Amazon’s Response to the OTT Universe

The digital transformation of the entertainment industry has given rise to a gamut of Over-the-Top (OTT) streaming services to rival the traditional pay-tv powerhouses. Starting with Netflix in 2007, OTT services have proliferated to cater to the growing demand base, which still is projected to grow at a CAGR of 17% through 2020 worldwide. What is Amazon’s response?

The digital transformation of the entertainment industry has given rise to a gamut of Over-the-Top (OTT) streaming services to rival the traditional pay-tv powerhouses. Starting with Netflix in 2007, OTT services have proliferated to cater to the growing demand base, which still is projected to grow at a CAGR of 17% through 2020 worldwide [1]. This exponential increase in platforms is now over 200 in the US [2], and has not only created a fragmented viewing audience, but has potentially over-saturated the market and created “subscription fatigue”.

Subscription Overload

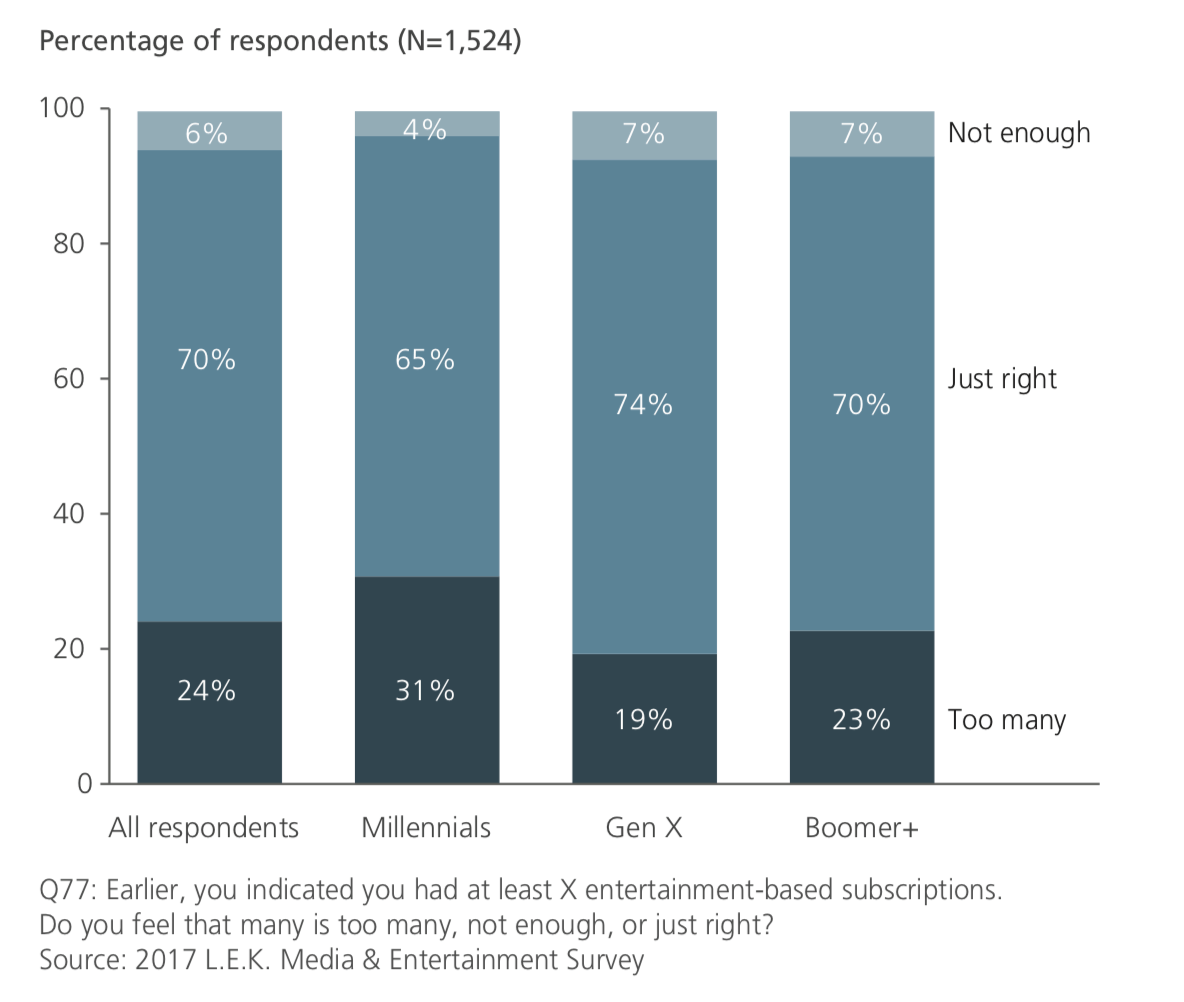

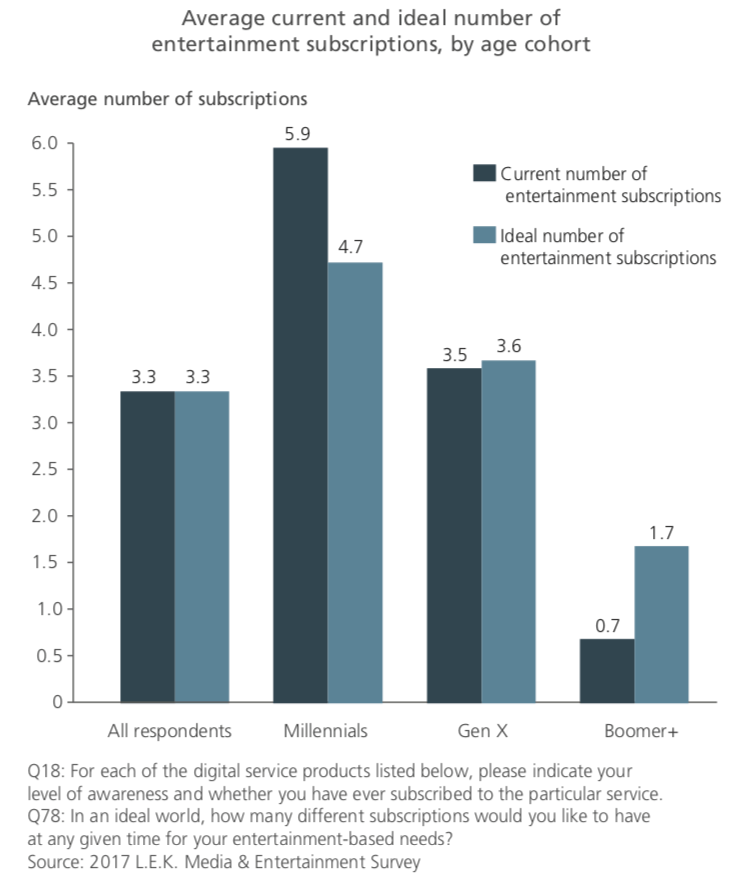

In the US, Netflix has over 50M subscribers, Amazon Video is at 60M, while Hulu is at 12M. Outside of the Big 3, numerous sports and niche streaming services have flooded the market. According to a survey conducted by L.E.K., 31% of millennials already feel that they are oversubscribed by more than 1 service [3]. This fragmentation has opened the door for consolidation of the user experience and management of these services on behalf of the consumers.

Enter Amazon Channels.

Amazon’s Strategy

In 2015, Amazon doubled down on its content strategy, and announced the ability to add and pay for 40 different live and on-demand channels, including HBO, Showtime, and Starz subscriptions [4]. To date Amazon has grown its channel offering to 140 channels, and is responsible for half of HBO and Showtime OTT subscribers, and 75% of Starz subscribers [5][6]. The platform houses all your content under one roof and unifies your payment and log-in information.

For phase two, the company is currently in talks to start buying scores of niche television channels from several major program providers in an attempt to further consolidate this digital supply chain [7]. As traditional cable companies slim down their channel lineup to what is called “skinny bundles” (think of Sling TV), niche channels are not making the cut. This enables Amazon to scoop up these under-distributed channels and offer individual subscriptions to its prime subscribers. The goal is to create a global online video platform that users can customize to fit their taste. Long term, the company will look to make its position in the market more defensible with exclusive partnerships. In fact, on November 15th, Sports Illustrated announced a streaming video service to launch on Amazon Channels that will offer a mix of documentary, narrative, and talk programing for $4.99 a month [8].

The Competition

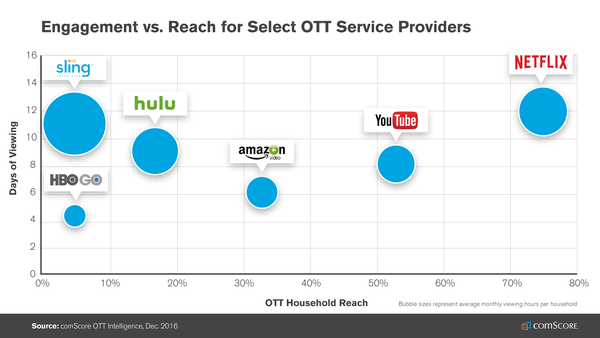

From a competition standpoint, Netflix still owns 75% of the streaming market while Amazon is currently third at 33% [9]. Netflix is not concerning itself with the oversaturated platform dilemma, its goal is to continue to amass the largest and best content library, coupled with an unmatched streaming infrastructure and content recommendation experience.

That comes with its own challenges as new entrants look to further disrupt the industry and the increased investment in content skyrockets. So far, 2018 budgets consist of Netflix at $8B, Amazon at $4.5B, and Facebook and Apple at $1B [10][11]. This pressure has increased when CEO Bob Igor announced that Disney will not renew its license agreements with Netflix in lieu of the company’s own OTT platform in 2019 [12]. While larger budgets create more room for content creators to get their projects greenlit, it also raises prices in bidding wars for the best intellectual property.

This is where Amazon has decisively picked it battles. The company went head-to-head this week against Netflix in a bidding war for Lord of the Rings, securing the rights for an estimated $250M compared to Netflix’s bid at $100M [13][14]. To put this record-breaking price point in perspective, this was 125 times as much as the $2M Warner Bros paid for the rights to the first four Harry Potter books [15].

Moving Forward

I think Amazon’s biggest challenge in its digital supply chain over the short and long term will be to create a more integrated user experience. Consumers still need to be cognizant of which company owns their favorite content to figure out their subscription package. In the music industry, consumers use aggregators (Apple Music, Spotify, etc.) seamlessly to navigate through content from multiple platforms (record labels) by genre and artist, and get recommendations from their friends and algorithms. Netflix has the clear edge in this regard, but Amazon is unique in this space with its vast troves of purchasing data. Amazon needs to continue to invest in its analytics capabilities to build out recommendation algorithms and custom “channels” tailored to each consumer’s interests.

How do you think Amazon can leverage its purchasing data in content recommendations? Where do you think Facebook’s and Apple’s edge will be as it enters this space next year?

[767 Words]

- Markets and Markets, “Over the Top Content by Market Type,” RN Market Research, February 6, 2016, http://www.rnrmarketresearch.com/over-the-top-ott-market-by-content-textimage-audio-video-access-type-smart-devices-phones-and-tablets-laptopsdesktops-set-top-boxes-smart-tv-gaming-consoles-worldwide-forecasts-ana-market-report.html, accessed November 2017.

- Parks Associates, “More than 200 OTT services in the U.S. market, research group says,” Park Associates, October 26, 2017 http://www.parksassociates.com/blog/article/more-than-200-ott-services-active-in-the-u-s–market–research-group-says, accessed November 2017.

- Evans Alex, “Subscription Fatigue”, LEK Associates, August 2017, http://www.lek.com/sites/default/files/1944_Subscription_Fatigue_LEK_Executive_Insights.pdf, accessed November 2017.

- Levy Adam, “A Small Part of Amazon Prime Could Play a Big Role in Its Future,” June 23, 2017, https://www.fool.com/investing/2017/06/23/a-small-part-of-amazon-prime-could-play-a-big-role.aspx, accessed November 2017.

- Perez Sarah, “Amazon drops plans for its own ‘skinny bundle’ TV service, report says,” November 15, 2017, https://techcrunch.com/2017/11/15/amazon-drops-plans-for-its-own-skinny-bundle-tv-service-report-says/, accessed November 2017.

- Greenfield Rich, “Half of HBO Now, most of Showtime and Starz OTT subcribers coming from Amazon Channels: analyst,” June 5, 2017, https://www.fiercecable.com/online-video/half-hbo-now-most-showtime-and-starz-ott-subs-coming-from-amazon-channels-analyst, accessed November 2015.

- Atkinson Claire, “Amazon Is Hungry and It’s Coming for Your Cable Channels,” September 15, 2017, https://www.nbcnews.com/tech/internet/amazon-hungry-it-s-coming-your-cable-channels-n801781, accessed November 2015.

- Hayes Dade, “Time Inc. Launches Sports Illustrated-Branded SVOD on Amazon Channels,” November 15, 2017, http://deadline.com/2017/11/time-inc-launches-sports-illustrated-svod-amazon-channels-1202208673/, accessed November 2017.

- Perez Sarah, “Netflix reaches 75% of US streaming service viewers, but YouTube is catching up,” April 10, 2017, https://techcrunch.com/2017/04/10/netflix-reaches-75-of-u-s-streaming-service-viewers-but-youtube-is-catching-up/, accessed November 2017.

- Koblin John, “Netflix Says It Will Spend Up to $8 Billion on Content Next Year,” October 16, 2017, https://www.nytimes.com/2017/10/16/business/media/netflix-earnings.html, accessed November 2015.

- Perez Sarah, “Hulu to spend $2.5 billion on content in 2017, add 7 more original series,” September 15, 2017, https://techcrunch.com/2017/09/15/hulu-to-spend-2-5-billion-on-content-in-2017-add-7-more-original-series/, accessed November 2015.

- Lynch John, “Disney’s upcoming Netflix competitor will include Marvel and ‘Star Wars’ movies, according to CEO Bob Iger,” September 7, 2017, http://www.businessinsider.com/disney-streaming-service-will-feature-marvel-star-wars-movies-2017-9, accessed November 2015.

- Andreeva Nellie, “Amazon Sets ‘Lord of the Rings’ TV Series In Mega Deal With Multi-Season Commitment,” November 13, 2017, http://deadline.com/2017/11/amazon-the-lord-of-the-rings-tv-series-multi-season-commitment-1202207065/, accessed November 2015.

- Fleming Mike, “After Amazon’s Huge Investment In Tolkien’s Middle Earth, Shouldn’t Peter Jackson Be on Jeff Bezos’ Call Sheet?,” November 13, 2017, http://deadline.com/2017/11/lord-of-the-rings-amazon-peter-jackson-no-call-jeff-bezos-1202207331/, accessed November 2015.

- Cain Rob, “Amazon’s $250M ‘Lord Of The Rings’ Purchase Price Is 1,000 Times What Tolkien First Got For It,” November 14, 2017, https://www.forbes.com/sites/robcain/2017/11/14/amazons-250m-lord-of-the-rings-purchase-price-is-1000-times-what-tolkein-first-got-for-it/#11ca99cb7273, accessed November 2017.

Really interesting article, thanks for sharing your thoughts!

The fundamental question in my mind from Amazon’s perspective is a worry on two fronts.

One is that while this solves the “unified experience” pain-point that customers seem to face, the fact that you still need to pay a fee for each channel you subscribe to within the interface might make it overwhelming for customers (assuming that the $4.99 a month by sports illustrated is representative of their overall service). Unless they figure out a way to bundle their services intelligently (which is where their customization comes in) and offer one fixed price for it, I struggle to see this working.

The second worry is that this is not Amazon’s core competence. Amazon’s strength in my view is in logistics innovation and they continue to be the leaders in that space. Yes, they are great at data analytics and coming up with purchase recommendations, and they could potentially bring the “big data” learning to video as well, but it worries me that they actually don’t have the true expertise to know whether they are overpaying for the content in the first place or not (which they clearly might be doing if they are bidding 2.5x what Netflix is willing to). Sort of like rearranging the deck chairs when the ship could be sinking.

I agree with you that Amazon’s core competence is outside of video analytics, and that Netflix has a substantial lead in this space, but I’m not so sure it matters. For example, Amazon’s CFO said on a recent earnings call (link below) that the video unit drives higher engagement for the rest of the Prime business, including higher conversion of free trials, and higher Prime renewal rates. This gives Amazon a huge advantage in that its video business doesn’t have to make money so long as it’s making up the losses throughout the rest of the Prime ecosystem. This could theoretically allow Amazon to overbid on content without negative consequences, diminishing Netflix’s ability to secure the content for itself.

http://www.homemediamagazine.com/retailers/amazon-cfo-prime-video-having-great-results-41011

This is extremely interesting! I have two thoughts:

First, I agree with Nivi that in the long run, the current model could be improved. Basically Amazon is creating a platform for people to sell bundled content and consumers need to pay for these bundles separately. Many of these bundles / channels are originally created as all-inclusive content offerings to consumers, while Amazon expects consumers to buy many of these channels at the same time. Consumers will end up buying a lot more than they can consume and are willing to pay for. I think ultimately Amazon needs to come up with a way to unbundle these content offerings and blend them into one content pool, and then pay the content providers based on consumption.

Secondly, as more content players emerge, platforms like this will become more valuable, which will attract more companies to attempt creating such aggregation platforms. What would be the competitive edge for a platform? The few things I can think of are its OTT device penetration, user base (not necessarily content users; could be Prime members for example) and proprietary content offering. Amazon has all three and a small number of other companies also do. Assuming the content supply market will be efficient and rational over time, a player like Amazon will have no issue acquiring content at reasonable prices once it establishes a consumer facing platform with a robust distribution strategy.

Very well written and interesting read! I believe that the purchasing data will enable Amazon to construct more accurate user personas and target content based on that insights. While Apple and Facebook have two of the largest consumer distribution channels in the world, I think they are best positioned to target certain segments of content such as user-generated live content or short-form video clips. Netflix and Amazon have a fairly strong head start in aggregating and creating wide range of premium content.

Michael, your comparison to Spotify’s business model is well taken! Amazon has the advantage over Netflix when it comes to the diversity of its purchasing data, which encompasses a wide variety of consumer products. And our class discussions have already brought up Amazon’s increasingly uncanny ability to anticipate the needs of its customers, to the point of knowing a woman was pregnant before she herself did.

To that point, is it really necessary for Amazon to purchase a niche television channel wholesale? Why not pick and choose the shows that its data indicates will attract the most viewers on its platform? To bring the conversation back to Spotify, listeners rarely stop to think about what label produced a certain song, and correspondingly I envision a world in which TV viewers will care less whether a show is Cinemax or Starz.