Adidas Speed Factories: the quest for single-day lead times from concept to consumer

Adidas is challenging the athletic wear and fashion industries with high-tech, local Speed Factories that create small-batch, custom products with potential to reduce innovation cycles to only days

Challenges in modern athletic wear

Athletic wear is facing a transformation from functional performance gear toward fashion-forward innovation. As new styles walk the runway, athletic wear companies must immediately incorporate the latest fashions into their product portfolios. This requires them to push new designs through the development, manufacturing, and distribution channels to reach consumers before the next new trend arises. In this environment, long innovation cycles and lead times threaten the viability of products. [1]

Though Nike has been leading the US market for athletic wear, Adidas is showing a recent resurgence due to a revival of its retro styles. Globally, Adidas continues to expand its reach and leads the market with global sales of 19.3 million Euros. [2] A consequence of this growth is that Adidas relies on manufacturing in emerging markets such as China, Indonesia, and Vietnam, where labor and resources are less expensive. [3] Additionally, as increasingly customized products enter the supply chain, companies have become more reliant on comprehensive inventory management solutions to manage complex supply chains. Cloud-based inventory solutions are expected to dominate the future, and athletic wear stands to benefit from additional cash flow associated with an optimized cash conversion cycles. [4]

Adidas takes action

Adidas has approached inventory challenges using Infor’s GT Nexus cloud inventory management solution, which provides visibility of raw materials and work-in-progress inventory, as well as tracking of finished goods inventory. Adidas is also experimenting with the use of near field communication (NFC) to establish direct-to-consumer relationships. They intend to expand this tactic across more products as NFC technology becomes entrenched in smartphone technology. Data generated from NFC interactions can provide feedback into the development process for more relevant innovation. [5]

Adidas is also addressing its global distribution challenge with highly innovative solutions that involve shifting footwear design and manufacturing toward local, high-tech manufacturing centers called “Speed Factories”. These high-tech factories are intended to employ automation and 3D printing technology to support small-batch production of custom footwear tailored to suit consumers in regions near their production site. The first Speed Factory was opened in Ansbach, Germany in early 2017, and another is expected to open in Atlanta at the end of 2017. [6]

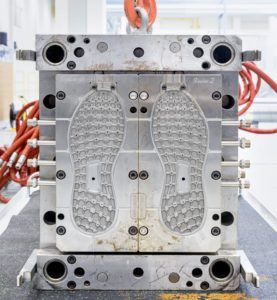

Speed Factory rubber outsole moulds – credit: Alastair Philip Wiper [6]

The future of factories

To support product innovation in these micro-factories, Adidas is experimenting with proprietary 3D visualization software that generates highly accurate digital models of footwear designs. These models are then tested for material performance on the ARAMIS 3D motion-capture and analysis program that NASA and Boeing use for stress-testing. Adidas is trialing this new approach in its Ansbach factory with AM4LDN (“Adidas Made for London”), a tailored pair of trainers built specifically to suit the rainy and early morning conditions of London’s large running-commuter population. In the next few years they intend to launch other regional custom trainers, and to open more Speed Factories to serve the needs of local metro populations. Each new factory is set at a target of 500,000 pairs of sneakers per year, supported by the premise that “premium sneakers thrive off scarcity”. [7]

AM4LDN Trainers – credit: Alastair Philip Wiper [6]

Moving farther into the future, Adidas intends to push the boundaries of this technology to customize designs at the individual level. Distribution challenges are expected to persist into the longer term, and Adidas intends to address these with a direct, expedited drone technology approach. Adidas’ VP of Technology Innovation Gerd Manz reported that by 2020 he intends for Adidas to deliver 50% of its concept designs to store shelves within only 45 days, while claiming that the new process allows for a theoretical design to consumer lead time of only a single day. [4]

Other opportunities

As Adidas pursues these new technologies, there has been a substantial, though expected, increase in capital investments, and yet the two Speed Factories will address just 1M of the 360M pairs of shoes currently produced in South Asian factories. [7] As a result, Adidas must strike a balance of custom designs against growing sales of their broader footwear portfolio. To balance the innovative process with broader operations, Adidas should look to contain its Speed Factory focus in the near-term to regions of high customer concentration, opening factories in places like London, Tokyo, and New York City. This will allow them to tailor to a large local base with lower capital outlay. Additionally, to push the capabilities of innovation, Adidas should explore other Internet of Things technologies such as sensors to monitor product performance and usage, as well as trackers to support rapid-distribution management.

These high-tech solutions raise the question: How can digital innovation in the supply chain become economically viable at scale against heavy capital and operating expenses of new technology?

Word count: 787

[1] Marketing Week, “Adidas details ‘revolutionary’ three-pillar strategy as it aims to reclaim lost ground” (19 Jul. 2016), accessed 12 Nov. 2017, https://www.marketingweek.com/2016/07/19/adidas-details-revolutionary-three-pillar-strategy-as-it-aims-to-reclaim-lost-ground/

[2] Adidas Group, “Adidas with Record Sales and Earnings in 2016” (2017), accessed 12 Nov. 2017, https://www.adidas-group.com/en/media/news-archive/press-releases/2017/adidas-record-sales-and-earnings-2016/

[3] The Economist, “Adidas’s high tech factory brings production back to Germany” (14. Jan 2017), accessed 12 Nov. 2017, https://www.economist.com/news/business/21714394-making-trainers-robots-and-3d-printers-adidass-high-tech-factory-brings-production-back

[4] GT Nexus, “Adidas wants to take shoes from idea to store shelf in 45 days” (27 Aug. 2015), accessed 12. Nov. 2017, http://www.gtnexus.com/resources/blog-posts/adidas-agile-supply-chain

[5] Infor Blog, “Ushering in the age of networked intelligence” (11 Jul. 2017), accessed 12 Nov. 2017, http://blogs.infor.com/insights/2017/07/age-of-networked-intelligence.html

[6] Wired UK, “Too make a new kind of shoe, Adidas had to change everything” (4 Oct. 2017), accessed 12 Nov. 2017, http://www.wired.co.uk/article/adidas-speedfactory-made-for-london-trainers

[7] Quartz Media, “Adidas can now make specialized shoes for runners in different cities, thanks to robots” (4 Oct. 2017), accessed 12 Nov. 2017, https://qz.com/1081511/adidas-can-now-make-specialized-shoes-for-runners-in-different-cities-thanks-to-robots/

[8] Fortune, “Why Adidas is turning to robots in Germany and the US” (25 May 2016), accessed 14 Nov. 2017, http://fortune.com/2016/05/25/adidas-robot-speedfactories/ (featured image)

There may be three answers to address the economic viability question. First, Adidas is sitting on $2.1B in net working capital as of 2016 (calculated off their most recent financial statements). Second, Adidas has always marketed itself as a shoe for “serious, technical athletes,” so the investments in the Speed Factories are a natural fit for the company and will allow it to compete more readily against Nike in the US markets. Finally, it is possible that Adidas does not expect to ever have its entire 360M pairs of shoes (in the South Asian factories) created by Speed Factories. They may begin marketing the customized footwear as an entirely new product with a new price point designed to recapture some of the heavy investments they’ve made into the factories, without scaling up. It remains to be seen what the broad demand will be for these shoes, and how much the high-end consumer will be willing to pay.

Great post! Another take on the economic viability question – this may not actually be critical to justify the investment in Speed Factories. It seems to me that the benefits to Adidas of Speed Factories (at least in the short- to medium-term) are marketing and R&D. If this project is thought of as a high-tech innovation lab, as opposed to the early stage of a full-scale production facility, then economic viability isn’t a determinant of success. One justification for viewing it in this way (as a capital-consuming innovation lab) is that the value proposition of the Speed Factories (small batch, highly customized shoes) doesn’t really match the customer promise for Adidas’ main customers (mass production for mass retailers – Adidas and Nike are wholesalers much more than direct to consumer retailers).

Their wholesale customers want shortened product lead times, that is for sure. But from what I can tell, these Speed Factories aren’t addressing mass production lead times, and are therefore innovating on a sliver of the business, and could be completely justifiable from a test and learn perspective even if never economically viable as currently envisioned.

Similar to the United Interconnectors dilemma we faced in class, it seems to be a decision whether Adidas wants to play in the low cost/low flexibility space or to advance into more of a customized area. As mentioned above, Adidas is known for its high quality, technically performing shoes – I would argue these Speed Factories sacrifice the economic profitability of the more mass-produced shoes for a stronger reputation in the high-quality competitive area. Considering Nike and UnderArmour are selling similar products, these fast-to-market, geographically customized products are a great way to differentiate within the market, thereby not necessarily competing with the exact same business model. Speed Factories should seek to optimize operations through 3D manufacturing technology, digital supply chain informatics, but to keep their primary function of creating differentiation through customization a priority by using advanced market data analytics to drive design.