Adidas Speedfactory: Disrupting The Sneaker Manufacturing Process

Adidas is leveraging futuristic automation and additive manufacturing to lead the pack in fast footwear

Futuristic Design

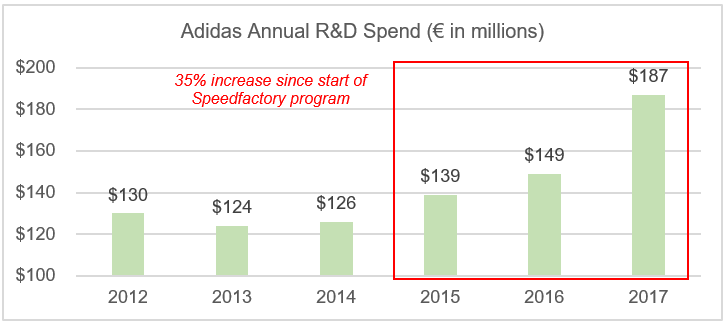

With a minimalist design, this German factory features robotic arms, multi-layered particle machines, laser cutting robots and 3D printers – no, this is not an electron particle laboratory, this is Adidas’ new “Speedfactory”, a factory designed to disrupt the sneaker supply chain. Why has Adidas increased their R&D spend by over 35% to build state-of-the art sneaker manufacturing factories [1]?

Shifting Consumer Demand

The rise of social media has led to a “see now, buy now culture”, where consumers are accustomed to instant gratification, driving demand for “fast fashion” products [2]. Additionally, a growing number of customers are pushing for customized products, creating a market for Mass Customization, the process of producing customized products for satisfying individuals with the efficiency of mass production [3].

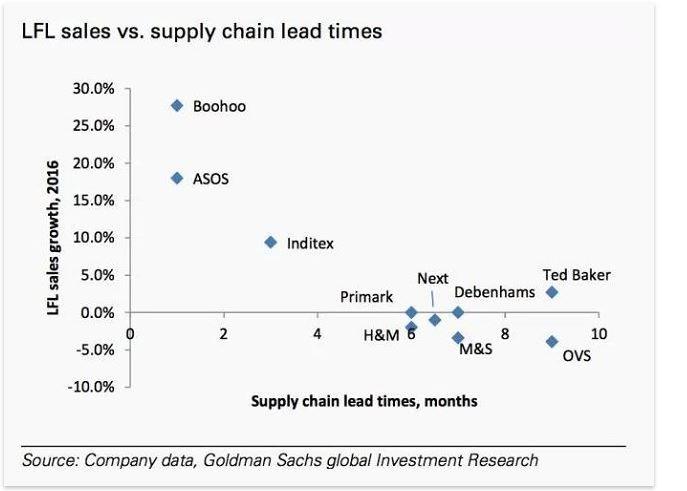

Goldman Sachs mapped the correlation between supply chain lead times and like-for-like sales growth [4]:

This chart illustrates an inverse correlation, with fashion brands like Boohoo and Asos capitalizing on market demand. Additionally, according to BCG, brands that create personalized experiences by integrating advanced technologies and proprietary data for customers are seeing revenue increase two to three times faster than those that don’t [5].

Fast + customized is the winning formula for consumer facing brands. For Adidas to capitalize on these trends, it is critical they invest in innovative manufacturing and supply chain processes.

The Rise of Fast Footwear

In response to consumer demand for customized products with shorter lead times, Adidas is determined to lead the fast footwear category. In the short-term Adidas is moving away from pre-season product development to in-season development. Pre-Season refers to predicting trends and building inventory while in-season refers to quickly reacting to trends, ensuring in-demand products are delivered just in time. The benefits of in-season development include:

- Fresher and more desirable products

- Reduced risk of overbuying

- Lower levels of excess inventory

By 2020 Adidas estimates they will generate 50% of sales through speed-enabled channels, increasing their share of full-price sales by 20% [6].

The Automation Experiment

This shift towards reactive, in-season manufacturing is table stakes for Adidas to compete in an increasingly automated market. Adidas’ main competitor, Nike is in the process of near-shoring production to North America and creating a responsive manufacturing model. Nike has partnered with supply chain and logistics innovator, FLEX to manufacture 25% of their shoes on a responsive model, reducing manufacturing to market times by ~85% [7]. Nike is also investing in automated manufacturing equipment and plans to install 1,200 new machines across their Asian facilities [7].

For Adidas to remain innovative, the company must continue to invest in their Speedfactory project in the medium term. In 2015 Adidas opened their first Speedfactory one hour outside of their German headquarters. This automated facility utilizes additive manufacturing and smart planning to create high-performance footwear. The 3D technology enables the company to easily create digital mock-ups and quickly print prototypes, transforming concepts into sneakers at a pace commensurate with consumer demand. In addition to speed and creativity, the automated equipment is reducing the number of laborers needed per facility by more than 70% [8].

Though still in its infancy, the Speedfactory project seems to be showing early signs of success. Less than a year after construction, the German Speedfactory released its first sneaker – the Futurecraft MFG.

Adidas opened their second Speedfactory outside of Atlanta, GA. This 74,000 square foot facility partnered with Silicon Valley additive manufacturing start-up Carbon to integrate Carbon’s technology to produce unique SKUs of 3D printed sneakers. Adidas and Carbon released 5,000 pairs of the Futurecraft 4D in January 2018 to much fanfare [9].

What’s Next?

Though Adidas has two Speedfactories, management forecasts the combined annual output will be one million units globally, or less than 0.3% of total volume of Adidas sneakers [1]. This raises a few questions:

- Are Speedfactories just an expensive marketing ploy?

- Is there a path to commercial viability?

- Should Adidas continue their partnership with Carbon?

One commercially viable use for the factories is rapid prototyping and market testing. Adidas has distinguished themselves as innovators in footwear design, and the Speedfactories enable them to produce limited quantities to test new product designs.

The Speedfactories also enable the company to test new production methods and institute their findings across other facilities. This sharing of best practices should reduce manufacturing times across the global footprint while reducing costs.

The investment in Speedfactories is not an imminent threat to traditional sneaker manufacturing but is a critical R&D expense, instilling a culture of innovation. The company should build-out their speedfactories in targeted geographies while continuing to expand their reactive manufacturing processes, further reducing lead times. The Company should also expand their partnership with Carbon, adding to the hype generated by the Futurecraft 4D release. These initiatives should bolster Adidas’ leadership position in the fast footwear category.

(Word Count: 794)

References

[1] Adidas AG (2017). Annual Report. [online] Available at: https://www.adidas-group.com/media/filer_public/a3/fb/a3fb7068-c556-4a24-8eea-cc00951a1061/2016_eng_gb.pdf [Accessed 10 Nov. 2018].

[2] Berg, A. (2018). Faster fashion: How to shorten the apparel calendar. [online] McKinsey & Company. Available at: https://www.mckinsey.com/industries/retail/our-insights/faster-fashion-how-to-shorten-the-apparel-calendar [Accessed 11 Nov. 2018].

[3] Yeung, Ho-Ting & Choi, Tsan-Ming & Chiu, Chun-Hung. (2010). Innovative Mass Customization in the Fashion Industry. 423-454. 10.1007/978-3-642-04313-0_21.

[4] O’Byrne, R. (2018). Traditional to Fast Fashion Retail: Supply Chain Transition. [online] Logisticsbureau.com. Available at: https://www.logisticsbureau.com/traditional-to-fast-fashion-retail/ [Accessed 12 Nov. 2018].

[5] Abraham, M. (2018). Profiting from Personalization. [online] https://www.bcg.com. Available at: https://www.bcg.com/en-us/publications/2017/retail-marketing-sales-profiting-personalization.aspx [Accessed 10 Nov. 2018].

[6] Adidas AG (2016). Annual Report. [online] Available at: https://www.adidas-group.com/media/filer_public/a3/fb/a3fb7068-c556-4a24-8eea-cc00951a1061/2016_eng_gb.pdf [Accessed 10 Nov. 2018].

[7] Sprunk, E., Nike COO (2017). 2017 NIKE, INC. INVESTOR DAY.

[8] Bain, M. (2018). A German company built a “Speedfactory” to produce sneakers in the most efficient way. [online] Quartz. Available at: https://classic.qz.com/perfect-company-2/1145012/a-german-company-built-a-speedfactory-to-produce-sneakers-in-the-most-efficient-way/ [Accessed 09 Nov. 2018].

[9] Digital Trends. (2018). Adidas’ Futurecraft 4D DLS Shoe Goes On Sale January 18 for $300 | Digital Trends. [online] Available at: https://www.digitaltrends.com/outdoors/adidas-futurecraft-4d-jan-18/ [Accessed 12 Nov. 2018].

Love this topic and analysis! I fully agree that there is commercial viability for Speedfactories and that competitors like Nike and Under Armour will continue to do the same. Under Armour opened up their innovation center called Lighthouse in Baltimore (https://baltimore.cbslocal.com/2016/06/28/under-armour-opens-lighthouse-innovation-center-in-baltimore/) to do a similar thing. They are experimenting with smaller, more reactive lines of apparel. While domestic manufacturing in the United States has been generally more expensive, I believe the long-term trend will yield lower costs in domestic distribution and reduced inventory. More importantly, they will be able to over better customization at a larger scale.

To answer your first and second questions, I believe that there is commercial viability in additive manufacturing for companies like Adidas and that this is not just a marketing ploy. Historical challenges in speed and cost are being replaced with faster, more cost effective machines that can produce efficient products using an array of materials [1]. That being said, my question moves to what’s next for companies like Adidas? Once additive manufacturing becomes the new norm, when access to such technology is at an even playing field for all apparel companies, how does a company like Adidas differentiate itself amongst consumers? A future with lower cost customization featuring nimble supply chains is surely a win for consumers, but I struggle to see how Adidas or any apparel company can maintain a competitive edge once additive manufacturing becomes commoditized.

[1] “‘Quietly, people were forging ahead’: the evolution of 3D printing.” The Guardian, 22 October 2018, https://www.theguardian.com/product-innovation-with-henkel/2018/oct/22/evolution-of-3d-printing-adidas-carbon-henkel-renishaw-additive-manufacturing.

Interesting article written with a great eye for detail!

To me, the Speedfactories seem more than an expensive marketing ploy (or at least a rather ineffective one, since awareness on this concept is relatively low). Rather, I believe they are an adequate response to the market demand for speed you identified, and to competitors (i.e. as you noted, Nike is taking similar measures). However, I wonder whether Adidas is focusing its additive manufacturing efforts too much on the speed aspect of production, where competitors (including Nike) are focusing mostly on improving performance. If you can get an Adidas pair of shoes two times faster, or a Nike shoe that is two times better – what would the consumer choose?

Thank you for this very interesting article! I would like to address the first and second questions that you posed above. I do believe that in the short term, the Speedfactory is a clever marketing ploy that could attract a number of customers who are interested in the latest design and technology of footwear. In fact the limited run of Futurecraft 4D shoes that you mentioned in your article was sold out within a short amount of time. That being said, in my opinion Adidas is playing the long game with this technology. There is indeed a path for commercial viability as the technology matures and efficiency increases with experience. Another potential impact that I could see is that this could be a driver to help bring back manufacturing back to western countries, as the process is highly automated. This would provide job opportunities to high skilled operators and engineers.

The statistic in this article that was most surprising to me was that the combined annual output of the two Speedfactories will be less than 0.3% of total volume of Adidas sneakers. Given that the capital cost of investing in additive manufacturing is very high, I wonder how scalable this strategy is for Adidas. In determining whether there is a path to commercial viability, Adidas needs to determine which type of sneakers additive manufacturing is most beneficial for and what percent of total volume those types of sneakers account for. Depending on the shoe type and the volume of that product sold, it would be interesting to run a break-even analysis to see whether traditional manufacturing or additive manufacturing makes more sense. While I understand the importance of speed to market, it is also important that Adidas has a clear understanding of the unit economics of producing shoes through additive manufacturing.

In terms of whether or not to continue partnering with Carbon, I think Adidas should assess which markets it is crucial to have speed to market and “fast fashion” sneakers in order to stay competitive with other players in the market and open Speedfactories in those markets.

Great article ! Like you mentioned, I believe the best use of the Speed Factory at the moment is rapid prototyping, which enables quick market testing. While 3D printing is likely to replace traditional manufacturing techniques in the future, I think it has great value in cutting the lead time for launching new products at the moment. With intense competition and the consumer moving to fast fashion, this will give Adidas a huge boost over competition. I am sure like VP above mentions, that competitors will enter this segment soon and like Alexandra mentions, with Nike currently focused on quality and the product, Adidas has this window of opportunity to maximize sales and convert customers.

There are few concerns on the 3D printing process itself, with critics pointing out the fact that the molecules are not as tightly glued together and could cause injury and that the output/ or consistency of shoes produced for the same input can vary. With the current R&D spend that Adidas is currently subscribing to, hopefully this issue is sorted out soon. Should Adidas build this expertise in-house? I think in the medium term yes but for now they should continue to partner with Carbon.

The speedfactory concept and the application of 3D printing for footwear is extremely interesting and, as you very rightly highlighted, the move toward in season, fast fashion is table stakes for Adidas as much of the fashion and retail world is moving in that direction. In response to your question, I do appreciate how in the short run such investments do create interesting buzz about the company, helping them use this as a marketing play to build the brand. At the same time, I do strongly feel that taking a long term view and starting early to build such capabilities to remain competitive is extremely important. Hence, I view this more as an investment in Adidas’ future, and a necessary response to shifting consumer preferences. Of course, the success or failure of such a venture will ultimately be defined by Adidas’ ability to execute effectively and scale this investment across its operations.