the company has created a “closed loop system” in which it is both the issuer of cards and the payment network operator (4). This “closed loop system” differentiates American Express’ business model from its credit card competitors’ business models. While this aspect of American Express’ business model hasn’t changed as a result of technological development, the company’s ability to leverage its “closed loop system” certainly has. Over the past few years, American Express has implemented machine based learning algorithms to detect and prevent fraud by using a variety of data sources to identify suspicious events and compare those events to a large dataset. Additionally, American Express has used machine based learning to improve its customer experience whether that means providing customized restaurant recommendations or real time coupons based on a customers’ current location (5,6,7).

Risks and Opportunities

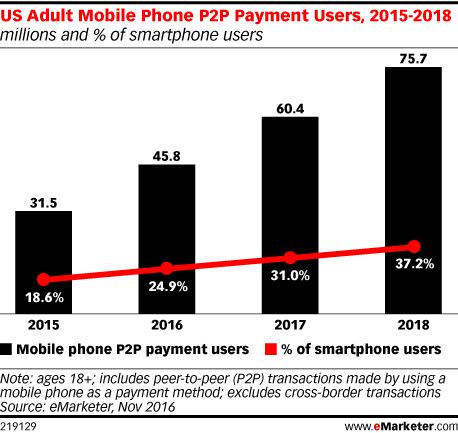

As reported in a study published earlier this year, 60% of merchants reported that they have experienced fraudulent online sales and 25% said their level of fraud with online sales increased versus last year (8). Although American Express has initiatives in place to minimize its risk, security will continue to be a top concern for the company. As American Express looks to innovate, one area that the company should evaluate is the peer-to-peer payments space in which American Express does not currently have a product. Additionally, American Express should continue to expand its ability to leverage the data produced from its “closed loop system”. While American Express has been able to adapt its operating model to align with the changing technological landscape, the company’s future success will depend on its ability continue to develop new systems and services that increase consumer value while protecting itself against security threats. (767 words)

(2) http://digiday.com/brands/not-technology-technologys-sake-amex-betting-digital-partnerships/

(3) http://ir.americanexpress.com/Cache/1500081626.PDF?O=PDF&T=&Y=&D=&FID=1500081626&iid=102700

(5) http://data-informed.com/american-express-charges-into-world-big-data/

(6) https://www.mapr.com/blog/machine-learning-american-express-benefits-and-requirements

What do you think about the threat posed by digital products like Venmo and Chase QuickPay? I would argue that that type of mobile payment system is the biggest threat to AMEX since, at least in the case of Venmo, users are incentivized to bypass using a credit card entirely when paying. (Venmo charges an extra fee to pay via credit card instead of using a linked bank account.) With so much of its revenue generated through card transaction fees, how will it adapt? Will it develop its own Venmo-like app, or, by leveraging the immense volume of data compiled from its closed-loop network, will it develop the “next big thing” in the payments industry?

The other question about AMEX as it moves forward and looks to enhance its digital products and capabilities has to do with its positioning in the marketplace — what will it do about its biggest-spending customers? Will future moves into digital be done with them in mind, or will the focus be on more everyday people? In general, since the introduction of credit cards, AMEX has positioned itself to grab the wealthiest, highest-spending people through products like the Platinum Centurion card, thereby generating high membership annual fees and a high amount of transaction fees on the wealthiest consumers’ spending. AMEX has already lost a solid chunk of these high spenders to Visa and Mastercard in recent years as it has started focusing on more everyday consumers, but will they shift back and focus future digital initiatives on the wealthy to try to entice defectors to return?

It seems that Amex is successfully managing threats against fraud, which is a big virus in the industry. As provided in the referred Forbes article, Amex claims to have one of the lowest fraud loss rates in the industry. I agree with Andy that mobile payment apps like Venmo presents threat not only for Amex but for all of its peers. Amex should consider penetrating mobile payment space in future.