AIG: Underwriting the Risk of Climate Change

The players who have the most to lose from climate change may be the source of the most innovative solutions.

“Climate change is increasingly recognized as an ongoing, significant global environmental problem with potential risks to the global economy and ecology, and to human health and wellbeing … At the same time, market-based environmental policies and potential new investments provide business opportunities for AIG to address the problem.”[1]

On May 15, 2006, American International Group (“AIG”) became the first U.S. insurance company to publicly address climate change as a risk and formally outline its corporate policy and programs regarding the issue. As a leading provider of Property and Casualty (“P&C”) insurance in the U.S., AIG is directly exposed to the risk of insured losses resulting from severe weather. According to Allianz, one of AIG’s competitors, “climate change stands to increase insured losses from extreme events in an average year by 37 per cent within just a decade”[2]. Given this threat, the players in this market have focused on limiting their financial exposure to high-risk areas, either by canceling or not renewing policies or by increasing deductibles, reducing limits, and adding new exclusions to policies.[3] Insurers such as AIG are working diligently to incorporate appropriate risk levels in their forecasting analyses to align rates and reserves. However, as stated in their May 2006 press release, AIG has identified opportunities that they expect not only to enhance the revenue and profitability of their business, but also to provide potential solutions to climate change.

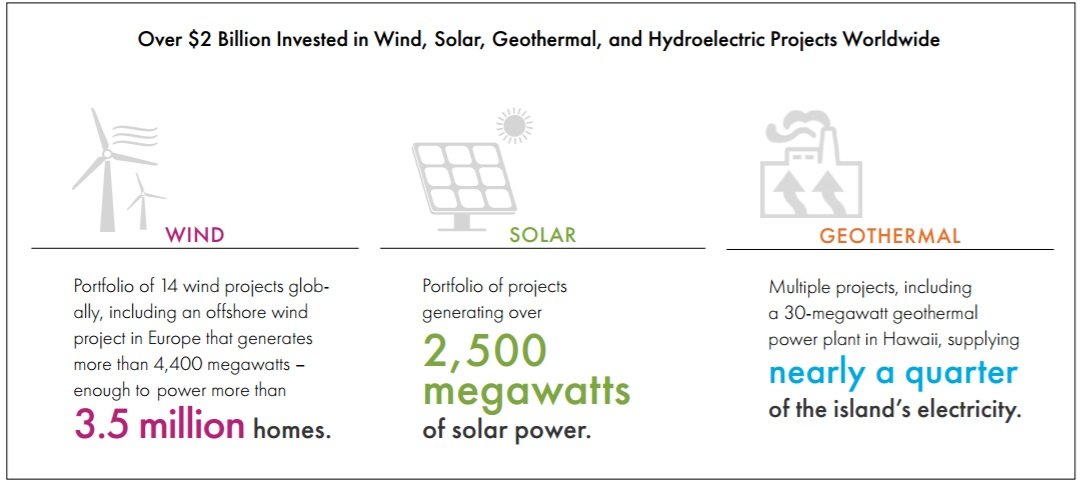

AIG’s specific actions to date include investing in clean energy and greenhouse gas emission mitigation projects, participating in the trading of emissions compliance securities, and creating customized insurance products for the renewable energy space, such as tailored insurance for ‘green’ buildings or ‘green replacement’ policies.[4] ‘Green replacement’ policies may offer premium discounts if an individual or business builds to a higher standard of sustainability.[5] In 2007, AIG created the AIG Global Alternative Energy Practice for “the insurance, risk management and loss control needs of U.S.-based alternative energy clients, including organizations engaged in biofuel, hydroelectric, geothermal, solar and wind operations”[6]. The following Figure 1 from AIG’s 2015 Corporate Citizenship Report highlights the key statistics related to AIG’s sustainable investing focus. AIG also has invested in markets such as waste-to-energy, fuel-cell, transmission, and distributed generation.

Figure 1

Although these actions aim to address reducing greenhouse gas emissions in the long-term, the more imminent issue facing AIG, the insurance industry, and the government is how to mitigate the effects of climate change in the near-term. If individuals or businesses are unable to obtain private insurance, governments and taxpayers will ultimately bear the burden of losses arising from property damage in areas affected by extreme weather. To highlight the impact on just the private insurance industry, as of 2011, payments made by insurance companies for destruction from climate change events increased by 15x over the past 30 years.[7]

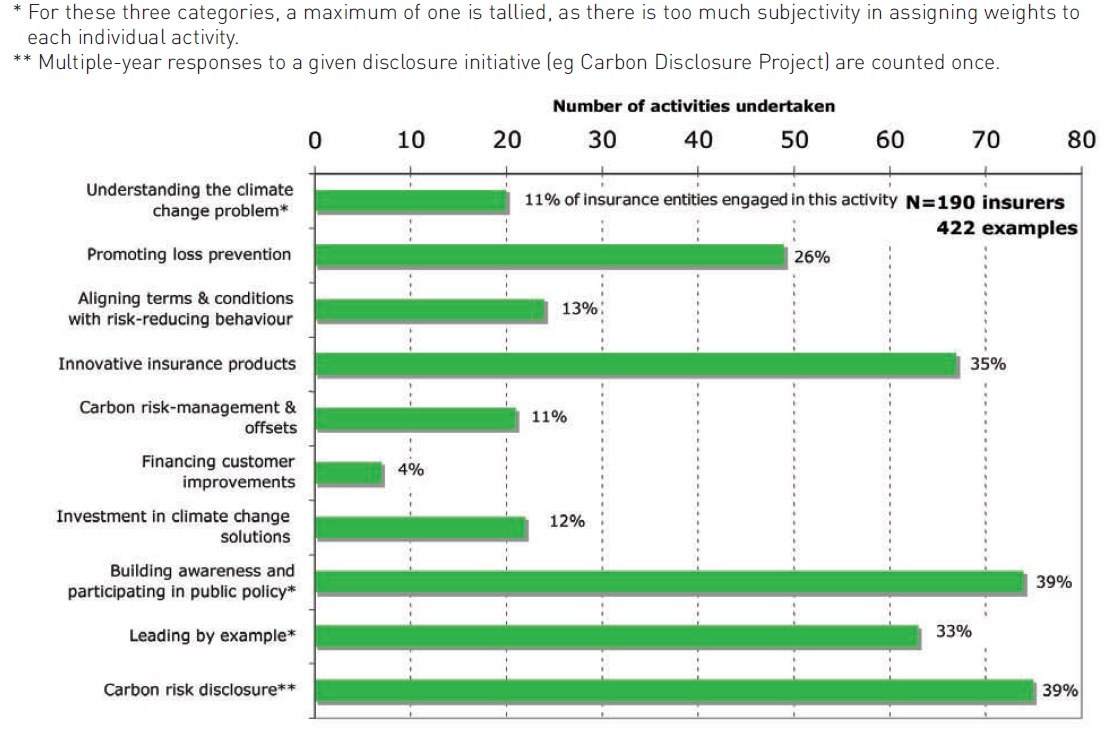

Ceres, a non-profit organization advocating for sustainability leadership, has urged insurers such as AIG to mitigate the effects of climate change by supporting research on national and local forecasting of future weather patterns and developing “underwriting guidelines and rate plans that reward insureds that increase resiliency (e.g., storm-resistant buildings)”[8]. AIG recognized this call to action in an informational brochure released after Hurricane Sandy. These recommendations highlight the importance of the insurance industry’s role in helping society better understand the drivers of (and forecast the impacts from) climate change. AIG should invest capital and resources to track trends in their data and partner with leading scientists to forecast risks. Figure 2 below, from an article by Dr. Evan Mills titled “Responding to Climate Change – The Insurance Industry Perspective”, outlines a range of activities pursued by participants in the insurance industry and shows the percent of insurance entities engaged in the activity. Disappointingly, only 11% of insurance entities are engaged in understanding the climate change problem, although this presents an interesting opportunity and point of differentiation for AIG. With their significant size, funding, ability to collect detailed weather data, and contacts in government and the research sector, AIG is poised to help the U.S. better understand and respond to climate change in parallel with their work to reduce the risks to their business.

Figure 2

Word Count: 709

[1] http://media.corporate-ir.net/media_files/irol/76/76115/aig_climate_change_updated.pdf

[2] Mills, Dr. Evan. Responding to Climate Change – The Insurance Industry Perspective, p. 1

[3] Ibid, p. 2

[4] http://media.corporate-ir.net/media_files/irol/76/76115/aig_climate_change_updated.pdf

[5] Messervy, Mills (Ceres Insurance Program). Insurer Climate Risk Disclosure Survey Report & Scorecard: 2014 Findings & Recommendations, October 2014, p. 38

[6] Parekh, Rupal. http://www.businessinsurance.com/article/20070411/NEWS/20009963/aig-sets-up-alternative-energy-practice

[7] American International Group, Inc. Climate Change: A Call for Weatherproofing the Insurance Industry. http://www.aig.com/content/dam/aig/america-canada/us/documents/business/industry/ipg-real-estate-climate-change-paper-brochure.pdf, p. 3

[8] Ibid, p. 4

Interesting piece. I think I’d be most interested in how reliably one can adjust underwriting guidelines for broad, long-term trends like climate change. The inherent assumption here is that historical data won’t be as reliable going forward as extreme tail events become more likely. Although there’s general agreement within the scientific community that this is true, I wonder whether there’s actually a consistent view one can use to reliably quantify and incorporate this impact in underwriting/premium calculations.

Hi Jess, this is an interesting post to show how insurance companies are related to climate change. I agree that insurance companies are on the front-lines of climate change risk, as the extreme weather and health threats are causing more and more losses for them. And I was shocked to learn that “payments made by insurance companies for destruction from climate change events increased by 15x over the past 30 years”! Thanks for helping me learn how AIG develop underwriting guidelines and help the society better understand drivers of and impacts from climate change.

On the other side, I personally think that climate change also brings some emerging business opportunities for insurance companies, as they can design and develop some creative product and service offerings that related to climate change.

Thanks for this Jess. It is also worth noting that insurance companies are closely connected to some major drivers of climate change. In 2015, AXA announced its intention to divest €500m from companies heavily exposed to carbon emissions, and to triple its green investments by 2020 (see https://www.ft.com/content/f349dbb0-0072-11e5-b91e-00144feabdc0). Companies like AXA and AIG have significant capital to invest and their decisions in doing so set important precedents regarding climate change and sustainability.

In addition, coal-fired power plants and other greenhouse gas-intensive projects are important sources of premiums for the same insurers, further complicating the cost-benefit analysis. It is therefore important that each conducts a balanced assessment the myriad impacts of climate change on their business when deciding which sales and investment practices should continue.

Jess, good post, however I believe there are better ways for insurers to deal with climate change risk than the ones outlined above.

Insurance companies basically make money from two sources: (1) premiums from assuming customers’ risks (the core business), and (2) financial gains from investing company’s reserves.

Currently, most of AIG’s sustainable strategy addresses the latter, namely investing in clean energy projects with the hopes of earning an attractive return.

I believe it is necessary to further incorporate the sustainability strategy in the premiums side of the equation (which as I mentioned earlier is the core of their business). The post mentions the idea of giving premium discounts to customers who meet certain “sustainability” conditions, but that does not seem financially viable, unless of course insurers have priced correctly the corresponding risks. However, pricing risks correctly implies being able to make reliable forecasts on the effects of climate change and the weather, which we all know is extremely hard to do and I think is not necessarily the best way to spend time and resources.

In my opinion, from an insurer standpoint, the solution will have to come from a smarter pooling, or more appropriately, offloading of risk. Insurers typically retain the risk on their balance sheets and share some risk with reinsurers. However, risk remains concentrated in a handful of players.

More appropriate would be for insurers to create tradable securities whose cash flows are matched with customers’ premium payments and in case a disaster occurs then investors in the securities forgo some or all of the principal. Such instruments already exist, which are called CAT bonds (CAT for catastrophic), but is still a young industry.

The three major advantages of CAT bonds are: (1) frees capital on insurers balance sheets and therefore increases ability to underwrite more risks; (2) diversifies risk in a much larger number of players, so that no single entity is heavily exposed to a particular event; and (3) highly attractive to investors since correlation of CAT bonds with stock and bond markets is low.

Andres,

Thank you so much for your thoughtful comment – you brought up some very interesting points. I think CAT bonds are definitely an innovative solution and allow underwriters to free-up capital on their balance sheets while allowing individuals in high-risk areas to obtain private insurance coverage, as you pointed out. Interestingly, quantitative easing has actually created some potential risk and reward issues in the CAT bond market as investors who are looking for yield have driven up prices of these bonds. In 2014, Berkshire Hathaway quietly stated that they “constrained the volume of business” in this reinsurance market because of “management’s assessment of the adequacy of premium rates”. Given the outlook that natural disasters are going to become more unpredictable, it appears that some major investors, such as Buffet, are concerned that the CAT market has worked thus far because the instruments haven’t faced any large losses. That being said, I personally cannot think of a better solution, but it will be interesting to see what may happen to capital markets if multiple hurricanes hit just as interest rates start to increase.

Great post, Jess. I agree with Andres on the suggestion of looking at Catastrophe Bonds:

http://www.investopedia.com/terms/c/catastrophebond.asp

The notion that you can invest in a security with an attractive yield that is completely uncorrelated to the economy or the stock market means that CAT bonds are theoretically a good security for pension funds to add to their portfolio, as we learned in FIN class. I think insurance companies will need to be innovative not just in how they price risk and align incentives for the future but also in how they finance their operations, and CATs are a simple but promising start. It seems that the whole insurance industry, both health and P&C, will need to undergo a paradigm shift to address preventative measures vs. reactive measures which are more costly (i.e. price health insurance based on people’s health habits, and price P&C insurance based on environmental externalities).

Ilan,

Thank you so much for your comment – I definitely agree that CAT bonds are an innovative solution. I replied to Andres comment above with one potential issue that will be interesting to track in this market as interest rates start to rise. A lot of it is summarized (with a lot more expertise and knowledge than I have) in an interesting article in the WSJ this summer: http://www.wsj.com/articles/the-insurance-industry-has-been-turned-upside-down-by-catastrophe-bonds-1470598470