Adidas: Front-running digitalization in sports retailing

As the “fourth industrial revolution” continues to transform traditional manufacturing processes, Adidas’ “Speedfactory” aims to lead the automated production of sporting goods.

“Industry 4.0” – A global buzz

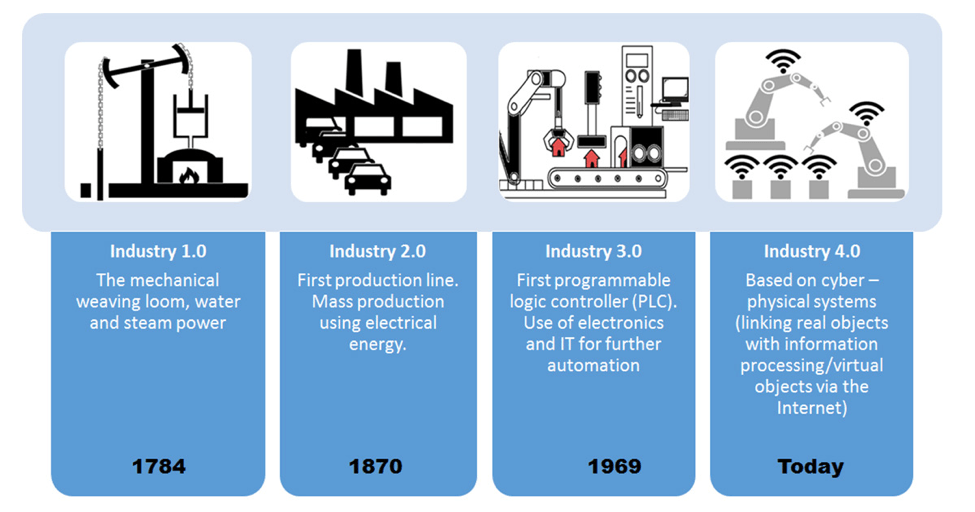

“Industry 4.0” describes the fourth industrial revolution (Exhibit 1) in which machinery no longer simply processes a product, but in which the new capabilities of smart, connected machines are reshaping the operations of manufacturing plants, leading to fully automatized and optimized production processes (“Smart factory”) [1] [2]. The concept originated in Germany in 2010 as part of the government’s High-Tech Strategy 2020 Action Plan, with similar applications having emerged globally (e.g. “Smart manufacturing” in the US).

Exhibit 1. From Industry 1.0 to Industry 4.0 [3].

Implications of Industry 4.0 for Adidas – Transformational challenges ahead

As the application of Industry 4.0 and the underlying digitalization of supply chains is transforming competition and manufacturers [2] [4], traditional retailers such as Adidas face the challenge of adjusting their value chain and production processes to sustain competitive edge. Due to the scope of innovation, companies failing to adapt to this megatrend are expected to miss out on significant operational and cost efficiency gains in the short to medium term. McKinsey estimates that the potential impact of Industry 4.0 innovations on a company’s supply chain could result in up to 30% lower operational costs, 75% fewer lost sales1, and a decrease in inventories of up to 75%, partially driven by a shift from push production (“make and build up inventory”) to a pull production (“make to order”) [5] [6].

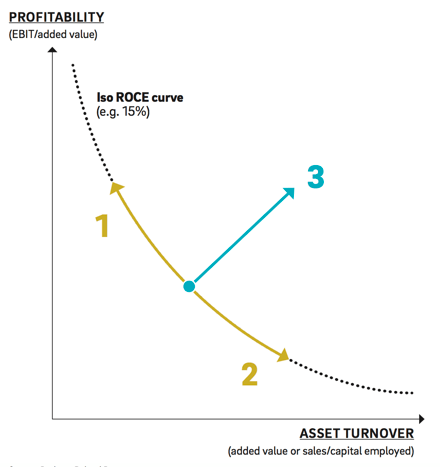

The effects of digitalization ultimately lead to a new economic rationale: Whereas historically, an automatized industry with low asset turnover and high margin (1) was able to offer the same ROCE as an industry with high asset turnover and low margin (2)2, Industry 4.0 represents a paradigm shift as the combination of increased profitability and asset efficiency structurally pushes ROCE to higher levels (3) (Exhibit 2).

Exhibit 2. The effects of Industry 4.0 on return on capital employed (ROCE) [5].

Former Adidas CEO Herbert Hainer (who was succeeded by Kasper Rorsted in October 2016) identified early on that “(…) [fully automated factories] will revolutionize the whole part of manufacturing in the sporting goods industry” [7], recognizing that the successful adoption of this new form of production represents a critical success factor for Adidas in the future.

A new manufacturing era at Adidas – The Speedfactory

Adidas represents one of the early adopters of the “smart factory” concept in the retail environment, in an effort to maintain a competitive advantage through manufacturing bespoke sports shoes at closer proximity to its customers. On December 9, 2015, the company revealed its plan to launch an automated, decentralized and highly flexible manufacturing facility based on intelligent robotic technology and additive manufacturing (“Speedfactory”) that allows to create high-performance sports shoes faster and more flexibly than ever before [8]. Compared to the formerly 18-month time lapse between the design of new models and their arrival in stores, the Speedfactory enables to process new collections in less than 45 days [5]. Instead of manufacturing components across different plants in Asia, with workers assembling components and sewing materials, the Speedfactory will instead create most parts itself from raw materials (e.g. plastics, fibres) and subsequently produce the goods [9]. In line with customers’ increasing appetite for individualized products and aversion for long production times, the new system enables mass customization and the ability to flexibly react to demand variations, making traditional retooling of conventional machines obsolete [5]. Adidas first Speedfactory is based in Ansbach, Germany. In the medium term, Adidas plans to roll-out additional Speedfactories, e.g. near Atlanta, USA.

Huge opportunity, yet at an early stage

With a target production volume of c.500k trainers per year, the overall impact of the Speedfactory on Adidas’ total manufacturing capacity of c.300m pairs of sports shoes remains limited [9]. In order to capture the benefits of Industry 4.0 in the near to medium term, Adidas needs to roll-out its Speedfactory across multiple locations and markets and replicate the concept for additional product categories (e.g. sports apparel). Adidas should also focus on further increasing the speed-to-market through directly connecting customer orders with its smart manufacturing plants. In the future, a customer should be able to order a customized/personalized product online, triggering the immediate “on-demand” production of respective product in the Speedfactory, followed by same-day delivery to the customer’s home.

As Adidas transitions into a radically different manufacturing process, digitalization is set to disrupt Adidas’ existing value chain in Emerging markets (e.g. China, Indonesia, Vietnam). In the long term, the shift from traditional manufacturing labor to automatized robotics is likely to make a large number of employees in these countries obsolete. How will Adidas manage this transition phase, also in the light of the company’s social responsibility for the people it currently employs? Given the increased vulnerability of connected machines to e.g. cyber attacks, how can Adidas successfully protect itself from such external threats?

Word count: 798 words

Footnotes:

1 Lost sales result from unrealistic lead times, poor inventory management that affects product availability and unreliable delivery of parts

2 Note: All points on the curve represent an equal ROCE of 15% (exemplary), indicating the mutual effect of profitability and capital efficiency on ROCE

Sources:

[1] Germany Trade & Invest (GTAI), “Industrie 4.0”; https://www.gtai.de/GTAI/Navigation/EN/Invest/Industries/Industrie-4-0/Industrie-4-0/industrie-4-0-what-is-it.html

[2] Porter, M. and Heppelmann, J., “How smart, connected products are transforming competition”, Harvard Business Review (Nov. 2014); https://hbr.org/2014/11/how-smart-connected-products-are-transforming-competition

[3] Kalyanaraman, S. (IBM), “Industry 4.0 meets Cognitive IoT” (Oct. 2016); https://www.ibm.com/blogs/internet-of-things/industry-4-0-meets-cognitive-iot/

[4] Porter, M. and Heppelmann, J., “How smart, connected products are transforming companies”, Harvard Business Review (Oct. 2015); https://hbr.org/2015/10/how-smart-connected-products-are-transforming-companies

[5] Blanchet, M. and Rinn, T. (Roland Berger), “The Industrie 4.0 transition quantified – How the fourth industrial revolution is reshuffling the economic, social and industrial model” (2016); https://www.rolandberger.com/en/Publications/pub_the_industrie_4_0_transition_quantified.html

[7] Nikkei Asian Review, “Adidas aims to lead revolution in sporting goods manufacturing” (Jul. 2016); https://asia.nikkei.com/Business/Companies/Adidas-aims-to-lead-revolution-in-sporting-goods-manufacturing?page=1

[8] Adidas press release; https://www.adidas-group.com/media/filer_public/fa/a4/faa42539-a5d3-45c0-8d5d-9ab96481e13c/dec9_adidas_speedfactory-en.pdf]

[9] Economist, “Adidas’ high-tech factory brings production back to Germany” (Jan. 2017); https://www.economist.com/news/business/21714394-making-trainers-robots-and-3d-printers-adidass-high-tech-factory-brings-production-back

As Industry 4.0 becomes more prevalent and more retailers develop their own “Speedfactory” in order to reap the many benefits, cybersecurity will be top of mind. In this sense, a retailer’s future competitive edge may be that it has the most robust cybersecurity technology and its production process is never interrupted. A retailer who is susceptible to cyber attacks will have higher operational costs and longer time lapses between design and product in store, and therefore will be unable to react quickly to changes in trends and demand. Given that Adidas’ competition will also likely be moving in the direction of Industry 4.0, I would suggest Adidas acquire a top cybersecurity company to provide it with exclusive technology and in-house service.

Great summary and analysis of this issue. It’s an exciting area for manufacturing. I think it’s interesting that Adidas is developing this Speedfactory as not only a way to increase ROCE, as you described, but also a way to increase speed to market. As I look at some more articles on their rationale for the factory (I liked the Wired article: https://www.wired.com/story/inside-speedfactory-adidas-robot-powered-sneaker-factory/), it appears that customization and speed to local market is a very big driver and the business strategy appears to rely on having many of these factories in several markets. This requires a much higher capital investment, though the capital invested is utilized much more efficiently. If the ROCE is meaningfully higher, perhaps it does make sense to deploy many factories in local areas, where previous manufacturing economics have demanded the economies of scale that a centralized factory provides. I worry however, about the amount of capital that will be required to deploy this model at scale. If they are not capable of getting the efficiency gains promised by the technology or if a local market changes substantially and no longer demands product from this factory, this could be a major operational risk. I would push Adidas to crystallize their business strategy around automation and understand whether they can just update existing factories with Internet 4.0 technology to gain the operational improvements without the added capital risk.

Thank you for your essay – you bring up key questions that I also ask myself as well when reading about Industry 4.0’s impact upon manufacturing employees and systems. A couple of thoughts:

– You specify that these smart factories will be rolled out in emerging markets first before being brought to the U.S. (Atlanta). I think this is an apt specification because the labor implications will be different in the developing vs. developed parts of the world. In the U.S., for example, I’ve often thought about how the government will become involved: for example, might it introduce a subsidy for worker salaries (e.g., some kind of tax credit) in traditional manufacturing facilities like those of Adidas to persuade companies to retain these (potentially obsolete) employees? While this would counter the theory of efficient markets that politicians may be reticent to disrupt to such a degree (e.g., subsidizing a clearly unproductive economic activity), the alternative (allowing millions of employees to lose their livelihoods) seems equally as unlikely. I have major concerns about how this might play out in emerging markets whose governments may not have the funds or the power/will to introduce protections for these workers. In both cases, people will lose jobs (it’s just a matter of when), and the key role that the corporations and governments will need to play is introducing training or transitions programs to support manufacturing employees in re-inventing their economic relevance in a digital world. I suspect that this next phase for “commoditized” workers (much like manufacturing line-workers in the 20th century) could be coding.

– Your point about cybersecurity is a good one. I would be curious to understand the economics of investing in buffing up a company’s internal systems and controls to thwart this threat, relative to the enhanced efficiency of smart factories. Do the benefits outweigh the costs, on average (remember, just one attack could be disastrous and immensely costly for a company).

– Per the case today on United Interconnect, I think Adidas also needs to remind themselves of who their customers are, what the customer promise is, and whether this operational enhancement will be the right choice for customers. It may be, but I think companies should be wary of jumping to change decisions just for change’s sake.

The “Speedfactory” appears to be a very advanced manufacturing solution and will bring Adidas a significant competitive advantage in the ability to quickly create customized shoes. However, as you pointed out above, the benefits that the Speedfactory brings to supply chain and inventory management can’t be sufficiently realized until the Speedfactory is implemented in the majority of Adidas’ manufacturing facilities spanning several different markets. Due to the high capital costs associated with transforming manufacturing facilities into Speedfactories (mentioned by Bridget above), the rollout of the Speedfactory across several markets will likely be relatively slow.

As mentioned by the Harvard Business Review (https://hbr.org/webinar/2017/10/digitizing-the-supply-chain), companies must move very quickly to digitize their supply chain in order to capture the competitive advantage. I worry that the slow capital-intensive rollout of the Speedfactory will hinder Adidas from capturing the supply chain benefits in order to keep up with its competition. Especially considering that New Balance, an athletic shoe competitor, has already implemented digitization in their supply chain (http://www.manh.com/sites/default/files/sys/en-gb/document/manh-new-balance-runs-ahead-competition-case-study-en-gb.pdf).

In the short term, Adidas should consider digitizing their supply chain with a less sophisticated method than the Speedfactory design to keep up with competition. Simply adding a barcode scanner to production lines and a traceable barcode on each product can provide enough information to greatly enhance supply chain management. (I was involved in a similar project at a previous employer.) This low-cost approach to digitizing the supply chain could help Adidas transform its inventory and supply chain management while the mass rollout of the Speedfactory is still in process. This way, Adidas could build its supply chain management processes and software systems around a “smart” production system and be ready to roll when the Speedfactory is implemented worldwide.