A trillion-dollar industry is reinventing itself; Damco is leading the way

The trillion-dollar freight forwarding industry is undergoing the most drastic operational changes it’s ever seen as a result of digitalization.

Unsexy work

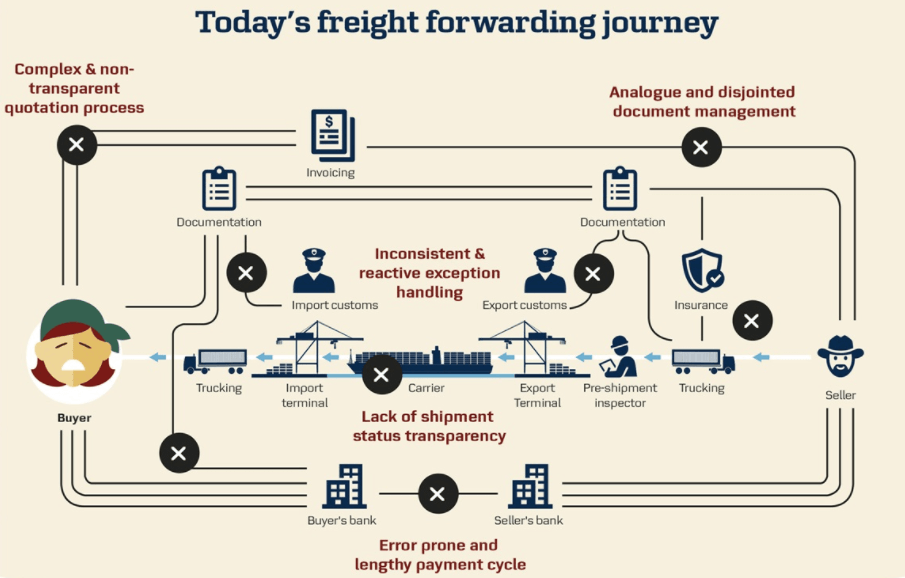

Let’s be real – freight forwarding is not a sexy industry. At a high level, forwarders are intermediaries between a shipper (the customer) and the transportation services (ships, trucks, trains, planes) that move the goods. Forwarders add value to the supply chain by providing access to better prices and expertise on export / import requirements such as documentation, regulation, and insurance.[1] An industry resistant to change, forwarders have operated their supply chains the same way for the last 30 years, which means physical paperwork, phone calls, and faxes continue to be used.[2] [3] This creates a number of pain points for customers, such as delays in getting quotes, a lack of flexibility to change routes mid-shipment, and a lack of transparency in pricing, location data, and issue resolution.[4] [5] [6]

Ripe for disruption

These numerous pain points, coupled with the sheer size and high profitability[7] of the industry makes it ripe for digital disruption. For Damco (Maersk Group’s freight forwarding subsidiary), one of the largest traditional players[8], management must acknowledge that disruption is an inevitability. Digitalization is particularly concerning because the aforementioned pain points are easily addressed with software. Research by Transport Intelligence, a think tank, indicates there is substantial demand from shippers for forwarders to offer online interfaces.[9]

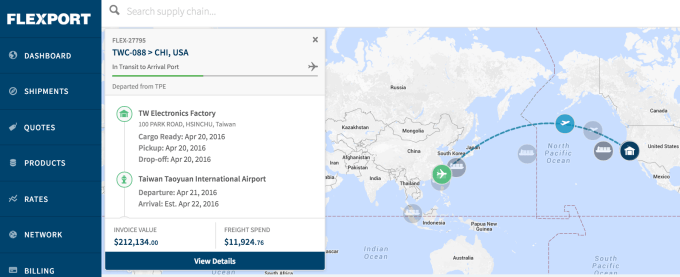

Indeed, numerous venture-backed technology startups have emerged in the last few years, all vying for a piece of the pie by building digital solutions to streamline the supply chain: Flexport, Haven, Xeneta, Freightos, iContainer – to name a few. Flexport is the best-funded challenger, with over $200 million raised and a valuation in excess of $900 million.[10] The company indexes all carriers into a database and offers shippers an online platform to easily understand, purchase, manage, and track services.[11] In 2016, Flexport grew 16x YoY and moved over $1 billion in merchandise.[12]

Damco’s response

Damco has arguably responded to these digitalization concerns the most rigorously out of all the traditional forwarders.

Short term, Damco responded to these tech-enabled challengers by launching its own online service, Twill[13], this past April. Twill offers instant price quotes and booking, transparency and tracking services, simplified paperwork, and proactive customer care.[14] At launch, Twill was focused on managing ocean shipments within the China-UK trade lane, and was thus available only to the UK market.[15] We can expect over the next few years, the priority for Twill will be to add more shipping routes to serve more markets.

Medium term, Damco intends to expand the scope of Twill’s product offerings. Twill currently serves only full container loads, but it plans to tackle more complex challenges, such as less-than-container load and air freight.[16] In doing so, Damco will be able to serve its larger accounts with Twill. Management describes the product development process as one mirroring that of tech startups by placing the focus of the business on the customer experience and developing in an agile manner.[17] More broadly, Maersk management announced in 2016 an effort to digitalize the businesses and processes. Beyond Twill, this has included a partnership with IBM to use blockchain technology to digitalize global supply chain paperwork to improve efficiency and optimize costs.[18]

Other steps

I interviewed Taylor Schwimmer, a Product Manager at Flexport, to get the disrupter’s perspective on where this space is headed. Mr. Schwimmer believes that in the short term, digitalization will focus on transparency of process and automation of menial tasks, as we are seeing with the online solutions today. In the medium term, solutions will focus on efficiency and optimization of the supply chain.[19]

My recommendation to Damco in the short term is to focus on hiring top software engineering talent for Twill. Whereas a startup like Flexport has the talent, it needs to spend time figuring out what needs to be built.[20] Contrariwise, Damco has the industry expertise and knows the major customer pain points, but will be constrained by whether it has the talent capable of developing the solutions in a timely manner. This may require a cultural shift to be more accepting of technology, as industry veterans will still refer to an engineering team as the “IT department.”[21]

Medium term, Damco should leverage its existing relationships and large scale to expand solutions better and faster than venture-funded startup are able to. For instance, many companies will try to use artificial intelligence to predict customer demand and optimize routes. Damco will have access to more training data than a startup, and thus must exploit this competitive advantage to get to market faster.

Open questions

Could Damco respond to digitalization more effectively by acquiring one of the new startups, or is it better off continuing to develop Twill in-house? How does Damco resolve the inevitable tension between human relationships and digital optimization? For instance, what happens if an “optimal” algorithmic route recommendation jeopardizes a carrier relationship?

(797 words)

References

[1] Rau, Raymond. “What does a freight forwarder do & do you need one?” Universal Cargo. December 9, 2014. Accessed November 4, 2017. http://www.universalcargo.com/what-does-a-freight-forwarder-do-do-you-need-one/.

[2] Constine, Josh. “The unsexiest trillion-dollar startup.” TechCrunch. June 07, 2016. Accessed November 4, 2017. https://techcrunch.com/2016/06/07/flexport/.

[3] Morley, Hugh R., and Greg Knowler. “Do logistics startups have staying power? (cover story)” Journal Of Commerce (1542-3867) Vol. 17, no. 16. August 8, 2016. 10-15.

[4] Byrnes, Nanette. “This $1 Trillion Industry Is Finally Going Digital.” MIT Technology Review. October 24, 2016. Accessed November 4, 2017. https://www.technologyreview.com/s/602596/this-1-trillion-industry-is-finally-going-digital/.

[5] Constine, Josh. “Unsexy Flexport scores $65 million as software eats shipping.” TechCrunch. September 26, 2016. Accessed November 4, 2017. https://techcrunch.com/2016/09/26/freight-forwarding/.

[6] Morley, Hugh R., and Greg Knowler. “Do logistics startups have staying power? (cover story)”

[7] Guerard, Laurent, Arsenio Martinez-Simon, Jeff Ward, and Oliver Gritz. “How to Succeed in One of the Most Profitable Industries in the World.” Supply Chain Management Review. March 29, 2016. Accessed November 4, 2017. http://www.scmr.com/article/how_to_succeed_in_one_of_the_most_profitable_industries_in_the_world.

[8] Burnson, Patrick. “Top 25 Freight Forwarders 2017: Digitization & E-Commerce continue to reshape the marketplace.” Logistics Management. August 29, 2017. Accessed November 4, 2017. http://www.logisticsmgmt.com/article/top_25_freight_forwarders_2017_digitization_e_commerce_continue_to_reshape.

[9] Ibid.

[10] Constine, Josh. “Flexport’s epic plan to build a freight empire with its $110M raise.” TechCrunch. October 6, 2017. Accessed November 4, 2017. https://techcrunch.com/2017/10/06/a-social-network-for-trade/.

[11] Morley, Hugh R., and Greg Knowler. “Do logistics startups have staying power? (cover story)”

[12] Constine, Josh. ” Unsexy Flexport scores $65 million as software eats shipping.”

[13] Twill company website. “About.” Accessed November 4, 2017. https://www.twill-logistics.com/about/.

[14] Twill company website. “Why Twill.” Accessed November 4, 2017. https://www.twill-logistics.com/why-twill/.

[15] Waters, Will. “Damco launches digital freight forwarder Twill.” April 6, 2017. Accessed November 4, 2017. https://www.lloydsloadinglist.com/freight-directory/news/Damco-launches-digital-freight-forwarder-Twill/69039.htm.

[16] Ibid.

[17] Ibid.

[18] Ibid.

[19] “Personal interview with Taylor Schwimmer, Product Manager at Flexport.” Telephone interview by author. November 6, 2017. Opinions are solely those of Mr. Schwimmer, and do not necessarily represent the views held by Flexport.

[20] Flexport’s CEO has admitted in interviews that he didn’t know what the term “freight forwarder” meant until a year after founding the company.

[21] “Personal interview with Taylor Schwimmer, Product Manager at Flexport.”

I do wonder to what extent Damco can effectively digitalize and automate its supply chain. As your second question suggests, there is a human element to consider behind all of this. The freight industry appears to be very traditional and, ultimately, freight forwarders themselves must still rely on the transportation providers. Perhaps the reason the industry has been so stagnant for decades is due to a reluctance to innovate given that supplier relationships have been paramount to other considerations.

It seems unlikely that Damco would be able to implement algorithmic solutions that damage their supplier relationships. Rather, in order to succeed, Damco will need to invest heavily in educating its transportation suppliers on how the new digitalized solutions can serve to benefit them.

My concern with this approach is that the culture in many of these VC tech firms is one of innovation deeply imbedded to align with the people, the formal organisational structure and its critical tasks in delivering cutting edge technology. I think the learning curve inhouse with Twill is too high for an old timer like Damco, and furthermore, let’s be honest… what business does Damco have developing it’s own “tech start-up”?. For example, I would argue that Flexport would probably figure out the ability to handle less than full container load a lot faster than Twill as it is in their DNA to do so. Damco could first of all consider outsourcing to Flexport and other tech startups, to really test out viability and push the boundaries at a low cost. The outsourcing model should work such that customers of Damco would be effectively be using the Flexport platform without knowing it, and Flexport would receive a fee for each consignment. Eventually, once proven successful, it may make sense to acquire one of these firms.