Amazon – In Prime position for the last mile

The last mile is the key step in each supply chain. Developing and testing new technologies, Amazon is at the forefront of digital innovation with technologies that will change how customers will order and receive deliveries in the future

Taking it all the way

Poised to become the first trillion-dollar company, Amazon always has been on the forefront of innovation, especially in its core value proposition of seamless, quick delivery across its global supply chain [1]. As global eCommerce sales are expected to grow by 23% in 2017 to account for one-tenth of global total retail sales [2], the digitalization of the “last mile” of delivery has become paramount. This final segment of the supply chain has been historically inefficient and costly, comprising up to 40% of the total shipping cost [3]. For Amazon overall net shipping costs have increased by more than 43% in 2016, thereby surpassing the net sales growth of 26% for the year [4].

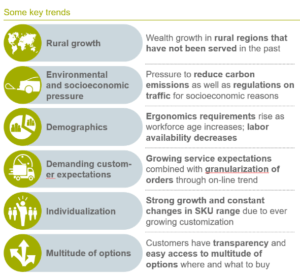

Several key trends fuel the pressure on Amazon’s last mile supply chain as it needs to become faster, more granular and more precise in order to keep up with changing expectations and customer demands. (See Figure 1)

Figure 1 – Key trends causing pressure on supply chains [5]

At the same time, a number of disruptive technologies have emerged that are likely to enable the digitization of supply chain management. These technologies – ranging from advancements in computational power that will transform the Internet of Things (IoT) to breakthroughs in artificial intelligence – will transform the last-mile delivery operations for Amazon. However, it has yet to be decided what ultimately will cause the paradigm shift in last-mile deliveries [6].

“The best way to predict the future is to invent it.” (Alan Kay)

Over the past years, Amazon has explored a variety of options and technologies to address the opportunities and challenges of last-mile delivery.

In 2012, Amazon filed a patent for an anticipatory shipping method that promises to significantly reduce delivery time by initiating the shipment of products before the actual order has been submitted [7]. Using insights on previous orders, product searches and even the time of cursor hovering, Amazon predicts and ships your future orders, thereby significantly reducing delivery times [8].

Another technology that has recently been patented revolves around mounted 3D printers in delivery trucks that could print purchases on the go and deliver them immediately [9]. By using this technology Amazon would not only save significant time on the last mile, it would also reduce its dependence on warehouse space and costly sorting operations.

Another hot topic in digitalization of supply chains is unmanned aerial vehicles (UAVs), or drones. In December 2013, Jeff Bezos announced his plan to use drones to deliver packages up to five pounds in a 10-mile radius around Amazon’s fulfillment centers [10]. Using octocopter aerial drones to fulfill orders has massive implications for both delivery time and cost. Not only could customers receive their items within 30 minutes but also, based on a research report of Deutsche Bank, drone deliveries have the potential to reduce shipping costs by half [11].

“Only those who dare to fail greatly can ever achieve greatly.” (Robert F. Kennedy)

Given the willingness of Amazon to revolutionize last-mile delivery combined with its financial firepower to push the boundaries of what is possible, few stones will be left unturned. Nevertheless, I believe that there are some additional levers that Amazon can improve on as well as some significant risks that need to be mitigated in order to ensure ultimate success.

Some critics argue [12], that it is unlikely that AmazonAir drones will become reality given the obstacles of prohibitive state and underdeveloped state regulations as well as growing privacy and security concerns. Hence, the management has to engage in costly lobbying practices and an extensive testing program to make the idea a practical reality.

Regarding the predictive shipping algorithm, one also has to realize the potential for errors that it could cause, in turn causing costly returns. To minimize those costs, Amazon might consider giving customers discounts, or convert the unwanted delivery into a gift to build additional customer loyalty.

All in all, I believe that Amazon’s management is well equipped for the transformational impact that digital technology will have on its supply chain. My recommendation would be however to not overpace to ensure that safety (drones) and customer satisfaction are never put in jeopardy.

A giant will find it difficult to hide

As Amazon reaches its goal to successfully transform the status quo of last-mile delivery, the technologies that start as internal tools will become third-party services as an additional income source. The play to establish Amazon Logistic Services as a new platform for freight forwarding could be the next logical step.

(1) Consequently, the question arises whether Amazon has set its eyes on the logistics industry and whether the company will be able to compete with and outperform the established players?

(2) If yes, will that be possible without triggering interest from regulators given its increased market power could potentially pose anticompetitive concerns?

(Word count: 798)

Sources:

[1] Cherney, Max A. “Amazon Headed for $1.6 Trillion Market Cap, Analyst Suggests.” MarketWatch, 8 Sept. 2017, www.marketwatch.com/story/amazon-headed-for-16-trillion-market-cap-analyst-suggests-2017-09-07, accessed November 2017

[2] McNair, Corey. “Worldwide Retail and Ecommerce Sales: EMarketer’s Estimates for 2016–2021.”, EMarketer, July 2017, www.emarketer.com/Report/Worldwide-Retail-Ecommerce-Sales-eMarketers-Estimates-20162021/2002090, accessed November 2017.

[3] Mantey, C 2017, ‘OVERCOMING LAST-MILE DELIVERY & URBAN LOGISTICS OBSTACLES’, Supply & Demand Chain Executive, vol. 18, no. 1, pp. 36-38.

[4] Amazon.com, Inc., December 31, 2016, Form 10-K, https://www.sec.gov/Archives/edgar/data/1018724/000101872417000011/amzn-20161231x10k.htm, accessed November 2017.

[5] Alicke, K., Rachor, J., and Seyfert, A., “Supply Chain 4.0 – The Next-Generation Digital Supply Chain,” McKinsey & Company

[6] Mantey, C 2017, “OVERCOMING LAST-MILE DELIVERY & URBAN LOGISTICS OBSTACLES”, Supply & Demand Chain Executive, vol. 18, no. 1, pp. 36-38.

[7] The United States Patent and Trademark Office, Patent #: US008615473, December 2013, http://bit.ly/2AiWV4w, accessed November 2017

[8] Kopalle, P., “Why Amazon’s Anticipatory Shipping Is Pure Genius.” Forbes, Forbes Magazine, 28 Jan. 2014, www.forbes.com/sites/onmarketing/2014/01/28/why-amazons-anticipatory-shipping-is-pure-genius/#6e3fd884605, accessed November 2017

[9] The United States Patent and Trademark Office, Patent #: US20150052024, November 2013, http://bit.ly/1aQfBvU, accessed November 2017

[10] Manjoo, Farhad. “Think Amazon’s Drone Delivery Idea Is a Gimmick? Think Again.” The New York Times, The New York Times, 10 Aug. 2016, www.nytimes.com/2016/08/11/technology/think-amazons-drone-delivery-idea-is-a-gimmick-think-again.html, accessed November 2017

[11] Ibid

[12] Burzichelli, CD 2016, “DELIVERY DRONES: WILL AMAZON AIR SEE THE NATIONAL AIRSPACE?”, Rutgers Computer & Technology Law Journal, vol. 42, no. 1, pp. 162-195.

You bring up an excellent point about Amazon starting to inch closer to competing with the logistics industry. If history tells us anything, betting against Amazon in any industry would be silly. I believe the logistics industry is a difficult target because the incumbents have a global reach and very low margins. What Amazon has is human capital that the logistics industry cannot match. If the projections remain accurate that drone delivery could reduce costs by 50%, then whoever owns that technology would dominate the industry. From a technology standpoint, there are few companies in a better position to create the technology and deep enough pockets to dismantle the current regulatory environment. However, there is no guarantee that even Amazon can convince the public that their privacy and security concerns are worth a couple of dollars off their next Amazon delivery. In the meantime, I would expect Amazon to move forward with bulk logistics (potentially getting into air freight), but until they are able to overcome their drone systems, the incumbents may be able to slow Amazon’s progress into the logistics industry.

Really interesting article Max! You’ve done a good job capturing many facets of Amazon’s last mile opportunities and also dove into a potential LaaS (Logistics as a Service) business unit for Amazon.

1. Many have spoken about Amazon predicting and shipping future orders as you mention above, but I see a problem with this practice as it relates to channel stuffing. Right now, people have a positive, fuzzy image of many tech firms, but this practice opens up the possibility of Amazon probabilistically sending people items that they know a percentage of which will be returned but a percentage of which will be kept. There may be a problem with the latter because there are few signals at that point of how the customer interacted with the delivered product: did they enjoy it and keep it? Were they too lazy to return it? Did they intend to return it but forget about it? The latter 2 events could be construed as unethical practices if Amazon is even slightly perceived as forcing unwanted products on users. Furthermore, this might lead to fines and legal action, but also hurt Amazon’s trust with its customers.

2. To your point about Amazon’s potential LaaS operation, I’m not sold that this would be a success. It is a similar origin to AWS , which arose out of Amazon’s excess server and storage capacity (which can easily be scaled as demand for AWS increases). I wonder whether the same excess capacity exists in Amazon’s warehouses, and I question whether it can be as easily scaled as server storage. This will likely be a much lower margin business than AWS if it is profitable at all.

This LaaS business also brings Amazon closer to anti-trust concerns. You might find this video (though some of it is alarmist and ungrounded): http://www.businessinsider.com/amazon-apple-facebook-google-should-be-broken-up-scott-galloway-2017-11

This video makes a strong argument that many tech firms have used a sweet, fuzzy public image to gain anti-competitive power in the overall consumer landscape and that other industries (like “big bad telecom”) are held to a higher anti-competitive standard while big tech gets off easy for now. After all, is the difference really that big in AT&T’s acquisition of Time Warner than in Google owning Youtube? There is a possibility that big tech’s image changes over the next decade where tech firms are held under a stricter anti-trust standard.

Very interesting article. It is fascinating to learn about the latest technology that Amazon has been leveraging to revolutionize the way customers think about online shopping. I also agree your recommendation not to overpace to implement every technology half-cooked in exchange of neglecting the regulations and safety/privacy concerns.

One thing I am very curious to know further is how all the technology that enables Amazon to essentially re-create the whole supply chain ecosystem will change the relationship with all the manufactures which sell their products though Amazon. Would such technical advancement alter the power dynamics between manufactures and Amazon? Also, does it alter the product mix Amazon will focus on in order to further drive profitability while improving efficiency?

I completely agree with your assessment of some of the challenges that Amazon will face in digitizing its supply chain for the last mile. In addition to the potential issues of privacy, unfavorable regulation, and imperfect algorithms, I wonder whether Amazon will truly be able to roll out this suite of digital products and services cost effectively at the last mile. I do not doubt Amazon’s ability to build or acquire the technologies, but rather fear that they will be unable to find cost-efficiencies as they continue to be at the frontier of new technologies which today are quite costly. Given that we are focused on the last mile where cost savings are key to success, Amazon will need to think not only innovatively, but also in a lean and streamlined way from a cost perspective which it has not necessarily done across its business to date.

Your question as to whether it is possible for Amazon to become a true market leader in logistics without raising regulatory red flags is a good one. I have no doubt that antitrust lawyers are already tracking Amazon’s every move. In fact, this summer the acquisition of Whole Foods seems to have triggered at least some anti-trust concerns* that are unlikely to go away as Amazon continues to buy up companies that offer threatening or complementary customer promises, including in the logistics realm.

*Graham, Jed. “The Amazon Monopoly Problem: Prime Time For Antitrust Action Vs. Internet Giants?” Investor’s Business Daily, 18 Sept. 2017, http://www.investors.com/news/technology/amazon-monopoly-problem-antitrust-action-vs-amazon-facebook-google/.In-text

Great article.

Two additional questions come to mind.

One additional question I have is whether Amazon’s generous return policy is sustainable. As customers become more used to returning items (for free), they might start purchasing items only with the intend to use it once and return it.

I agree that regulation around privacy might limit Amazon’s success in developing its drone operation. In addition to this, I am wondering how Amazon will deal with the EU’s increased focus on tax regulation, as its trying to expand its operations in Europe.

https://www.cnbc.com/2017/10/04/amazon-eu-tax-bill-luxembourg-deal.html

Very interesting article. Regarding whether or not Amazon has set its eyes on the logistics industry, Bloomberg Technology’s article “Amazon Building Global Delivery Business to Take on Alibaba” mentions an internal document that was shared with the Amazon leadership team in 2013 called Project Dragon Boat, which details a path towards entering the global shipping business (even beyond servicing its own existing customers). [1] Thus, a strategy towards entering the market has at least been outlined before.

From a competitive perspective, it makes sense for Amazon to enter the fray. Amazon has a history of upending traditional business models and even if it doesn’t attain critical mass versus the existing competitors, at least the portion of business it does retain will keep UPS and others honest in terms of price increases on a go-forward basis (historically have been around 5% p.a.). [2] Interestingly, Amazon’s approach to upending last mile logistics thus far has used the gig economy – “Amazon Flex” allows people to contract with Amazon to deliver packages at an hourly rate of $18-$25 using Amazon’s routing technology. [2]

[1] Spencer Soper, “Amazon Building Global Delivery Business to Take On Alibaba,” https://www.bloomberg.com/news/articles/2016-02-09/amazon-is-building-global-delivery-business-to-take-on-alibaba-ikfhpyes, accessed December 2017.

[2] Wolf Richter, “Amazon is encroaching on an industry that’s key to its success,” http://www.businessinsider.com/amazon-stock-price-logistics-companies-couriers-ups-2017-6, accessed December 2017.